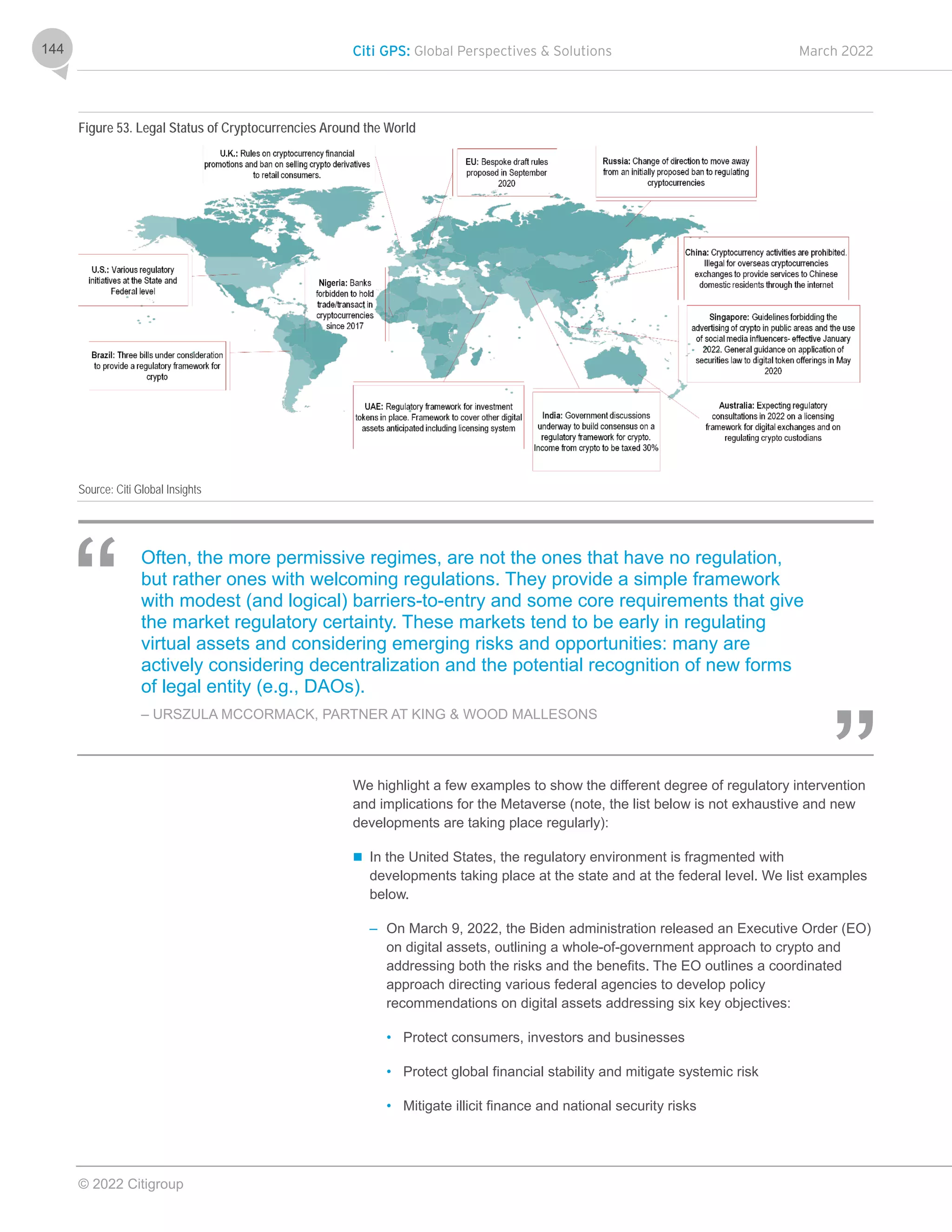

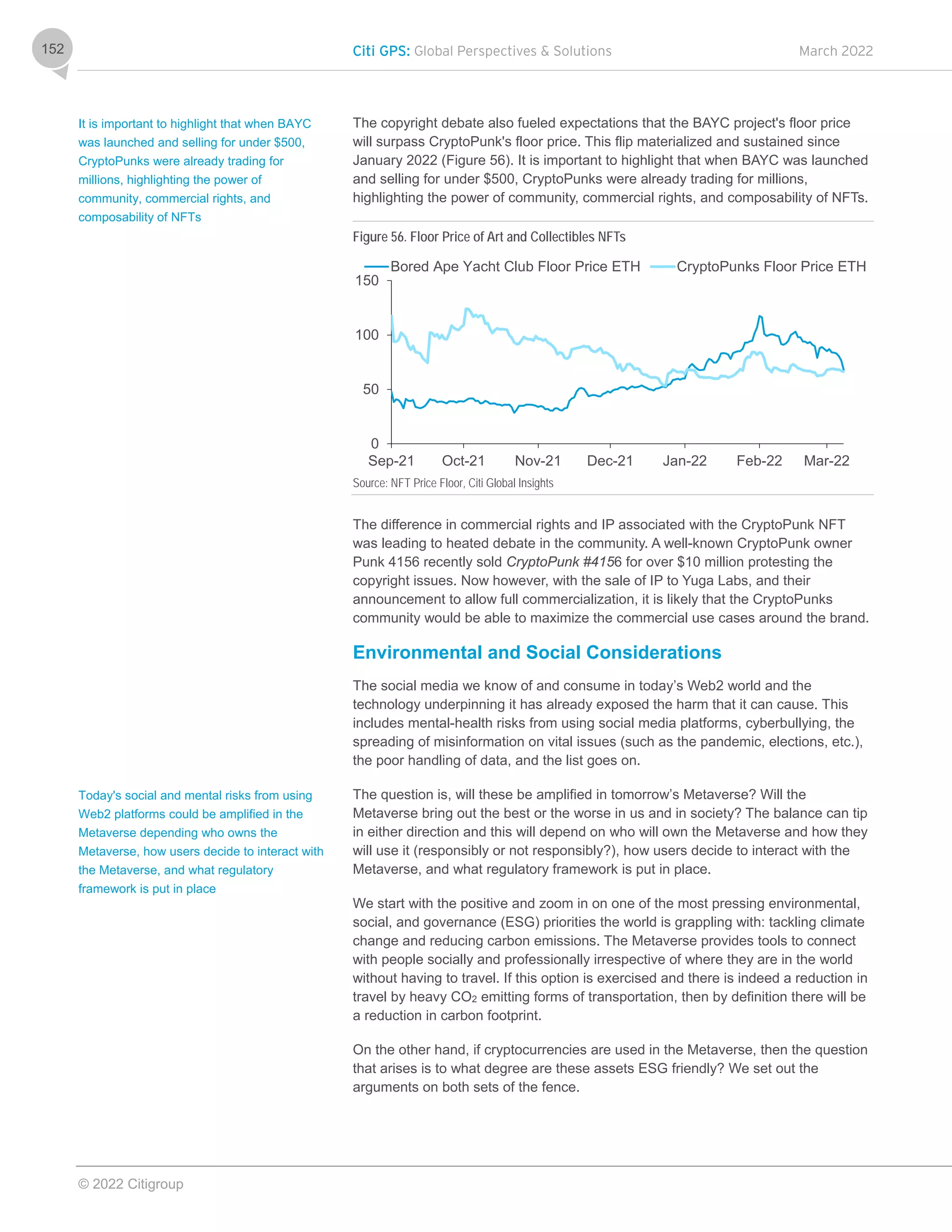

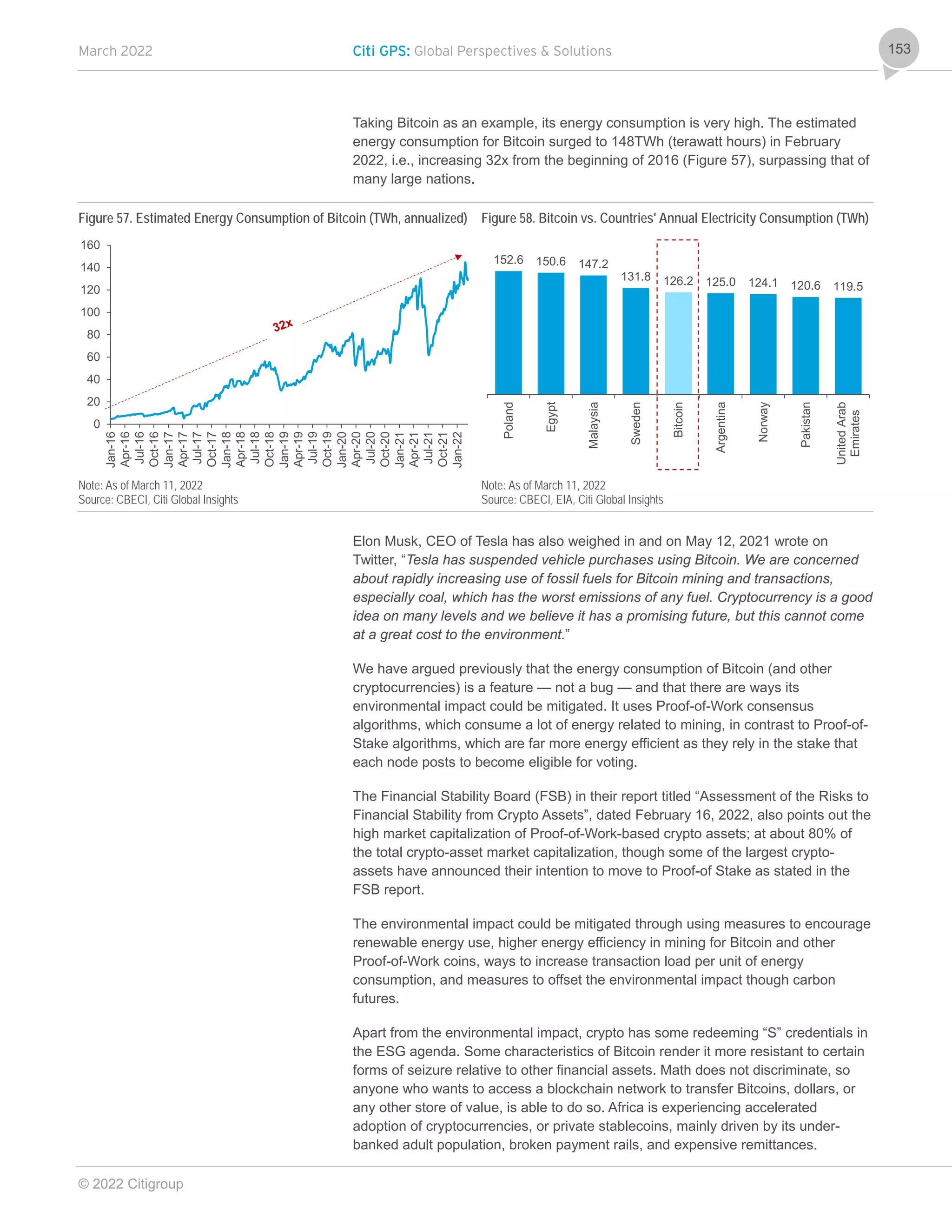

Citi's report highlights the metaverse as the next iteration of the internet, predicting a potential market growth of $8 to $13 trillion by 2030. The study emphasizes the importance of infrastructure investment to support a seamless immersive experience, and discusses the evolving concept of money in the metaverse, including various cryptocurrencies and digital currencies. As the metaverse expands, it will likely face increased regulatory scrutiny on financial transactions and user rights.

![Citi GPS: Global Perspectives & Solutions March 2022

© 2022 Citigroup

30

Figure 10. Fashion in The Metaverse

Source: Republique and Monnier Frères

– Consumers may experience theme parks in more immersive and personalized

ways in the future. Disney for example is interested in building a theme park in

the Metaverse and registered its patent known as ”virtual world simulator in a

real place,” which received approval in December 2021.9

It is envisioned that

personalized interactive attractions for theme park visitors would be created

using headset-free augmented reality. 3D images and effects will be projected

onto physical spaces and the experience of visiting Disney theme parks will be

tailored to individual users. It remains to be seen if the Metaverse plans will

come to fruition and to what degree this sets a trend for other theme parks.

– Museum experiences in the Metaverse are already in the process of being

built. For example, the online group Pixlr Genesis is aiming to build the

“Louvre of the Metaverse” with NFTs as a way of connecting artists and art

connoisseurs globally and as a way of empowering creators to showcase their

artwork to a wider audience.

– Major sporting events and clubs are starting to tap into the Metaverse to

attract fans. The president of the football club FC Barcelona, Joan Laporta,

announced in his keynote speech at the Mobile World Congress 2022 that the

club will deploy NFTs (the launch date at this stage has not been defined) and

build its own Metaverse as part of its strategy to attract new fans. He said at

the conference, “We want to develop our Metaverse, our NFTs, and all of

these new business [opportunities] that appear in our world.” He explained that

the club will soon be able to offer digital products to members and to fans and

made reference to the club’s players being in the Metaverse — without

providing any detailed plans.

– Tennis is ahead of the game with the Australian Open (AO) already in the

Metaverse. It is the first Grand Slam event to enter this space with the first

minting of the “AO Art Ball NFT” linked to live match data, giving people

globally the opportunity to own a piece of the AO. In addition, there will be a

virtual hosting of the AO in Decentraland so that tennis fans can explore the

Grand Slam from anywhere in the world.

9

Disney Enterprises Inc., U.S. Patent11210843, dated December 28, 2021.](https://image.slidesharecdn.com/citibankmetaverseandmoney-220402083901/75/CITIBANK-METAVERSE-AND-MONEY-30-2048.jpg)

![March 2022 Citi GPS: Global Perspectives & Solutions

© 2022 Citigroup

37

Making the Case for a Progressively Open Metaverse

Tim Sweeney, founder of Epic Games, advocates an incremental approach to

opening up the Metaverse from the current framework of closed platforms. He

suggests that current game platforms like Fortnite, Roblox, and Minecraft adopt

more and more open standards, progressively enabling more interoperability.

The benefit of more activity and openness to everybody is much stronger than

any other temporary benefit to any player from having lock-in.

– TIM SWEENEY, FOUNDER OF EPIC GAMES

Sweeney also points that he believes Metcalfe’s law applies in the Metaverse

scenario, where the value of the network is proportional to the square of the number

of network users. With positive-sum payoffs, the whole market grows with more

users jumping in, and all the platforms benefit. This would suggest individual

components of services therefore need to be built without enforcing a “tie-in” to

another service offered by the same platform or game developer. Different game

platforms opening up more of their services would also pave an alternate path

towards getting to, at the minimum, a “semi” Open Metaverse — starting from

established centralized platforms as opposed to a fully closed one.

