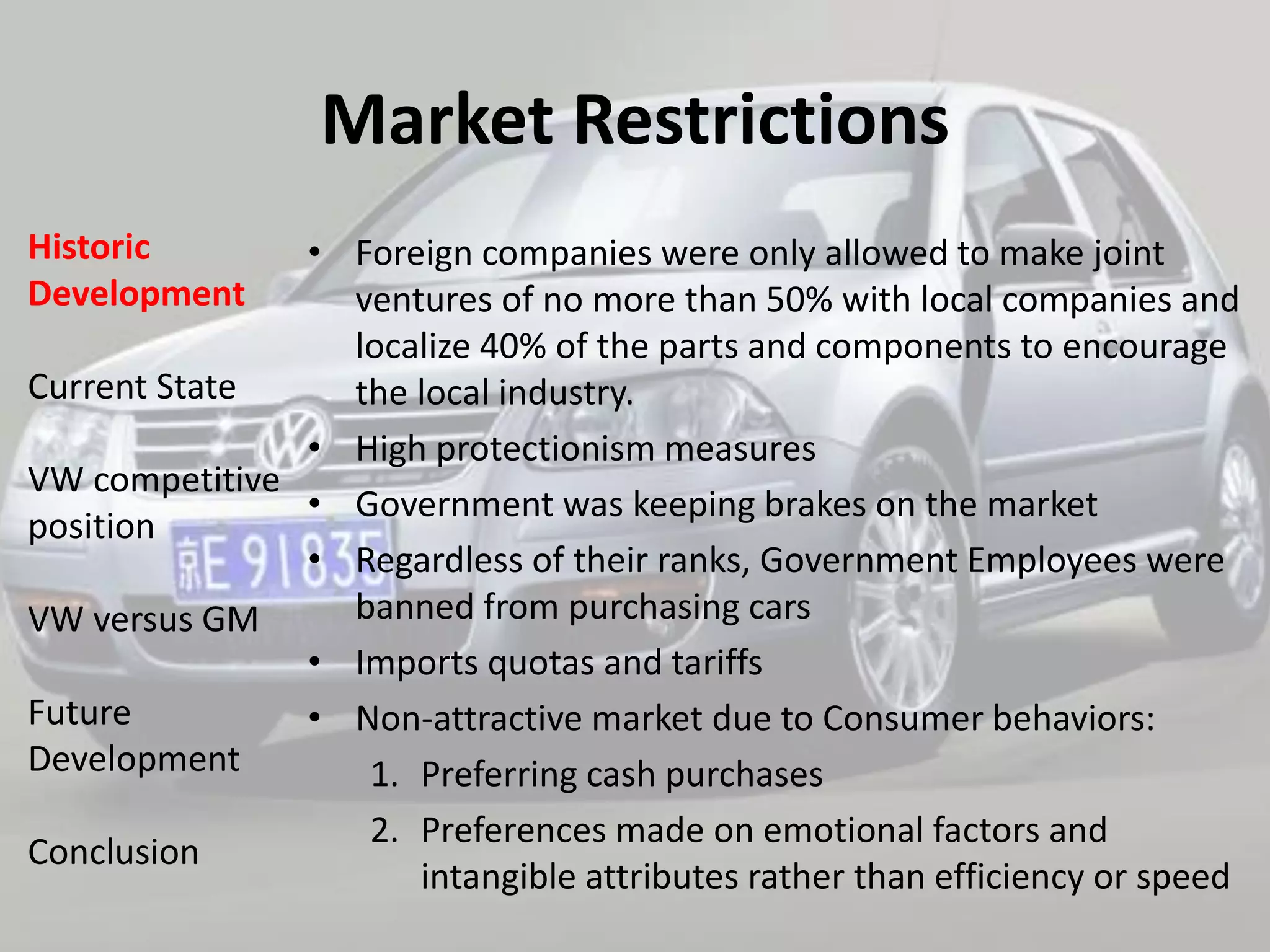

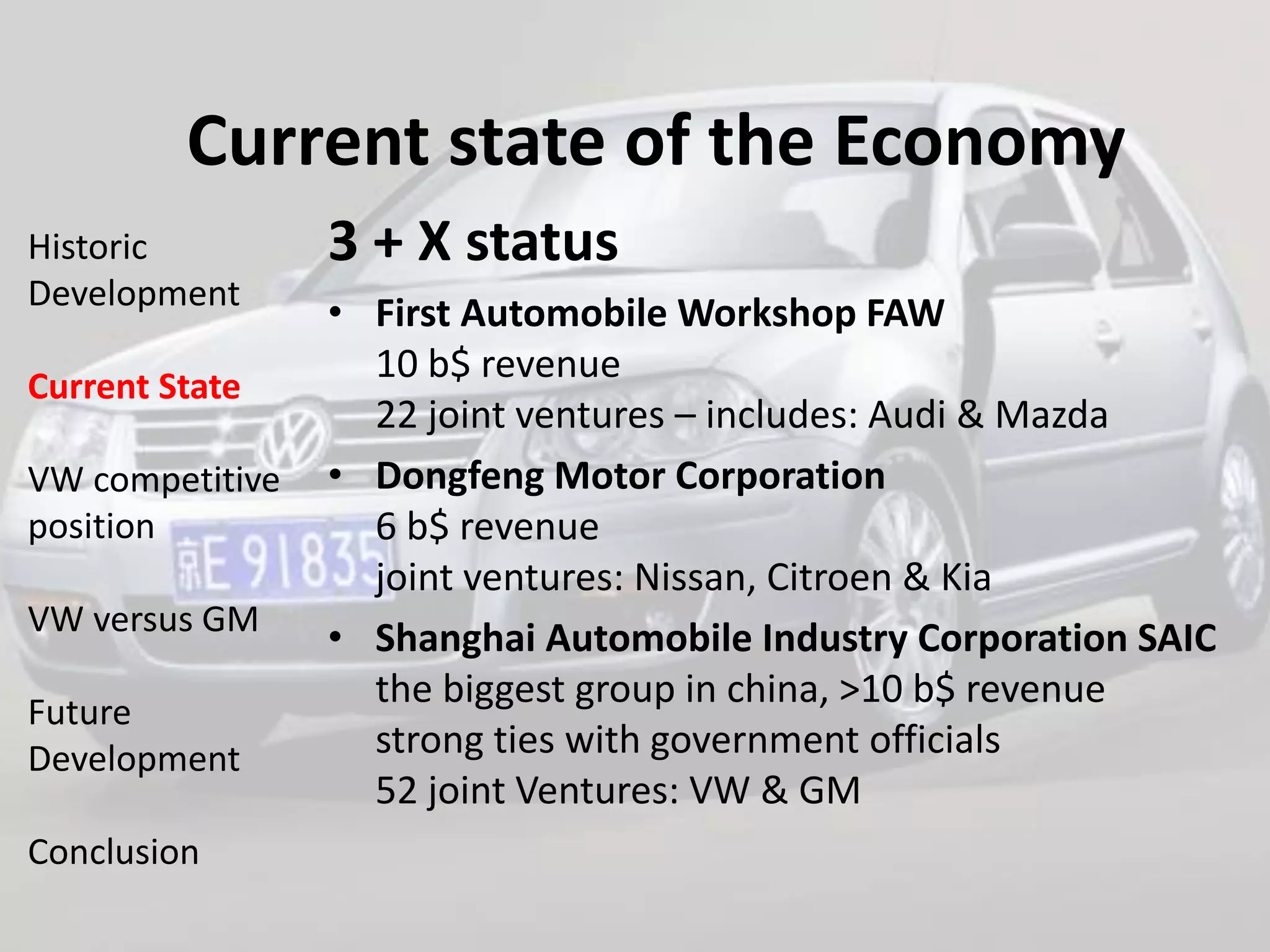

