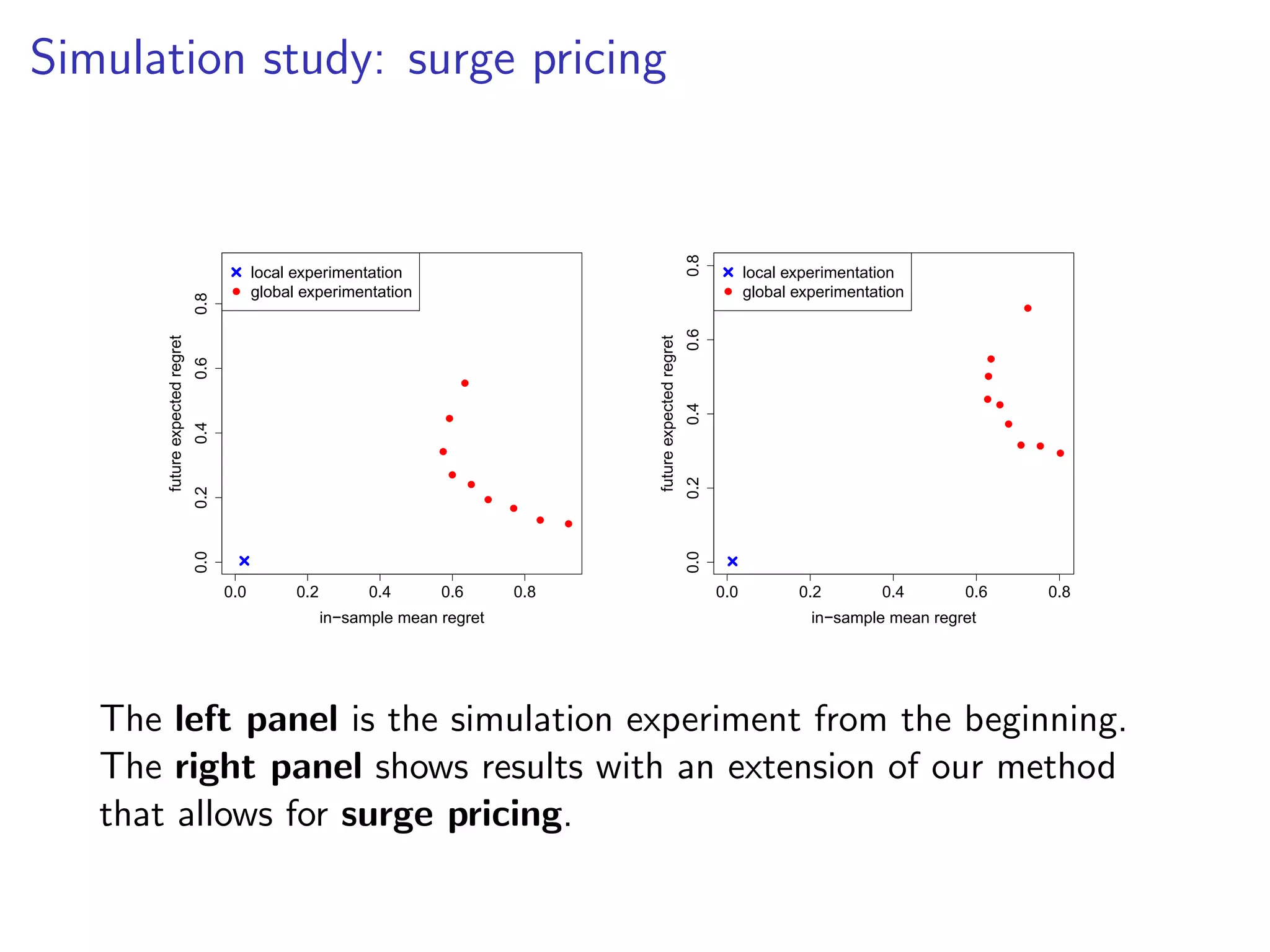

