Cloud based solutions transforming the merchandising process

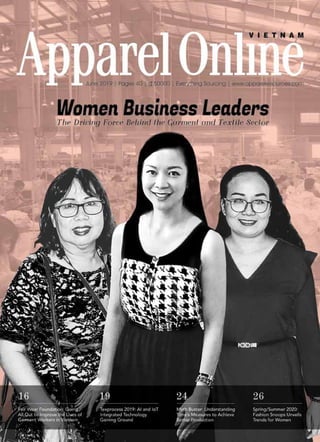

- 4. 4 Apparel Online Vietnam | JUNE 2019 | www.apparelresources.com Cover Story CONTENT Vol. 4 ISSUE 1 JUNE 2019 Women leaders in Vietnam’s garment and textile industry: Encouraging female entrepreneurship The garment and textile industry in Vietnam has played a significant role in enhancing the social and economic conditions of the country... p8 Vietnam & Beyond Vietnam Insight Resource Centre Tech Management 24 World Wrap Kraig Labs’ Vietnam factory signs lease to expand production capacity Kraig Biocraft Laboratories, a prominent developer of ‘spider silk’ textiles, announced that its subsidiary Prodigy Textiles has signed a 5-year lease on a factory in Quang Nam province in Vietnam... p12 Fair Wear Foundation: Going all out to improve the lives of garment workers in VietnamWhen Prime Minister Nguyen Xuan Phuc and his Dutch counterpart Mark Rutte attended the Sustainable Fashion show, themed ‘Walk the Talk’ on 9 April 2019 in Hanoi, the thunderous applause that both of them received was a clear indication of Vietnam’s commitment towards sustainable fashion... p16 Texprocess 2019: AI and IoT integrated technology gaining ground Texprocess 2019, held in Frankfurt (Germany) from 14th to 17th May, marked a total of 317 exhibitors from 34 countries who showcased the latest processing technologies and sewing systems as well as an array of IT and logistics solutions... p19 Myth Buster: Understanding time’s measures to achieve better production Time is the single most important commodity in garment production; thus correct measure of time is very important. Brand extension: Retailers and brands transition from clothing to lifestyle solutions p32 FFT Trends Spring/Summer 2020: Fashion Snoops Unveils S/S ’20 Trends For Womenp26

- 5. www.apparelresources.com | JUNE 2019 | Apparel Online Vietnam 5

- 6. 6 Apparel Online Vietnam | JUNE 2019 | www.apparelresources.com EDITORIAL TEAM EDITOR-IN-CHIEF Deepak Mohindra EDITOR Ila Saxena ASST. EDITOR Praveen Menon COPY EDITOR Veereshwar Sobti SUB EDITOR Priyanka Mishra CREATIVE TEAM Raj Kumar Chahal Peeush Jauhari Satyapal Bisht PHOTOGRAPHER Vishal Chaudhary OPERATION DIRECTOR Mayank Mohindra PUBLISHER & MANAGING DIRECTOR Renu Mohindra HEAD OFFICE Apparel Resources Private Limited B-32, South Extension-1, New Delhi-110 049 (India) Phone: 91-11-47390000 E-mail: contact@apparelresources.com; editor@apparelresources.com Web associate: www.apparelresources.com SUBSCRIPTION RATE Yes, I wish to subscribe to Apparel Online Dong 600000 USD 25 12 issues *This rate is valid only for subscription in Vietnam International subscription (in Dollar) - Credit Card using www.apparelresources.com Telegraphic transfer to Bank Account No. 03192320003806 (Swift No:HDFCINBB) with HDFC Bank, D-9, South Extn. Part-2, New Delhi-110049. INDIA SUBSCRIPTION ENQUIRY +91-11-47390000 subscribe@ apparelresources.com ADVERTISEMENT ENQUIRY +91-11-9811088666 rani@ apparelresources.com GENERAL ENQUIRY +91-11-47390000 contact@ apparelresources.com Women: Continual source of inspiration As Vietnam’s apparel and textile exports earn an impressive US $ 12.1 billion in the first five months of 2019, my belief of the industry growing at a fast pace yet again gets strengthened. The industry today provides jobs to nearly 2.4 million people in Vietnam, of which over 80 per cent constitute women. Women have been the strong foundation on which the industry in Vietnam has been built upon over the years, and I do not just mean the women workers in garment and textile factories. A lot of women in Vietnam have taken on the mantle of leadership, especially in garment and textile sector, and they all have been doing a wonderful job. One such lady has been Tuyet Mai, Secretary General, VITAS, whom my team has had the fortune of meeting and talking to several times. Her strong vision and concise understanding of the industry has been hugely responsible for the growth of the garment and textile industry in the country in the last few years. And, that’s why my team is doubly excited to meet her again during our visit to the country later this month. Talking about strong women like her, it gives me more pleasure to see my team come out with a cover story on women in this issue – women who have inspired other women to be the best in whatever they do, be it in garment industry or for that matter any other industry. As I have always said, they are the ‘spine’ of the industry. In this story, we have spoken to some such inspiring women leaders of the industry and understood their vision that has helped them and the country move towards the path of growth and success. Yes, the country keeps growing and women are playing a big role in it. US $ 12.1 billion export earnings from apparels and textiles in just 5 months, is good enough indication that the country will surpass the projected target of US $ 40 billion much before the year ends, considering several companies are booked for the whole year. This issue also gives an insight into the role played by the Fair Wear Foundation (FWF) in promoting sustainable fashion or sustainable business in Vietnam and thereby bring some improvement in the lives of garment workers. The efforts put in by FWF, especially to arrest the gender-based violence in Vietnam’s garment factories, are truly commendable. What impresses me the most about them is that they execute what they plan – very few have been able to do that successfully. What makes my team’s visit to the country this time different is that they will be accompanied by a senior management team, wherein we plan to meet some of industry leaders and I am sure the experience is going to be as enthralling as it always has been. FROM THE EDITOR-IN-CHIEF’s DESK…

- 7. www.apparelresources.com | JUNE 2019 | Apparel Online Vietnam 7

- 8. 8 Apparel Online Vietnam | JUNE 2019 | www.apparelresources.com COVER STORY T eam Apparel Online, during its numerous visits to Vietnam, met many such inspiring women leaders and understood their vision that is taking them and the nation on the path of progress. Here in this issue, we will focus on the vision that these women leaders have to take Vietnam forward. Nguyen Thi Tuyet Mai, Secretary General, VITAS, is one such lady who has been very clear about her thoughts on the country’s garment and textile industry. Everyone in Vietnam, who is a part of the textile industry, knows Tuyet Mai – the face of VITAS. When she spoke about the efforts put by VITAS to encourage the growth of small and medium enterprises (SMEs) in Vietnam, the conviction in her voice complemented the confidence of the organisation. Corroborating further on the same, Tuyet Mai averred, “There are special projects providing training courses to our members. These projects are supported by companies from Korea, Germany and Bureau Veritas wherein we make them aware of all the dos and don’ts that are essential to export apparels to USA and Europe. Besides, we also conduct seminars and help them understand business sustainability and environmental sustainability.” It’s been a struggle for SMEs to find a footing in the industry unlike bigwigs, like Saitex, Nhabe Corporation or Phong Phu Corporation. Talking of Phong Phu Corporation immediately reminds one of the lady with the magnetic personality – Phan Kim Hang, Vice General Director, Phong Phu Corporation. The company is a big name in Vietnam’s apparel and textile sector over the last five ENCOURAGING FEMALE ENTREPRENEURSHIP JENNIFER NGUYEN “When I was new into fashion, I launched 1 store and it did well; and within no time 2 more stores were opened. Soon, I had unveiled 5 more stores and it was around the same time Vietnamese market started booming. Now the competition is tough. Gradually, Vietnam started doing very well in garment production too and so I thought there was no better time than now to get into it.” WOMEN LEADERS IN VIETNAM’s GARMENT AND TEXTILE INDUSTRY The garment and textile industry in Vietnam has played a significant role in enhancing the social and economic conditions of the country. The sector today accounts for nearly 2.4 million jobs, with women constituting 80 per cent of these. Women workforce have been effectively the spine of Vietnam’s industry over last several years. It is pertinent to note that a lot of women have not only taken on the mantle of leadership but have also been an inspiring and guiding force for many other women striving to make a mark in the industry.