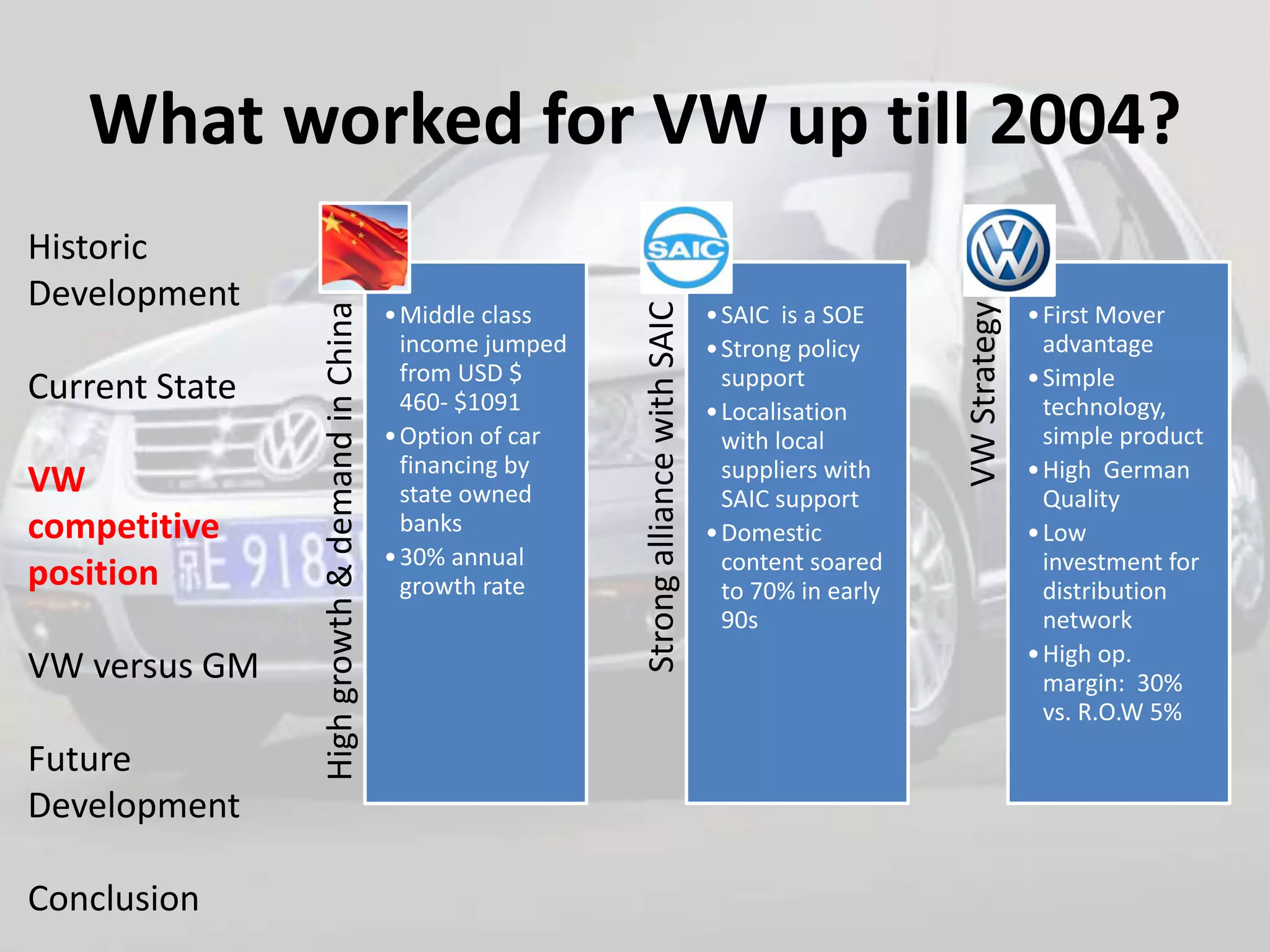

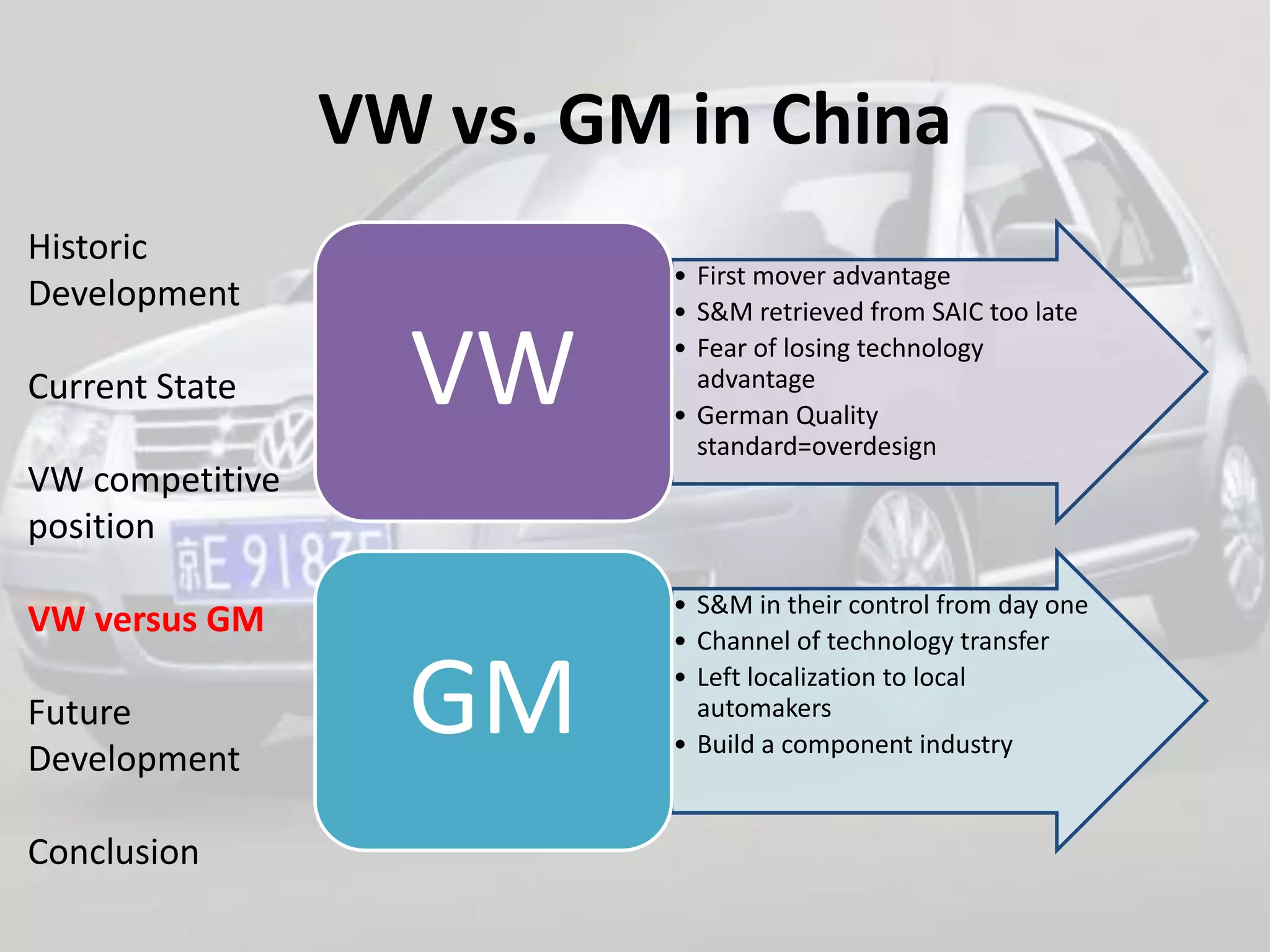

1) VW had early success in China from the 1990s-2004 due to its alliance with SAIC, localization efforts, and focus on quality and simple products.