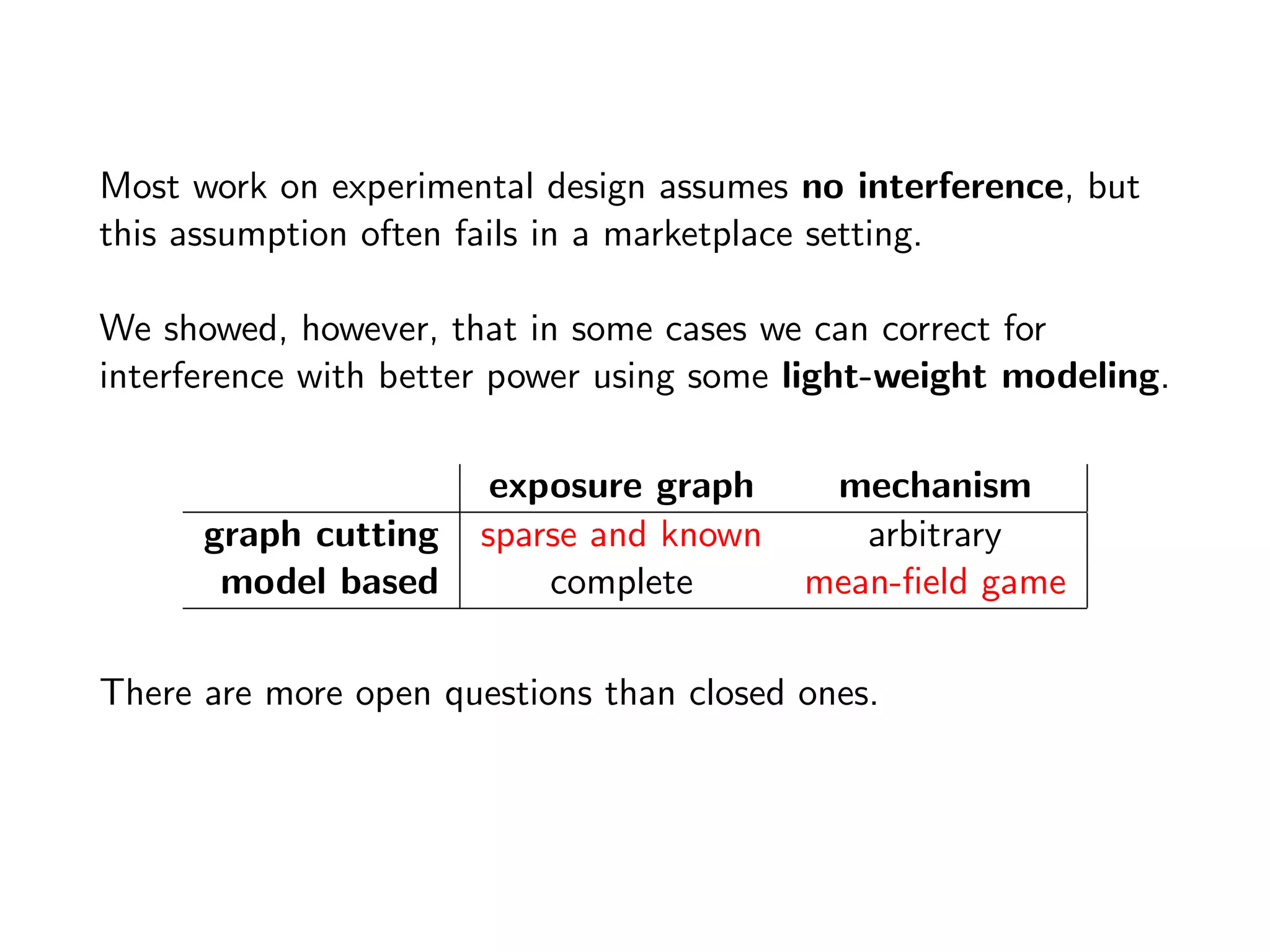

