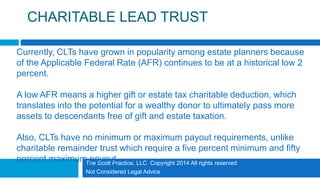

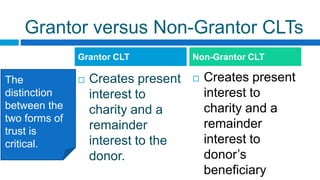

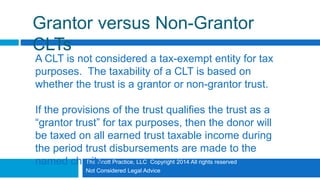

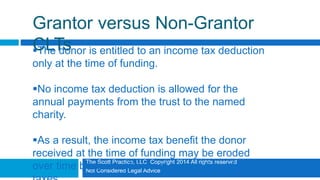

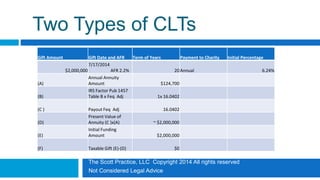

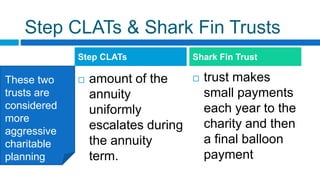

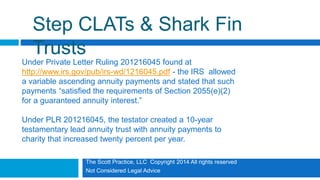

The document outlines the various types of charitable trusts, specifically charitable split-interest trusts including charitable lead and remainder trusts. It details the tax implications, structures, and benefits of these trusts, highlighting their use in charitable planning and estate tax minimization. Additionally, it compares grantor versus non-grantor trusts and discusses the flexibility and requirements of different trust types, providing insights for effective estate planning strategies.