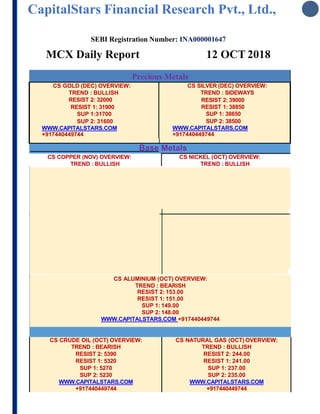

Gold prices edged higher as investors sought safe havens due to stock market volatility. While gold prices were down slightly on Friday, they remained near a two-month high set the previous day when prices surged over 2% amid a global stock market rout. Copper prices rebounded in London and China as the US dollar weakened and Chinese infrastructure growth is expected to boost demand. Oil prices stabilized after falling over the previous two days due to stock market declines and signs that supply concerns have been overstated, though oil remained on track for a weekly drop of over 4%.