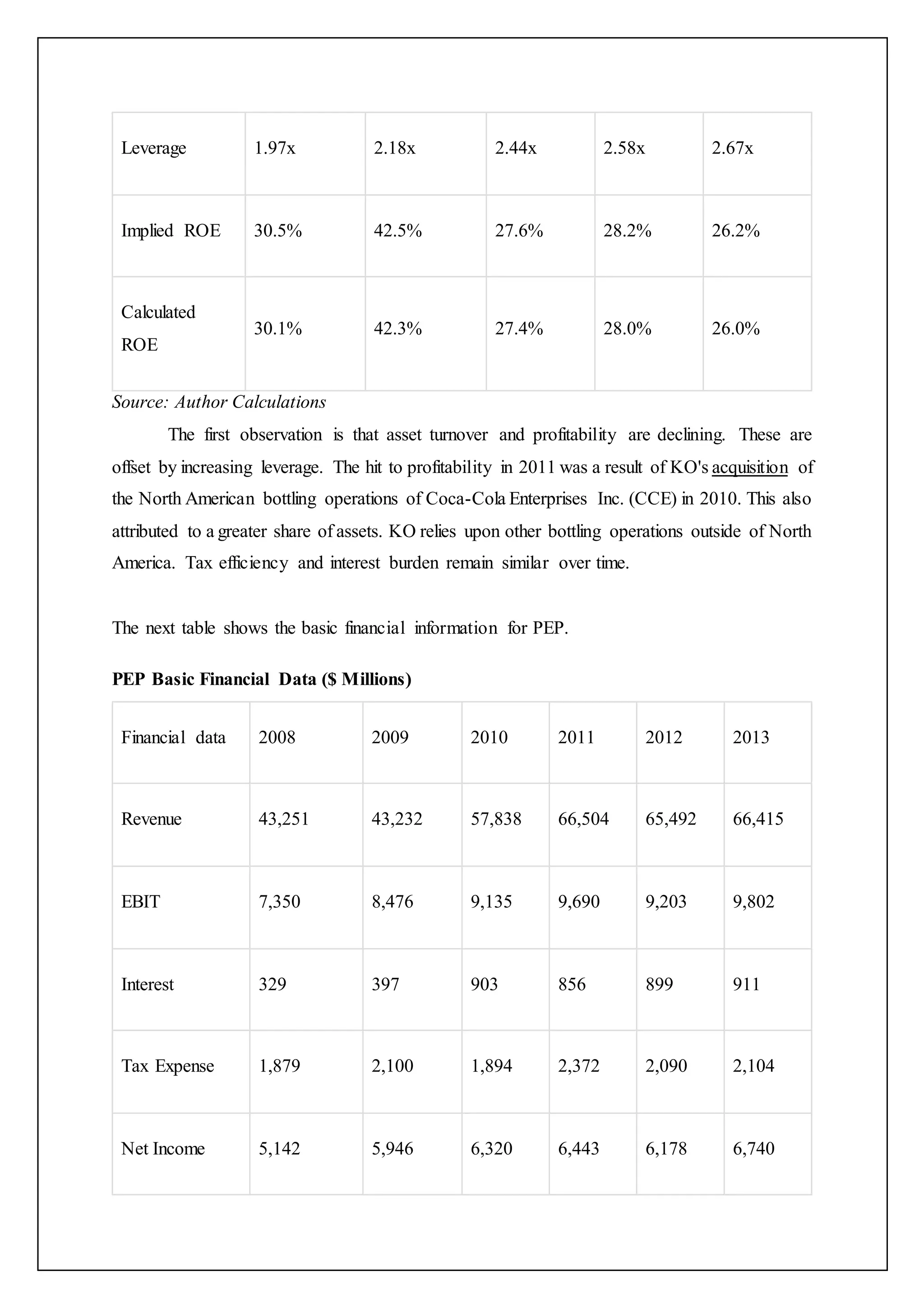

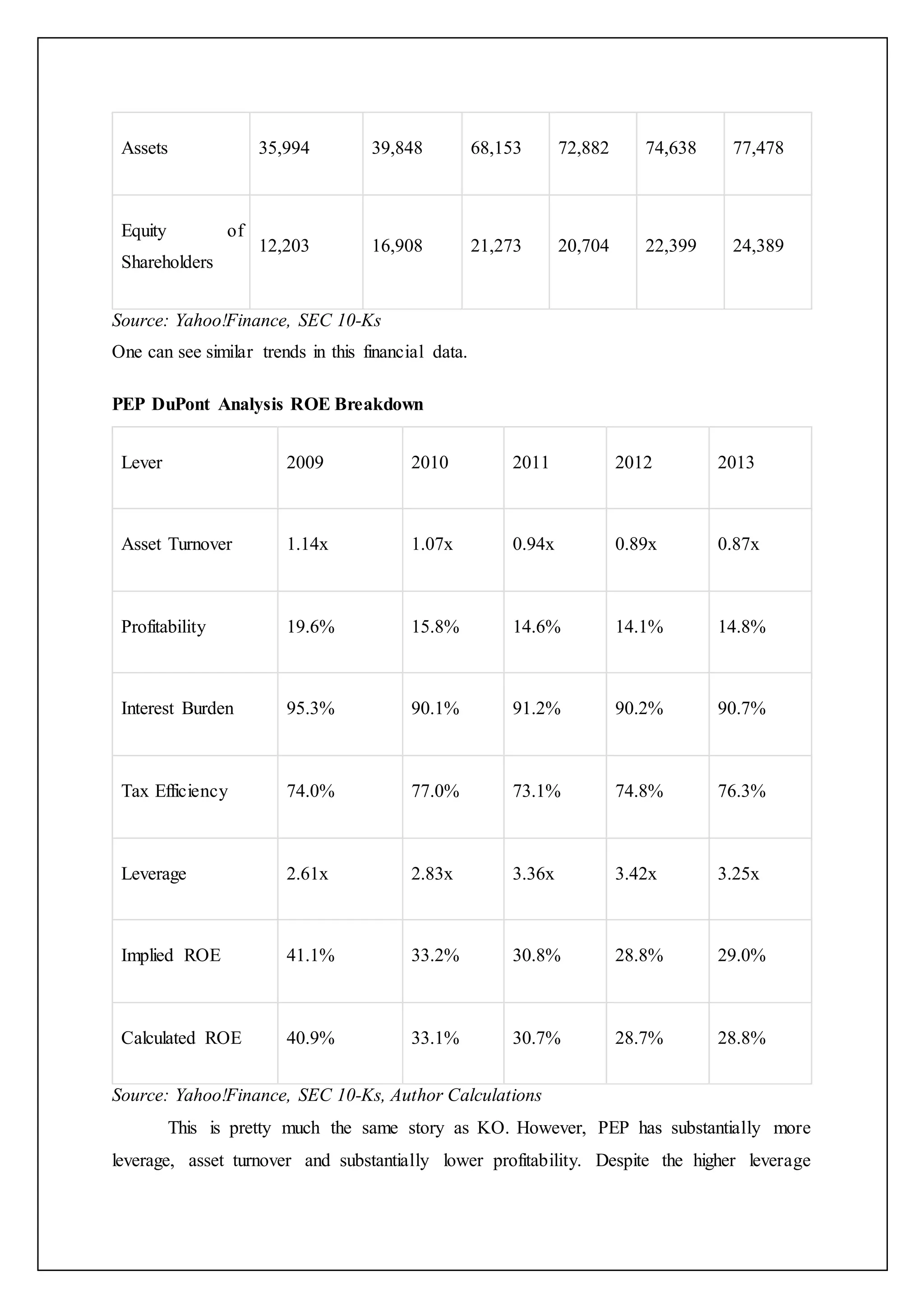

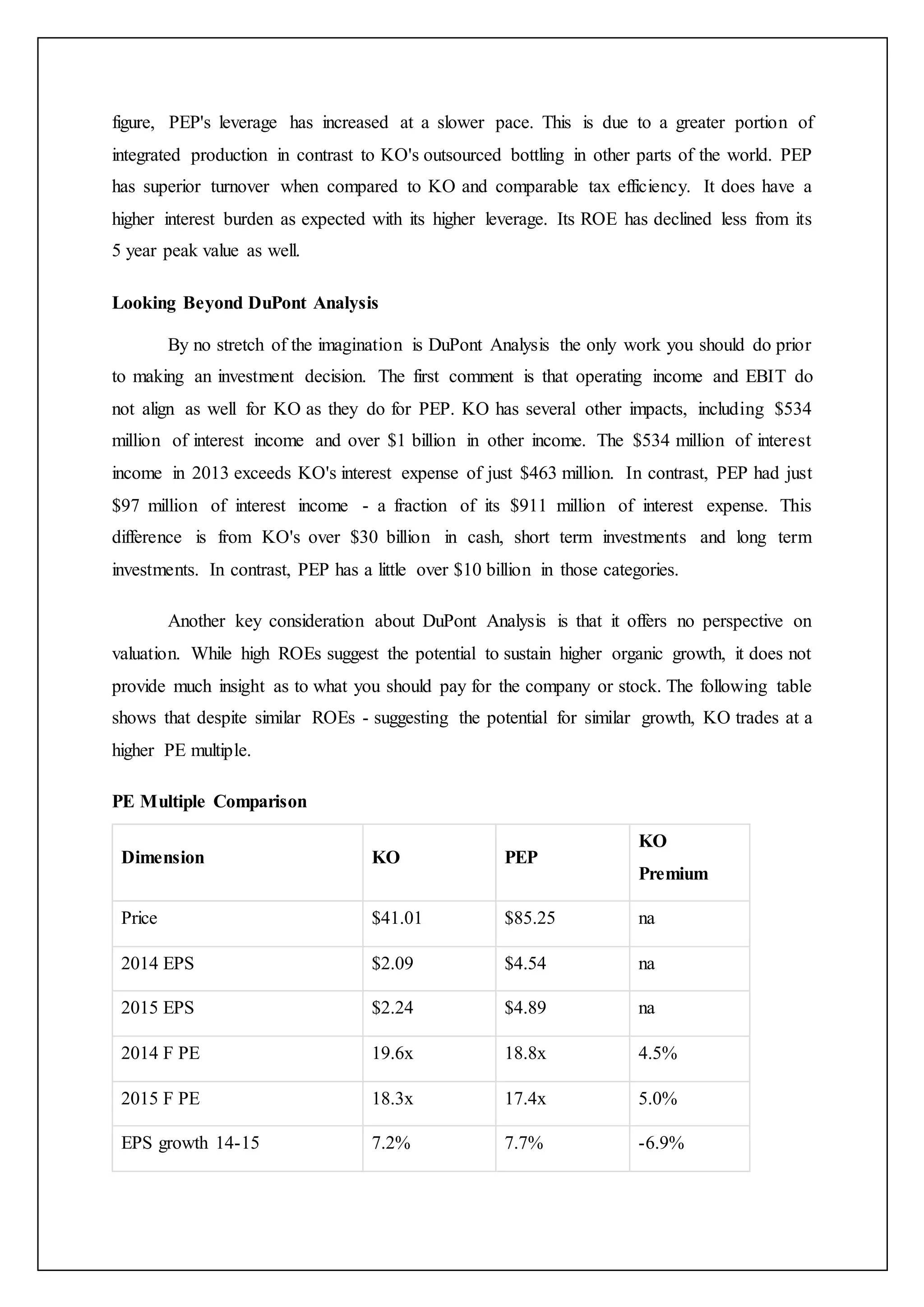

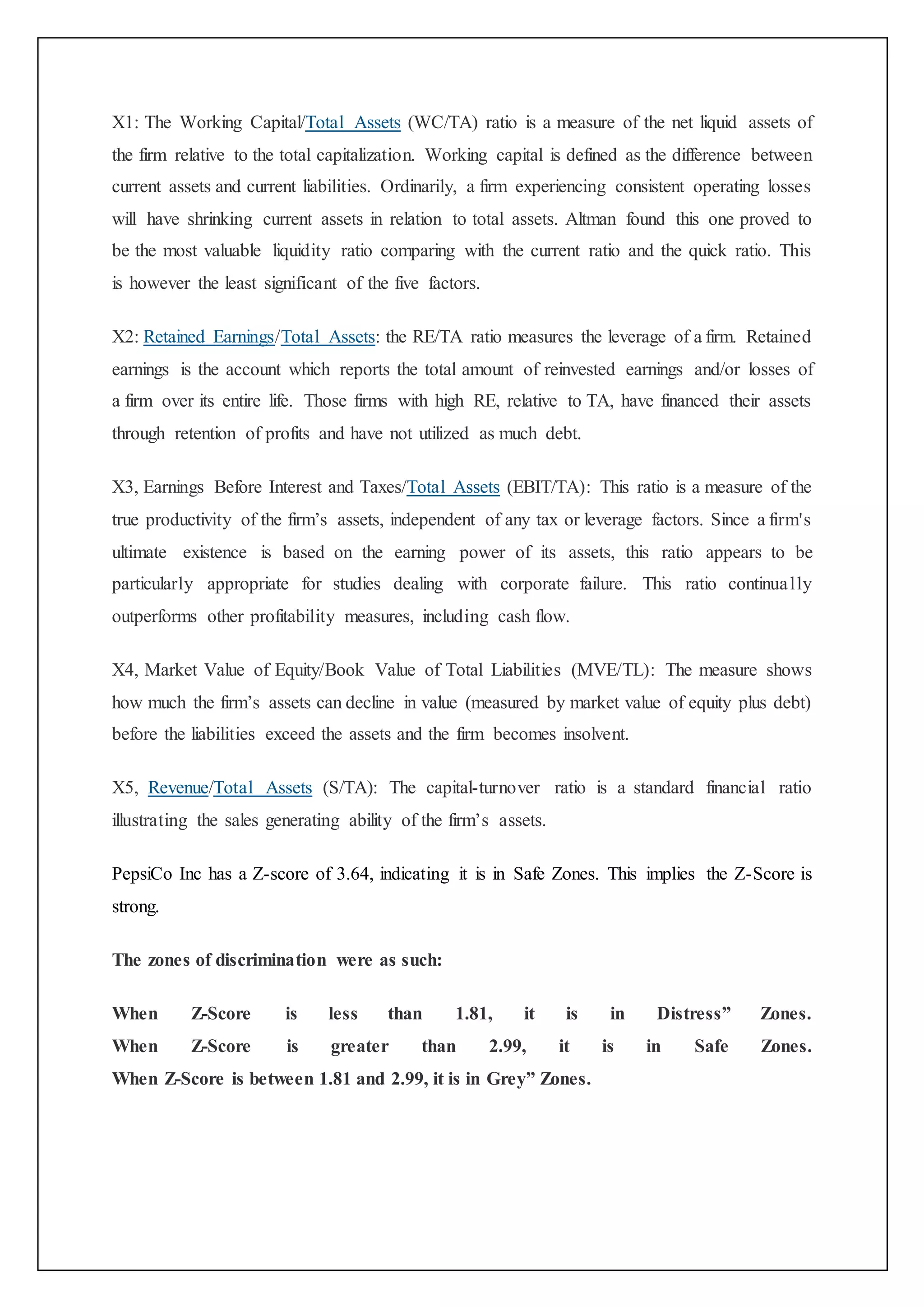

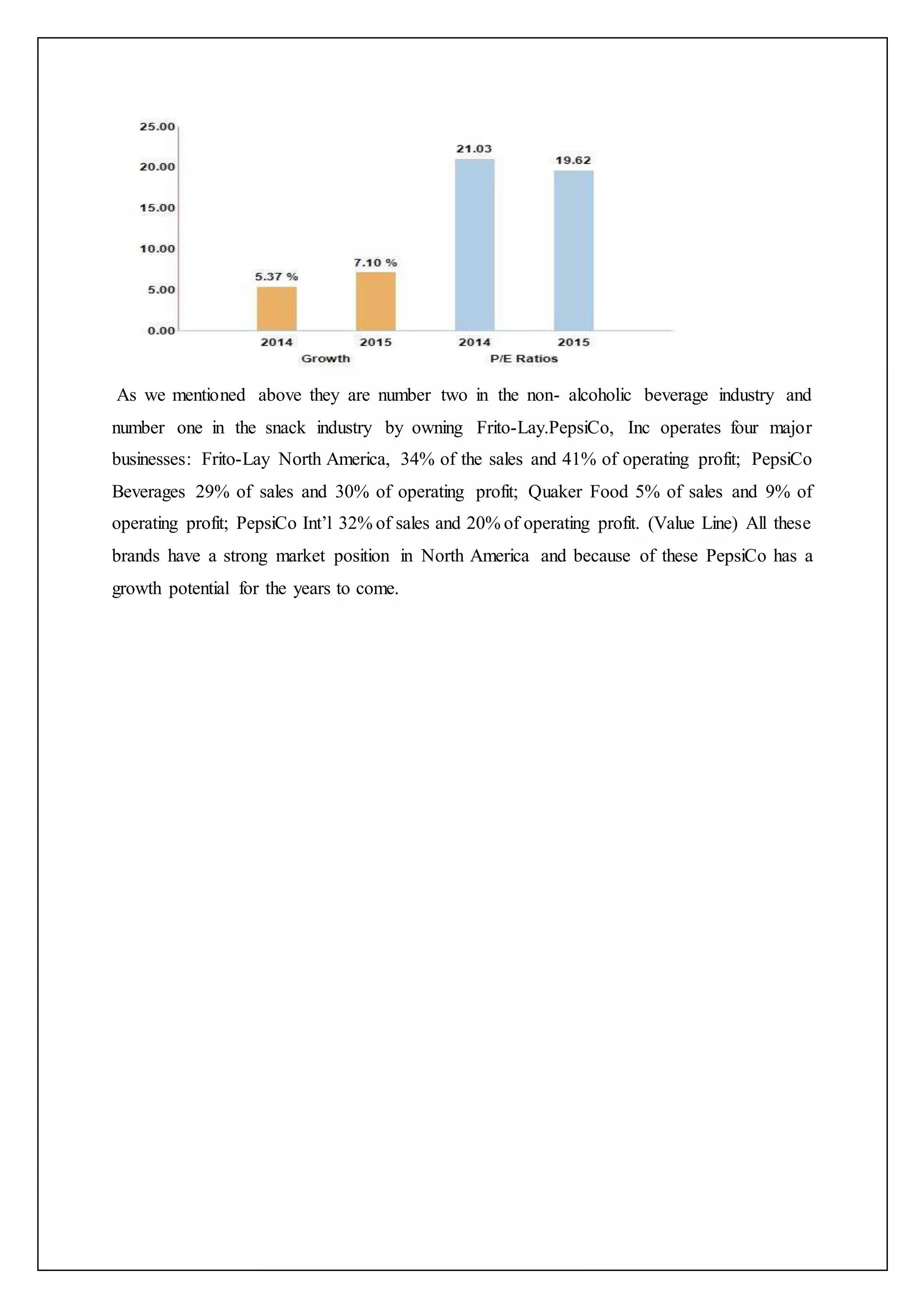

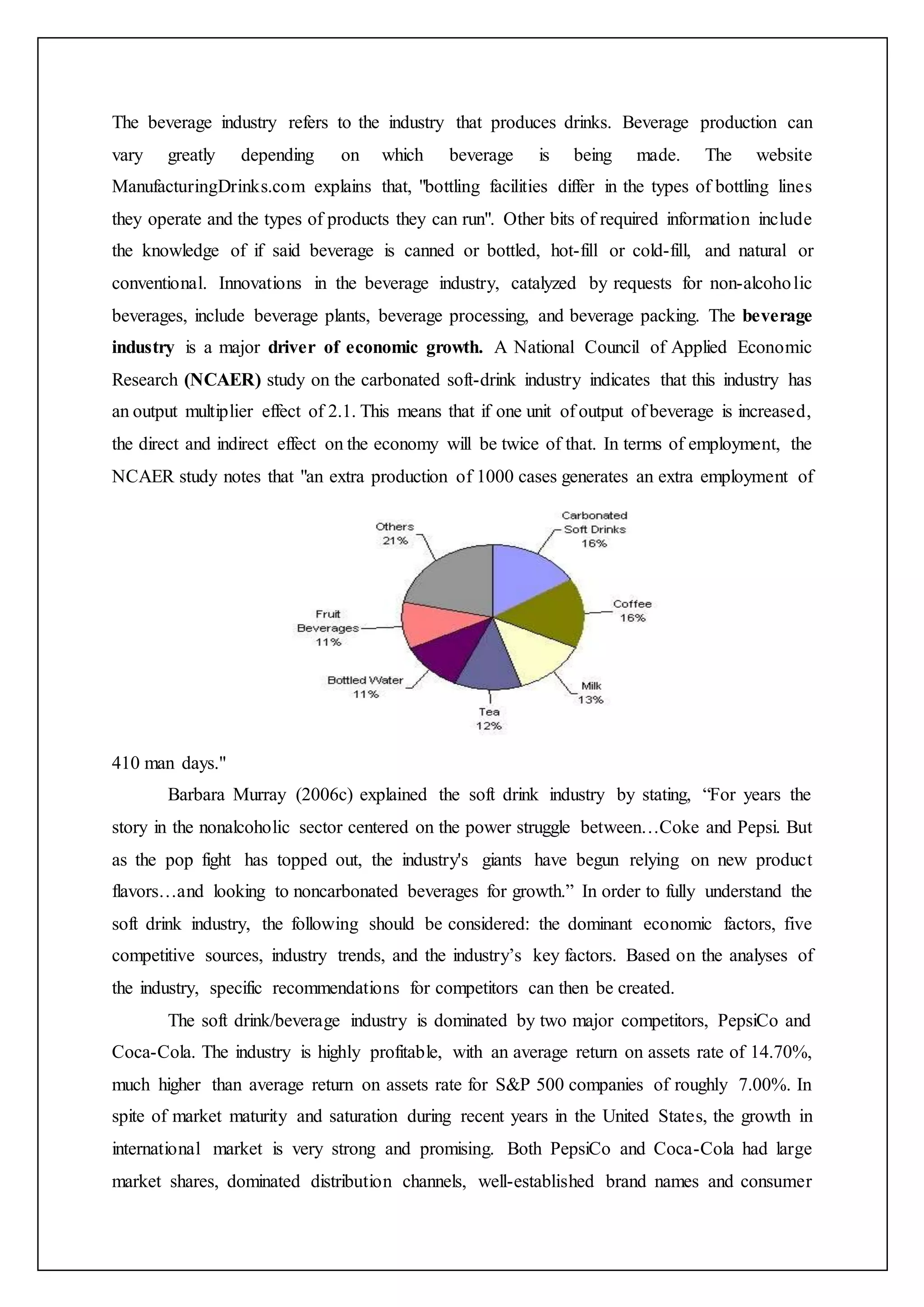

