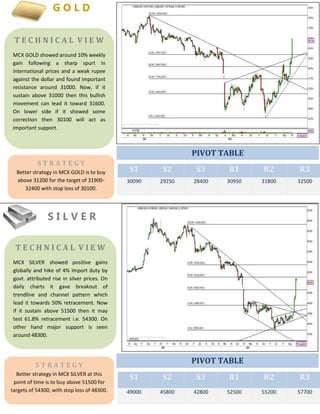

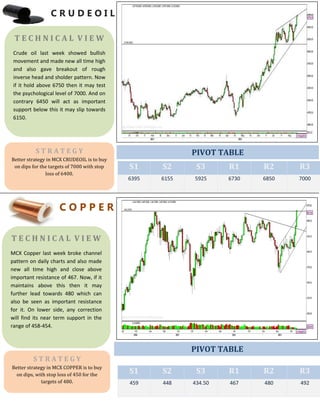

Gold prices in India hit record highs due to a weak rupee and positive Chinese outlook. The rupee declined further against the dollar, supporting higher gold futures prices in India. Crude oil prices rose to $107 on concerns about potential disruptions from unrest in Egypt and an approaching storm in the Gulf of Mexico, while fears of a tapering of US stimulus measures by the Fed also contributed to higher oil prices. Copper futures in India look bullish given the weakening of the rupee.