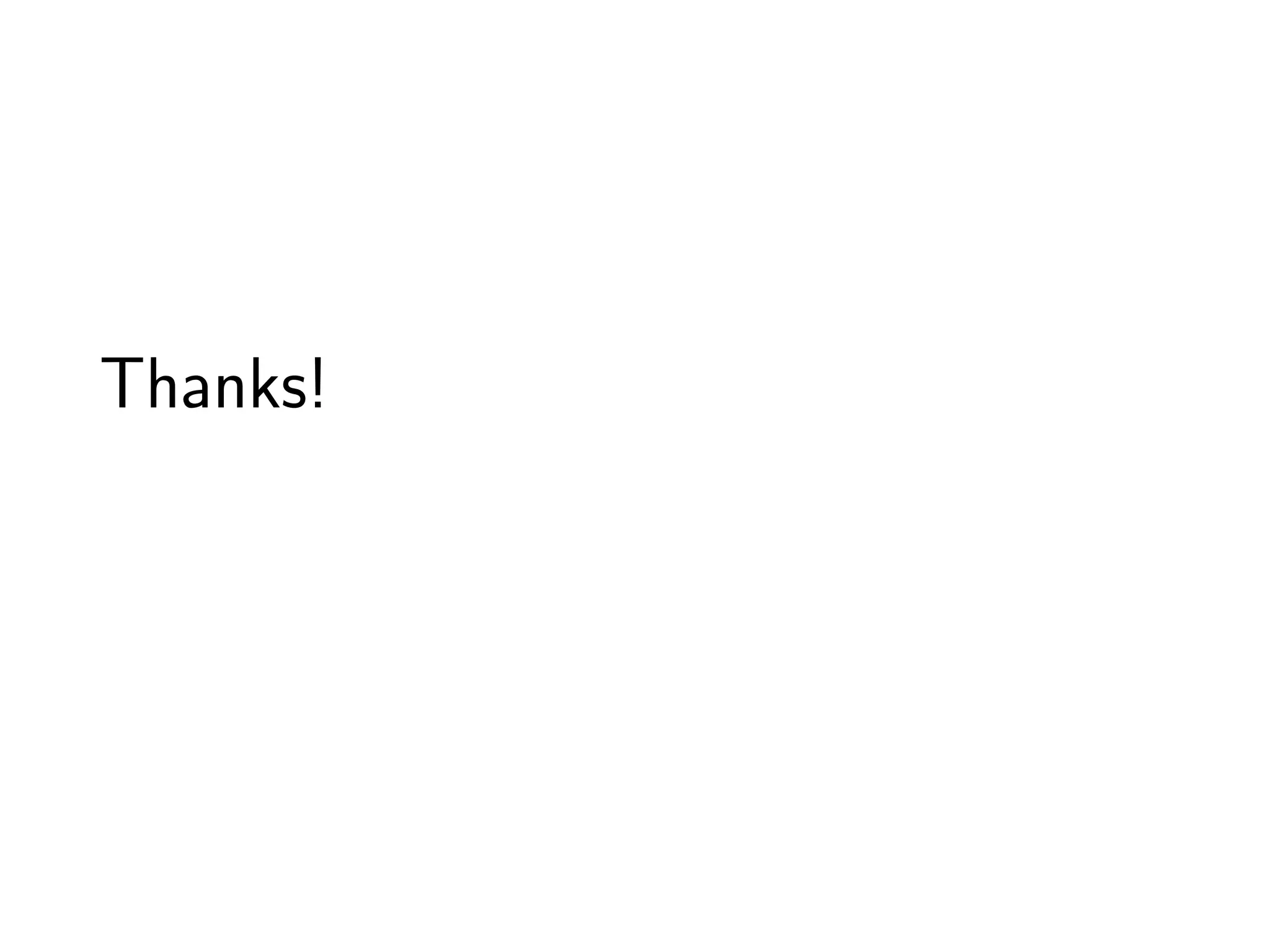