- 9. www.apparelresources.com | JUNE 2019 | Apparel Online Vietnam 9 COVER STORY decades and Phan Kim Hang’s contribution towards it is immeasurable. While substantiating on how Phong Phu has successfully managed to carve a niche for itself, the Vice General Director remarked, “We try to provide the best response to the requirement of the customer both in garments and fabrics, so that customers get everything on time. That is what gives us an edge over our competitors; we have been doing it consistently with good amount of success.” Phong Phu Corporation, a renowned manufacturer of denim and knitted fabrics in Vietnam, has also been a leader in setting up a highly creative and customer- oriented product development team and huge credit for that goes to Phan Kim Hang. She has made it a norm that the core management at Phong Phu Corporation – including herself – is committed to enhancing the product development that is central to weaving, spinning and garmenting. There is nothing that drives the growth of the company than the complete involvement of the management in understanding and executing the process and Phan Kim Hang has ensured it happens the way she wants it to happen. Endorsing the same thoughts is Meishin Bui, Managing Director, 5S Interlining – the lady with an ever smiling and a strong conviction in everything she does. In a candid tête-à-tête with Team Apparel Online, Meishin said that the management is an active part of the internal training programmes at 5S Interlining. She said that organised training and active involvement of management in training programmes is the key to success of any organisation, and 5S Interlining strongly believes in it. To put it in her own words, “We ensure that both sales team and the client servicing team are well acquainted with the products that are manufactured by us. We train every sales person who joins us and I personally give each of them knowledge about the fabric quality of the product. This is our training process and I am a part of it.” 5S Interlining is today one of the prominent interlining suppliers in Vietnam with wide range of interlinings for more than 150 items, including non- woven, non-fused, woven fusible, woven, top fuse and tear away for embroidery. “My company is keen to tell the whole world about the way HP Link Fashion works,” said Ana Huynh, Director of the company. No vision could be bigger than the intent to grow bigger than the competitors, and at HP Link Fashion, it does not end there. The efforts, initiatives and the conviction of the young lady, who also owns the company, are worth every applause. In its bid to grow big, the company recently opened a new well-equipped sample room in its plush office located in Khanh Thi Thuc Ho “Our objective was and will always be to discover the talent in an individual and then hone those talents to make them the best for the future.”

- 10. 10 Apparel Online Vietnam | JUNE 2019 | www.apparelresources.com Meishin Bui “We ensure that both sales team and the client servicing team are well acquainted with the products that are manufactured by us. We train every sales person who joins us and I personally give each of them knowledge about the fabric quality of the product. This is our training process and I am a part of it.” Ho Chi Minh City. The intent has been to make samples at a rapid pace for customers. Elucidating on the same, Ana said, “I have complete ability to take orders very fast. While most of the factories take 15 days to finish a sample, we at HP Link Fashion take 2 or 3 days at the most to complete a sample.” What has been fast working towards HP Link Fashion’s advantage is that they have a big factory that produces sportswear, a big office and a well-equipped sample room, both at the factory and in the office. Ana, who also happens to be the owner, believes that the philosophy at HP Link Fashion is not just to defeat the challenges but also to turn those challenges into one’s strengths – a mindset that is essential to drive the company and the nation towards success. The University of Technical Education in Ho Chi Minh City has been an institute, which has over the last several years, taken up the challenge – and succeeded – the challenge of discovering as well as nurturing the best candidates for the country’s garment and textile industry. And, one person who has been keeping it going for the institute is Khanh Thi Thuc Ho, Head, Fashion Design Section, University of Technical Education. While she could easily be passed off as a student, it is only after meeting her that one realises ‘the mine of knowledge’ the lady is. “Our objective was and will always be to discover the talent in an individual and then hone those talents to make them the best for the future,” underlined Khanh. Her vision matches exactly with that of the institute. She said that when everything from the process of enrolment to the syllabus of the 4-year course is very tough, it helps in producing the best professionals…, and best professionals define the industry. The Institute teaches the students everything from designing and sewing to sampling, marketing and merchandising. Khanh says what delights her most is that despite having nearly 12 universities all across Vietnam, the training methods and elite faculty members make The University of Technical Education the best in the country. The story of young Jennifer Nguyen, Owner, Candy Rox Studio is also interesting. From a fashion studio COVER STORY Phan Kim Hang “We try to provide the best response to the requirement of the customer both in garments and fabrics, so that customers get everything on time. That is what gives us an edge over our competitors; we have been doing it consistently with good amount of success.” Phan Kim Hang (second from right), Vice General Director, Phong Phu Corporation has been instrumental in the growth of this company

- 11. www.apparelresources.com | JUNE 2019 | Apparel Online Vietnam 11 COVER STORY Ana Huynh “I have complete ability to take orders very fast. While most of the factories take 15 days to finish a sample, we at HP Link Fashion take 2 or 3 days at the most to complete a sample. My company is keen to tell the whole world about the way HP Link Fashion works. No vision could be bigger than the intent to grow bigger than the competitors, and at HP Link Fashion, it does not end there.” in guiding and directing not only other designers of her product development team, but also the pattern makers, fabric cutters and seamstress workers. “I guide my team to give what I exactly want. I also go and search the fabrics and help the team prepare sample according to customer specifications,” said Jennifer. What makes the contribution of women in business notable is the struggle that they almost and always have to undergo to keep a balance between work and home. Utilising her sheer skill to be the best at both places deserves every award and recognition. The Women Leaders International Forum is an annual event held in March by the Women Leaders International Network (WLIN), under the direction of the Vietnam Women Entrepreneurs Council. During the past 4 years, the Women Leaders International Forum has made a lot of buzz in the local and international business community, confirming the vision of women in the new age – women can rise and assert themselves as leaders. It will indeed be great to see a lot of women from Vietnam’s garment and textile sector receive this award in future. owner to now being in apparel production business, clearly shows the pace at which Jennifer and her company has been growing in recent years. Having done her education in the West, she is one Vietnamese entrepreneur whose strong command over English language has strengthened her leadership credentials. “When I was new into fashion, I launched 1 store and it did well; and within no time 2 more stores were opened. Soon, I had unreiled 5 more stores, and it was around the same time that Vietnamese market also started booming. Now the competition is tough. Gradually, Vietnam started doing very well in garment production too and so I thought there was no better time than now to get into it,” averred Jennifer. Quite like what Phan Kim Hang does, Jennifer has also been actively involved in the product development of her company and is keen to take it to the highest possible level of quality and service. Compared to the other women we discussed, she may be a small entrepreneur now, but has all the potential to join the big league. Being a fashion designer herself, Jennifer has been successful The garment sector in Vietnam today accounts for nearly 2.4 million jobs, with women constituting 80 per cent of these. The Women Leaders International Forum is an annual event held in March by the Women Leaders International Network (WLIN), under the direction of the Vietnam Women Entrepreneurs Council. What makes the contribution of women in business notable is the struggle that they almost and always have to undergo to keep balance between work and home.

- 12. 12 Apparel Online Vietnam | JUNE 2019 | www.apparelresources.com In what is seen as an effort to promote Indian textiles overseas while also strengthen bilateral trade ties, an Indian business delegation comprising representatives of 30 Indian companies under the leadership of the Chairman of the Indian Silk Export Promotion Council Dr. Bimal Mawandia met with their Vietnamese counterparts at a buyer-seller meet in Ho Chi Minh City (HCMC) of Vietnam recently. “India is promoting exports of all textiles. We are presenting the silk sector in India and as per the guidance of the Government of India, we want to increase exports and we are exploring different markets worldwide. We came here to eveningwear, beachwear, fashion accessories, tops, bottoms, trousers and jacket makers; along with those producing silk and other fabrics. “Vietnamese garment and textile companies want to have stronger co-operation with Indian counterparts. They have high demand for importing raw materials from India,” observed Chairman of the HCM City Association of Garment Textile Embroidery-Knitting, Phạm Xuân Hồng. Phạm further underlined that trade relations between India and Vietnam in RMG and textile sector had increased significantly over the years but were still moderate considering the potential of the two countries. Amongst the Indian companies were readymade garment manufacturers; Pareo shawls, promote export of not only silk but also other fibres in this market,” underlined Dr. Mawandia. India-Vietnam business leaders meet to strengthen trade ties; promote Indian silk and fabrics Kraig Biocraft Laboratories, a prominent developer of ‘spider silk’ textiles, announced that its subsidiary Prodigy Textiles has signed a 5-year lease on a factory in Quang Nam province in Vietnam. The factory covering an area of 50,000 square feet aims to enhance the company’s production capacity of its proprietary recombinant spider silk technologies. While expressing happiness over his team’s effort in Vietnam, Jon Rice, COO, Kraig Biocraft Laboratories, said that the Kraig team under the able leadership of Kenneth Le has been doing a great job in scouting, selecting and negotiating the terms of the agreement. Further on the same, he added that the new factory’s nearness to mulberry fields as well as easy access to shipping ports would go a long way in helping Kraig Labs’ Vietnam factory signs lease to expand production capacity Kraig Biocraft introduce spider silk technology in world textile market. The company soon expects the technology to get transferred to the new factory from the existing temporary facility used by Prodigy Textiles. It is worth noting here that protective garments for military are one of the several applications of textiles made from these strong fibres. VIETNAM & BEYOND

