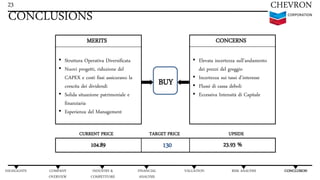

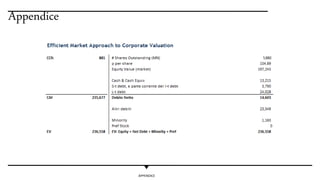

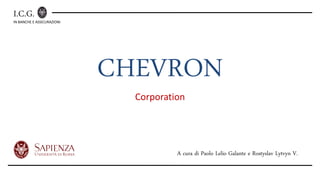

The document provides an extensive analysis of Chevron Corporation, including its financial performance, profitability, dividend policy, and stock performance indicators. It highlights key aspects such as corporate governance, strategic business units, and competitive positioning within the industry, as well as presenting financial metrics and market forecasts. Additionally, it includes risk analysis and assumptions related to future growth and dividend strategies.

![08

INDUSTRY & COMPETITORS

CHEVRON

CORPORATION

HIGHLIGHTS COMPANY

OVERVIEW

INDUSTRY &

COMPETITORS

FINANCIAL

ANALYSIS

VALUATION RISK ANALYSIS CONCLUSION

06/2014 07/2014 08/2014 09/2014 10/2014 11/2014 12/2014 01/2015 02/2015 03/2015 04/2015 05/2015

70.000000

75.000000

80.000000

85.000000

90.000000

95.000000

100.000000

105.000000

110.000000

115.000000BP-LON Price CVX-USA Price FP-PAR Price RDSB-LON Price XOM-USA Price Index Base [100]

BP CVX FP RDSB XOM

BP

100.00% 75.04% 94.90% 66.48% 64.76%

CVX

75.04% 100.00% 73.32% 95.09% 94.79%

FP

94.90% 73.32% 100.00% 68.35% 62.91%

RDSB

66.48% 95.09% 68.35% 100.00% 92.70%

XOM

64.76% 94.79% 62.91% 92.70% 100.00%

COMPETITOR’S PRICE HISTORY AND

CORRELATION MATRIX](https://image.slidesharecdn.com/chevroncorp-161114120700/85/Chevron-corp-9-320.jpg)

![CHEVRON

CORPORATION

HIGHLIGHTS COMPANY

OVERVIEW

INDUSTRY &

COMPETITORS

FINANCIAL

ANALYSIS

VALUATION RISK ANALYSIS CONCLUSION

VALUATION : Sensitivity

18

Excess Ret % Δ Intrinsic Value $ Δ val GIUDIZIO Rendim Azionario

5.00% -20.00% 158.83 26.32% BUY 51.4%

5.25% -16.00% 151.1 20.17% BUY 44.1%

5.50% -12.00% 143.99 14.52% BUY 37.3%

5.75% -8.00% 137.43 9.30% BUY 31.0%

6.00% -4.00% 131.36 4.47% BUY 25.2%

6.25% 0.00% 125.74 0.00% BUY 19.9%

6.50% 14.34% 120.5 -4.16% BUY 14.9%

6.75% 15.22% 115.63 -8.04% HOLD 10.2%

7.00% 16.09% 111.08 -11.66% HOLD 5.9%

7.25% 16.96% 106.82 -15.04% HOLD 1.8%

7.50% 20.00% 102.82 -18.23% HOLD -2.0%

Rf % Δ Intrinsic Value $ Δ val GIUDIZIO E[Rendim Azionario]

1.00% -54.75% 159.36 26.74% BUY 51.9%

1.25% -43.44% 151.16 20.22% BUY 44.1%

1.50% -32.13% 143.7 14.29% BUY 37.0%

1.75% -20.81% 136.87 8.86% BUY 30.5%

2.00% -9.50% 130.61 3.88% BUY 24.5%

2.21% 0.00% 125.74 0.00% BUY 19.9%

2.50% 14.34% 119.52 -4.94% BUY 13.9%

2.75% 15.22% 114.58 -8.87% HOLD 9.2%

3.00% 16.09% 110 -12.51% HOLD 4.9%

3.25% 16.96% 105.74 -15.90% HOLD 0.8%

3.50% 58.37% 101.76 -19.07% HOLD -3.0%](https://image.slidesharecdn.com/chevroncorp-161114120700/85/Chevron-corp-19-320.jpg)