The principle here is every creator owns their original creations and has the right

to make the profit from them…And it’s great to choose service providers they

choose to work with, without being forced to accept a massive bundle of services

in order to reach the customer base. We want each component of the system to

stand on its own merits and not use dominance or significant market power in

any space to force adoption.

– TIM SWEENEY, FOUNDER OF EPIC GAMES

However, technical interoperability standards are a missing core component of

openness in the Metaverse. To enable portability of assets, different suites of 3D

modelling need to be able to interface each other, and the industry needs

standardized file formats for exchanging data, among other requirements.

From a technology standpoint, this is a big challenge, and a number of leading

game technologists predict that inter-game or virtual world interoperability is a pipe

dream, or at the very least, a long way away.

Once again, you cannot take a 'skin' from one game, drop it into another, and

expect good results — even if they were made in the same engine…

The scales won't match. The rigs won't match. The [level of detail] won't match.

The hitboxes won't match. The shader budgets won't match…

– JULES GLEGG, PRINCIPAL ENGINEER AT RIOT GAMES

Today, technical interoperability standards

are the missing core component of an Open

Metaverse and leading game technologies

believe that achieving inter-game or virtual

world interoperability is a pipe dream](https://image.slidesharecdn.com/citibankmetaverseandmoney-220402083901/75/CITIBANK-METAVERSE-AND-MONEY-37-2048.jpg)

![March 2022 Citi GPS: Global Perspectives & Solutions

© 2022 Citigroup

71

Linux was the first project to make a conscious and successful effort to use the

entire world as its talent pool. I don't think it's a coincidence that the gestation

period of Linux coincided with the birth of the World Wide Web, and that Linux

left its infancy during the same period in 1993–1994 that saw the takeoff of the

Internet Service Provider (ISP) industry and the explosion of mainstream interest

in the Internet. Linus [Torvald] was the first person who learned how to play by

the new rules that pervasive Internet access made possible.

– ERIC S RAYMOND, SOFTWARE DEVELOPER AND AUTHOR OF THE CATHEDRAL AND THE

BAZAAR

In his experience of experimenting with distributed apps, Moxie makes the following

observations:

Distributed apps are just normal react websites. The “distributedness” refers

to where the state and logic/permissions for updating the state lives — on the

blockchain instead of “centralized” databases.

Lack of attention in the crypto world to “client/server interfaces.” Moxie

highlights that in all the focus on distributed trust, leaderless consensus, etc.,

clients cannot participate in those mechanics, only servers can. Blockchains are

designed to be a network of peers, but not designed such that it is really possible

for a mobile device or browser to be one of those peers.

Further to the point that people do not want to run their own servers, a

decentralized app (dApp) also does not have to run its own node.

Companies have emerged that sell API (application programming interface)

access to an Ethereum node they run as a service, along with analytics and

access to historical transactions. These are centralized services, and a majority

of decentralized applications (dApps) today rely on services like Infura or

Alchemy to interact with the blockchain, and the client APIs do not verify

blockchain state or authenticity of responses.

A crypto wallet faces similar challenges like dApps. A wallet needs to do

basic things like display balances/recent transactions, showcase NFTs, and more

complex things like construct transactions, and interact with smart contracts.

However, most wallets run on mobile devices or browsers, and neither of these

can interact directly with blockchain, and hence rely on the same centralized

service providers that extend APIs to access blockchain through their nodes.

We see a lot of validity in Moxie’s criticisms above, especially around access and

centralization, but believe the comment that distributed apps could just be react

websites is not accurate. In-browser, one-click, native plug-in to DeFi enabled by

wallet apps like MetaMask and the easy portability of coins, tokens, and NFTs

between dApps are unlike anything seen in Web2 sites.