- 13. www.apparelresources.com | JUNE 2019 | Apparel Online Vietnam 13 VIETNAM & BEYOND After the resounding success of the third edition, Denimsandjeans.com show, Vietnam’s international denim exhibition, will be back with its fourth edition in June with a focus on sustainable growth and development. The two-day event, which begins on 12 June, is themed ‘My Earth, My Denim’ and will feature interesting and informative talks, seminars and knowledge-sharing sessions. One of the major highlights of ‘Denim Talks’ will be a talk by Joanne Swift, Ex-Creative Director, Mamiye Brothers. She will be speaking on current trends in retail sector as well IKEA is planning to launch its new app to allow its customers to shop for products directly from their homes, eliminating the need to visit its vast network of self-service, out of town stores. The new app would allow customers to enter their room dimensions to ensure a good fit and choose from different styles and ‘life stages’ to narrow down the selection. The retailer is changing its business model to focus on making it easier for customers to shop online, rather than forcing them to come to their warehouses. While it’s known for giant stores on the outskirts of towns, it’s testing smaller urban locations that only carry a fraction of the lineup. Combined with the app, shoppers can see some products in person while still having access to the fuller catalogue. It could tweak its traditional stores to focus more on carrying online stock than serving in-person customers. “It is a completely new experience. sustainable denim collections at the event that is expected to get visitors from many continents and countries including China, Japan, Korea, US and Europe. Other retailers experimenting with augmented reality include Williams-Sonoma, which bought 3D imaging firm Outward in 2017, and US start-up Modsy, which raised US $ 37 million this month to expand in 360-degree room and furniture imaging. between China and Vietnam’ and ‘Growth through sustainable denim production’. Over 40 denim companies from across the world will be showcasing the best of their – including Germany, the United States and China – by the end of the year. In 2017, IKEA originally launched an augmented reality app which allowed customers to see how more than 2,000 items would fit into their homes; however they could not shop from there. as sustainability for consumers, buyers and manufacturers. Leo Gu, General Manager, Prosperity Textile, will not only discuss opportunities and challenges in the denim industry but also share his first-hand experience of sustainable denim at Prosperity’s mills in Vietnam and China – ranging from sourcing of raw materials and new recycling methods to next generation denim business models. The event will also bring several denim experts from USA, Europe and Hong Kong who will discuss varying topics on sustainability in denim, including ‘Sustainable denim production – a comparison The app is combined with the store experience, with the online experience,” Barbara Martin Coppola, Chief Digital Officer at IKEA, said. IKEA is initially launching this app in France and The Netherlands and will then roll out in IKEA’s top eight markets Denimsandjeans Vietnam 2019 to focus on sustainable development IKEA revamping app to enable online shopping

- 14. 14 Apparel Online Vietnam | JUNE 2019 | www.apparelresources.com Poney, a well-known Malaysian- based kidswear retailer, unveiled its new flagship store at the newly opened Central i-City shopping Vietnam is all set to become the favourite manufacturer of globally renowned fashion brands, mainly owing to the many free trade agreements (FTAs) signed by the country recently. While confirming on the same, Pham Thiet Hoa, Director, Ho Chi Minh City Investment and Trade Promotion Centre, said that several international brands are now buying apparels from Vietnam as there was a significant improvement in the supply chains for locally manufactured products. He further added that competitive pricing along with preferential policies gave Vietnam an edge over all the other garment hubs. In the recently concluded Global Sources Fashion Show in Hong Kong, over 30 local manufacturers from Vietnam had showcased offer the highest quality of clothes and accessories for newborns, babies and kids up to 12 years and the same will be displayed at the new store. The Central i-City, which was launched earlier this year, has the distinction of being the first shopping centre in Malaysia to be opened by Thailand’s Central Group. The opening day saw the Group offering sales of products up to 50 per cent at Central i-City, which attracted huge crowd of shoppers. Poney had first opened its flagship store in Malaysia back in 1997 at the popular KLCC Shopping Mall. In less than 2 decades, the Malaysian retailer spread its wings globally by opening stores in China, Singapore, Spain, Indonesia, Middle East and several other countries. the best of their garment, textile and handicraft items, which had generated good response. In fact, a lot of these Vietnamese manufacturers are expecting big orders from brands such as Li & Fung, Target, Marks & Spencer, Tesco, Swarovski, K-Swiss, among several others. Besides, the FTAs signed with European Union (EU) have already undergone the legal review process and are now just awaiting the approval of country’s National Assembly in June 2019. Also, once the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) becomes fully operational, it could help Vietnam increase its market share in CPTPP member nations and make the nation the favourite of every big fashion brand. and light setting, next to Trudy & Teddy. All the three brands housed by Poney, namely Poney, Baby Poney and Poney Enfants, complex in Kuala Lumpur. The new store will see the Poney Group display the complete range of its brands in a bright Poney opens new store at Central i-City, Kuala Lumpur Vietnam fast becoming a favourite of global fashion brands Over 30 local manufacturers from Vietnam showcased the best of their garment and textile products at Global Sources Fashion Show. Competitive pricing and preferential policies give Vietnam an edge over all the other garment hubs. VIETNAM & BEYOND

- 15. www.apparelresources.com | JUNE 2019 | Apparel Online Vietnam 15 Vietnam has, reportedly, raked in more than US $ 9.4 billion by exporting apparels and textiles during the period from January to April 2019. While confirming this, the Ministry of Industry and Trade said that the amount earned is a 9.8 per cent increase year-on-year. In fact, in April alone, the country’s garment and textile sector generated US $ 2.3 billion from exports, which is a jump of 7.1 per cent. The increase hasn’t come as a surprise as several garment companies were booked for the first 6 months of 2019, with some of them being booked till December 2019. Many industry experts, therefore, predict that the industry will surpass its projected apparel and textile export target of US $ 40 billion much before the year ends. Target Corporation has announced its first quarter 2019 result, including its first quarter comparable sales growth, which went up by 4.8 per cent driven by a 4.3 per cent increase in comparable traffic. “Target had an outstanding first quarter, as our team delivered a great experience for our guests and drove strong growth in traffic, comparable sales, operating income and earnings per share,” said Brian Cornell, Chairman and CEO of Target Corporation, adding, “Over the last two years, we have made important investments to build a durable operating and financial model that drives consumer relevance and sustainable growth. Target’s first quarter performance and market- brands, remodel and open more stores and invest in our team. We’re confident that we’re well- positioned to deliver strong financial performance in 2019 and beyond.” Target also reported GAAP earnings per share (EPS) from continuing operations of US $ 1.53 in first quarter 2019, up 15.1 per cent from US $ 1.33 in first quarter of 2018. The first quarter adjusted EPS was US $ 1.53, up 15.9 per cent from US $ 1.32 in the first quarter of 2018. For full-year 2019, Target expects a low- to mid-single digit increase in comparable sales, a mid-single digit increase in operating income, and both GAAP EPS from continuing operations and adjusted EPS of US $ 5.75 to US $ 6.05. extend the reach of our same-day fulfilment options, strengthen our portfolio of owned and exclusive In 2018 too, the garment and textile export target was revised to US $ 35 billion in the middle of the year; however, the country went on to achieve an impressive US $ 36 billion by the end of 2018. However, one area where Vietnam still struggles is its inability to satisfy the export market with the quality of its local clothes, which is below average. share gains demonstrate that the model is working. Throughout this year, we will continue to The Vietnam Textile and Apparel Association (VITAS) and the World Wildlife Fund (WWF) have come together yet again to promote eco- friendliness in Vietnam’s garment and textile industry. This was stressed at the meeting for VITAS’ Environment Committee that was held in Hanoi on 7 May 2019. Both the organisations had met late last year too to initiate a project to help the garment and textile industry go green in Vietnam. Truong Van Cam, Vice Chairman, VITAS, said that though the garment and textile industry in Vietnam was going through a great phase with export earnings touching US $ 36 billion in 2018, yet one cannot overlook the fact that the industry is one of the biggest greenhouse gas emitters – not far behind electricity production and agriculture. The project initiated by VITAS and WWF focuses on improving water management and energy sustainability. The three-year project, from 2018 to 2020, aims to transform the country’s garment and textile industry into green industry and thereby bring economic benefits to the country. Talking about global customers’ growing preference for eco- friendly business, Hoang Viet, Sustainable Development Programme Manager, WWF Vietnam, said, “Consumers’ shift towards sustainability is now compelling global fashion brands to change their production modes with the objective of meeting high environmental standards.” VITAS and WWF continue their endeavour to promote eco-friendly garment industry Vietnam’s garment and textile sector witnesses growth in Jan.-Apr. 2019 Target announces Q1 result In April ’19 alone, the country’s garment and textile sector generated US $ 2.3 billion from exports, which is a jump of 7.1 per cent. VIETNAM & BEYOND

