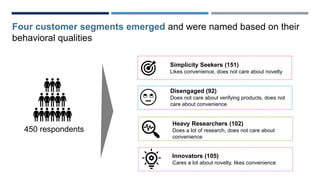

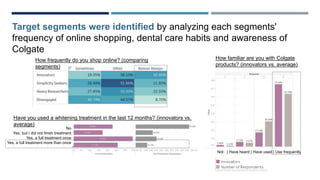

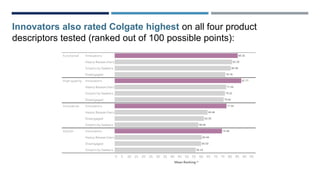

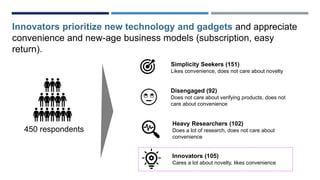

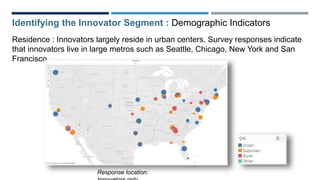

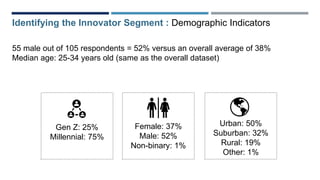

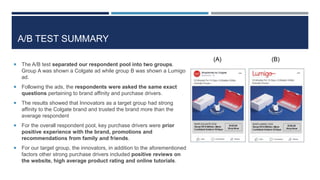

Colgate wants to establish itself as a direct-to-consumer brand for millennials and Gen Z. It asked about identifying target customer segments, launching a new brand, and branding/marketing strategies. Research found innovators who prioritize novelty and convenience are most open to Colgate's DTC approach. An A/B test showed innovators have strong affinity for Colgate. The recommendation is for Colgate to target male, urban innovators aged 25-34 with its existing brand, focusing on product reviews, ratings and tutorials to drive purchases.