Blockchain infrastructure is not accessible directly from browser or mobile yet,

although technically an Ethereum node can run on a system as simple as a

Raspberry Pi (a single board computer used by hobbyists). However, a lot of

infrastructure build is still early. We expect that light nodes on Ethereum, which only

store the block headers and not the full chain, will soon bring blockchain to mobile

phones/smaller devices.](https://image.slidesharecdn.com/citibankmetaverseandmoney-220402083901/75/CITIBANK-METAVERSE-AND-MONEY-71-2048.jpg)

![March 2022 Citi GPS: Global Perspectives & Solutions

© 2022 Citigroup

77

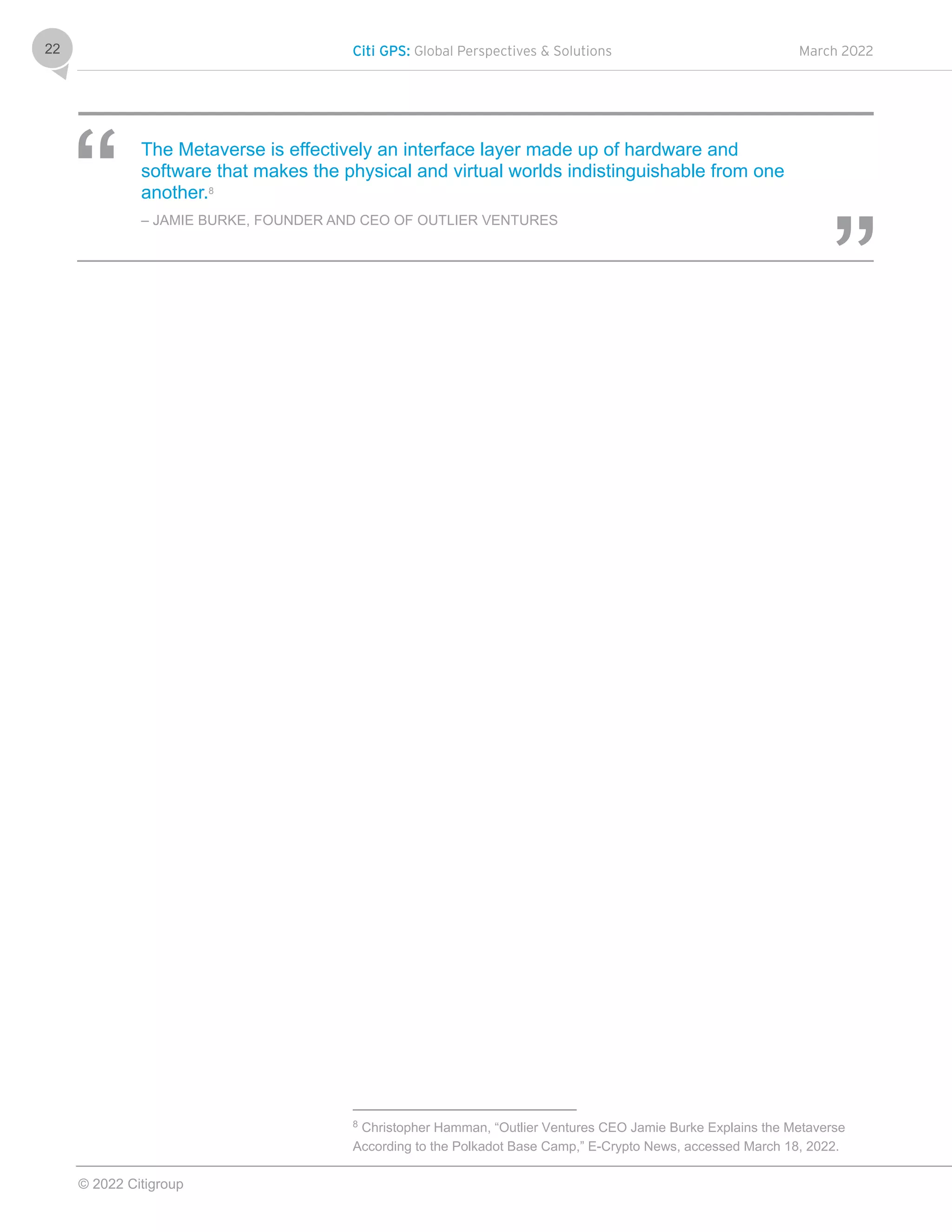

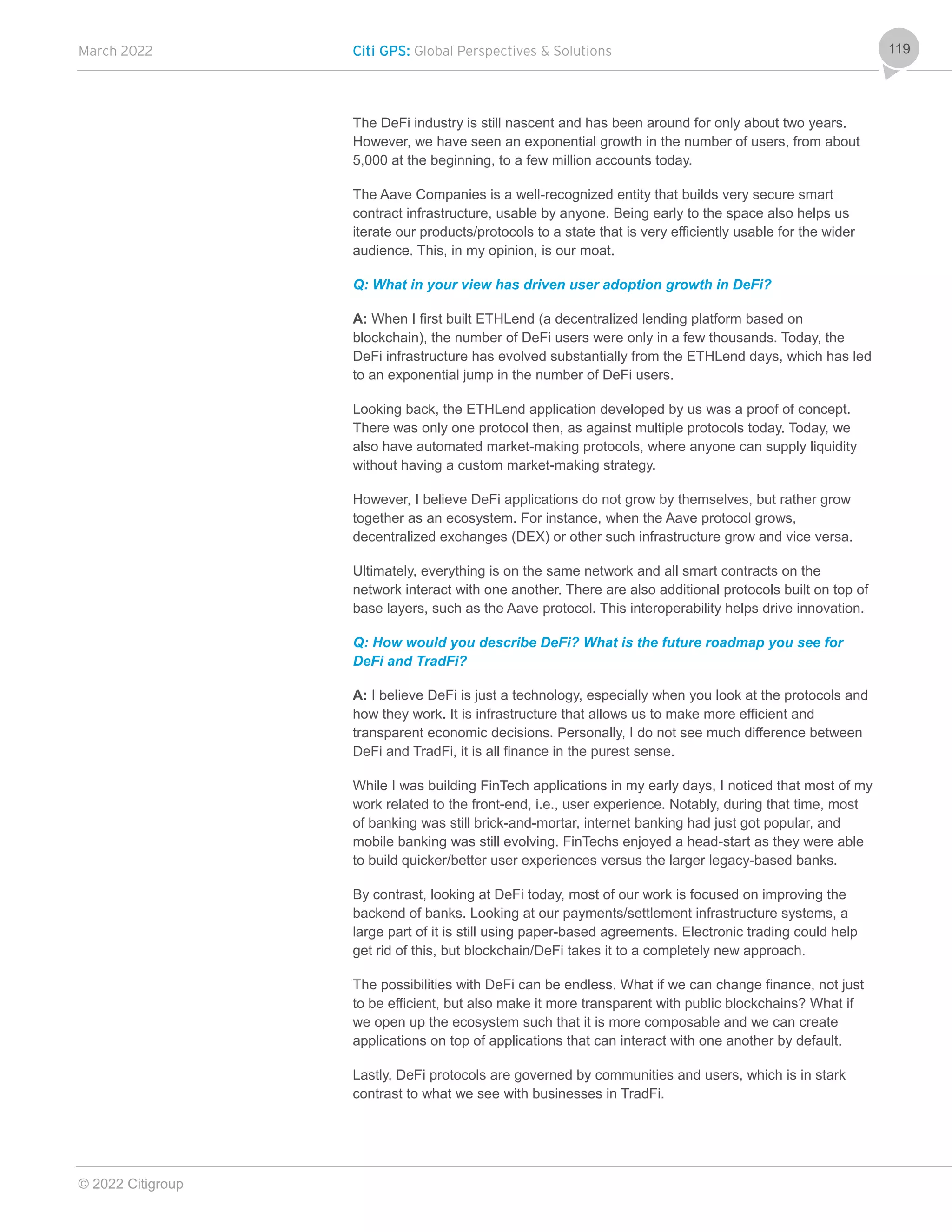

Figure 23. CryptoKitties Figure 24. CryptoPunks

Source: OpenSea Source: OpenSea

Composability of NFTs is best illustrated by the Loot NFT project, which was

created in 2021 by Dom Hofmann, co-founder of the Vine video app. Loot is a

collection of 8,000 (virtual) bags of adventure gear, mintable as NFTs, with each bag

essentially containing a unique list of eight items, with the items only represented by

text phrases like “divine robe” and “silk hood.”

Buyers spent hundreds and thousands of dollars to buy these unique text lists that

they could keep in their crypto wallets. The project not only went viral immediately,

hitting market capitalization of $180 million within five days, but also spurred many

projects to build on top of those few phrases. Certain kinds of items in these lists

were found to be rare within the whole set, and so bags with those lists were very

valuable.

[Loot is] a minimum viable product that anybody can take up and expand upon,

limited only by their collective imaginations. The speed of which builders have

flocked towards Loot has been astounding, incensed by the possibility of building

something altogether.

