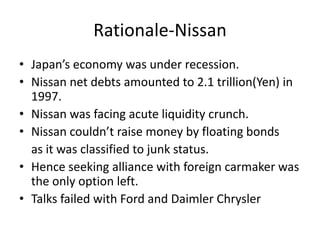

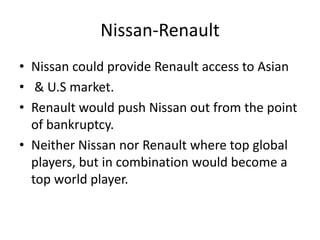

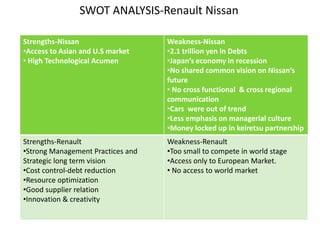

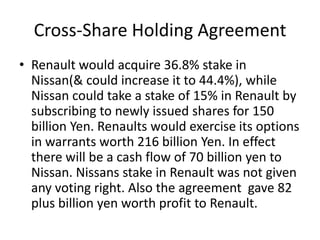

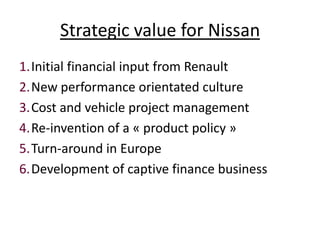

The document discusses the strategic alliance between Renault and Nissan. Renault and Nissan formed an alliance in 1999 due to both companies needing to expand globally. Nissan was facing financial difficulties and wanted to access overseas markets, while Renault only had a 4% global market share and was confined to Europe. The alliance gave both companies access to new markets and economies of scale. It involved Renault acquiring a 36.8% stake in Nissan in exchange for cash and loans to help turn Nissan around financially. The alliance provided both companies with strategic benefits like increased international presence, shared resources, and transfer of best practices.