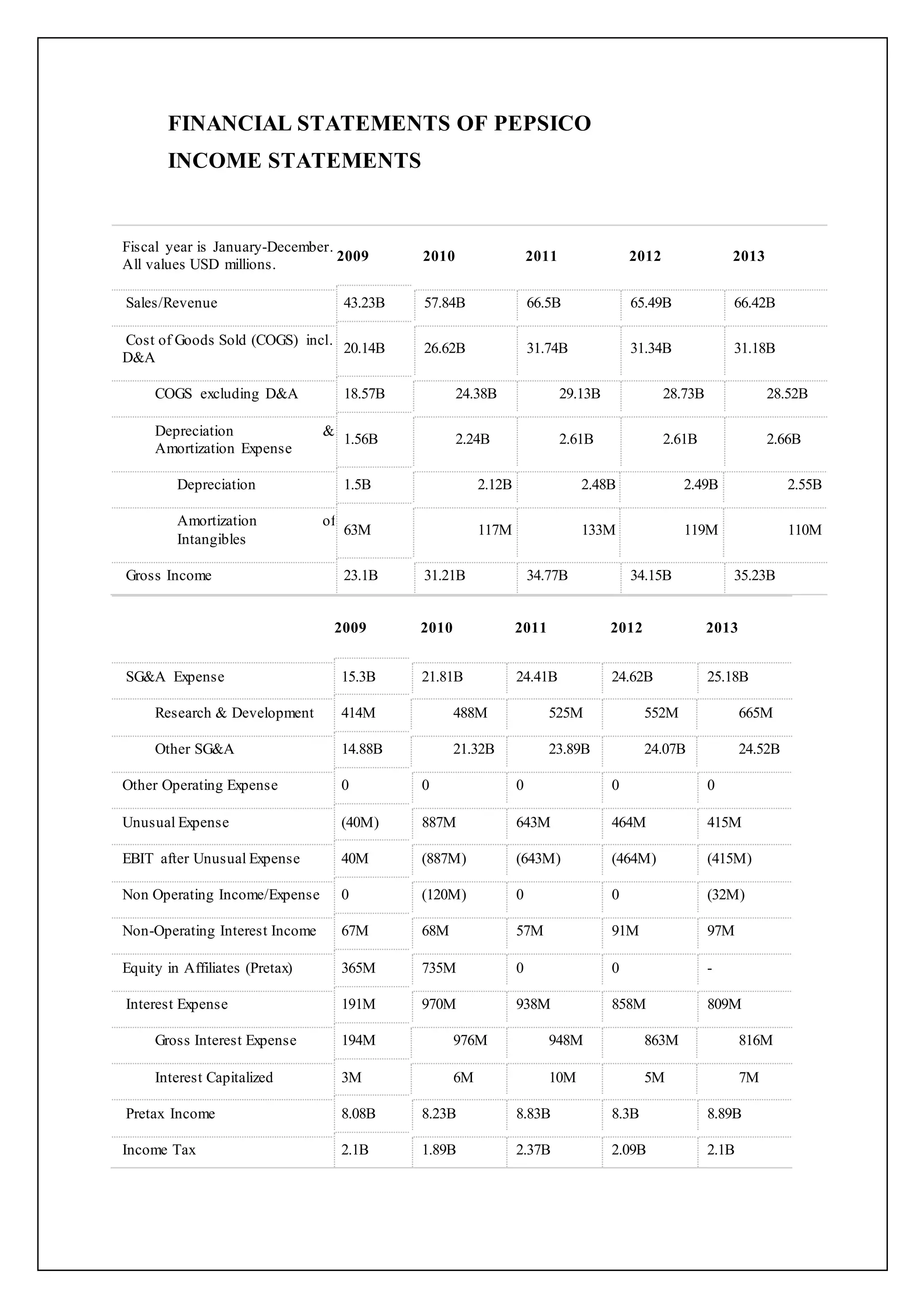

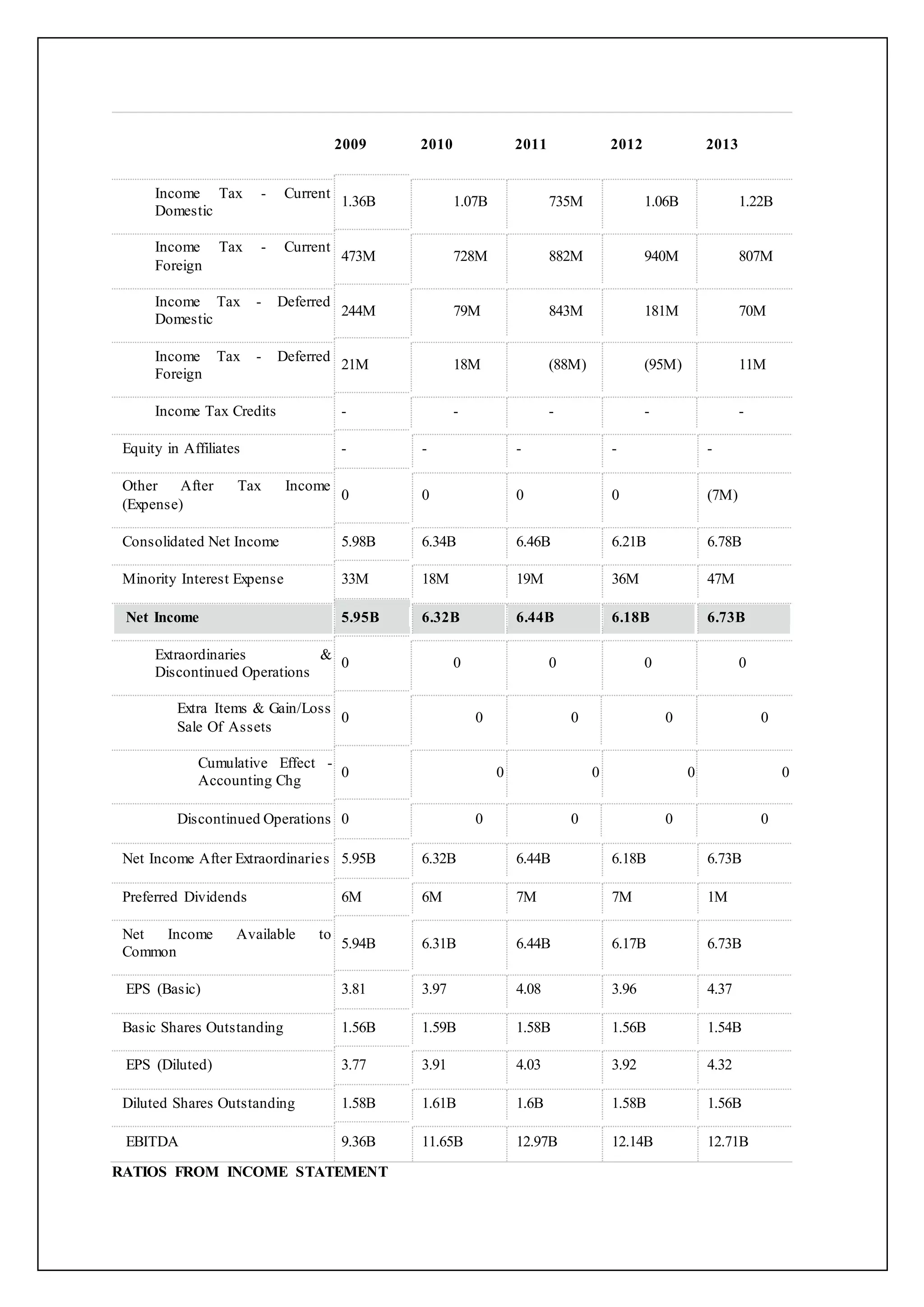

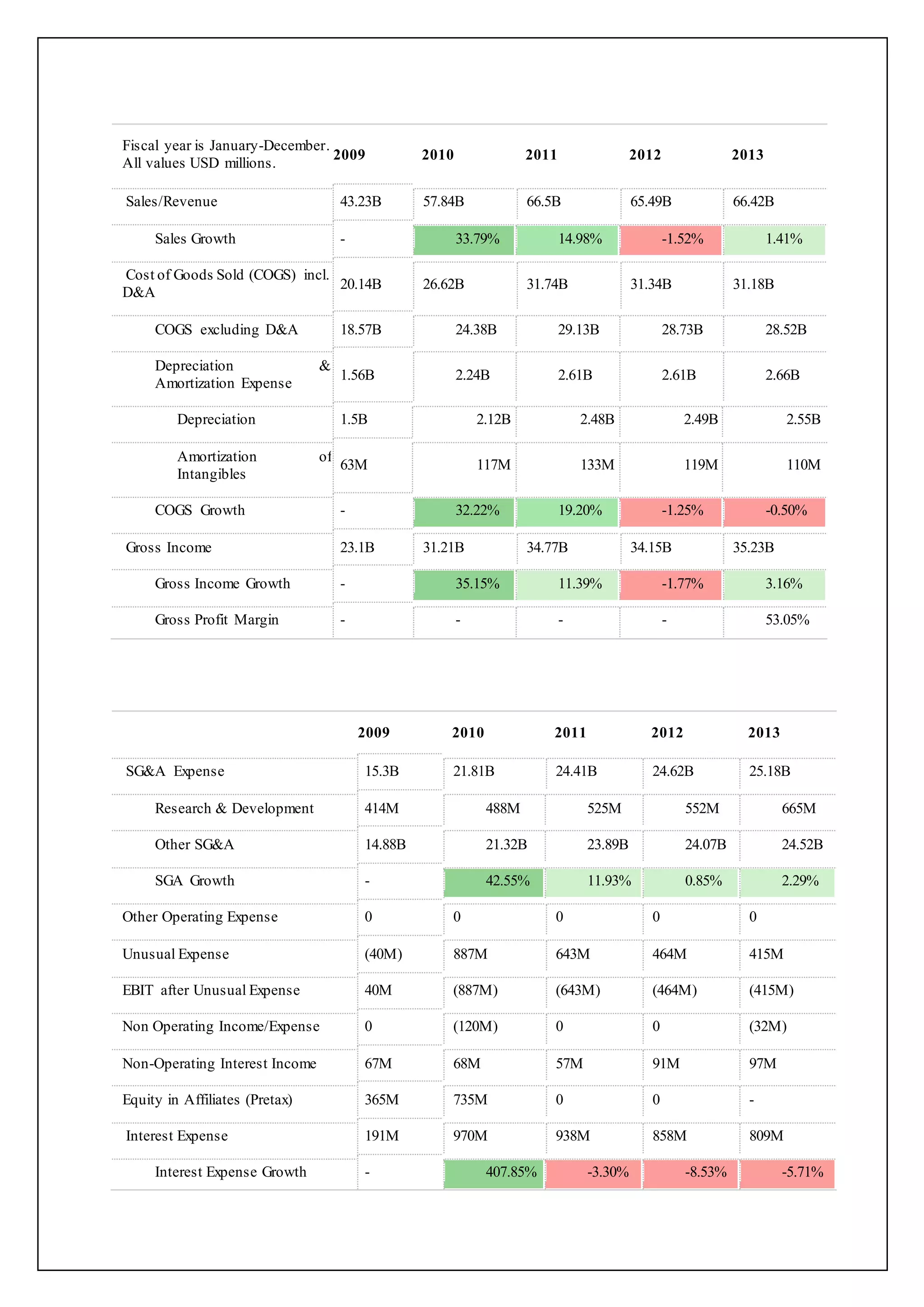

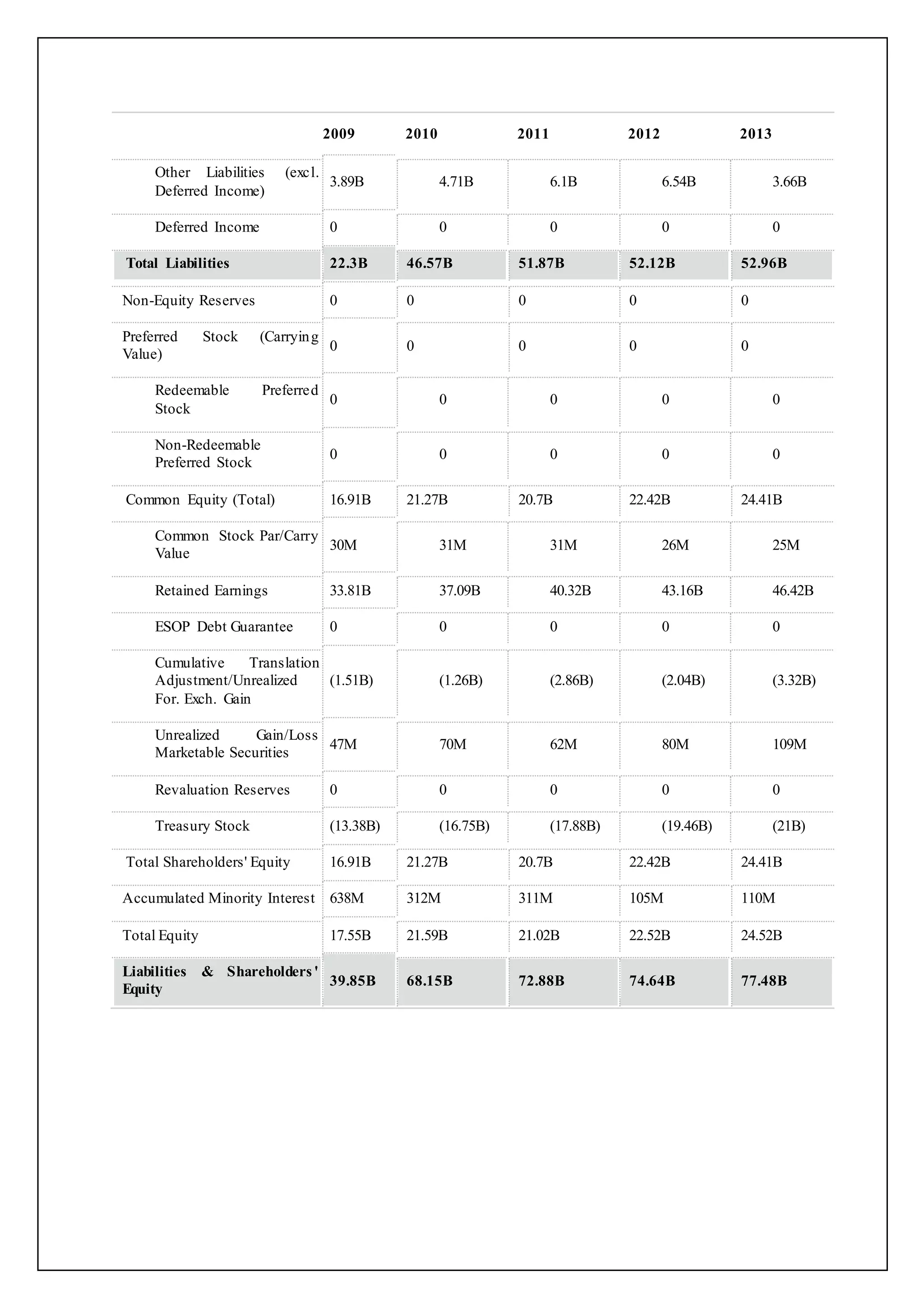

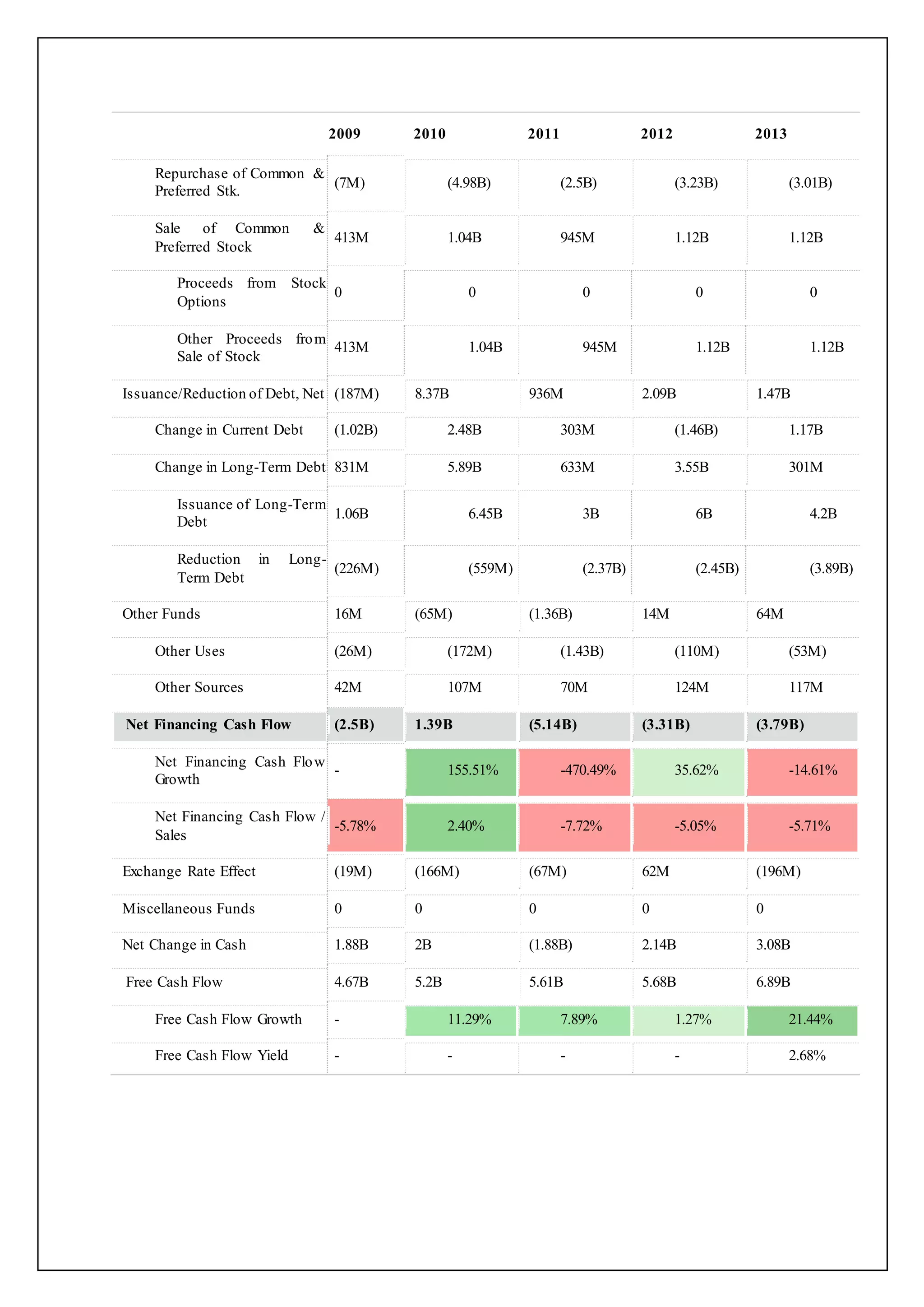

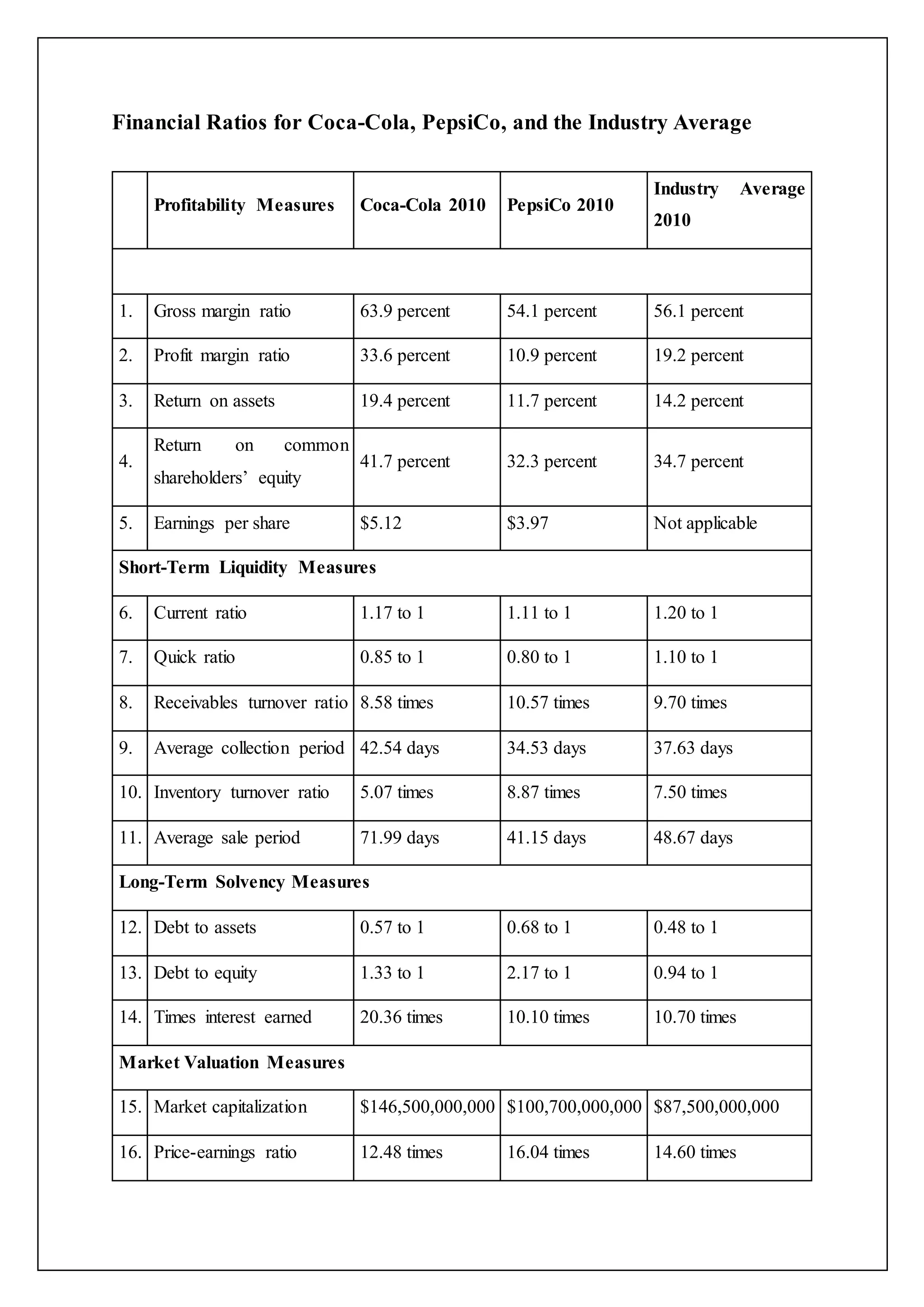