- 16. 16 Apparel Online Vietnam | JUNE 2019 | www.apparelresources.com GOING ALL OUT TO IMPROVE THE LIVES OF GARMENT WORKERS IN VIETNAM VIETNAM INSIGHT W hen Prime Minister Nguyen Xuan Phuc and his Dutch counterpart Mark Rutte attended the Sustainable Fashion show, themed ‘Walk the Talk’ on 9 April 2019 in Hanoi, the thunderous applause that both of them received was a clear indication of Vietnam’s commitment towards sustainable fashion. And, one cannot overlook the significant role Fair Wear Foundation (FWF) had to play in making the event a success. The show was organised by FWF and the Dutch Embassy in Vietnam in association with FWF’s partner in Vietnam, CNV Internationaal. The Amsterdam-based FWF is a non- profit organisation that closely works with apparel brands, factories, trade unions, NGOs and Governments to improve working conditions for garment workers in 11 production countries across Asia, Europe and Africa. While applauding the efforts of Vietnamese Premier and his Government to make the country’s apparel and textile sector sustainable, the Dutch Prime Minister Mark Rutte said, “We all need to ensure that women and men who make clothes for us not only must have safe workplace but should also get wages that can cover their actual cost of living.” His thoughts were fully endorsed by Alexander Kohnstamm, Director, FWF. This is not the first time FWF has initiated efforts to promote workers’ welfare in Vietnam. Late 2017 had seen FWF organising the Gender Forum in Ha Long Bay during which several business firms and Government officials along with NGOs and trade unions came together and shared solutions to help fight and end gender-based violence in Vietnamese garment factories. Despite the fact that Vietnam has skilled and educated workforce in garment sector, the truth of the matter has also been that millions of female garment workers are victims of harassment at work. FWF has been initiating efforts to promote workers’ welfare in Vietnam. Late 2017 had seen FWF organising the Gender Forum in Ha Long Bay during which several business firms and Government officials along with NGOs and trade unions came together and shared solutions to help fight and end gender-based violence in Vietnamese garment factories. APPAREL RESOURCES NEWSLETTERS To subscribe, send us an email at subscribe@apparelresources.com FACEBOOK FRIENDS Join more than 10,000 people who are already fans of Apparel Resources on facebook. Search for Apparel Resources at https://www.facebook.com/apparelresources/

- 17. www.apparelresources.com | JUNE 2019 | Apparel Online Vietnam 17 VIETNAM INSIGHT NGOs in Hanoi, Ho Chi Minh City and Hai Phuong. It is these stakeholders who have, over the years, formed the basis of FWF’s working strategy in Vietnam. Notably, last year, FWF conducted 23 factory audits at members’ suppliers and handled 13 new complaints. FWF has also been ensuring that the industry is completely aware of all the processes in the fashion and apparel supply chain right from the apparel factories in Ho Chi Minh City and Hanoi to the stores in Amsterdam. Its activities in Vietnam have lately also focused on the implementation of the Workplace Education Programme, to raise awareness on labour rights and grievance There were also reports of workers being abused verbally and physically, subjected to forced labour and even being assaulted in some cases. FWF has been ensuring that through such forums, some solutions are given to arrest such violence. In fact, the idea of the first Gender Forum to be initiated by FWF was to prevent violence against men and women in the garment sector through the exchange of information and creation of networks. FWF has been successfully organising such training and knowledge-sharing events in partnership with International Training Centre of the ILO (ITCILO) and Dutch unions Mondiaal FNV and CNV Internationaal, who have been long- time partners of FWF in Vietnam in the Strategic Partnership for Garment Supply Chain Transformation. In this regard, it is imperative to note that FWF has also been regularly working on anti-harassment committees in garment factories in Bangladesh and India. Within the framework of the strategic partnership with CNV Internationaal and the Dutch Ministry of Foreign Affairs, FWF has also been implementing several programmes to improve lobbying and advocacy capacity of trade unions and labour-related NGOs by enhancing their understanding of international garment supply chains. This partnership aims at living wages and social dialogue along with ending gender-based violence in country’s apparel sector. In 2018, FWF had 29 member companies that sourced from nearly 155 factories in Vietnam, with most of them located in and around Ho Chi Minh City and Hanoi. What has made FWF work so effectively in Vietnam has been its concise strategy and its equally adept execution. Besides having a local audit team in Ho Chi Minh City and Hanoi and a complaints handler in Hanoi, FWF has been consistently in contact with the Vietnam Chamber of Commerce and Industry (VCCI), the Vietnam Ministry of Labour, Invalids and Social Affairs (MOLISA), the Vietnam trade union VGCL and a number of grassroots labour mechanisms. It is noteworthy that in 2018, FWF organised 18 training sessions for both management and workers. The FWF Code of Labour Practices is based on the conventions of the International Labour Organization (ILO) and the Universal Declaration on Human Rights. It ensures employment is freely chosen and there is no discrimination, there is no exploitation of child labour, there is freedom of association and right to collective bargaining, payment of a living wage, no excessive working hours, safe and healthy working conditions and legally binding employment relationship. Speaking more on the same, Sebastian Sasse, General Director, bei S4 Fashion Partner FWF had a big role to play in organising the Sustainable Fashion show themed ‘Walk the Talk’, which was held on 9 April 2019 in Hanoi. The show was attended by Prime Minister Nguyen Xuan Phuc and his Dutch counterpart Mark Rutte The Sustainable Fashion show in Hanoi

- 18. 18 Apparel Online Vietnam | JUNE 2019 | www.apparelresources.com SEBASTIAN SASSE “FWF does check all factories according to the Code of Labour Practices and after audit, it also gives an action plan to the factories to rework on the observations; however, I feel FWF also needs to strictly check on their part to ensure if there is any improvement. This is one area FWF needs to work on.” - Vietnam Ltd., averred, “FWF does check all factories according to the Code of Labour Practices and after audit, it also gives an action plan to the factories to rework on the observations; however, I feel FWF also needs to strictly check on their part to ensure if there is any improvement. This is one area FWF needs to work on.” FWF, indeed, has some challenges ahead to be overcome in Vietnam and the good part is that it is on the way to combat those challenges. So what are the biggest challenges for FWF in Vietnam! While US is today the biggest market for apparels from Vietnam, Japan and EU stand at second and third position respectively. The formalisation of free trade agreement (FTA) between Europe and Vietnam is expected to further enhance business opportunities in Vietnam. And this could also enable creating major revisions in labour laws, especially with regard to freedom of association. The Vietnam General Confederation of Labour, better known as VGCL, is today the only recognised union organisation and therefore freedom of association remains the most challenging area for FWF in Vietnam mainly in terms of labour rights. Most of the textile and garment factory unions are reliant on management, and therefore many times, they fail in representing the workers especially in matters of negotiation with management. Similarly, though law encourages social dialogue at the workplace, union’s weakness does not allow the law to be effectively implemented. FWF feels it has a big role to play in the coming years to combat this challenge. Early this year, the Government of Vietnam, through a tripartite National Wage Council, had increased the minimum wage between €110 and €160 depending on the zones. Though this tripartite structure is promising and has set a good example for many Asian manufacturing nations, the biggest challenge for FWF, however, is to include factory workers in collective bargaining and wage negotiations. Despite increase in wage structure, the workers are still struggling to meet their daily ends. In one of its audits, FWF highlighted that excessive overtime is the major violation of workers’ rights in garment factories across Vietnam. Workers majorly depend on wages earned during overtime hours, and do not receive the same on time severely impacts their livelihood. Reducing excessive overtime in the Vietnamese garment industry remains another major challenge for brands and factories in Vietnam. Some of the other challenges include incomplete labour contracts, resignation policies not correctly implemented and very little awareness among garment workers about their rights. The good thing, though, is that the garment industry in Vietnam, in general, has witnessed a significant improvement in health and safety standards and is continuously improving its internal compliance system, and with the FWF committed to overcome the existing challenges, one can see the lives of garment workers on an upswing. JOHN WOODEN American basketball legend “When you improve a little each day, eventually big things occur.” THE LATEST NEWS For the latest news on apparel and textile, make sure that you visit https://apparelresources.com/top-news/ HAVE YOUR SAY Write to Apparel Resources, B-32, South Extension-1, New Delhi (110049), India or email: editor@apparelresources.com VIETNAM INSIGHT FWF has been successfully organising training and knowledge-sharing events in association with international organisations

