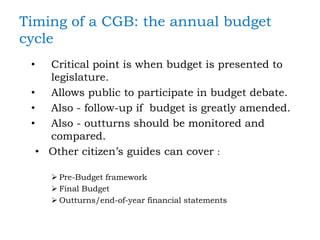

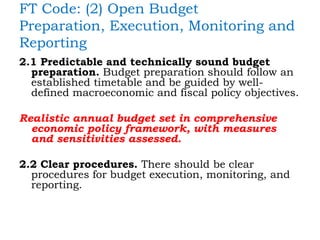

The document discusses Citizens' Guides to the Budget (CGB) which aim to increase fiscal transparency and public participation in budgeting. CGBs typically explain annual budget proposals and the economic context in a clear, non-technical way. They can strengthen accountability, buy-in for policies, and accessibility of fiscal information. The document outlines recommended contents of a CGB, including discussions of the economic outlook, spending and revenue plans, fiscal risks, and how the budget supports government objectives. It emphasizes presenting information in an engaging format with charts and making CGBs widely available.