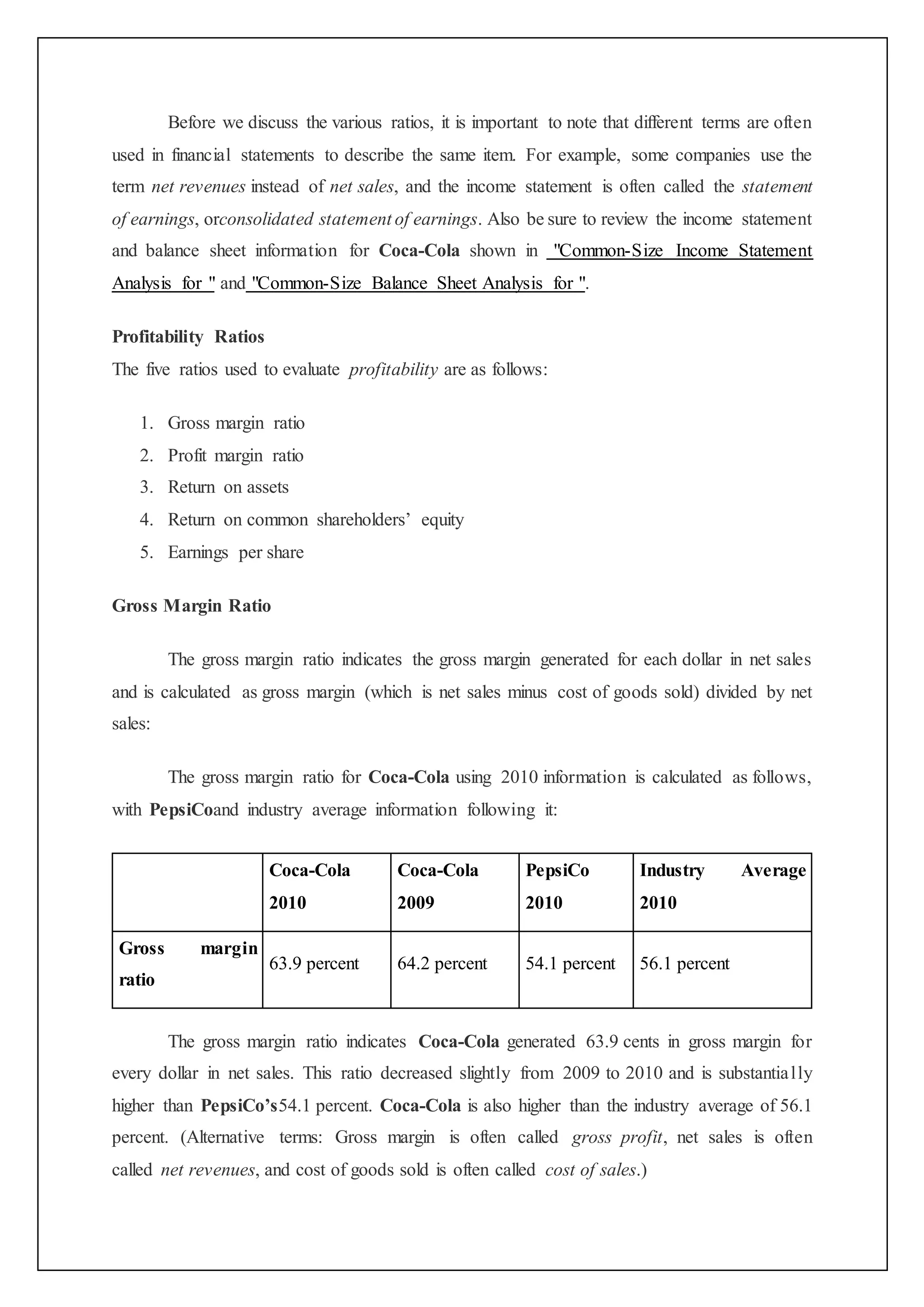

This document provides information about PepsiCo and the beverage industry. It discusses PepsiCo's CEO, Indra Nooyi, and provides an industry profile that describes the beverage industry and dominant economic factors like market size and growth rate. It also analyzes the financial statements of major companies like PepsiCo, Coca-Cola, and Cadbury Schweppes and notes trends in the industry like increasing globalization and changing consumer preferences.