- 19. www.apparelresources.com | JUNE 2019 | Apparel Online Vietnam 19 EVENT REVIEW T his four-day long event had a number of activities that kept visitors engaged in understanding the innovations and technologies through seminars and demonstrations. It can be stated that Texprocess was also all about digital solutions for the apparel and textile sector – from fully networked production lines in the form of micro-factories and machines capable of autonomous learning to cloud-based collaboration between designers, product developers, manufacturers and retailers across the globe. Innovations showcased at Texprocess Among the exhibitors showcasing their cutting- edge innovations were Duerkopp Adler, Vibemac, Eastman Machine Company, Juki, Morgan Tecnica, Efka, Richpeace, Bullmer, Gerber Technology, Euromac, Assyst GmbH and Vetron. Keeping pace with the industry trends, the exhibitors displayed a wide array of their products and some of them even utilised Texprocess as a platform to launch their much-awaited technologies; two of them – M-TYPE DELTA and VETRON VIPER even bagged Texprocess Innovation Award by the jury members. M-TYPE DELTA sewing system made by Duerkopp Adler AG was the one which impressed jury with its industrial-sewing concept. DELTA can be integrated into a fully digitalised sewing production line for automotive interiors, home upholstery, leather goods and technical textiles. Using digital solutions to the maximum extent, the machine guides the operator and continuously augments its functions and ‘knowledge’. The award to DELTA system was given in ‘New Technology’ category. The second award in this category went to Vetron Typical Europe GmbH for VETRON VIPER, an ultra-lightweight sewing system made using carbon components. The system weighs a total of 6 kg, including yarn corps and drive motor, which means a smaller and more cost-effective industrial robot can be used in the sewing process. Thus, the solution is compact, flexible and easy to install and remove. Jeans automation pioneer Vibemac displayed its upcoming technological breakthrough in a specially made ‘secret room’, for which the access was granted only to VIP customers. Inside it, Vibemac displayed the most important innovation of the company, the first feed-off-the-arm unit, 100 per cent Made in Vibemac. This unit is made in special edition with blue and yellow colour details, to celebrate Verona, the hometown of Texprocess 2019 AI AND IOT INTEGRATED TECHNOLOGY GAINING GROUND Texprocess 2019, held in Frankfurt (Germany) from 14th to 17th May, marked a total of 317 exhibitors from 34 countries who showcased the latest processing technologies and sewing systems as well as an array of IT and logistics solutions. The increased number of exhibitors from past editions reflect the strong growth in the global apparel and textile industry. Team Vibemac with its dealers and business associates (This jeans automation pioneer registered a successful event this time as well)

- 20. 20 Apparel Online Vietnam | JUNE 2019 | www.apparelresources.com EVENT REVIEW Anshuman Dash (second from left), Marketing Director, H&H with Juki team Wade Stevenson (second from left), President, Eastman Machine Company with his team Sergio Gori (extreme right), CEO, FKgroup giving machine demonstration to visitors Tuncay KORU, VP, International Sales & Marketing, Robotech Team Morgan Tecnica and Speed Step, led by Federica Giachetti (fourth from right), President, Morgan Tecnica, saw massive visitation from customers from all around the world

- 21. www.apparelresources.com | JUNE 2019 | Apparel Online Vietnam 21 Vibemac with the colours of its own flag. Its key characteristics are highest speed in the world, differential feed dog, innovative hybrid oil system, besides many more. Micro-factories grab the attention This edition of the world’s leading trade fair will be remembered for its approach towards ‘Micro-factory’ which garnered massive positive response from the visitors. Digitisation, networking and Industry 4.0 played a major role in the event. Texprocess 2019 featured five micro-factories – Digital Textile Micro-Factory; Smart Textiles Micro-Factory; World of Digital Fashion; Modern Innovative Seat Design; and Pixel to Product. Gemini CAD was overwhelmed to see the response of its own micro-factory ‘Pixel to Product’ with which the company was able to clearly show the benefits of made- to-measure garments and the end-to-end workflow that takes place to produce them. Artificial Intelligence (AI) is becoming an integral part of auto-cutters All the cutting solution providers unleashed their best of cutting technologies in the event and a common thread among all was the use of AI and machine learning tools in their products. Bullmer, Gerber, Morgan Tecnica and Eastman shared that their machines can sense possible breakdown in advance which can help users better manage their production with less maintenance time. Federica Giachetti, President, Morgan Tecnica shared. “We imbibed industry 4.0 in our cutters a decade back when this concept was not known to people in apparel and textile industry. Sensors in our cutters can automatically diagnose possible upcoming defects and warn users in advance so that they can take preventive measures.” Technical advanced features of any machine are complemented with their ease of use and Gerber Technology is never behind at this. KERI, Paragon cutter’s Knowledge Experience & Reference Interface, guides the users through the cutting process to enable them to learn operating quickly. Based on the concept of AI, KERI also learns from operators over a period of time so that in future, users can rely on built-in intelligence. “Data is of foremost importance to a factory. However, instead of examining heaps of data, managers need precise data and that’s where KERI comes into play. KERI can generate a concise report including parameters like total cutting time, idle time, total units cuts, machine run time, etc,” explained Sajith Kumar, Vice President, IIGM who takes care of Gerber’s market in India. Innovation in yarns and threads A number of yarn and thread suppliers made their presence felt in Texprocess including AMANN Group, A&E, Madeira, Coloreel and Durak. AMANN Group unveiled its ‘intelligent thread’ which is made up of ‘smart yarns’ and can be used as sensors to transfer media. AMANN has made it possible to integrate ‘conductive technology’ through smart threads in daily life products such as car seats, home textiles and even in clothing. “These threads can sense the finger movement and work as conductive material in order to light up the lamps or bulbs at home and people can get rid of weight of plastic,” elaborated Barbara Binder, Head of Global Marketing, AMANN Group. Holger Labes, the main pillar of VETRON, stated that VETRON VIPER got Texprocess Innovation Award for its innovative robotic sewing system Ashok Chhajer (second from left), Director, Krishna Lamicoat with his team EVENT REVIEW