– DARREN LAU, INVESTOR AT NOT3LAU CAPITAL](https://image.slidesharecdn.com/citibankmetaverseandmoney-220402083901/75/CITIBANK-METAVERSE-AND-MONEY-77-2048.jpg)

![Citi GPS: Global Perspectives & Solutions March 2022

© 2022 Citigroup

84

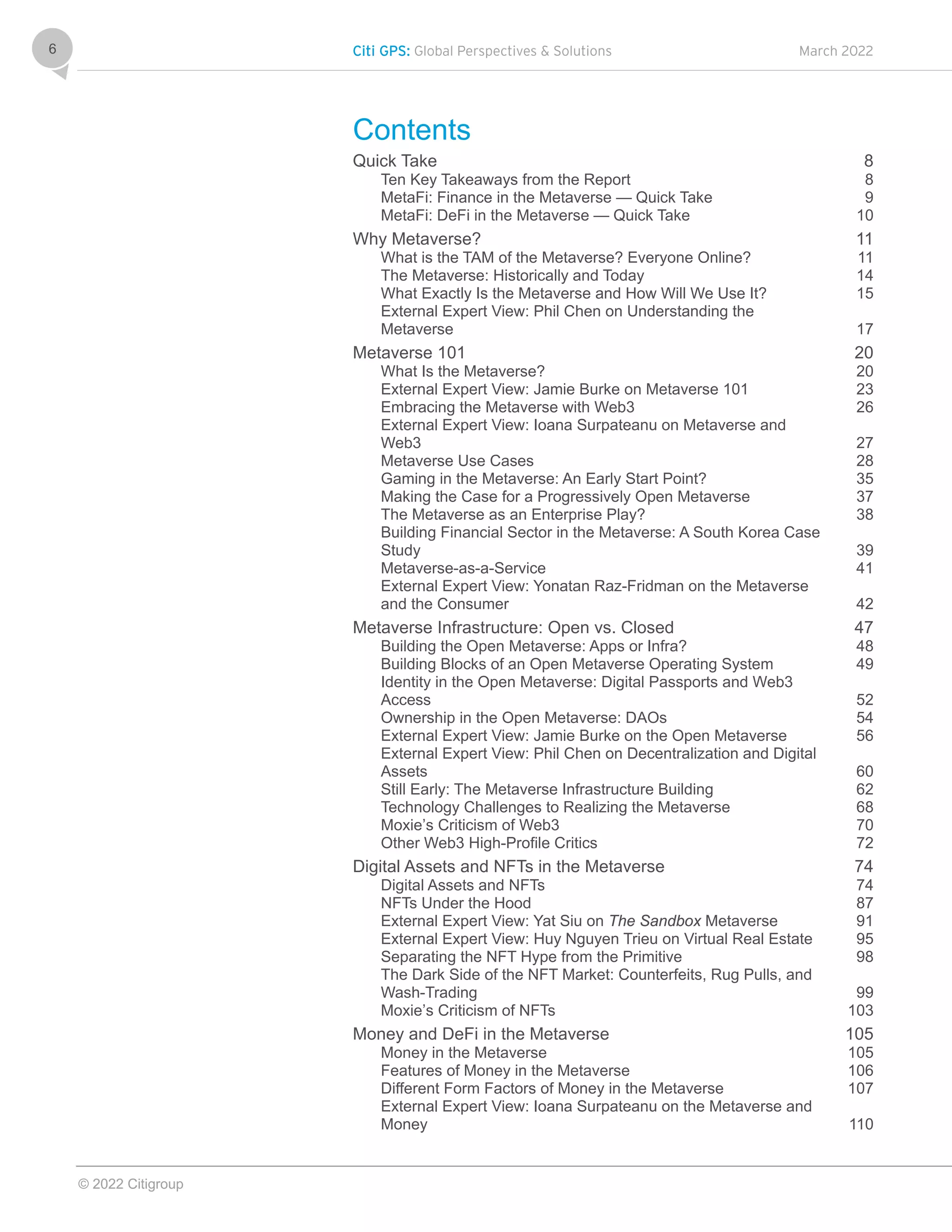

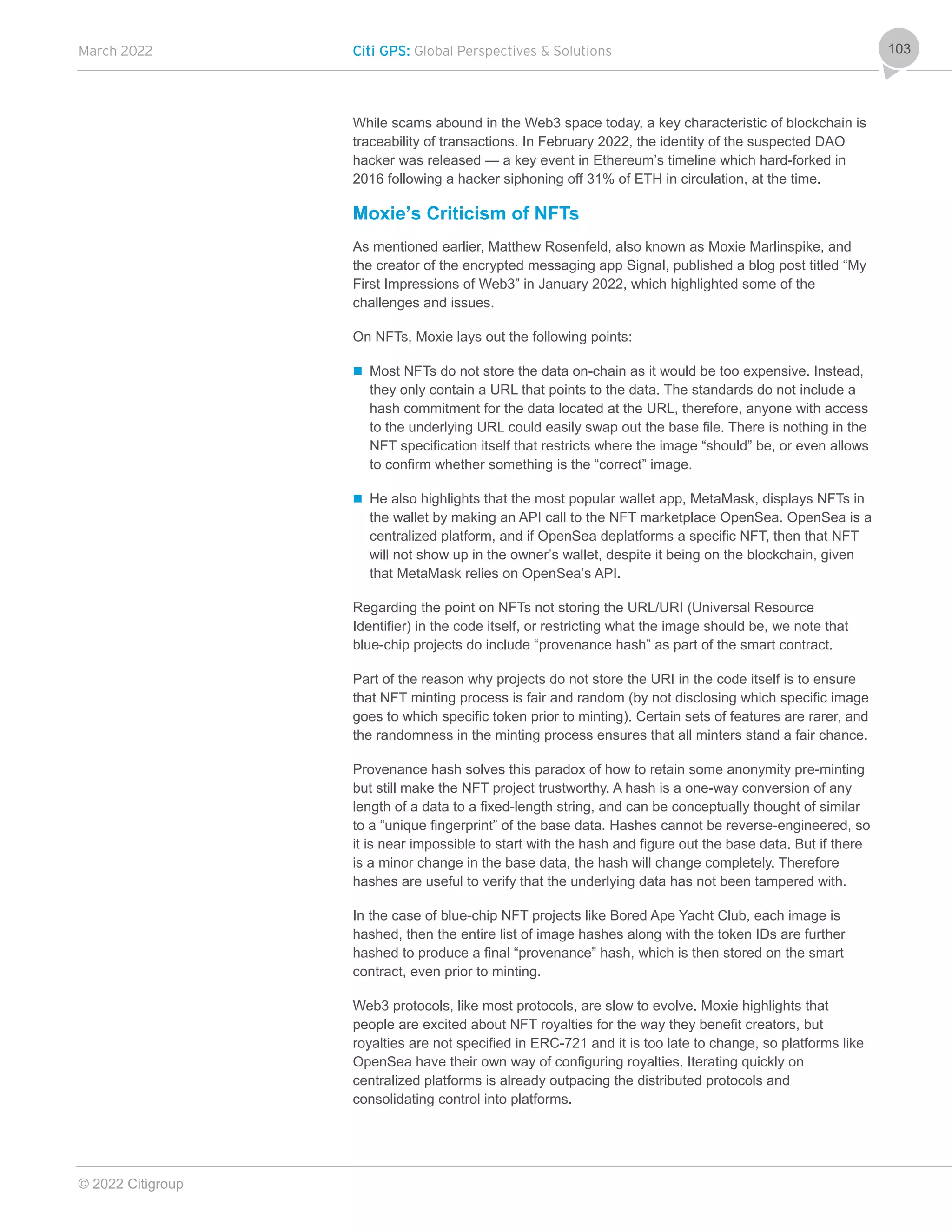

There are three layers that enable these virtual land platforms:

Consensus Layer: Tracks the ownership of land purchases on the blockchain.

Content Layer: Controls the distribution of the parcels and renders content such

as audio, video, and voice chat.

Real-Time Layer: Used for peer-to-peer connections.

Virtual real-estate is just starting to emerge and head towards the mainstream, and

we are yet to see a wide array of potential use cases. Barbados launched the first

“virtual embassy” in the Metaverse in Decentraland in November 2021.

[E]-consular services will be a core feature alongside with a virtual teleporter

which will be built in Barbados’ Metaverse Embassy connecting all Metaworlds

as a gesture of diplomatic unification between technology platforms.

– BARBADOS GOVERNMENT, PRESS RELEASE

Investing in digital real estate is still highly speculative, and with users and investors

trying to get early entry into betting on which districts and areas are likely to

appreciate the most.

