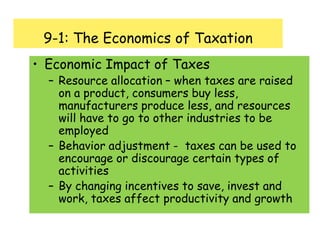

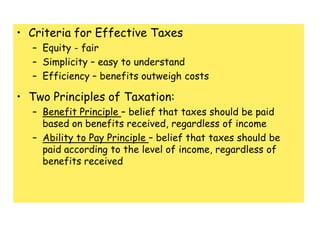

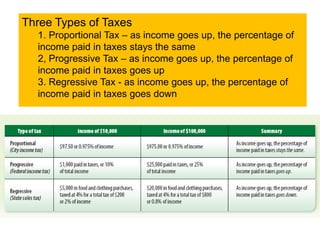

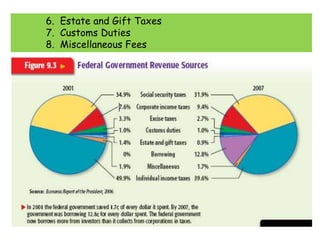

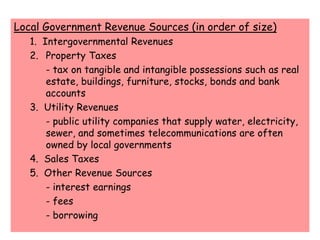

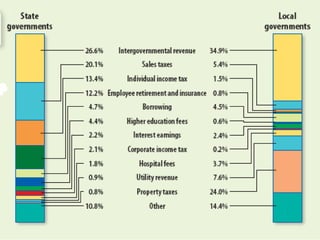

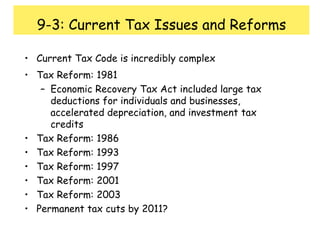

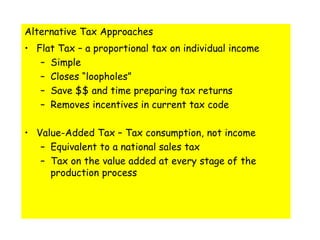

The document summarizes sources of government revenue for federal, state, and local governments. At the federal level, the largest sources are individual income taxes, FICA taxes, borrowing, and corporate income taxes. For states, the primary sources are intergovernmental revenues, sales taxes, and individual income taxes. Local governments rely most heavily on intergovernmental revenues and property taxes, as well as utility revenues and sales taxes. The document also discusses criteria for effective taxes, principles of taxation, types of taxes, and proposals for tax reform such as a flat tax or value-added tax.