- 22. 22 Apparel Online Vietnam | JUNE 2019 | www.apparelresources.com In another innovative display, AMANN showed how its conductive thread can help innovate the forward and backward movement of a car seat. On car seat handle, a textile switch is there which is made of highly conductive silver thread. Whenever a person presses this switch, car seat moves forward or backward sensing the touch of fingers. Swedish technology company Coloreel attracted a lot of visitors to its booth for its instant thread colouring technology. Coloreel technology enables high-quality colouring of textile thread on-demand and the first product based on this technology is a groundbreaking unit for industrial embroidery machines. By instantly colouring the thread during production, it enables unique designs and vastly improves overall production efficiency. According to Coloreel team, “We use Coloreel Studio, a newly developed software, for colorisation of embroidery design. The program is the link between digitisation software and the Coloreel unit. The user can use the same DST file that the user loads into his/her embroidery machine.” Visitors made Texprocess a successful event Visitors are the most significant part of any trade show and Texprocess was not an exception. Other than the countries of Europe, the event witnessed visitation from India, Pakistan, Bangladesh, Sri Lanka, Indonesia, Turkey, Colombia and Ethiopia. It’s a well-known fact that labour cost in garment manufacturing is rising worldwide and manufacturers want more uniformity in product quality with minimum wastage. The manufacturers who visited the event looked for some technology which can fulfil both these requirements. Sujeewa Imbulgoda, Director (Operations), Artistic Milliners, Pakistan who seemed quite content with the kind of technologies that were up on display told that he attended Texprocess in 2015 and now comparing it to the 2019 edition, he found the trend has changed from traditional to automation and currently, technology suppliers are moving on to imbibe more robotics in their technology. “We are one of the leading denim suppliers of Pakistan and I am looking forward to some automats for denim manufacturing as well as some cutting solutions which can reduce human efforts and give product quality as desired,” averred Sujeewa. He got in touch with Vibemac, Jam International and SipItaly for denim automats, while he preferred Gerber, IMA and Tukatech for cutting solutions and took his discussions to the next level with them, finalisation of which might be done in the next few weeks. Faruq Ahmed, Managing Director, Teen Age Modern Fashion Ltd., Bangladesh and Maniwanen Marimutu, Chairman, PT Busana Group, Indonesia too expressed their opinions on the same lines as they visited the fair to find automats that can reduce human efforts and improve their efficiency, productivity and quality. Not just exporters, there were visitors from universities and educational institutes as well and they learnt how well the industry is moving to adopt industry 4.0 concepts. Endorsing the same, Dr. Evridiki Papachristou, Researcher and Fashion Engineer, University of Crete, Greece said, “I visited Texprocess, the most important international event on industry 4.0, digitisation, latest technology and new ideas and came back quite inspired. I was very impressed by the well-structured and organised exhibition area and the different approaches that this technological trade fair was covering.” Evridiki also enjoyed networking, demonstrations of new versions of the most influential software companies in fashion industry and of course the press conferences. “The vibes from everyone I met were positive and the energy progressive. I will definitely visit again in 2021 with more time to visit other halls as well,” she averred. • Digital Textile Micro-Factory Assyst (CAD/Design), Mitwill (Material), Caddon, ErgoSoft, Mimaki, Zünd, Juki, Veit (Finishing), Vuframe (AR/VR), HS Albstadt (3D) Schoeller Textil AG (Material) • Smart Textiles Micro-Factory ITA, Gerber Technology (Cutting), Korea Institute of Industrial Technology (KITECH), VETRON TYPICAL, Wear it (Product Design) and ZSK (Embroidery) • World of Digital Fashion Browzwear Solutions (Visualisation), Software Dr. K. Friedrich (CAD), Fision, Bullmer, Gertsch Consulting and Mode Vision • Modern Innovative Seat Design KSL, RING, VEIT and ZSK • Pixel to Product Gemini CAD Systems Thomas Brinkhoff (L), Director of Marketing, DA Group with Dietrich Eickhoff, Managing Director/CEO, DA Group Jochen Cramer (L), General Sales Manager, Bullmer with M A Saleque, Managing Director, Uni Asia, also Bullmer’s dealer in Bangladesh PARTNERS IN VARIOUS MICRO- FACTORIES PRESENTED DURING TEXPROCESS 2019 EVENT REVIEW

- 23. www.apparelresources.com | JUNE 2019 | Apparel Online Vietnam 23

- 24. 24 Apparel Online Vietnam | JUNE 2019 | www.apparelresources.com TECH MANAGEMENT SAM are neither defined nor mentioned. In American published books, SAM is mentioned, while in European published books, SMV is mentioned. Similarly, factories in Asia which are under the influence of European consultants use the term SMV, while factories in South America which are under the influence of American consultants use the term SAM. SMV or SAM is commonly calculated as: Observed Time (Time Study) + Rating Allowance + PF&D (Personal Fatigue and Delay) Allowances; or Synthetic Time (PTMS) + PF&D (Personal Fatigue and Delay) Allowances. SMV or SAM, both are same RIGHT Standard Minute Value (SMV) or Standard Allowed Minute (SAM) is arguably the single most controversial topic today amongst garment production executives across the world. Mostly both these terms are used alternatively as many people, including the experts, don’t know if there is any difference. There are three schools of thoughts in this regard: first, both are same; second, SAM is an extension of SMV; and third, SAM and SMV are completely different measures. In all work study books, there is only a reference to Standard Time. SMV and When SAM is used as an extension to SMV, i.e. it is the allocated time for a task rather than the measured time – it is SMV plus policy allowances, if any. It is worth mentioning here that these calculations are from experienced experts and consultants and not from any textbook. While in other schools of thoughts, units for both are in minutes, the third school of thought (but not really used in garment industry), talks about completely different things. Standard Allowed Minute means time (in minutes) that is assigned to a specific operation after doing Time Study or using PMTS (Predetermined Motion Time Systems). While Standard Minute Value means the Cost Factor (in cost/minute) that is multiplied with SAM to get the cost of the operation. For example: Operation name: Bottom hemming SAM: 1.3 minutes SMV: 0.50 INR/minute Cost/bottom hemming operation: 0.65 INR Utilisation, Line Efficiency and Balance Efficiency are always same WRONG All three terminologies are again used interchangeably across organisations. All measure as to how efficiently/effectively time is utilised by operators in the line. While utilisation is percentage of attended time that the operator spends ‘on standard’, line efficiency is the calculation of ‘standard minutes earned’ / ‘time attended’. Although it can be calculated for individual operators, it is most useful as a measure of sections or lines. In reality, factories generally calculate line efficiency but often use the term ‘utilisation’. In micro measure, there is a fine line of difference between utilisation and efficiency. In first case, simply how much time is utilised productively is calculated; while in second case, how efficiently the available time is utilised is taken into account. Let’s explain with an example: One operator attends work 480 minutes in a day and spends 440 minutes on a standard (40 minutes lost due to machine breakdown and no cut components); completes pocket attaching of 500 pieces, and SMV for pocket attach operation is 0.80 minutes. Operator utilisation is 440/480 expressed in percentage, i.e. 91.67% (how productively the operator’s time is utilised). SMV earned by operator is 500 pieces x 0.80 minutes/piece = 400 minutes. So, operator efficiency will be 400/480 expressed in percentage, i.e. 83.33% (how efficiently the operator’s time is used). Time is the single most important commodity in garment production; thus correct measure of time is very important. There are different measures of time in garment manufacturing: Standard Allowed Time, Utilisation of Time, Pitch Time and Throughput Time. These are some of the most commonly used terminologies amongst garment production executives across the world. However, there are many other similar terminologies, often used interchangeably, but may have different meanings altogether. As long as we are using macro-measures to evaluate our performance, probably many such measures will not make too much difference. But nowadays companies are using professional micro-measures to measure time. Properly defining and fine tuning these measures to what we want and using correct terminology is of paramount importance. Understanding time’s measures to achieve better production Myth Buster