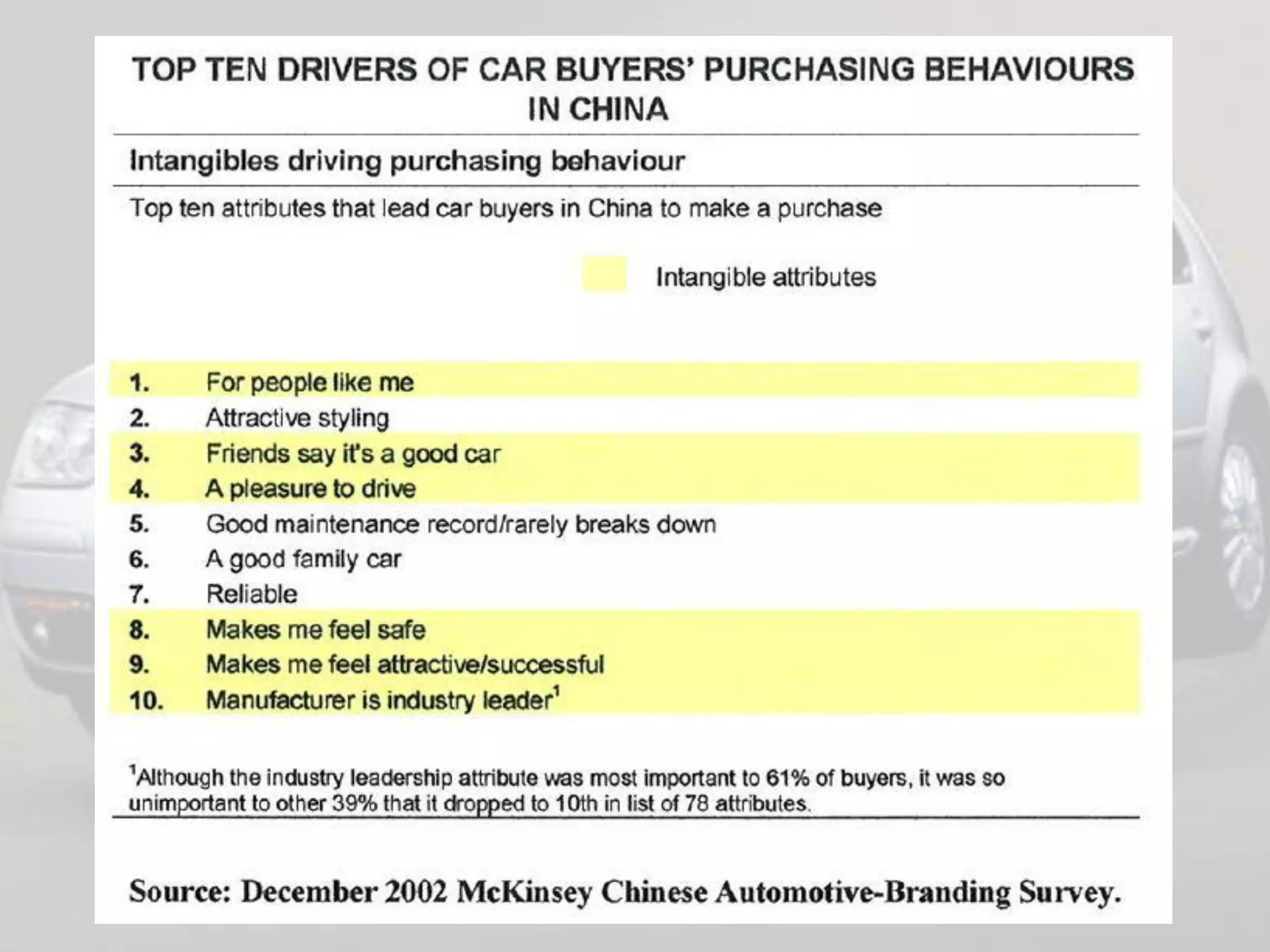

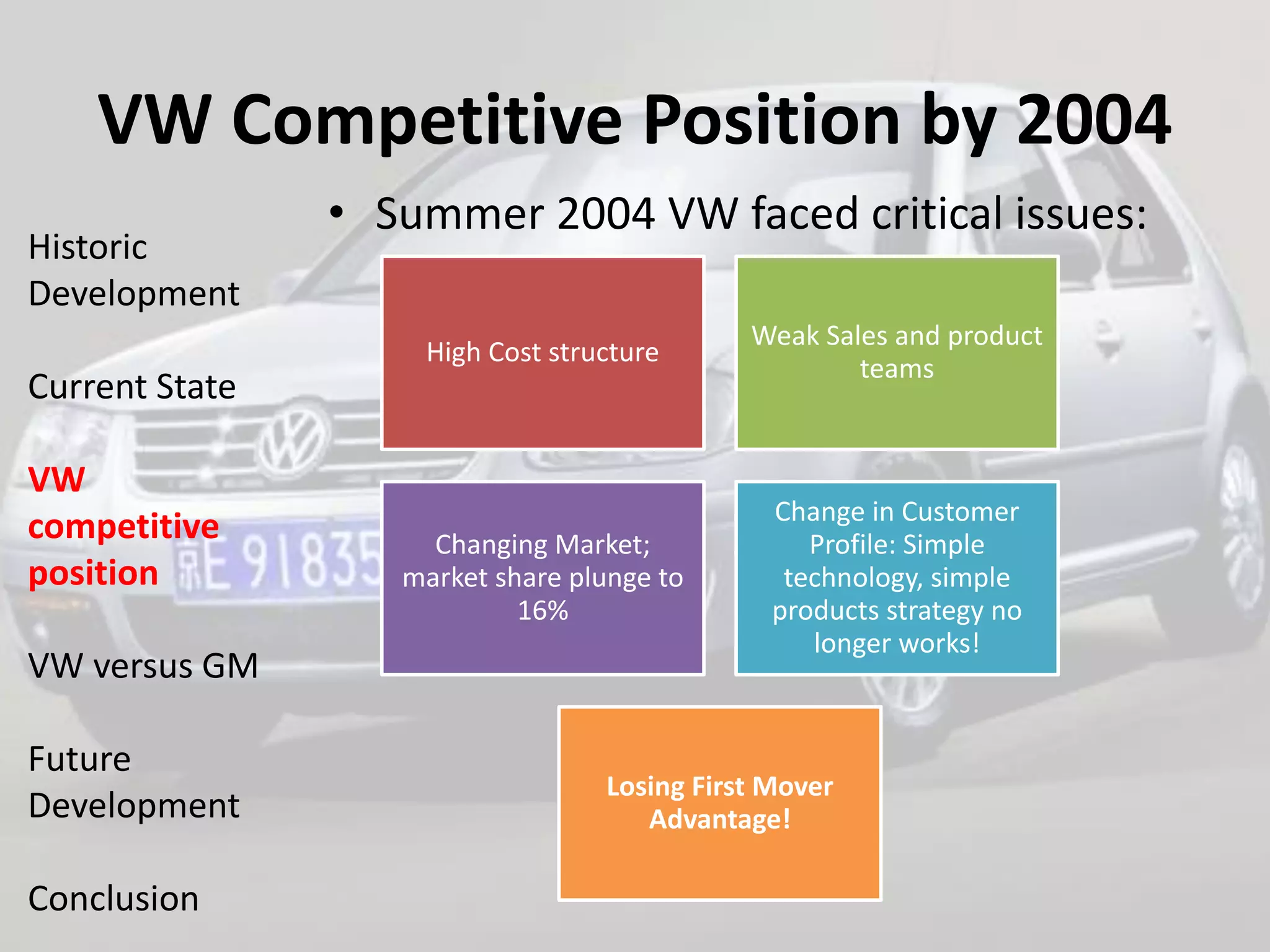

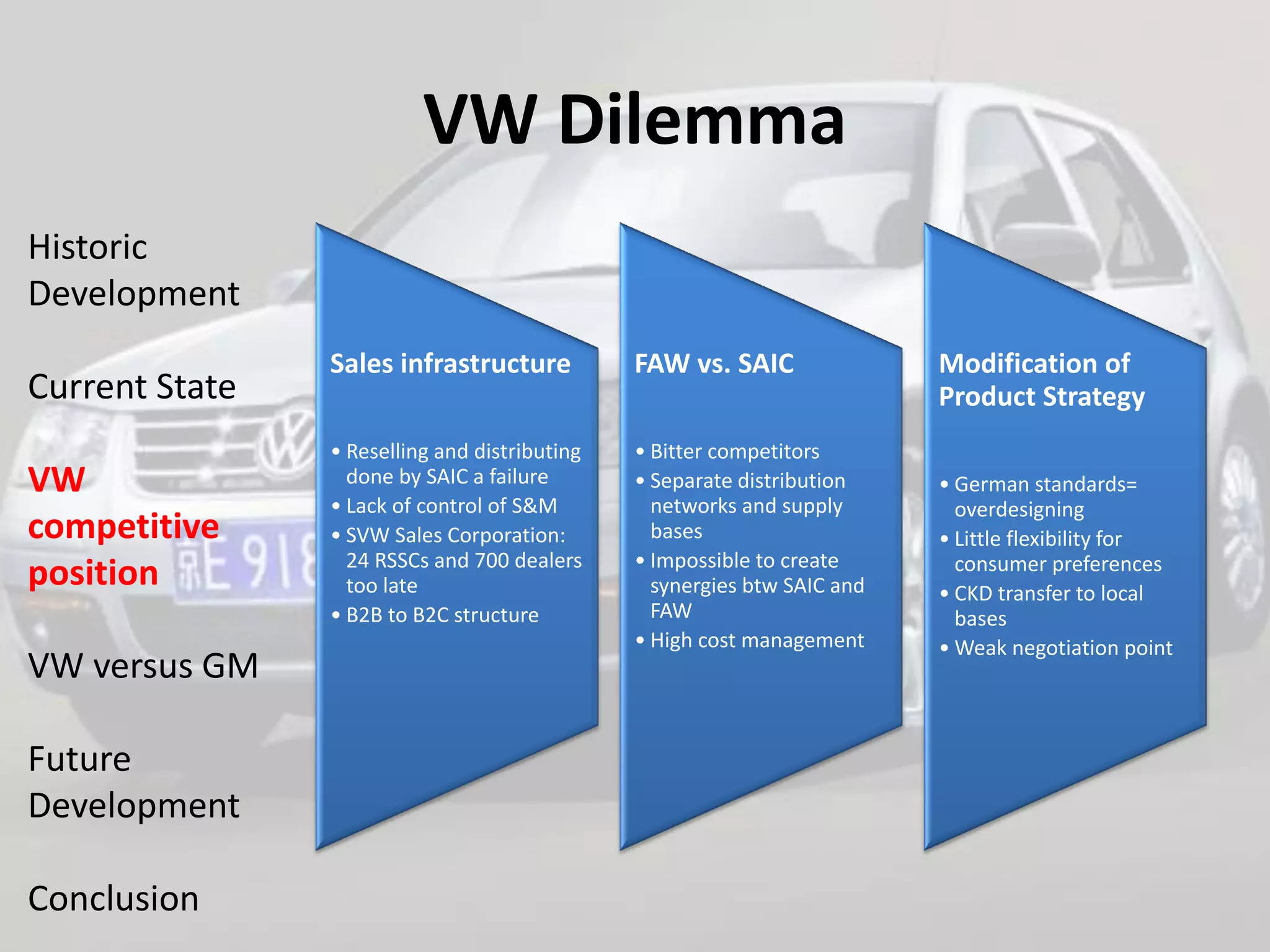

2) However, by 2004 VW faced issues as costs rose, market share fell, and customer preferences changed requiring more flexible products.

3) VW launched a "Start from Zero" change program to develop a more sustainable strategy, including modifying product design and restructuring sales and distribution networks.