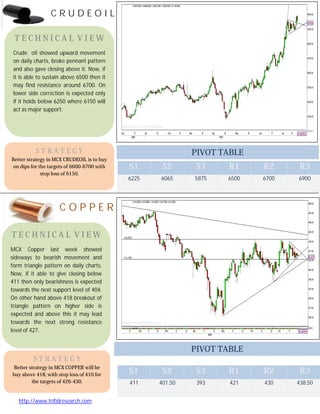

Gold prices rebounded on sustained local and global demand while silver weakened further due to speculative selling. Standard gold rose by Rs 145 to Rs 26,795 per 10 gm while pure gold rose by Rs 135 to Rs 26,925 per 10 gm. MCX crude oil looks sideways to bullish and traders are advised to take buy positions, while MCX copper may trade volatile and traders should sell on rises.