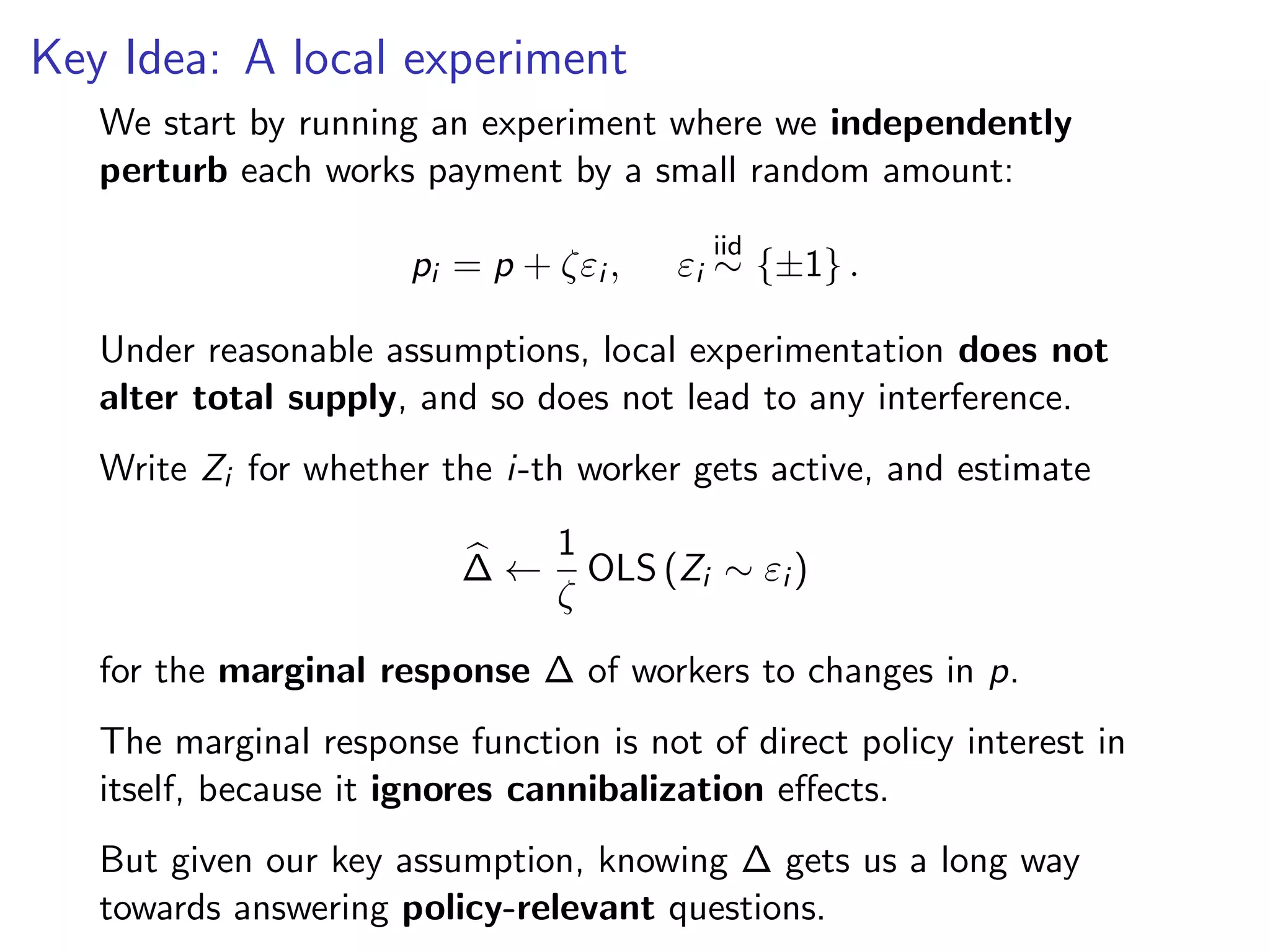

