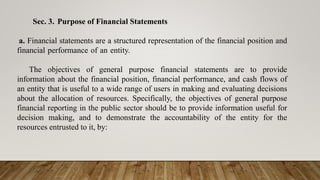

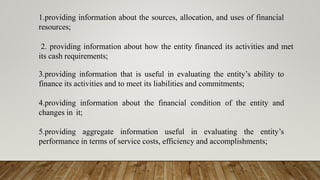

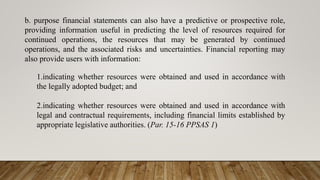

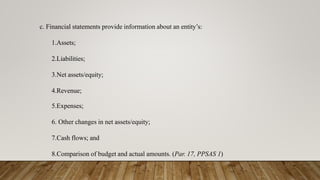

This document provides guidance on financial reporting and the preparation of general purpose financial statements. It discusses the objectives of financial reporting which is to provide useful information to decision makers and demonstrate accountability. The key components of financial statements are identified as the statement of financial position, statement of financial performance, statement of changes in net assets/equity, statement of cash flows, statement of comparison of budget and actual amounts, and notes to the financial statements. Qualitative characteristics like understandability, relevance, reliability, and comparability are also outlined.