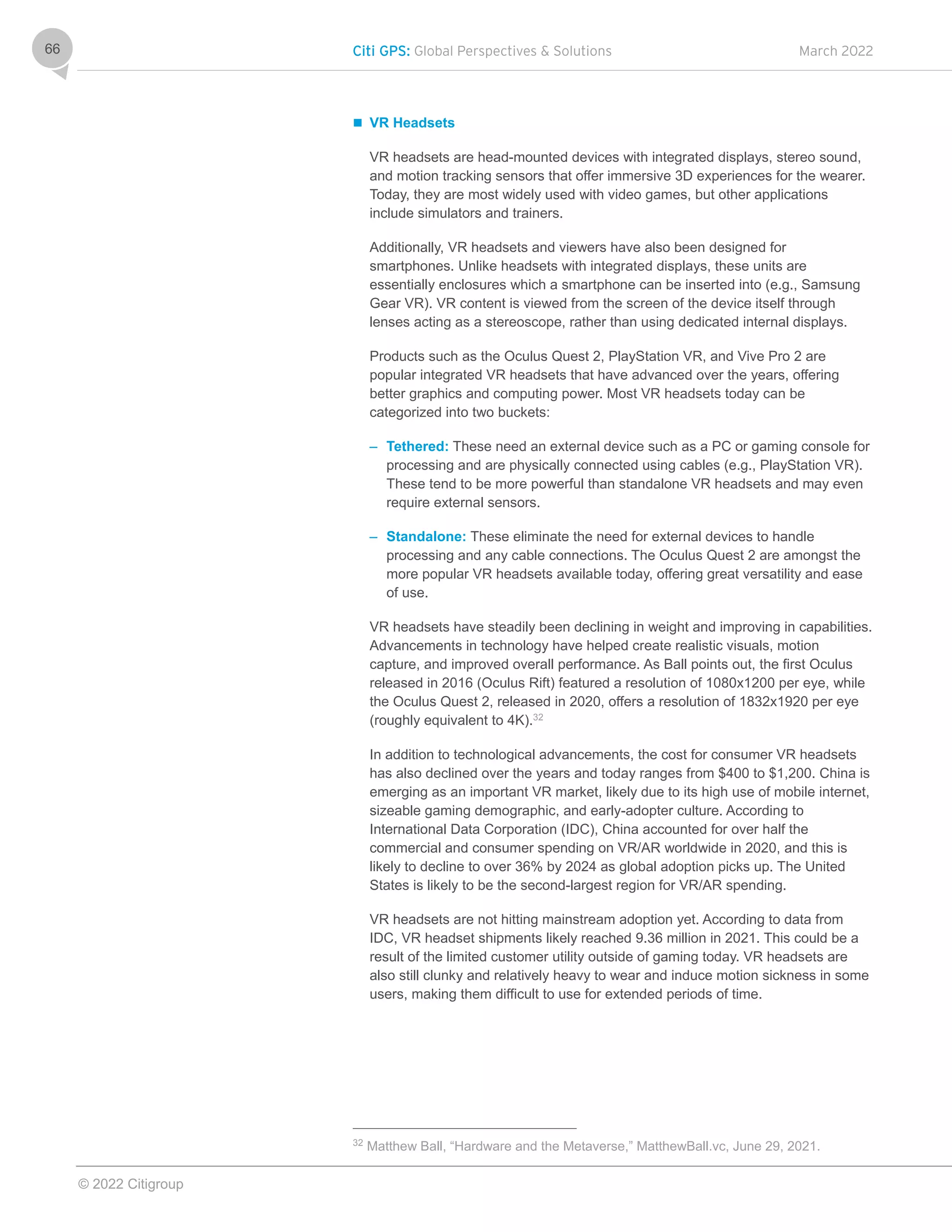

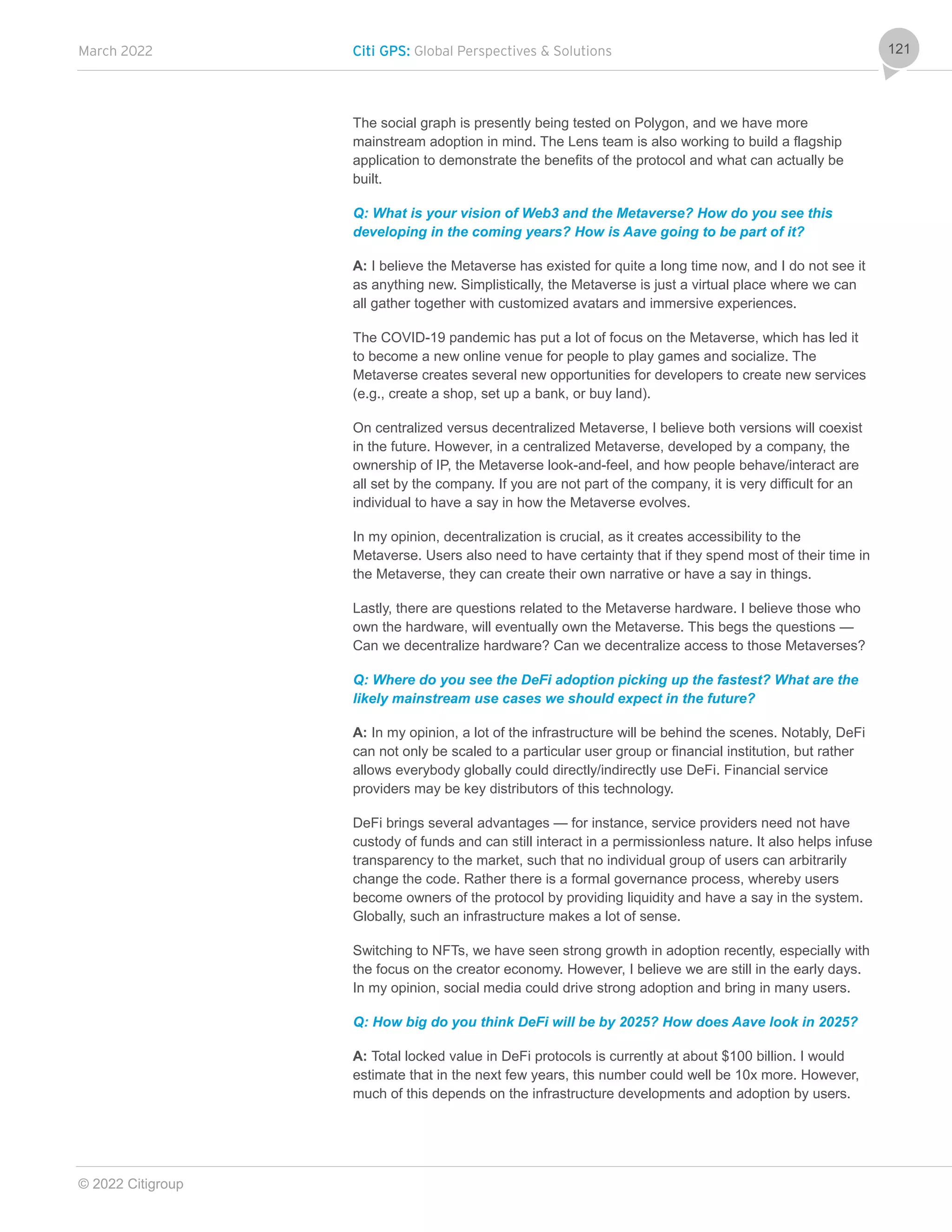

Figure 31. Top NFT Sales on Decentraland

NFTs Price (US$) Price (MANA)

1. Fashion Street Estate $2.42 million 618,000 MANA

2. Lady Bug (Plaza) $1.32 million 510,000 MANA

3. Official District $1.19 million 425,000 MANA

4. Massive Genesis Plaza $1.08 million 210,000 MANA

5. VentureEstates $1.03 million 300,000 MANA

Note: Decentraland (MANA) is an Ethereum token that powers the Decentraland virtual reality platform.

Source: DappRadar.com, Citi Global Insights

Tokens.com, the majority owner of the Metaverse Group, one of the world’s first

virtual real estate companies, purchased Fashion Street Estate for $2.4 million in

November 2021 and is developing the virtual land parcel it acquired with virtual

towers, fashion tents, and runways. It plans to host the first of its kind virtual fashion

event in March 2022, featuring avatar models, catwalks, pop-up shops, after parties,

and immersive experiences connecting digital to physical fashion.

5. Sports NFTs

Sports NFTs offer fans a chance to acquire licensed digital media of their favorite

sport moments, including limited-edition video clips, player cards, or game-related

artifacts. Sports NFTs caught the collective attention of fans with NBA Top Shots

NFTs, launched in late 2020, by the NBA in partnership with Dapper Labs (of

CryptoKitties fame), clocking in over $700 million sales in less than a year of launch.

Sports NFTs not only bring additional revenue to sports leagues, teams, and

players, but also provide an opportunity to enhance relationships with fans, as well

as design and sell merchandise. Additionally, NFTs could be useful for digital sports

tickets, reducing instances of fakes and black-marketing.](https://image.slidesharecdn.com/citibankmetaverseandmoney-220402083901/75/CITIBANK-METAVERSE-AND-MONEY-84-2048.jpg)

