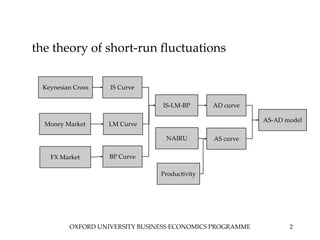

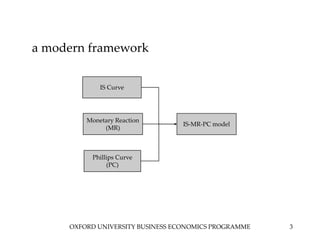

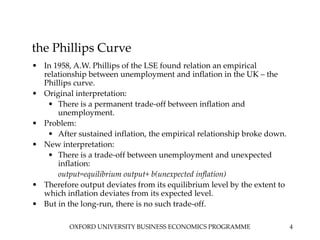

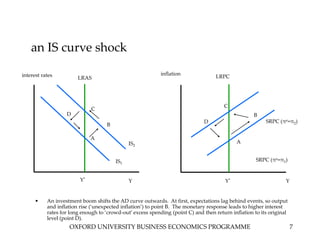

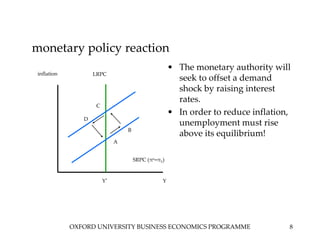

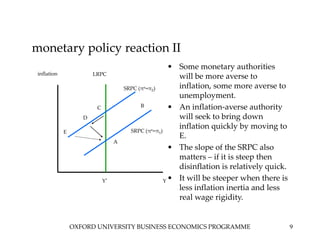

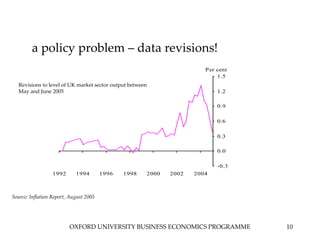

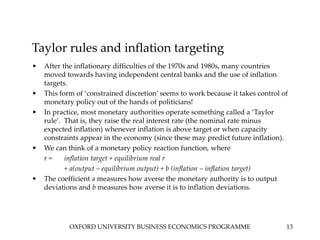

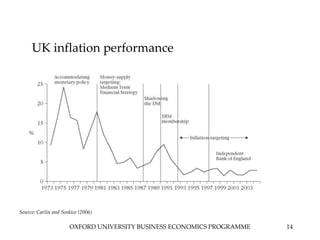

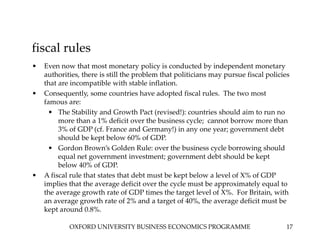

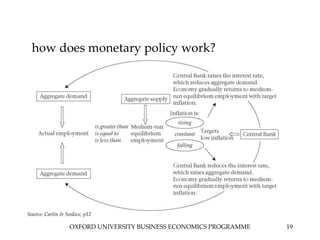

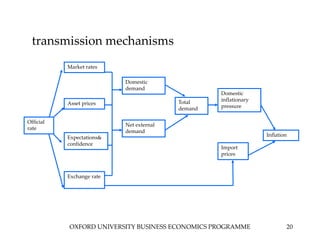

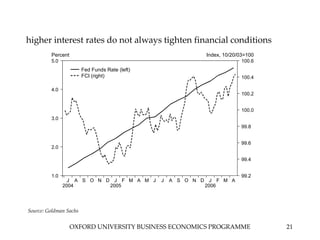

This document provides an overview of modern macroeconomic practices, including key theories such as the IS-LM model, Phillips Curve, and monetary and fiscal policy frameworks. It discusses concepts like aggregate demand, inflation expectations, monetary policy reaction functions, and fiscal rules. Models presented include the IS-MR-PC framework and how shocks to the economy can be analyzed using the IS and Phillips curves. It also examines transmission mechanisms of monetary policy and challenges like data revisions and limits to policy effectiveness.