Embed presentation

Download as PDF, PPTX

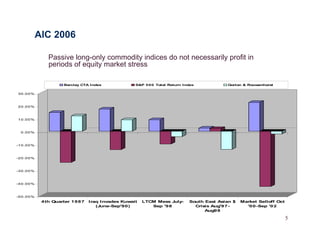

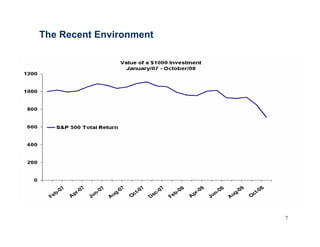

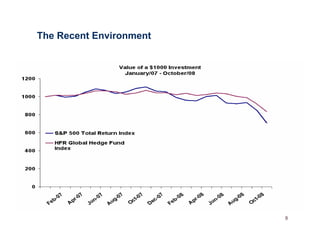

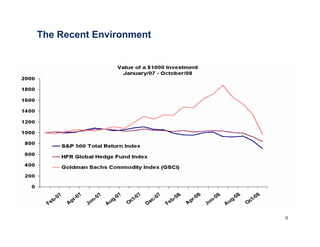

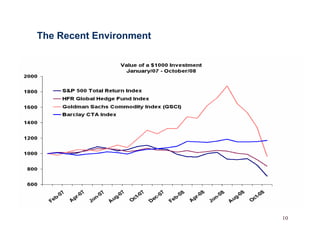

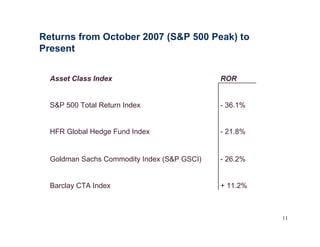

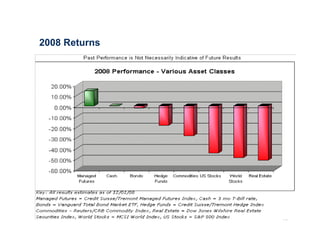

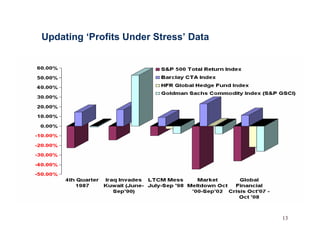

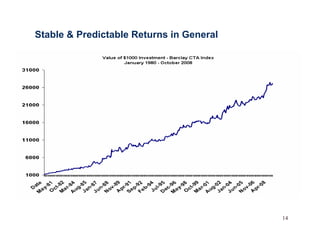

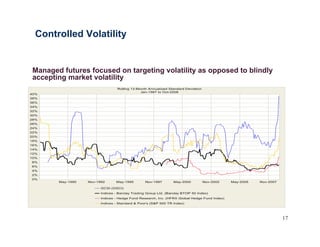

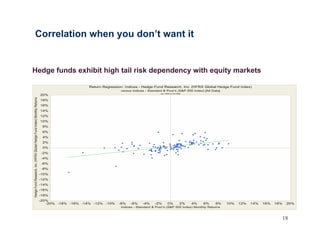

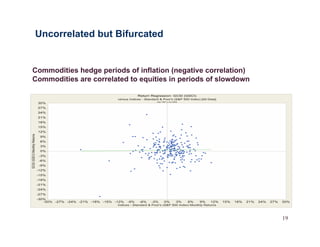

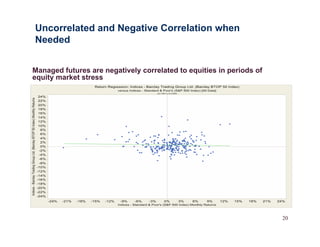

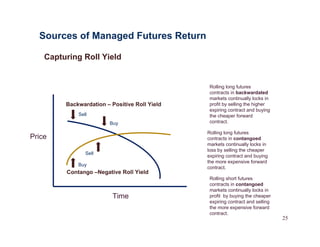

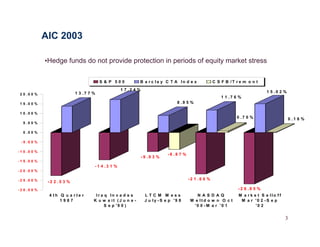

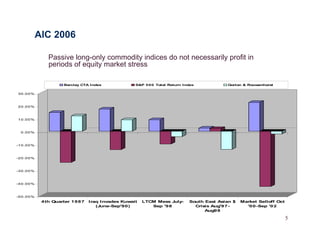

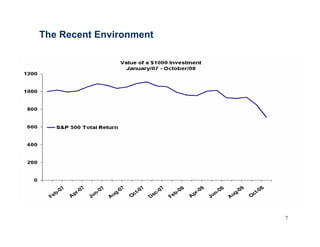

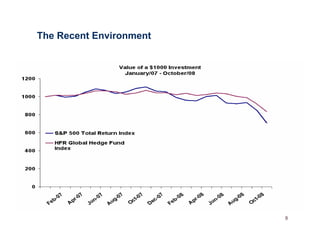

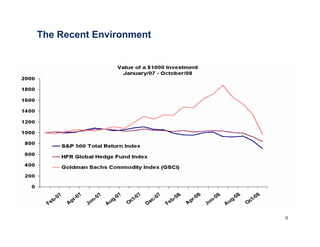

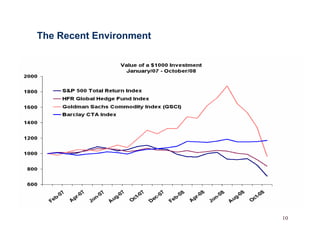

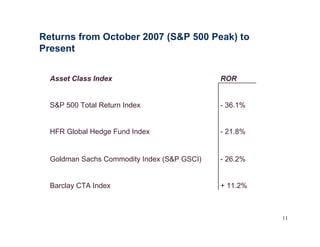

