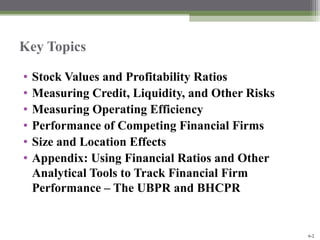

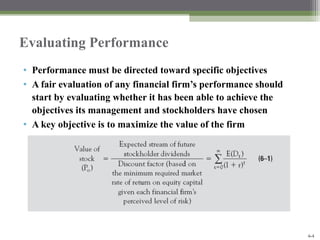

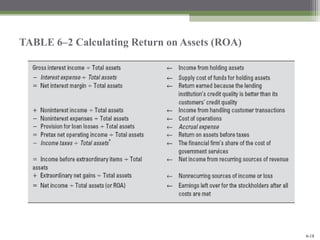

This chapter discusses measuring and evaluating the performance of banks and their competitors. It covers key profitability and risk ratios used to analyze performance, including return on equity, return on assets, net interest margin, and risk measures. The chapter also discusses how size and location can impact performance metrics and ratios. Regulatory reports like the UBPR and BHCPR provide detailed financial data and ratios to analyze bank and holding company performance over time.