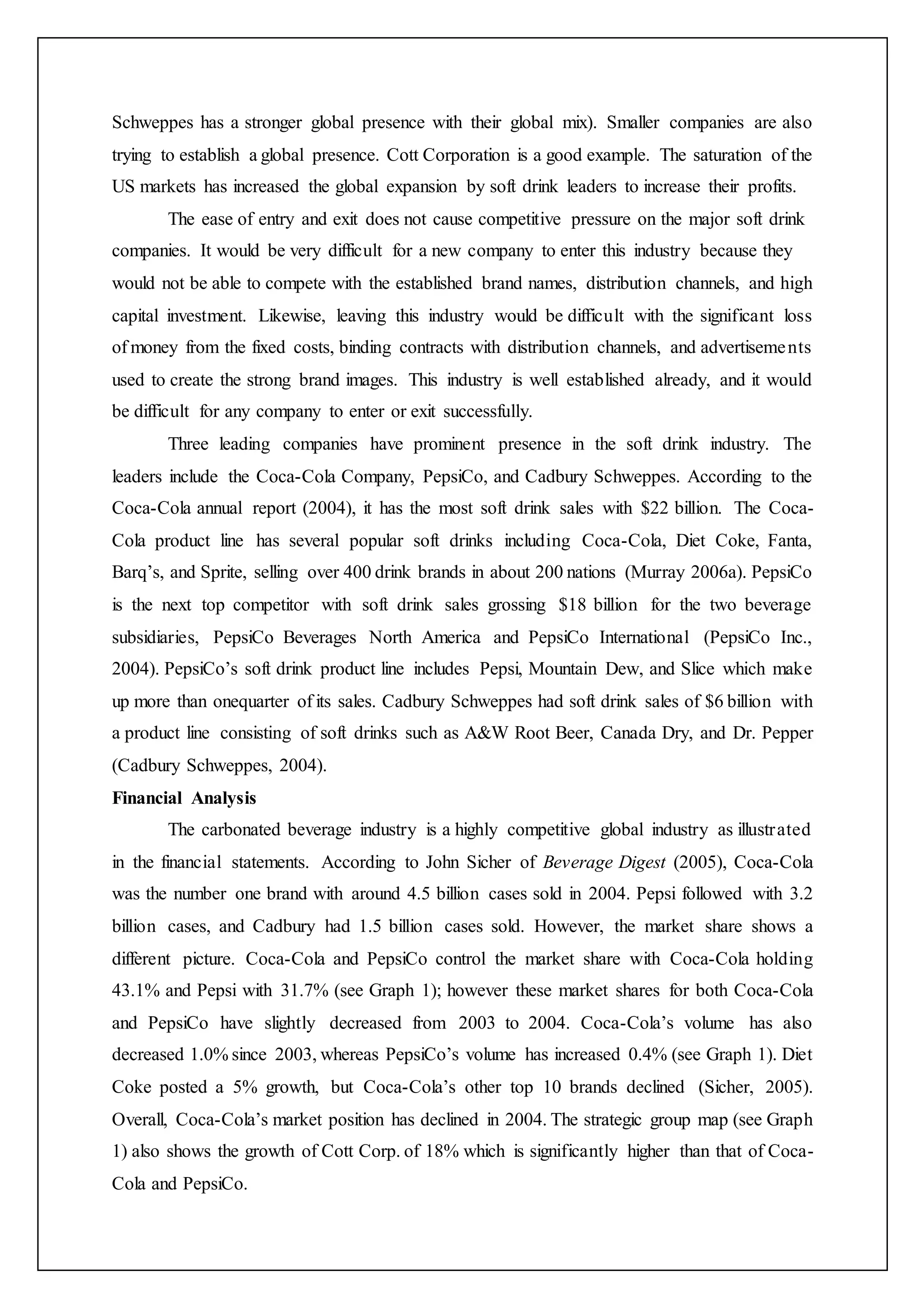

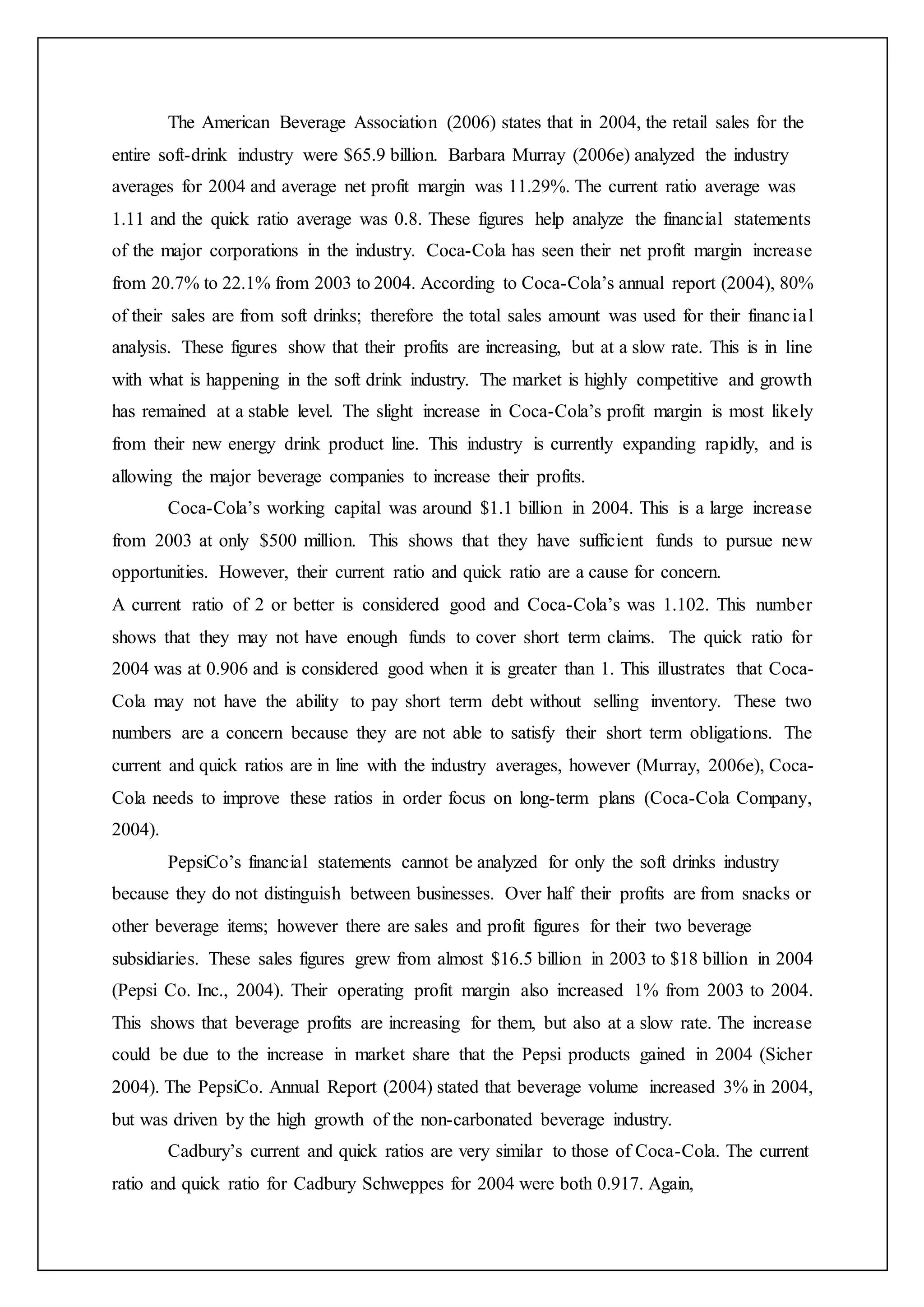

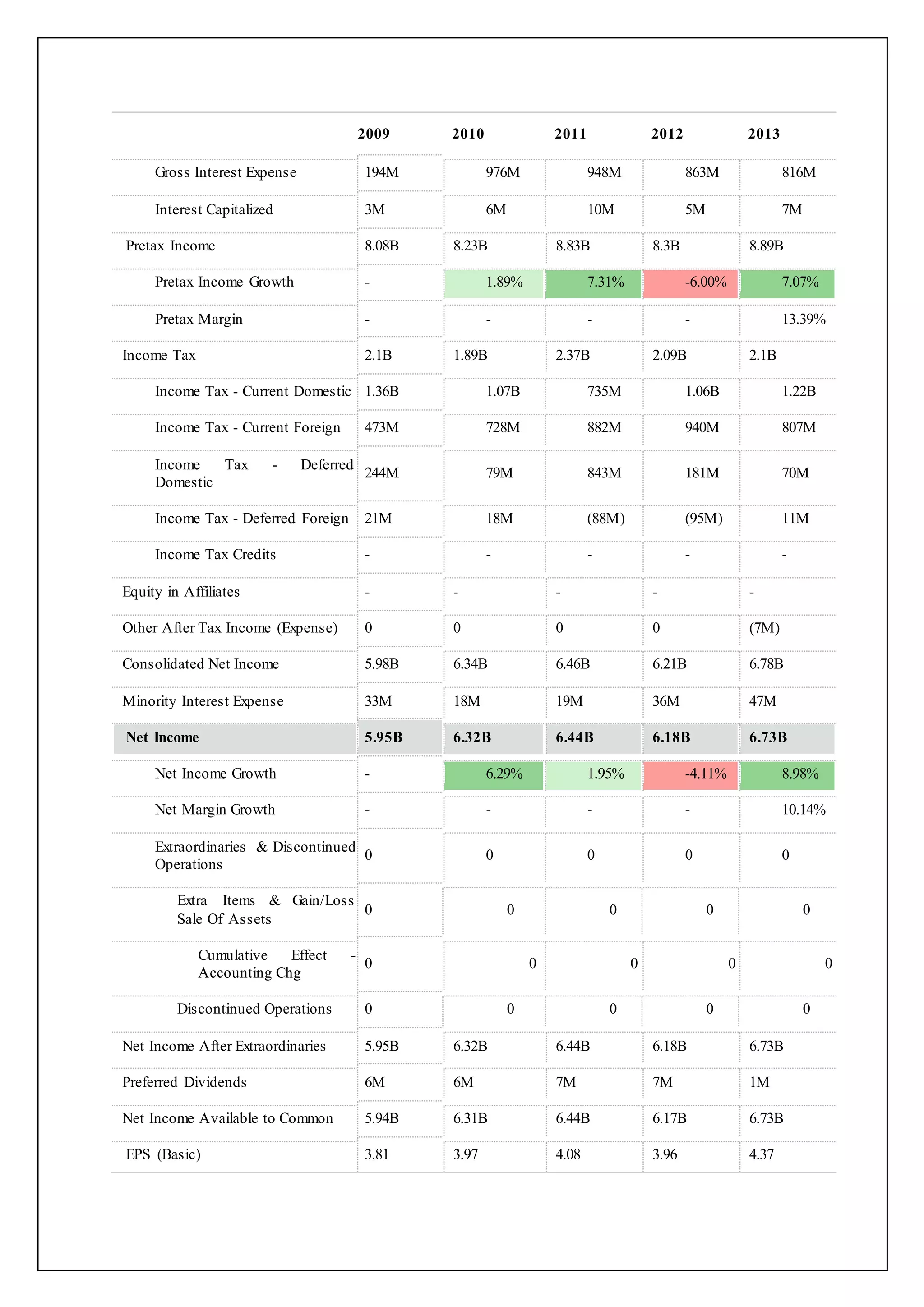

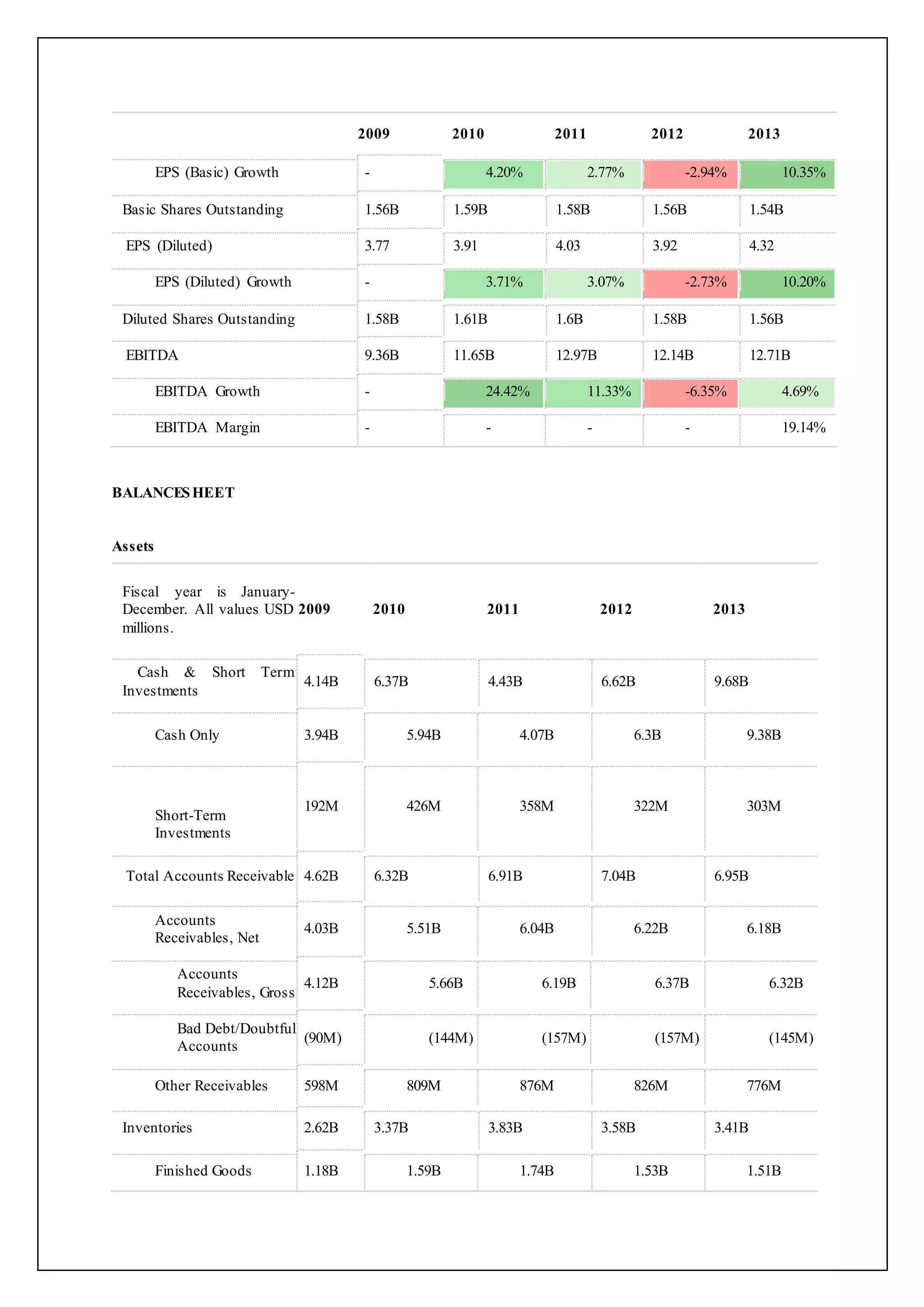

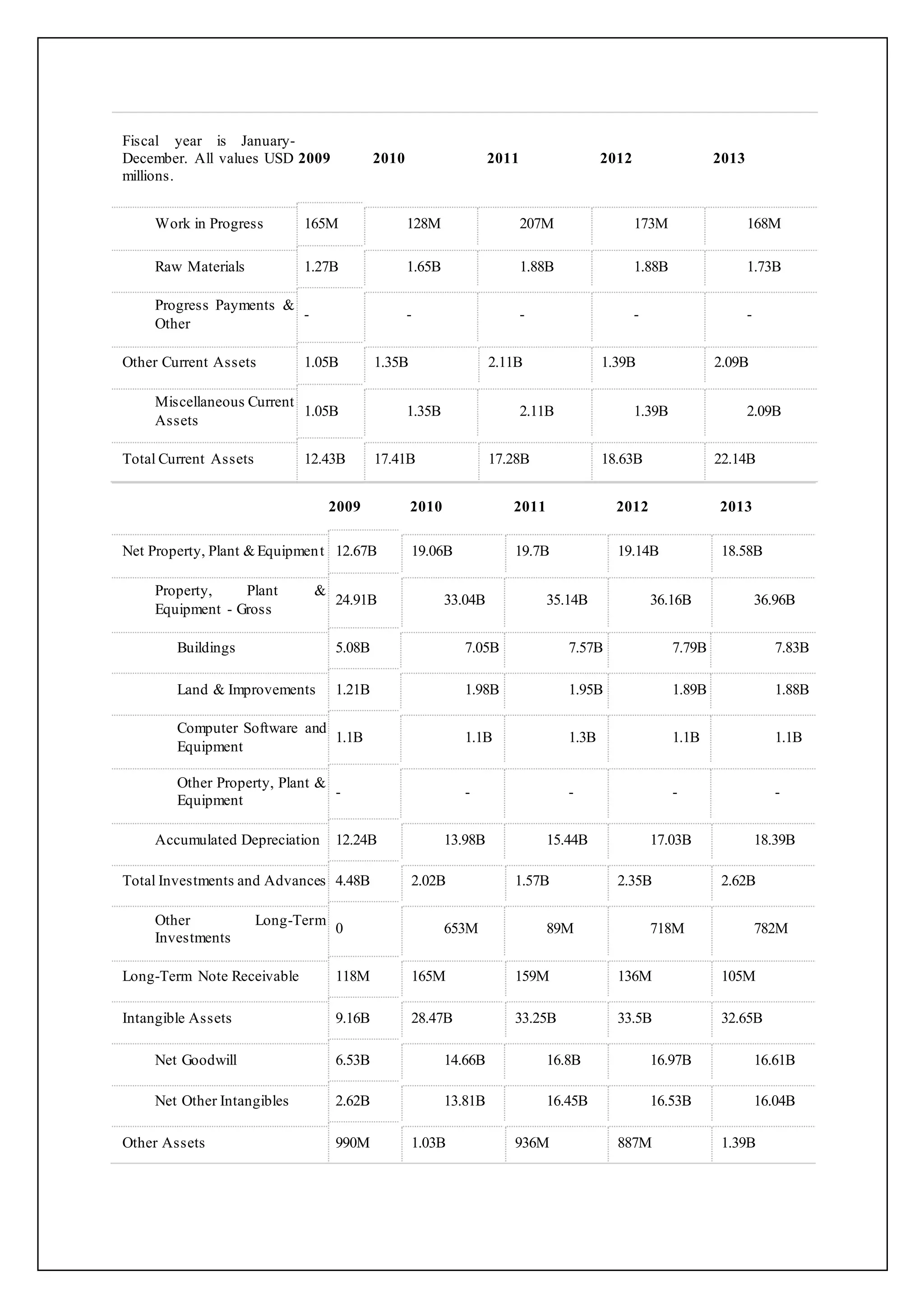

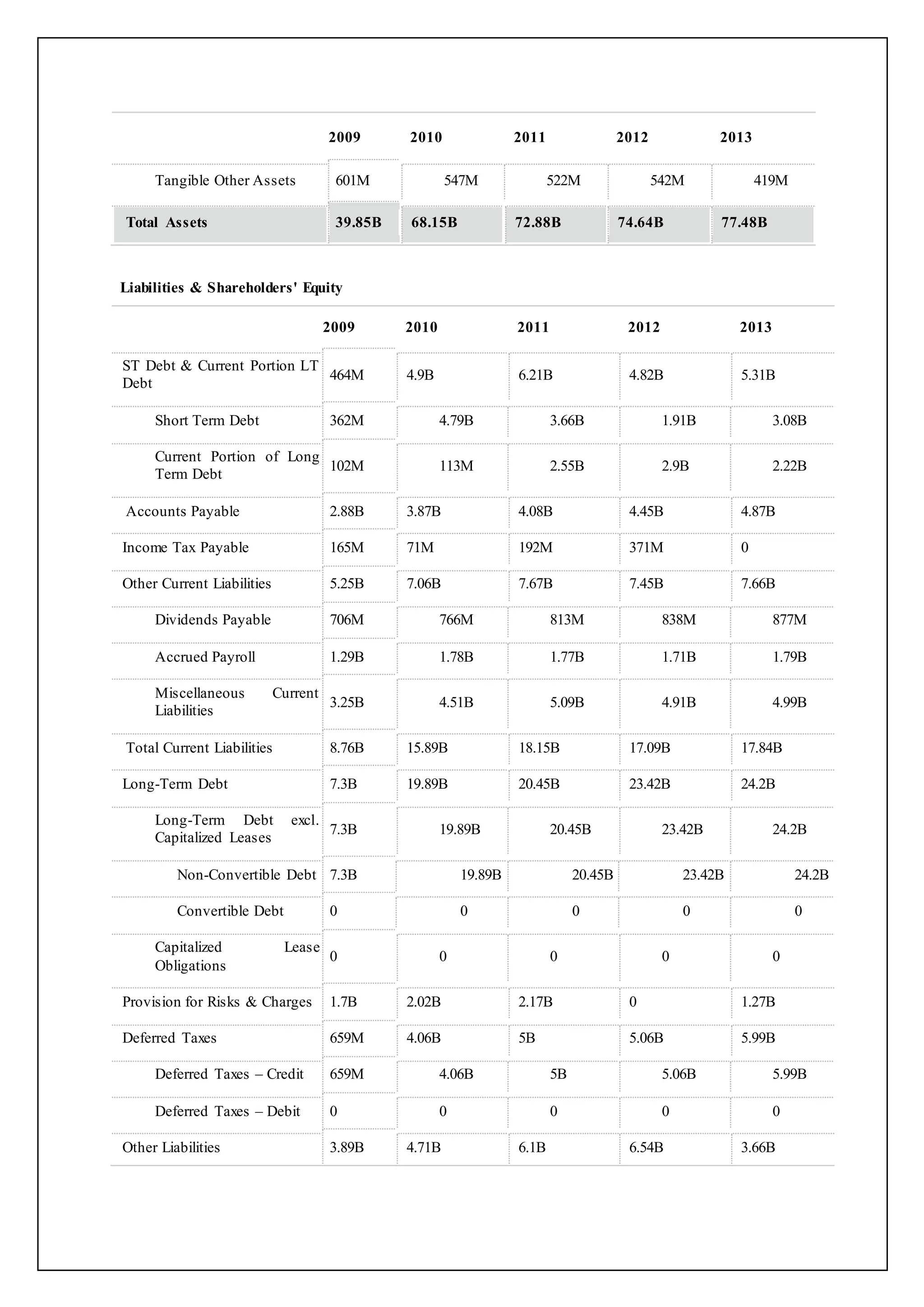

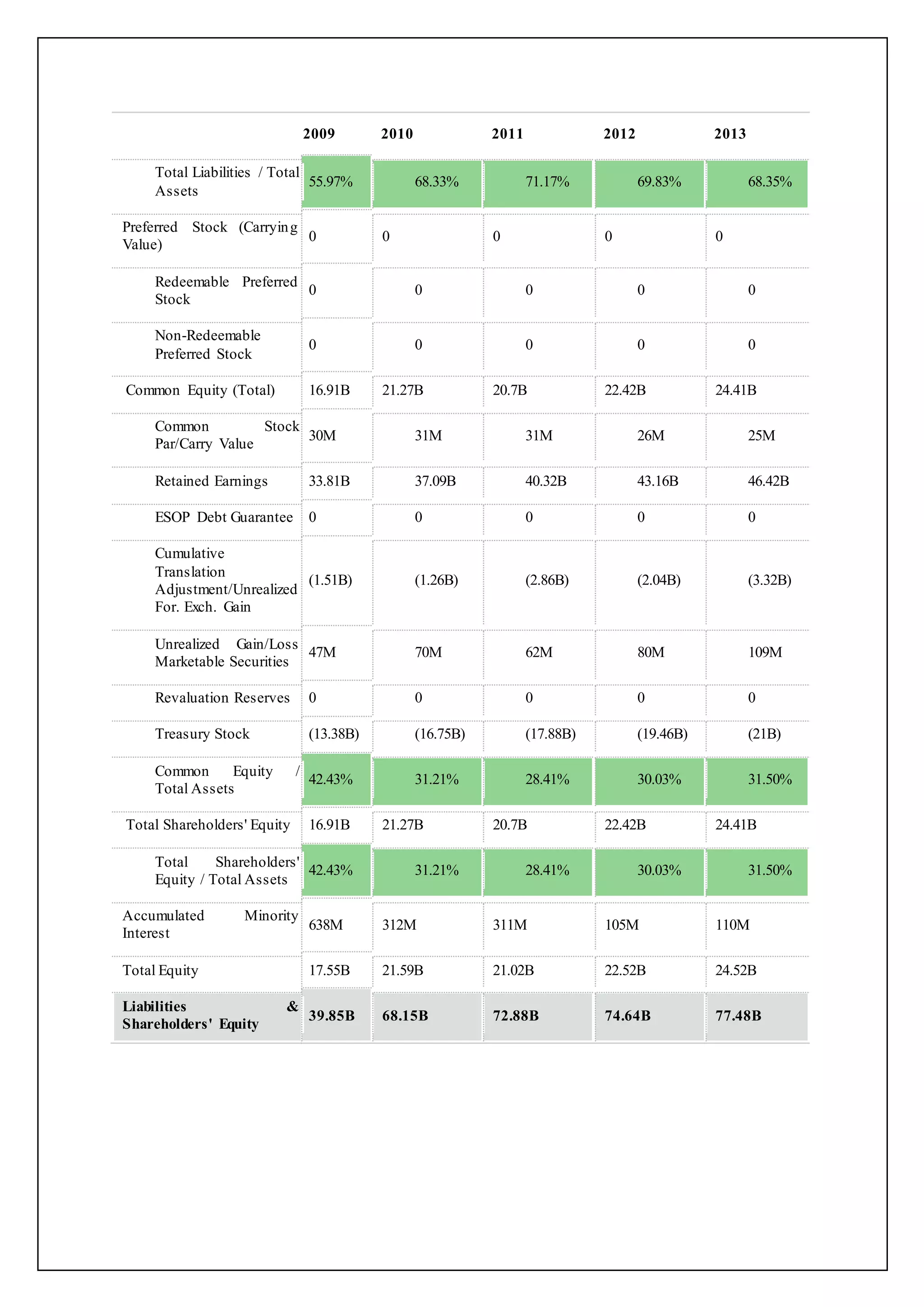

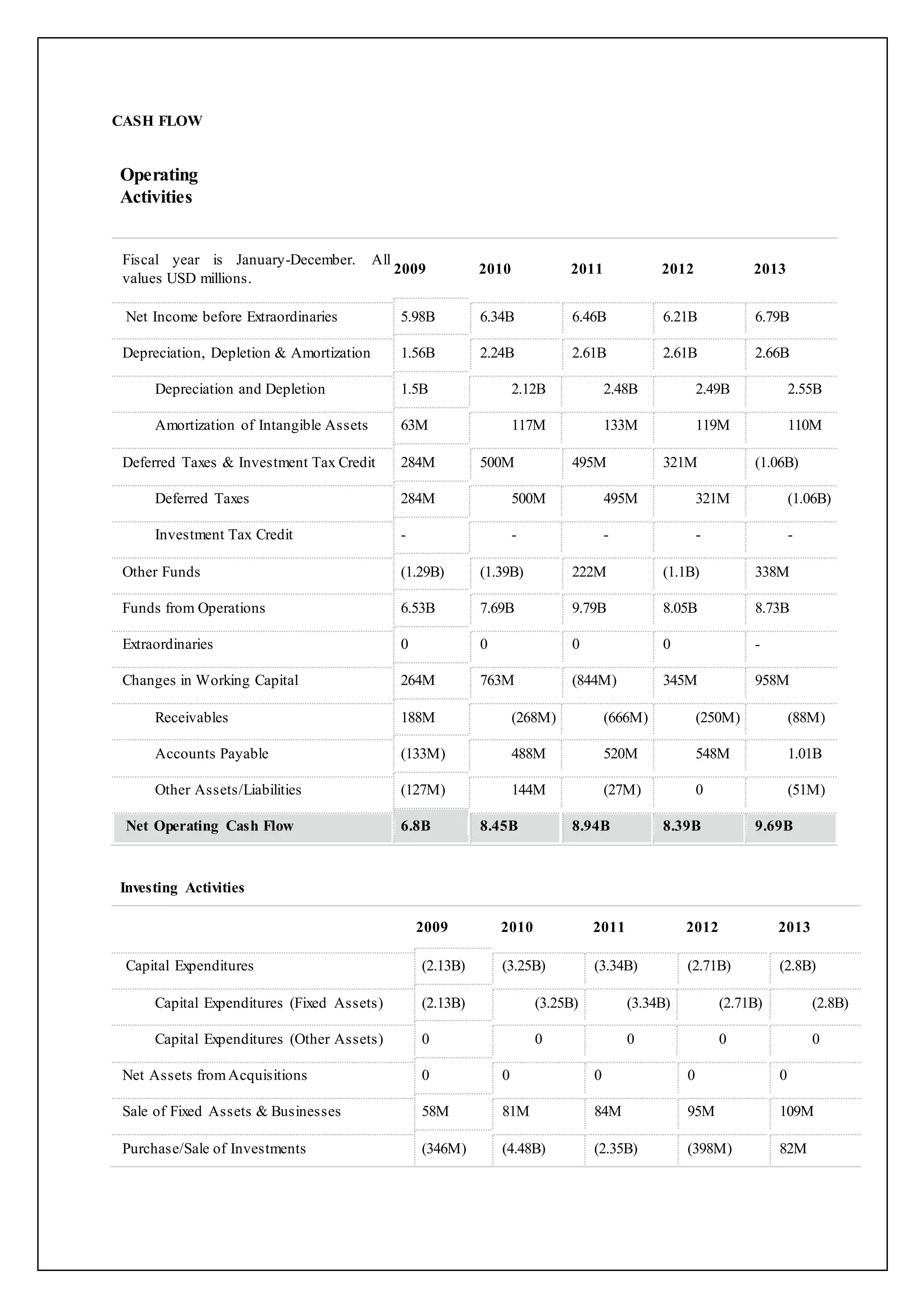

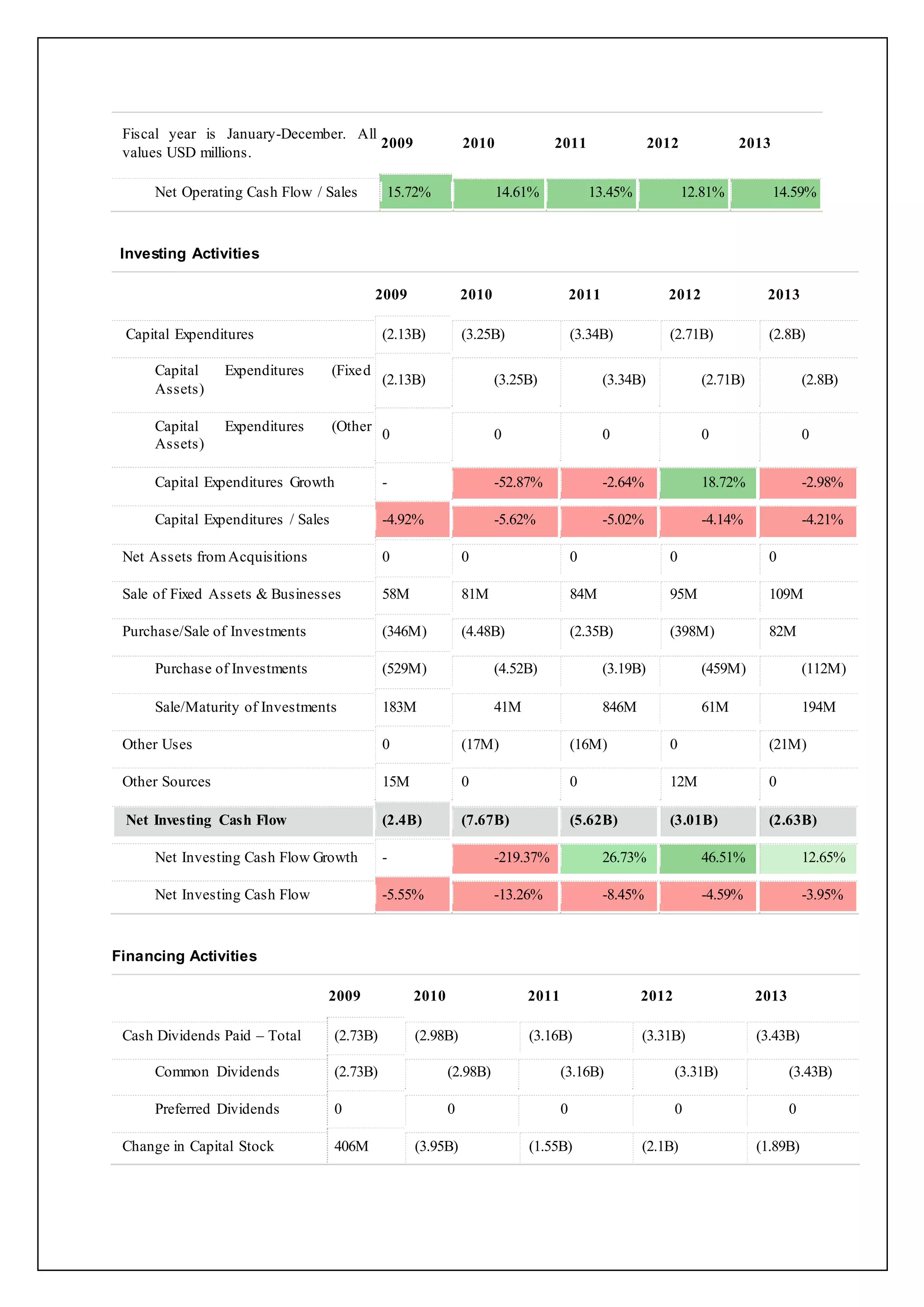

![Coca-Cola’s return on common shareholders’ equity of 41.7 percent is higher than its

return on assets of 19.4 percent, indicating that the company has positive financial

leverage. Financial leverage describes a company’s ability to leverage common shareholders’