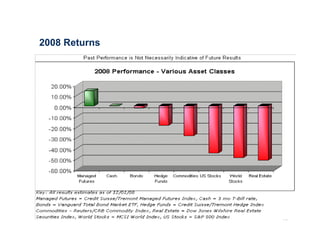

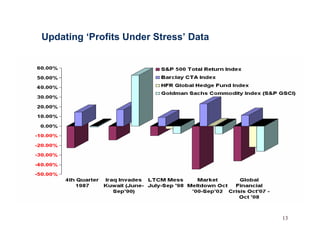

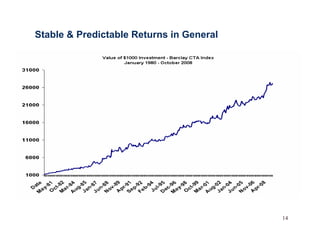

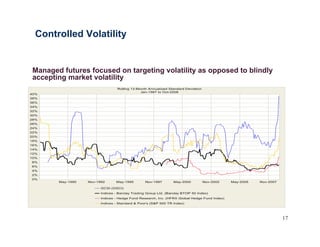

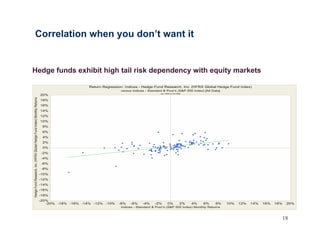

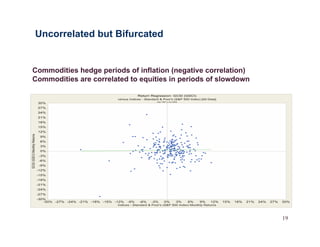

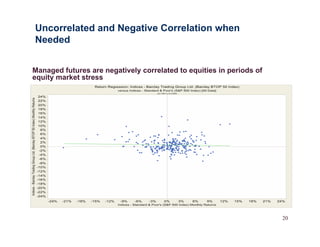

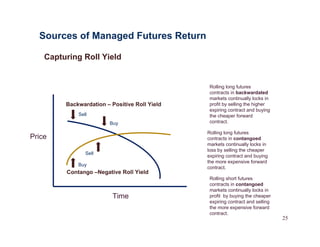

This document discusses how managed futures strategies can provide stable, predictable returns during periods of economic and market stress by capturing risk premia priced into various asset classes. It explains that the sources of return for managed futures are the market mechanisms that price risk premia into futures prices for commodities, currencies, fixed income, and equities. Managed futures managers use systematic strategies to identify and capture these risk premia across a diversified portfolio of assets and markets in order to generate uncorrelated returns.