- 25. www.apparelresources.com | JUNE 2019 | Apparel Online Vietnam 25 TECH MANAGEMENT Balance inefficiency (used commonly in Japanese literature) calculation is similar to efficiency calculation above, but generally calculated for a line from a different perspective. Basically how much time is proportionately lost due to imperfect balance, as the primary reason behind time loss is attributed to poor balancing. Suppose in a sewing line of 20 operators, a style of 20 SMV is produced in 8-hour shift. If the average daily production of the style is 400 pcs/shift, then Minutes produced = SMV x pcs/shift = 20 x 400 = 8000 Minutes attended = Number of operators x Number of minutes per shift = 20 x 480 = 9600 Out of 9,600 minutes available, only 8,000 minutes of worth is produced, rest minutes are lost due to line imbalance. Thus, balance efficiency is 8000/9600, i.e. 83.33%. If 83.33% is balance efficiency, then balance inefficiency is 100-83.33 = 16.67%. Takt Time or Pitch Time are same RIGHT Takt Time comes from a German word ‘takt’ meaning rhythm or beat. Takt Time sets the ‘beat’ of the organisation in sync with customer demand. Takt Time is a simple concept, yet counter-intuitive, and is often confused with Cycle Time or machine speed. Takt Time is the pace of production needed to meet customer’s demand or production target. The formula for Takt Time is: Time available for production (Number of operators x Time contracted) Target or Required number of pieces For example: Net available time to work = 1 shift x 8 hrs. x 60 min. x 20 operators = 9600 minutes Customer demand (production target) = 2400 pieces Takt Time = (9600 minutes)/2400 = 4 minutes/piece This means a unit needs to be completed every 4 minutes. Therefore, every step or operation in assembly needs to be done/ delivered every 4 minutes (or multiples of it). Pitch Time is the theoretical operation time; each operator should take for a planned balanced line. It is calculated as: (SAM value of a garment) (No. of operators required to meet the target) Suppose the work content (SAM value) of a garment is 40 minutes and there are 10 operators available to meet the target, it means while working in assembly line, each operation should take 4 minutes to have a balanced line. Clubbing and Splitting of operations are done to match each operation’s timings with Pitch Time. Lesser the deviation of operation timings from Pitch Time, better the balancing efficiency that can be achieved. Both Takt Time and Pitch Time can never be measured using a stopwatch. Throughput Time and Flow Time are not same RIGHT Throughput Time is the time required from one cut component fed till the final garment comes out at the end of sewing line. It is the total elapsed time between the point at which cut component enters the sewing line to the point at which the complete garment exits. Throughput Time is the total work content of the style (in critical path) plus the total waiting time. It is calculated as: Throughput Time = (Work content of the style in critical path) x (1 + WIP) In other words, Throughput Time is defined as the rate at which the production happens. While the elapsed time between the point at which cut component enters the sewing line to the point at which the complete garment exits, is termed as Material Flow Time or Flow Time. If Throughput Time is represented by T and Flow Time by F, then inventory (I) can be calculated by I = T x F For example, if the Flow Time (F) for a garment assembly process is 10 hours and rate of production (throughput) is 60 pieces per hour, then inventory in the line is 600 garments equivalent, of cut components and partially sewn components. Time Study and Capacity Study are not same RIGHT Although Time Study is commonly used in the industry, complete exercise is ‘Motion and Time Study’, where Time Study is to establish Target Time (that is achievable). Motion Study explores possibility of improving it through methods improvement. In many of the cases in organisations, Time Study is conducted but the aim is not to establish the target but to only assess the capacity of existing workforce. While Time Study is cumbersome and time consuming, capacity study can be done quickly and easily where element breakdown of operations is not necessary. Simply Cycle Time taken for complete sewing operation (from pick-up to dispose of) can be calculated to assess how many pieces can be made by existing workforce with existing methods and infrastructure. The time lost and hidden potential for improvement are never identified in capacity study. Cycle Time is more important than standard time as it gives an accurate indication of what can be achieved. For balancing purposes, it is much better to use achieved cycle times than standard times. Takt Time is a simple concept, yet counter-intuitive, and often confused with Cycle Time or machine speed. Takt Time is the pace of production needed to meet customer’s demand or production target. Although Time Study is commonly used in the industry, complete exercise is ‘Motion and Time Study’, where Time Study is to establish Target Time (that is achievable). Motion Study explores possibility of improving it through methods improvement.

- 26. 26 Apparel Online Vietnam | JUNE 2019 | www.apparelresources.com S/S’20 comes up with a continuing appreciation for craft and a new sense of minimalism that is arising through local design, one that actually speaks about a purpose. Sustainability is taking on new forms with plant-based fabrics, and an increase in farm-to-table ingredients found in beauty and health. Younger people are identifying with non-traditional gender labels and our insecurities and imperfections are now seen as beautiful examples of uniqueness. Visions of a virtual world become more ingrained in our daily life and the futuristic advancements challenge our subconscious capacities, hence giving this season the identifying name of ‘Futuristic’. Advancements in technology give us a clearer insight into the beginning of time, as we continue to reveal hidden secrets and treasures of the world. Designers like Axel Vervoordt reflect the elemental aesthetic of the trend as we merge ancient antiquities and modern minimalism. Embracing the past, it can be seen that the pulsating excitement of the 1980s influences a modern-day look that’s all about amplified colour, sensual movement and fluid culture. A slew of today’s designers show how the toughness of the streets can inspire a surprising level of softness and femininity. Pulling references from the ancient elements and modern biotechnology, the most innovative of materials balance both the past and the present, also keeping sustainability as the end result. As a result, we see that raw fibres, plant-based dyes, brushed and naped earthy knits take precedence. Vintage fabrications are enhanced by simplified and innovative processes, where suiting takes a more plush approach. While cotton takes a more crisp approach, meshes take a more dynamic approach. This vision of S/S ’20 is not only easy to reach but is also beautifully rooted in reality. The strong contrasts of the decade mean luxury and grit co-exist in a place that is as exciting as it is edgy. Spring/Summer 2020 Fashion snoops unveils s/s’20 trends for women

- 27. www.apparelresources.com | JUNE 2019 | Apparel Online Vietnam 27 Babylon takes its name from ancient Babylonia, a state and cultural area which encompasses the modern day Middle East. The Babylon woman is an archaeologist well-versed in the history of the region. She's drawn to sites along the Nile and gets a thrill out of unearthing primitive artefacts and discovering early warriors. An explorer at heart, she's empowered to unveil stories that go beneath the surface of material goods and reveal the livelihood that shaped foregone times. Her wardrobe is composed of exotic elements like intricate pattern motifs, practical utility details and polished draped silhouettes. Ever the storyteller, the Babylon woman embodies a lifestyle that preserves the past and makes it relevant for the future. Materials – colour faded linen, wrinkled chiffon, cotton openwork, gauze knit, woven raffia, softened canvas, printed stretch jersey Design details – drapes, utility pockets, fringes, cutouts, embroidery, patchwork, tiered ruffles, relaxed fit silhouettes Must-haves – sweater dresses, sarong style wrap skirts, camp shirts, baggy pants PATTERN + GRAPHICS Antique dyes, woven market, marbleised camo, flax lines, tamed animal, bright damasks, primitive blocking A rediscovery of traditional patterns and graphics takes on a global expedition as environmental influences provide an organic direction while the handcrafted compositions look toward an artisanal aspiration for an exploration of Babylon in S/S ’20. Traditional stripes re-emerge amongst the woven techniques for a loom constructed sensibility as more crafted qualities take hold of the scarf prints for a feminine focus with a sensual appeal. For a minimal pattern option, sub-theme Primitive Blockings showcases fresh modernity as the intricate markings sit beside oversized abstractions for a diversity within this season's colour block compositions for encompassing impact. Florals find a new outlook throughout the bohemian tufts and block printed directionals of Bright Damasks as the hue make for a bold and playful pattern choice while the animal prints take a more muted route in Babylon, with the skins utilising a toned down approach to reflect the relaxed expedition this season.

- 28. 28 Apparel Online Vietnam | JUNE 2019 | www.apparelresources.com Must haves – bra tops, bike shorts, windbreakers, track pants, slip dresses, straight leg jeans, wide leg jeans PATTERN + GRAPHICS Electric slither, ombre flow, dark wave, cognitive gradient, disrupted motion A trip into the electrified collection of Circuit showcases a fresh perspective of hallucinatory patterns and introspective colours for an array of printed illusionary designs for S/S ’20. More energy infused lines come forward with echoing details and blurs of colour for an exploration of fluorescent ombre prints, where flickering saturations receive a jolt of electricity for excitement. Sub-theme Neon also finds importance amongst the wild jungle of animal prints for a playful take on a traditional pattern in Fierce. The tropicalia of the island looks toward the dizzying palm trees with a wavering stance as the Dark Waves find influence in the trailed graphics of the leaves for a mesmeric approach. Playful tie-dyes get a psychedelic sense with a bright palette and a kaleidoscopic swirl of experimental technique for impact while a softer approach comes through within the whisper of hue tinged designs for a reflection of self- awareness and heightened consciousness through pattern and graphic compositions. gallery setting allows viewers to escape everyday life and immerse themselves in different worlds from lush tropics to calming meditative environments. Materials – iridescent stretch knits, tie-dye denim, silken nylon, digitally printed silk, neon blocked knit, ultra-light chiffon, tension rib knit Design details – cut-outs, zippers, drawstrings, knottings, contrast stitches Circuit speaks about the quest for innovation and technology that enlivens our senses. At the helm of a leading virtual reality company, the Circuit woman seeks out galleries instead of gamers to bring her visions to life. Signature experiences combine vibrant colour, sound and light. Sporty undertones add energy and inspire futuristic elements like holograms, while nature is another angle transformed through a hyper-realistic lens. The artistic

