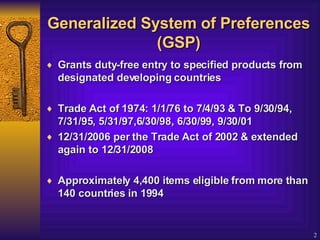

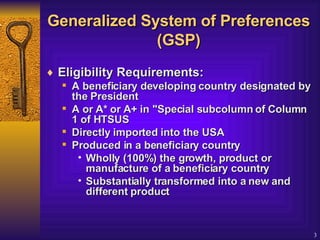

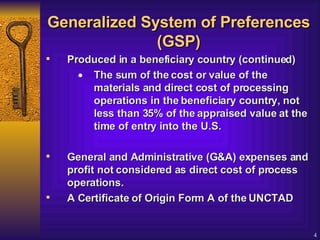

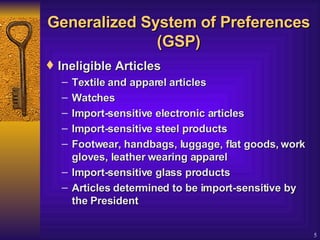

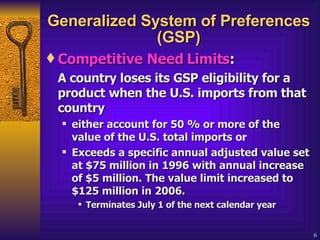

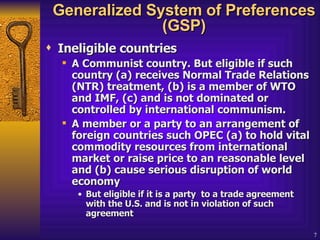

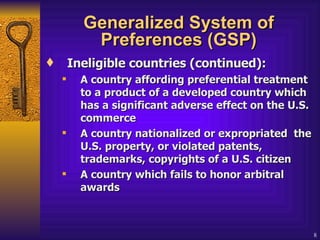

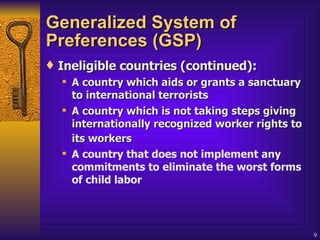

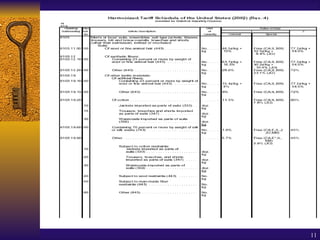

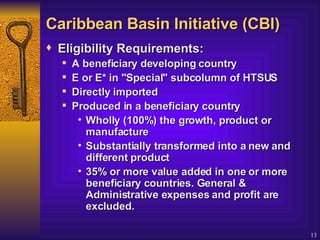

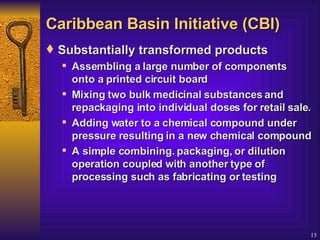

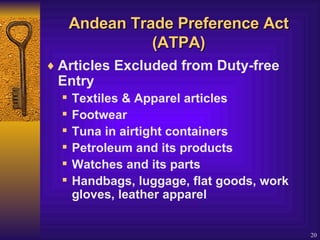

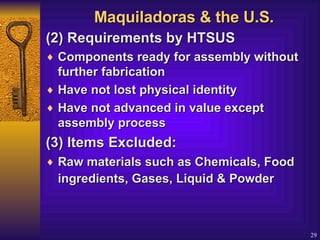

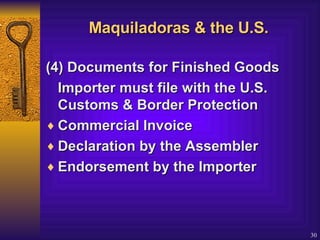

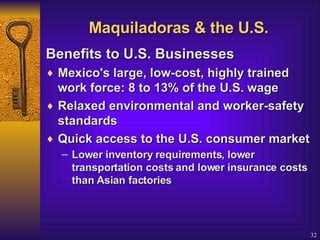

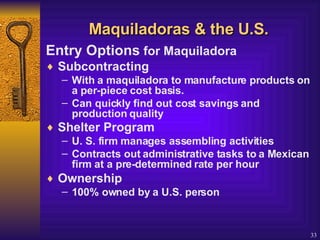

The document summarizes several U.S. trade preference programs including the Generalized System of Preferences (GSP), Caribbean Basin Initiative (CBI), Andean Trade Preference Act (ATPA), African Growth and Opportunity Act (AGOA), and the maquiladora program between the U.S. and Mexico. It describes eligibility requirements, rules of origin, products that qualify for duty-free access, and exclusions under each program.