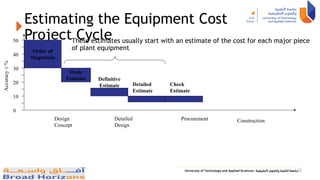

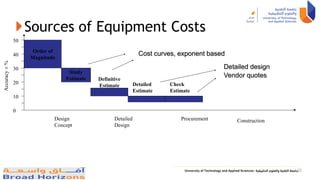

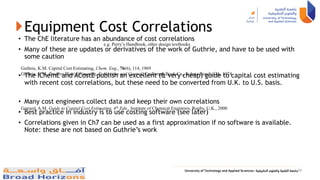

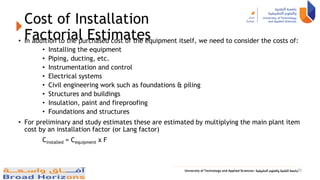

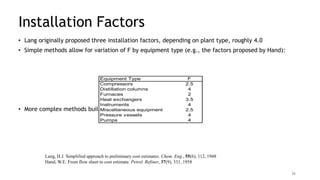

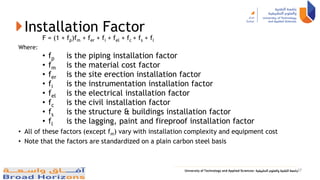

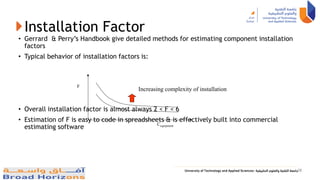

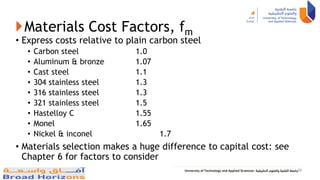

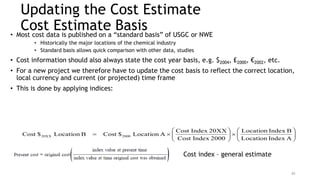

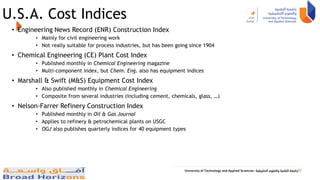

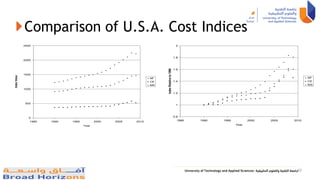

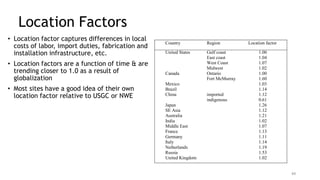

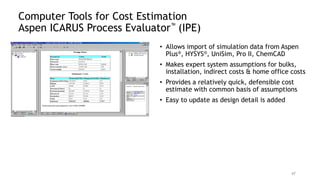

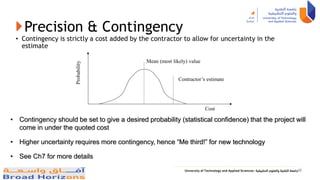

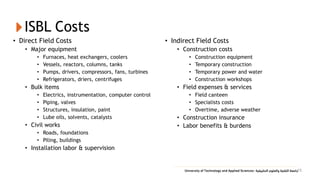

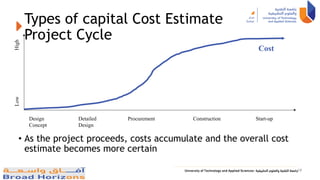

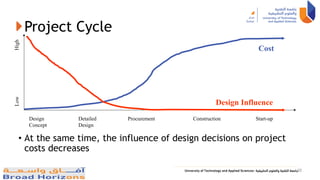

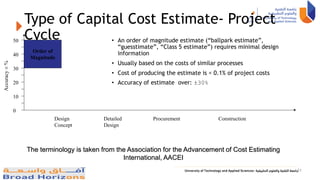

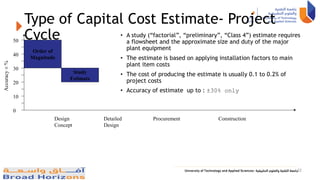

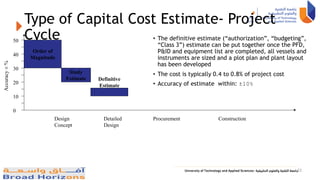

The document outlines the principles of engineering economics, emphasizing the importance of understanding the time value of money, cash flow estimation, and profitability in the context of engineering projects. It details the components of capital costs, including direct and indirect investments, working capital, and estimation methods for different phases of project development. Additionally, it addresses installation factors and material cost variations, key for accurate cost assessments in engineering designs.

![Exponential Estimating

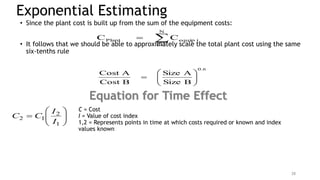

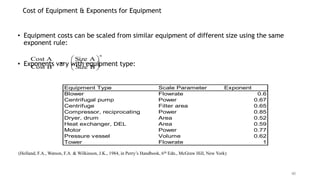

• The cost of most plant items varies with the equipment size in a non-linear manner:

Size

Cost

Log[Size]

Log[Cost]

• By taking logs, we can usually get a reasonably good correlation over a few orders of

magnitude

• The exponent n is 0.6 for many types of equipment, hence this is often known as the “Six-

tenths rule”

n

B

Size

A

Size

B

Cost

A

Cost

27

n

a

a KA

C b

n

b

C

K

A

](https://image.slidesharecdn.com/ch4-costestimationfordesignutasfall22-241008182256-b4c3e22e/85/Ch4-Cost-Estimation-for-Design-UTAS-Fall22-pdf-27-320.jpg)