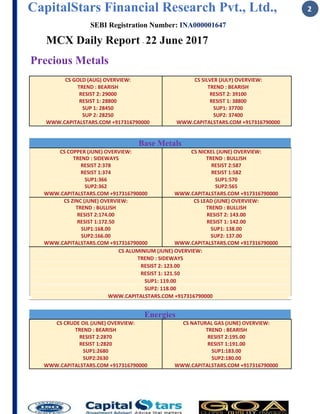

On June 22, 2017, gold prices rose in Asia due to a weaker dollar and changing Federal Reserve views on interest rate hikes, while Peru's copper output is predicted to increase following the end of a strike. Oil prices also climbed after a decrease in U.S. crude stockpiles, though concerns about OPEC's effectiveness in managing supply persisted. The report includes market trends and technical recommendations for various commodities including crude oil and precious metals.