equity by taking on debt at an interest rate lower than the company’s return on assets. For

example, assume a company has equity of $10,000 earning 10 percent. The company can

leverage this equity by borrowing $8,000 with a 6 percent interest rate. Assuming the company

uses this $8,000 to purchase assets that earn 10 percent, the company has created positive

financial leverage since the cost of borrowing is lower than the return on assets. This results in

a return on equity that is higher than the return on assets. (Note: For a one-year period, the

return on assets is $1,800 [= $18,000 × 10 percent] less the cost of debt of $480 [= 6 percent ×

$8,000], or $1,320. This results in a return on assets of 7.3 percent [= $1,320 ÷ $18,000].

Positive financial leverage causes the return on equity to be much higher at 13.2 percent [=

$1,320 ÷ $10,000 equity].)

Although some level of financial leverage is generally regarded as healthy, companies

that are highly leveraged tend to be riskier than similar companies with less leverage. Analysts

and shareholders should avoid drawing quick conclusions that increases in return on common

shareholders’ equity are always better than decreases without thoroughly reviewing the rest of

the data.

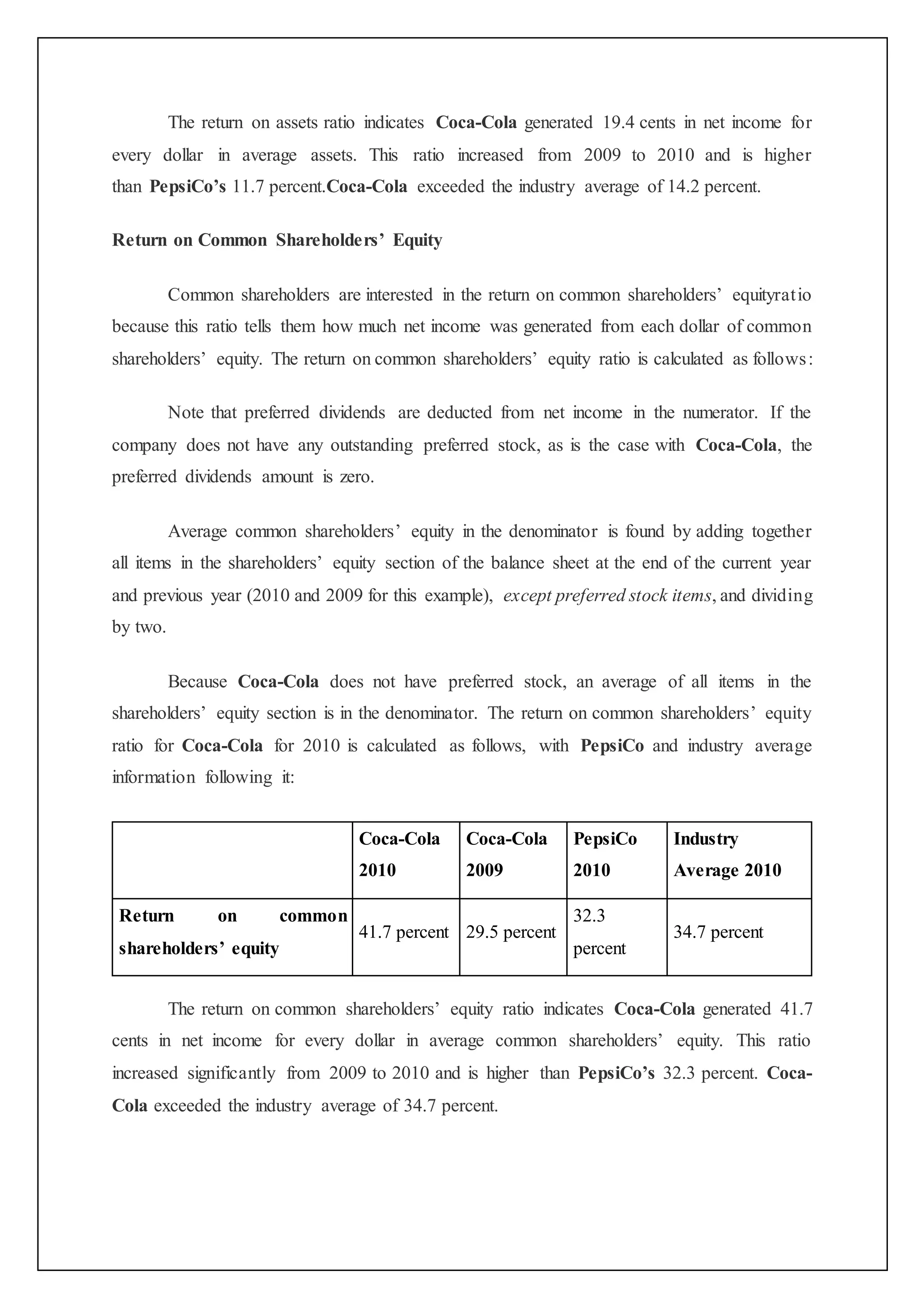

Return on Assets and Return on Equity for Coca-Cola, PepsiCo, and the Industry Average

Earnings per Share: Earnings per share indicates how much net income was earned for each

share of common stock outstanding. The earnings per share ratio states net income on a per

share basis and is calculated as the following:](https://image.slidesharecdn.com/chairspeakreport-pepsicodupontanlysiswithcoke-150321082054-conversion-gate01/75/Chair-speak-report-PEPSICO-Dupont-analysis-with-coke-64-2048.jpg)