- 29. www.apparelresources.com | JUNE 2019 | Apparel Online Vietnam 29 Must haves – baggy pants, sweaters, dresses, camp shirts, culottes, jumpsuits, paperbag jeans, pleated skirt, shirt dresses PATTERN + GRAPHICS Sunset scapes, blanket stripes, in check, tonal stripes, floral smudges, soft ginghams, relaxed abstracts, basket weaves The gentle collective of Lagom invites S/S ’20 towards prints that convey a relaxed composure with arrangements that derive from modest craftsmanship and tranquil sensibilities. Soft palettes offer a view of ease within the patterns and playful lines. Peaches, oranges and other ripe delectables are key graphic options as Lagom explores the sun soaked environment, while florals take on a smudged exterior with blurred details for a refined laziness within the blooms. Even traditional Gingham Patterns find a new calmness in structure as the boxed print utilises a soft presence for a more laid-back style. Painterly aspects take hold in sunset compositions for an artistic ombre formation as more relaxed designs offer abstract elements with a focus on simple lines, hue direction and textural details for interest. Handcrafted inspirations bring forward a new plaid print, with basket woven influences creating textile-based designs with interlocking forms and gentle grids for a fresh look. Minimal lines also receive a warm weather update, as the modest and tonal focused stripes make for a casual pattern of a mild, easygoing assemblage this season. lives further afield in a remote woodland cottage, surrounded by unspoiled nature. Her cultivated aesthetic reflects modern craft, sustainability and raw earth elements. Materials – linen blended canvas, crafted intarsia, macramé, softened leather, puckered jersey, silk crepe De Chine Design details – mixed media, knottings, fringes, belted waists, pleating, wrap styling, darts Lagom is a Swedish term for ‘just the right amount’. We extend Lagom to capture a lifestyle inspired by Scandinavian design that is both minimal and functional with a dash of folk mixed in. By trade, the Lagom woman is an interior designer working in an urban environment amongst respected creatives. While she is very much tapped into the urban design world, she

- 30. 30 Apparel Online Vietnam | JUNE 2019 | www.apparelresources.com Must haves – mini skirts, power blazers, puff sleeve blouses, high waist pants, pencil skirts, bright suits, oversized jackets, skinny jeans PATTERN + GRAPHICS Explosive colour, logomania, soft galactic, gritty art, spraycan dyes An underground glam takes focus within Scene as the grit mixes with the glossy for a social and texture clash of excitement in S/S ’20. Bright colours, airbrushed effects, space age graphics and retro patterns make for a collection of statement designs that take a nod from the past and utilise a futuristic spin for a youthful appeal. Branding makes a powerful impact as Logomania finds the designers’ namesake as an all- encompassing pattern for effect while graffiti aspects focus on the more rebellious side amongst the Gritty Art compositions. Ombres look toward the street influences too, as the Spraycan Dyes sub-theme emphasises on the overlapped fuzziness and rough textures. Space aspirations offer a candy coloured surrealism of dreamy planet centered graphics for a fantastical view. Traditional checks re-emerge with a futuristic Glow Grid with laser lights creating a modern perspective as the markings form a playful energy in Spontaneous Squiggle for a range of patterns designs with a multi-dimensional appeal. night, she takes more risks with strong tailored shoulders or volume, and even a bit of gritty street inspiration from denim to graffitti prints. From her power office to the pulsating club, the Scene woman is always in the limelight. Materials – extreme bleached denim, washable silk charmeuse, metallic lame, burnout velvet, lightweight poly suiting, pastel denim, lurex stretch knit Design details – shoulder action, statement sleeves, sequins, statement sleeves, shoulders, feather trim Scene is about the woman who's part of the scene and also prone to cause a scene herself. Living a fast-paced life in the city, she takes her cues from the ’80s age of excess. As a publicist, she's in with the in-crowd and no stranger to Page Six. But this isn't just a throwback look. The Scene woman finds a way to make otherwise flashy elements modern. Vibrant colours, shiny surfaces and metallics are wardrobe signatures, and she has a futuristic way of pulling it all together that works for daytime. At

- 31. www.apparelresources.com | JUNE 2019 | Apparel Online Vietnam 31

- 32. 32 Apparel Online Vietnam | JUNE 2019 | www.apparelresources.com A s retailers and brands struggle to retail relevance in a crowded market, strategy to attract a large audience has become a key. What a better way to do this than increasing product portfolio not only in its traditional segment, but also in new areas. The industry players adopting this trend were successful enough in sustaining the extension as it allowed them to create a new image in the consumer psyche using the reach of existing brand image. HOLISTIC OFFERING IS THE KEY Diversification is done at different levels, as brands first trudged safer boundaries through basic line extensions with extended- size collections or capsules, then went on to expand their product levels with added swimwear, kidswear or athleisure ranges and finally forayed into adjacent industries such as homeware and beauty. Plus-size collections, disguised as a step towards inclusive fashion, were deemed as successful line extensions for Nike, Adidas, Macy’s and Target. Similarly, departmental all-solution stores such as Primark started retailing licensed products for popular character- inspired clothing, giving media an outlet to promote their entertainment ventures as and when they launched. RETAILERS AND BRANDS TRANSITION FROM CLOTHING TO LIFESTYLE SOLUTIONS WORLD WRAP The Jacquard Project – Google’s newly launched apparel in collaboration with Levi’s B R A N D E X T E N S I O N The lifestyle of the consumer is now diversifying from the usual ‘Get up, Earn bread, Eat, Repeat’ cycle as healthcare, environmental consciousness, travel and developmental activities are now a huge part of the timetables. The only thing on the low is time, and time is money. This has driven several brands and retailers to tap into the potential of lifestyle, one-stop solution outlets that provide more than just fashion apparel, with offerings such as beauty and accessories, footwear and the rapidly rising homeware market. A Zara Home store

- 33. www.apparelresources.com | JUNE 2019 | Apparel Online Vietnam 33 Brand Extension is a trend on the rise since late ’90s, which started off as a marketing stint as the cost of marketing gets divided over a multitude of products. As per recent studies by statista.com, the Furniture and Homeware segment amounts to US $ 2,25,259 million in 2019. A parent brand can create several extensions of its offerings to cater to the masses, providing the shoppers a single destination to fulfil all their demands – whether niche or basic. Ralph Lauren is one of the biggest and most successful instances as they harnessed the brand reputation to extend into Polo Ralph Lauren, Ralph Lauren Purple Label, and more, to cater to multiple consumer segments. High fashion retailer Armani is yet another brand to provide a lifestyle solution as it operates through Giorgio Armani Privé, Giorgio Armani, Emporio Armani (including EA7), Armani Junior and Armani Exchange, after announcing the closing of Armani Collezioni and Armani Jeans. It later on explored hospitality with the launch of Armani hotels that offer detailed Armani branded experiences right down to the last throw pillows and night lamps. Footwear also became a go-to for many retailers as denimwear brand Paige expanded its merchandise to foray into the footwear field in September 2018 with a 19-piece collection and Indian menswear retailer Mufti launched its footwear range after introducing athleisure last season. Meanwhile, fast- fashion giant Zara also stretched its horizons to the beauty sector in November 2018. HOMEWARE – THE RIPE AVENUE The popularity of homeware is entailing a line of retailers and brands which are exploring opportunity in cross-market boundaries. What started as a trend in the luxury segment, trickled down to provide mass brands a segment that slowly popularised their existing market position. Gucci, Armani, Loewe and La DoubleJ started with their own On the masses front, fast-fashion and discount retailers are not far behind in the race to have a successful homeware range with the introduction of Zara Home by Inditex in 2003, to the recent venture of Swedish brand H&M, H&M Home, launched in 2009. Small kidswear brands such as Rachel Riley and Noe & Zoe spread their categories to offer homeware ranges to help parents transform their kids’ wardrobes as well as living space. Multi-brand retailers and large format stores are also delving into the segment as Walmart launched a series of virtual showrooms online, while ASOS recruited designers to create textiles, ceramics and hard goods for its first own brand homeware collection that was launched earlier this month. A COLLABORATIVE EFFORT Several brands have also started collaborating with players in the field they are interested in to inculcate the existing brand image of the collaborator; use their expertise while adding their technical advancement to the mix. Levi’s collaborated with tech stalwart Google to unveil a high tech jacket that provides the wearer the convenience of controlling smartphone features with basic arm movements with recent edition, Project Jacquard featuring ride-sharing support via Uber and Lyft. All in all, the idea of providing a one-stop store solution is popularising as every brand wants a stake in the rapidly diversifying market, exploiting new trends in the arena with the added advantage of being distinguished from the existing competition. lines that sold like hot cakes. The existence of Gucci ceramics and Loewe chairs provide the same brand factor to the consumer on an extended level as a luxury wallpaper will be utilised longer than a skirt. Affordable furniture giant Ikea collaborated with celebrated designer Virgil Abloh for a limited edition furnishing line that was sold out within days of its launch.