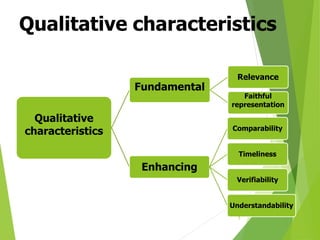

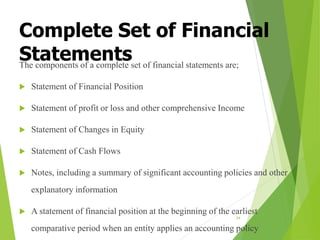

The document outlines the key components of the conceptual framework for financial reporting. It discusses the objective of providing useful financial information to investors and creditors. It also covers the underlying assumption of going concern, qualitative characteristics like relevance and faithful representation. It defines the elements of financial statements such as assets, liabilities, equity, income and expenses. It discusses recognition and measurement of these elements using approaches such as historical cost and current cost. Finally, it covers concepts of capital and capital maintenance in determining profit.