![March 2022 Citi GPS: Global Perspectives & Solutions

© 2022 Citigroup

127

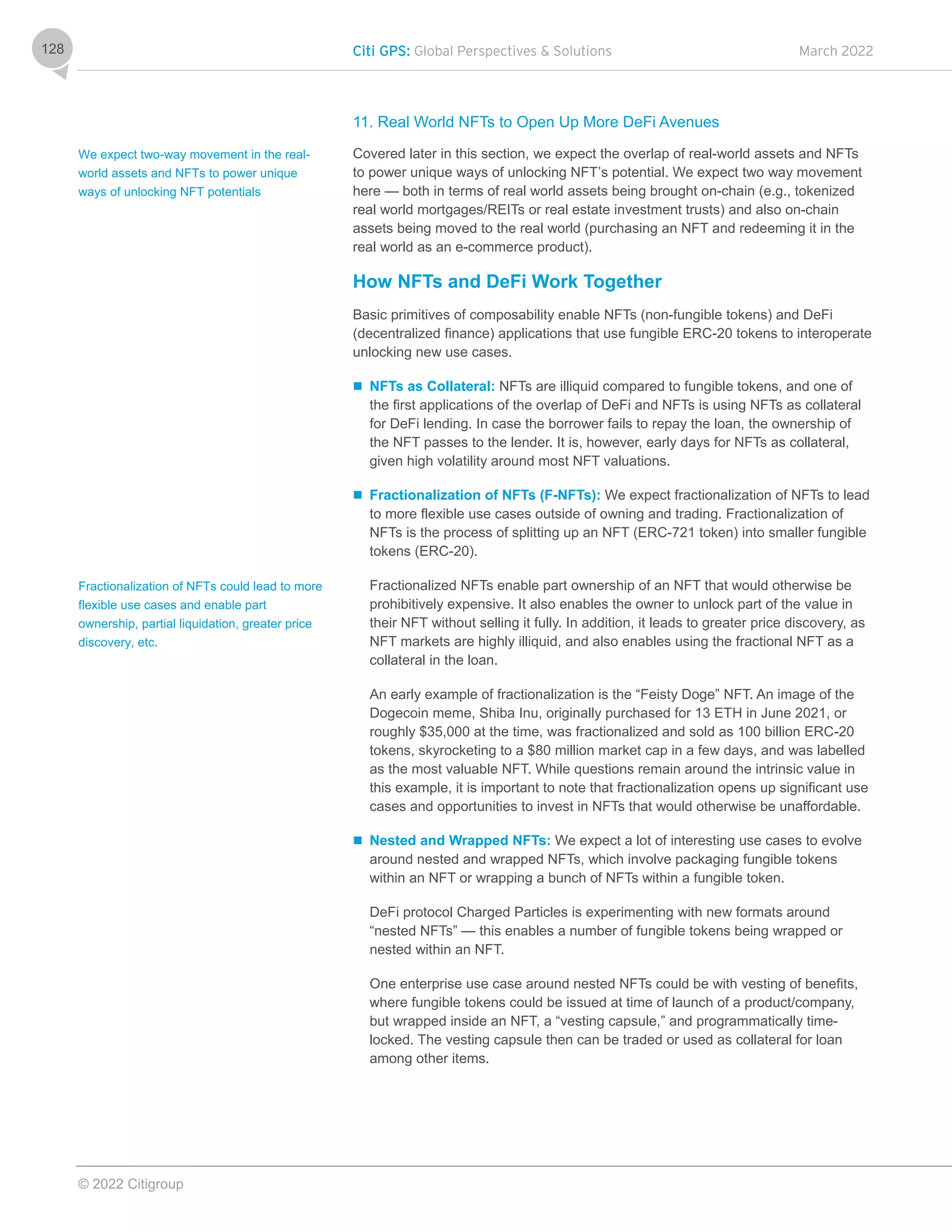

The DeFi matrix may be to the 2020s what the social graph was to the 2010s.

Once every asset can be represented in a digital wallet — Bitcoin and Ethereum,

yes, but also CBDCs [central bank digital currencies], stocks, loans, bonds, etc.

— all these billions of assets will trade against each other every second of every

day around the world.

This table of pairwise trades is what I call the DeFi matrix. Some of the cells in

the DeFi matrix, like BTC/USD, have tremendous liquidity across many order

books. Others, like a recent NFT [non-fungible token] vs. a new token, may only

have what an AMM [Automated Market Maker] can give them. But all financial

markets can be reduced to sub-matrices of the DeFi matrix. The traditional stock

market will be CBDCs vs. crypto equities. The forex market will be CBDCs vs.

CBDCs. And the fiat/crypto markets will be BTC/USDC and the like.

– BALAJI SRINIVASAN, INVESTOR, FORMER CHIEF TECHNOLOGY OFFICER OF COINBASE AND

GENERAL PARTNER AT A16Z

8. Centralized Services on DeFi

In the Metaverse, we expect there are likely to be use cases where centralization is

relevant, and we expect DeFi payment rails to enable access to these services,

coexisting with traditional payment rails like cards/instant payments. One example

could be local municipal governments offering services on the Metaverse that are

paid for in stablecoins. As noted earlier, centralization and decentralization will likely

coexist on a spectrum, although increased regulatory scrutiny on DeFi will also lead

to both blending towards the middle.

9. Micropayments and Streaming Packets of Money in the Metaverse

Micropayments should drive “pay-per-use” content monetization as opposed to

established monetization norms of charging flat fee subscriptions or digital ad-

revenue models.

Payments as small as a tenth of a cent are required to realize the value of the

Metaverse, especially around the new economy of millions of digital goods, each of

which can have a value and a price. Monetizing the vast majority of digital goods is

impossible without the Metaverse enabling the infrastructure for real-time

micropayments. A user can pay $0.50 to unlock a digital item and its features, with

this payment being immediately split between the artists and creators who

contributed to the making of the object.

10. NFTs Central to Near-Term Metaverse DeFi Use Cases

Translating the established DeFi use cases to the Metaverse, we expect NFTs to

play a central role in tapping the potential of DeFi in the Metaverse. DeFi can help

unlock the value in NFTs by means of its use as collateral for lending, especially for

high-value NFTs that today cannot be unlocked without an outright sale.

Fractionalization of NFTs also brings in more liquidity through DeFi, by combining

NFTs with tokens that can be traded on DEX-based (decentralized exchange-

based) liquidity pools. Nesting and wrapping of NFTs with fungible tokens opens up

new avenues and use cases.

Payments as small as tenth of a cent are

required to realize the value of the

Metaverse

DeFi can help unlock the value in NFTs by

means of its use as collateral for lending](https://image.slidesharecdn.com/citibankmetaverseandmoney-220402083901/75/CITIBANK-METAVERSE-AND-MONEY-127-2048.jpg)

![Citi GPS: Global Perspectives & Solutions March 2022

© 2022 Citigroup

138

In South Korea, the Communications Commission (the domestic media regulation

agency) announced a new council mandate in January 2022 focused on user

protection in the Metaverse, including sexual harassment targeting minors, violence,

and inclusivity. The council consists of 30 professionals in media, law, technology,

and industrial management.

During a parliamentary sitting in Singapore on January 11, 2022, the Minister for

Communications and Information was asked to comment on the Metaverse

specifically. The Ministry’s response highlights the fine balancing act between risk

and reward, and the importance of international regulatory coordination.

The Ministry observed that technologies such as the Metaverse are at a nascent

stage of development and application, and that they present the potential for both

businesses and people to extend their activities and ownership into the virtual world.

The Ministry also noted that the government is closely studying their characteristics,

attendant implications, and risks:

“For example, the immersive, interactive, decentralized, or anonymity elements of

these technologies have the potential to be harnessed to either strengthen or pose

risks to online safety, consumer protection, privacy, and protection of intellectual

property.”

The Ministry went on to explain that the government “will seek to balance between

promoting economic vitality, preserving social stability, and protecting public security

in the digital domain. International coordination of regulatory approaches to the

Metaverse and associated technologies will also be crucial, given the borderless

nature of these technologies.”

Margrethe Vestager, Executive Vice-President for a Europe Fit for the Digital Age

and Commissioner for Competition at the European Commission (EC), has also

called out the Metaverse and expressed competition concerns in an interview she

did with the online news site POLITICO Europe on January 18, 2022.

“The Metaverse will present new markets and a range of different businesses.

There will be a marketplace where someone may have a dominant position,” and

said. “Things are happening that [the EU needs] to be able to follow.”

On examining emerging digital spaces and the potential abuses of power that could

arise, she goes on to say, “We should start thinking about it now.” Vestager added

that the likely increase in the use of non-fungible tokens (NFTs) within the

Metaverse could also be an area to follow closely.

This is a warning signal of what is to come, namely, scrutiny from competition

regulators and scrutiny of NFTs (more on these tokens below). The fact that NFTs

are called out is understandable given the role they will play in the Metaverse.

Open or Closed Metaverse?

Earlier in the report, we cover two design choices pertaining to the Metaverse,

namely Open, based on blockchain primitives of sovereign identity and ownership,

that are trustless, permissionless, and borderless; and Closed, built by capital-

efficient platform companies that provide convenient user experience. There will be

different regulatory considerations for each as they are being built out.](https://image.slidesharecdn.com/citibankmetaverseandmoney-220402083901/75/CITIBANK-METAVERSE-AND-MONEY-138-2048.jpg)

