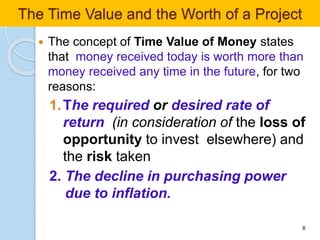

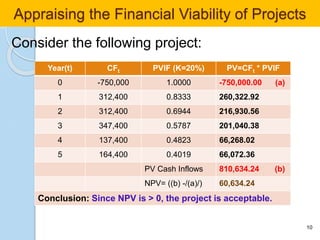

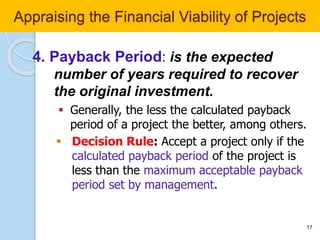

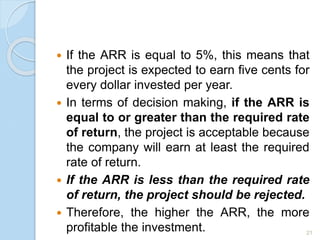

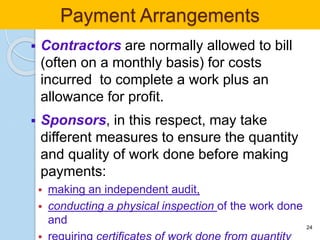

This chapter discusses the importance of cash flow management for projects. It defines cash flow as the movement of funds in and out of a project over time. Poor cash flow can cause projects to fall behind schedule and over budget. The chapter examines cash flow considerations for both project sponsors and contractors. It also covers various methods for evaluating project financial viability, including net present value, internal rate of return, profitability index, and payback period. Finally, it discusses payment arrangements, claims, variations, price adjustments, and retentions which all impact project cash flows.