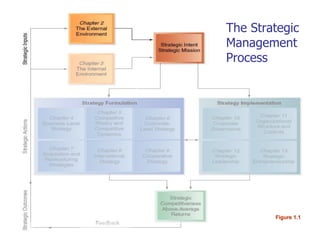

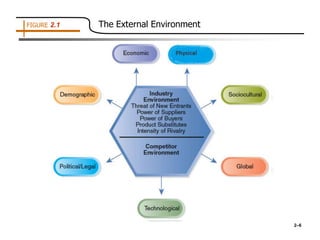

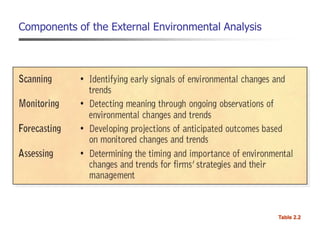

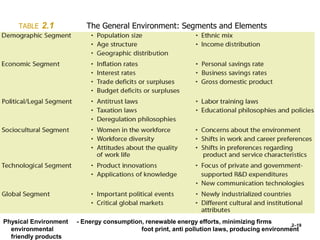

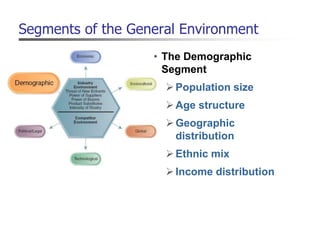

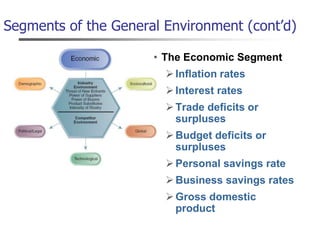

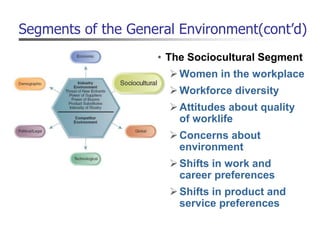

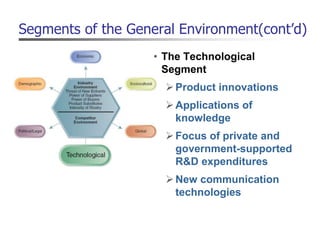

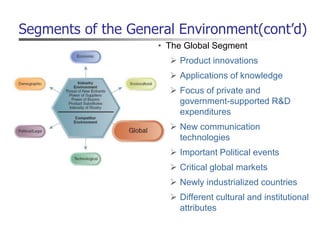

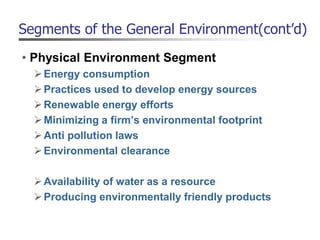

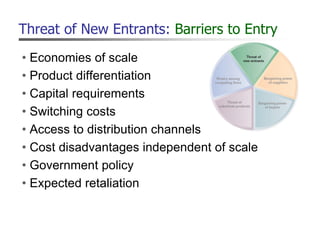

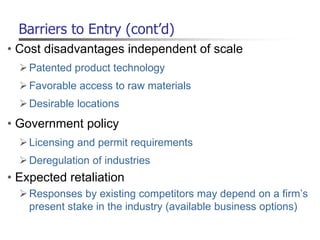

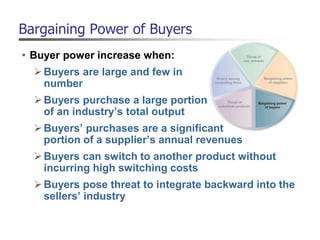

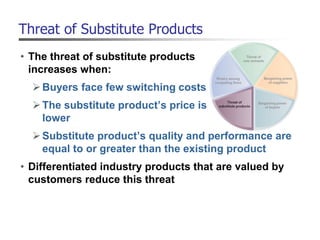

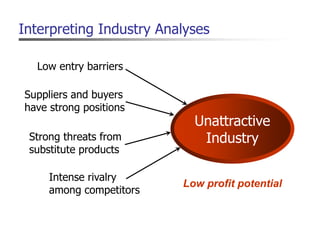

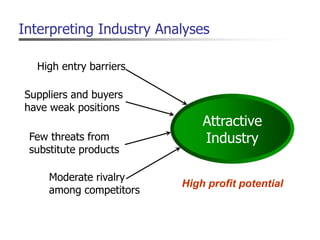

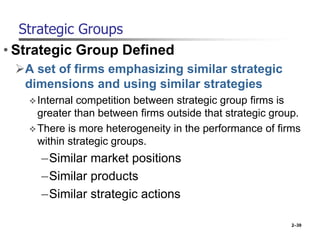

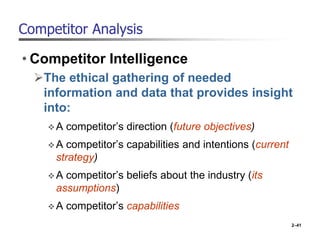

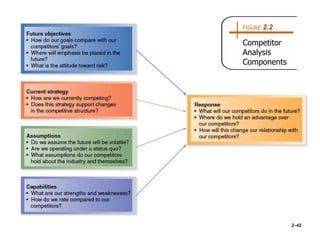

This document outlines key concepts from Chapter 2 of a strategic management textbook. It discusses the importance of analyzing a firm's external environment, including the general environment and industry environment. The general environment comprises 6 segments: demographic, economic, political/legal, sociocultural, technological, and physical. The industry environment is analyzed using Porter's 5 forces model. Competitor analysis and identifying a firm's key success factors are also important parts of external analysis. The document provides examples and definitions to explain these strategic management concepts.