![Citi GPS: Global Perspectives & Solutions March 2022

© 2022 Citigroup

142

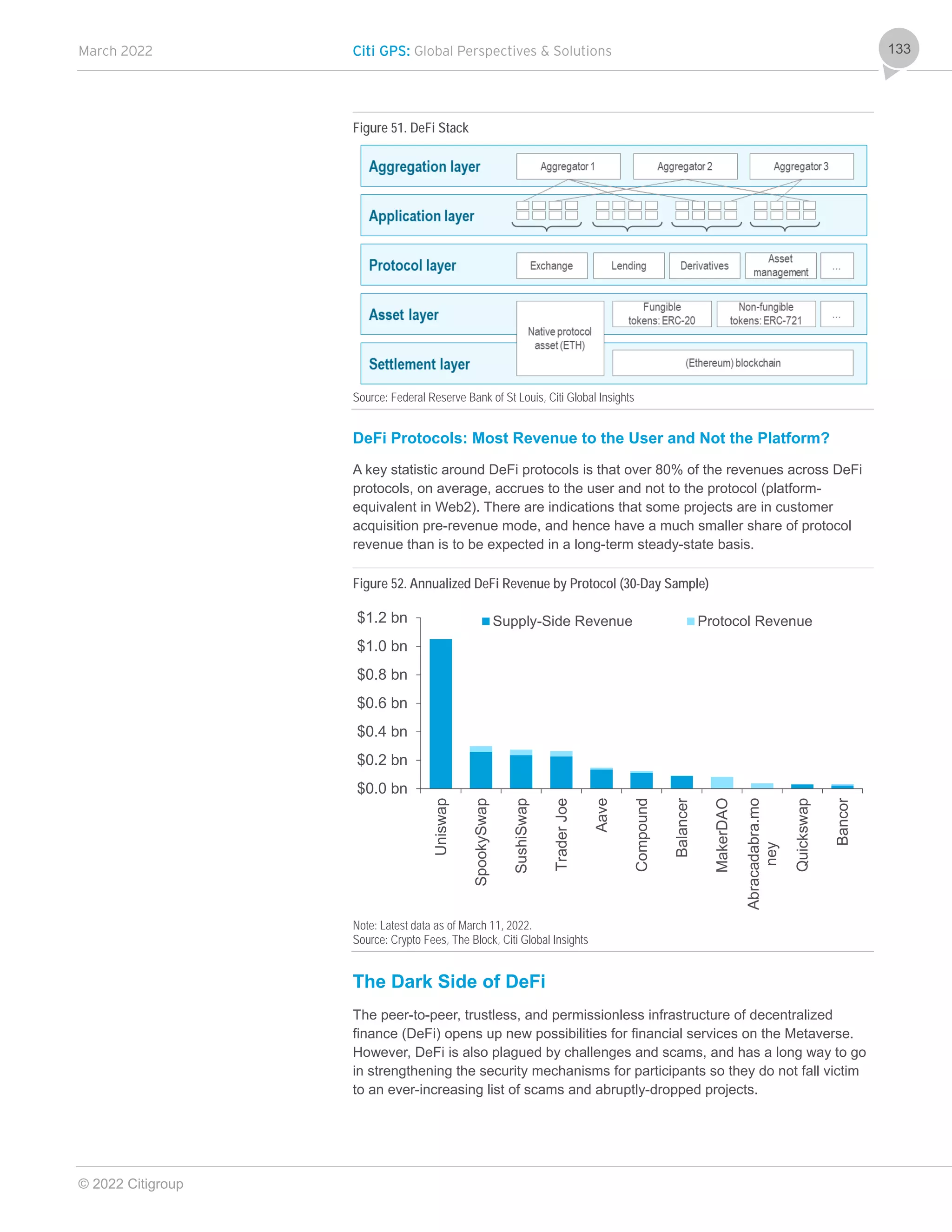

The authors of the paper “DeFi Risks and the Decentralization Illusion,” published in

the BIS Quarterly Review, note, “[DeFi] platforms have groups of stakeholders that

take and implement decisions, exercising managerial or ownership benefits. These

groups, and the governance protocols on which their interactions are based, are the

natural entry points for policymakers.”

They also warn, “The limited application of anti-money laundering and know-your-

customer (AML/KYC) provisions, together with transaction anonymity, exposes DeFi

to illegal activities and market manipulation.”

We saw these risks crystalize very recently following the Wonderland DeFi protocol

scandal in January 2022 after it emerged that a convict was serving as its treasury

manager. This is certainly an area to watch and see how the regulatory response

will unfold in the future.

Already, the 2021 FATF guidance mentioned above brings creators, owners,

operators, and other persons who maintain control or sufficient influence in DeFi

arrangements under its “VASP” definition, where they are providing or actively

facilitating VASP services (and leaves the door open for countries to consider other

factors as well).

This means that owners/operators falling within the VASP definition will have to

undertake money laundering/terrorism financing risk assessments prior to the

launch or use of the software or platform and take appropriate measures to manage

and mitigate these risks on an ongoing and forward-looking basis as per the 2021

FATF guidance.

This guidance also considers cases where it is not possible to identify a legal or

natural person with control or sufficient influence over a DeFi arrangement. In these

cases, it says that, “countries should consider, where appropriate, any mitigating

actions, where DeFi services operating in this manner are known to them.” An

example of a mitigating action is for countries to consider the option of requiring a

regulated VASP to be involved in the activities related to the DeFi arrangement in

line with the country’s risk-based approach or to consider other mitigations.

Following the publication of the BIS paper and the FATF guidance, policymakers

around the world are in the very early stages of contemplating what action to take. It

is possible that the scams/rug pulls, which have made their way into the DeFi

ecosystem, will give regulators a reason to look at this space more closely.

It is difficult to see what recourse, if any, there will be in the case of decentralized

exchanges that do not have auditing protocols in place making it very easy for any

bad actor (e.g., a bad developer) to create and enlist new tokens.

However, this very characteristic makes these regulations difficult to implement

in the DeFi world, as they do not function in a similar manner. Well-reviewed and

audited smart contracts should do exactly what you want them to do — there is

no scope for subjectivity or judgement.

– REBECCA RETTIG, GENERAL COUNSEL AT AAVE COMPANIES

The FATF's 2021 guidance brings creators,

owners, operators and any person who

maintains control or sufficient influence in

the DeFi protocols under their VASP

definition

We believe there will be a further regulatory

response given DeFi and decentralized

applications are the financial backbone of

Web3, allowing transactions to take place on

a peer-to-peer basis without the need for an

intermediary](https://image.slidesharecdn.com/citibankmetaverseandmoney-220402083901/75/CITIBANK-METAVERSE-AND-MONEY-142-2048.jpg)

![March 2022 Citi GPS: Global Perspectives & Solutions

© 2022 Citigroup

173

Anyone can create an application with any rules by DeFining it as a smart

contract. Almost everything that’s implemented in Ethereum is done through

smart contracts. A smart contract is a piece of program that has scripting code

built into it. It is a testament to Ethereum’s smart contract functionality that the

total value locked in its smart contract platform is over $110 billion (March 2022)

— in diverse use cases ranging from stablecoins to virtual lands.

Once created, anyone can interact with the application by sending transactions to

that specific contract address.

Ethereum as a State Machine

Similar to Bitcoin, Ethereum maintains a single global state — however, this state is

embodied by a more complex description than in Bitcoin.

In simple terms, the state of the Bitcoin blockchain is the list of balances of accounts

— the unspent transaction outputs (UTXOs), i.e., the amount of Bitcoin that every

person has. In Ethereum, the state is more complex — the state is represented as a

mapping from addresses to account objects. As noted earlier, account objects can

be simple user accounts, or contract accounts.

How Code Execution Works in Ethereum

A transaction can only be initiated by an Externally Owned Account.

If the destination of the transaction is another user account, it is a simple transfer

of balance (ether — ETH — the currency of Ethereum blockchain) from one

address to another.

If the destination of the transaction is an account that has code, then the code at

the destination gets executed.

Code in Ethereum can do one of the three things:

– Send ETH to other contracts

– Read/write storage on the blockchain

– Call (i.e., start execution of) other contracts on the blockchain

In the process of running the transaction, if the transaction goes to a contract,

then the contract code gets executed, and the state of the global computer is

updated post the execution.

Given that any complex program could run indefinitely and clog the entire global

computer, Ethereum has an built-in metering system by means of “gas” and “gas

price.” Gas is a fee that is charged for every computational step, and depends on

factors like complexity and storage involved.

Programs will execute until they run out of gas, and in a way that is atomic (implying

that the entire transaction will be reverted if it runs out of gas mid-way). This keeps

malicious or badly written programs from clogging the entire blockchain.

Ethereum Blockchain

At its very core, a blockchain group blocks of transactions and writes them to the

database. At the end of addition of every new block to the chain, we get a new state

of the blockchain. In Figure 60, S[1], S[2] etc., are the different states of the

blockchain after a set of transactions are written to it.

Every full node on the Ethereum blockchain

processes every transaction and stores the

entire state](https://image.slidesharecdn.com/citibankmetaverseandmoney-220402083901/75/CITIBANK-METAVERSE-AND-MONEY-173-2048.jpg)

![Citi GPS: Global Perspectives & Solutions March 2022

© 2022 Citigroup

174

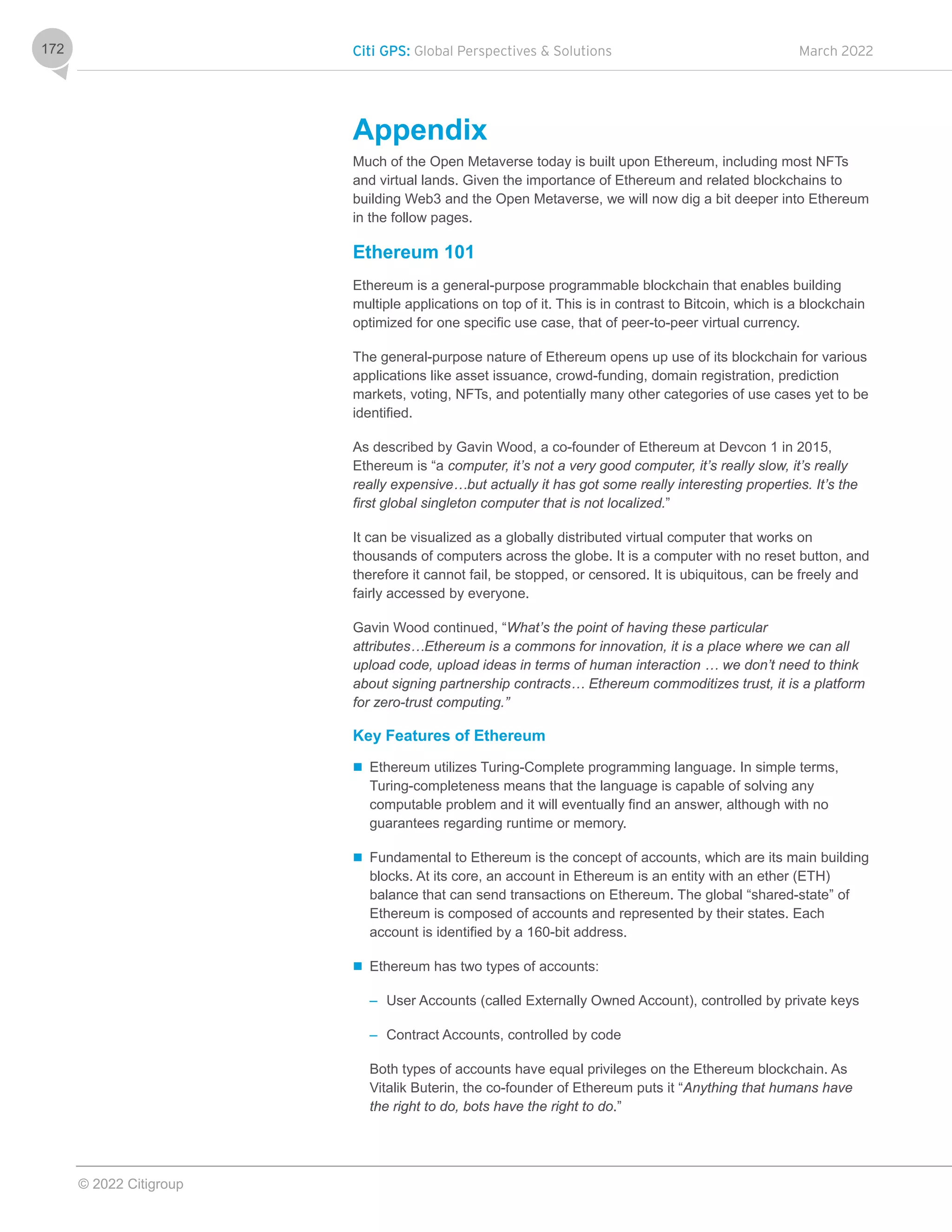

Figure 60. The Ethereum Blockchain

Source: Ethereum Whitepaper, Citi Global Insights

Below are the main components of the Ethereum blockchain (and in general, most

public blockchains):

A peer-to-peer network of nodes that propagate transactions and blocks of

verified transactions.

Messages, in the form of transactions, representing state transitions.

A set of consensus rules, governing what constitutes a transaction and what

makes for a valid state transition.

A state machine that processes transactions according to the consensus rules.

A chain of cryptographically-secured blocks that act as a journal of all the verified

and accepted state transitions.

A consensus algorithm that decentralizes control over the blockchain.

A game-theoretically sound incentive scheme (e.g., Proof-of-Work, Proof-of-

Stake, etc.) to economically secure the state machine.

Open-source implementation of the above (clients).

An Ethereum client is a software application that implements the Ethereum

specification and communicates over the peer-to-peer network with other Ethereum

clients. Different Ethereum clients interoperate if they comply with the reference

specification and the standardized communication protocols.

Any node on the network that is a “miner” can attempt to create and validate a

block. Miners compete to write the next block (and earn rewards) by racing to solve

a complex computational problem, by “Proof-of-Work”.

Proof-of-Work (or any other reliable consensus mechanism) is a core requirement

of a public, trustless blockchain to ensure that there is a real cost to the miners’

participation, and this incentivizes honest behavior from the miners, thereby

securing the network.

Switch from Proof-of-Work to Proof-of-Stake

Proof-of-Work is highly wasteful. Around 600 trillion hashing computations are being

performed by the Bitcoin network every second, and these ultimately have no

practical or scientific value, other than to evidence that real effort was expended to

ensure there are no easily-enabled malicious attacks.

Tx[0]

PAY

BLOCK

REWARD

S_FINAL

S[n]

APPLY

Tx[n-1]

S[0]

Tx[1]

APPLY S[2]

S[1] APPLY …](https://image.slidesharecdn.com/citibankmetaverseandmoney-220402083901/75/CITIBANK-METAVERSE-AND-MONEY-174-2048.jpg)

![Citi GPS: Global Perspectives & Solutions March 2022

© 2022 Citigroup

182

If you are visually impaired and would like to speak to a Citi representative regarding the details of the graphics in this

document, please call USA 1-888-800-5008 (TTY: 711), from outside the US +1-210-677-3788

IMPORTANT DISCLOSURES

This communication has been prepared by Citigroup Global Markets Inc. and is distributed by or through its locally authorised affiliates (collectively, the "Firm")

[E6GYB6412478]. This communication is not intended to constitute "research" as that term is defined by applicable regulations. Unless otherwise indicated, any reference to a

research report or research recommendation is not intended to represent the whole report and is not in itself considered a recommendation or research report. The views

expressed by each author herein are his/ her personal views and do not necessarily reflect the views of his/ her employer or any affiliated entity or the other authors, may differ

from the views of other personnel at such entities, and may change without notice.

You should assume the following: The Firm may be the issuer of, or may trade as principal in, the financial instruments referred to in this communication or other related

financial instruments. The author of this communication may have discussed the information contained herein with others within the Firm and the author and such other Firm

personnel may have already acted on the basis of this information (including by trading for the Firm's proprietary accounts or communicating the information contained herein to

other customers of the Firm). The Firm performs or seeks to perform investment banking and other services for the issuer of any such financial instruments. The Firm, the Firm's

personnel (including those with whom the author may have consulted in the preparation of this communication), and other customers of the Firm may be long or short the

financial instruments referred to herein, may have acquired such positions at prices and market conditions that are no longer available, and may have interests different or

adverse to your interests.

This communication is provided for information and discussion purposes only. It does not constitute an offer or solicitation to purchase or sell any financial instruments. The

information contained in this communication is based on generally available information and, although obtained from sources believed by the Firm to be reliable, its accuracy

and completeness is not guaranteed. Certain personnel or business areas of the Firm may have access to or have acquired material non-public information that may have an

impact (positive or negative) on the information contained herein, but that is not available to or known by the author of this communication.

The Firm shall have no liability to the user or to third parties, for the quality, accuracy, timeliness, continued availability or completeness of the data nor for any special, direct,

indirect, incidental or consequential loss or damage which may be sustained because of the use of the information in this communication or otherwise arising in connection with

this communication, provided that this exclusion of liability shall not exclude or limit any liability under any law or regulation applicable to the Firm that may not be excluded or

restricted.

The provision of information is not based on your individual circumstances and should not be relied upon as an assessment of suitability for you of a particular product or

transaction. Even if we possess information as to your objectives in relation to any transaction, series of transactions or trading strategy, this will not be deemed sufficient for

any assessment of suitability for you of any transaction, series of transactions or trading strategy.

The Firm is not acting as your advisor, fiduciary or agent and is not managing your account. The information herein does not constitute investment advice and the Firm makes

no recommendation as to the suitability of any of the products or transactions mentioned. Any trading or investment decisions you take are in reliance on your own analysis and

judgment and/or that of your advisors and not in reliance on us. Therefore, prior to entering into any transaction, you should determine, without reliance on the Firm, the

economic risks or merits, as well as the legal, tax and accounting characteristics and consequences of the transaction and that you are able to assume these risks.

Financial instruments denominated in a foreign currency are subject to exchange rate fluctuations, which may have an adverse effect on the price or value of an investment in

such products. Investments in financial instruments carry significant risk, including the possible loss of the principal amount invested. Investors should obtain advice from their

own tax, financial, legal and other advisors, and only make investment decisions on the basis of the investor's own objectives, experience and resources.

This communication is not intended to forecast or predict future events. Past performance is not a guarantee or indication of future results. Any prices provided herein (other

than those that are identified as being historical) are indicative only and do not represent firm quotes as to either price or size. You should contact your local representative

directly if you are interested in buying or selling any financial instrument, or pursuing any trading strategy, mentioned herein. No liability is accepted by the Firm for any loss

(whether direct, indirect or consequential) that may arise from any use of the information contained herein or derived herefrom.

Although the Firm is affiliated with Citibank, N.A. (together with its subsidiaries and branches worldwide, "Citibank"), you should be aware that none of the other financial

instruments mentioned in this communication (unless expressly stated otherwise) are (i) insured by the Federal Deposit Insurance Corporation or any other governmental

authority, or (ii) deposits or other obligations of, or guaranteed by, Citibank or any other insured depository institution. This communication contains data compilations, writings

and information that are proprietary to the Firm and protected under copyright and other intellectual property laws, and may not be redistributed or otherwise transmitted by you

to any other person for any purpose.

IRS Circular 230 Disclosure: Citi and its employees are not in the business of providing, and do not provide, tax or legal advice to any taxpayer outside of Citi. Any statements

in this Communication to tax matters were not intended or written to be used, and cannot be used or relied upon, by any taxpayer for the purpose of avoiding tax penalties. Any

such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor.

© 2022 Citigroup Global Markets Inc. Member SIPC. All rights reserved. Citi and Citi and Arc Design are trademarks and service marks of Citigroup Inc. or its affiliates and are

used and registered throughout the world.](https://image.slidesharecdn.com/citibankmetaverseandmoney-220402083901/75/CITIBANK-METAVERSE-AND-MONEY-182-2048.jpg)