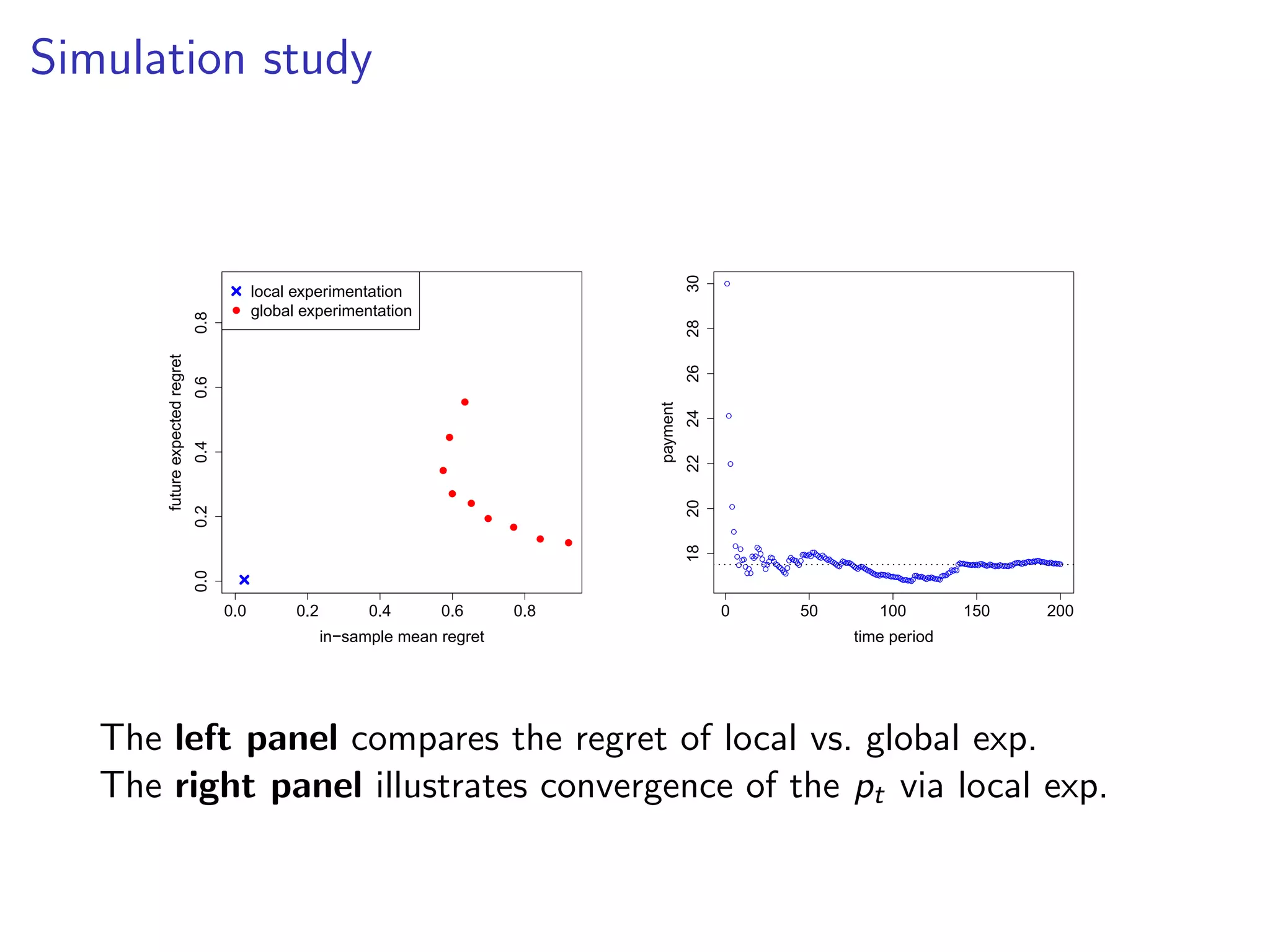

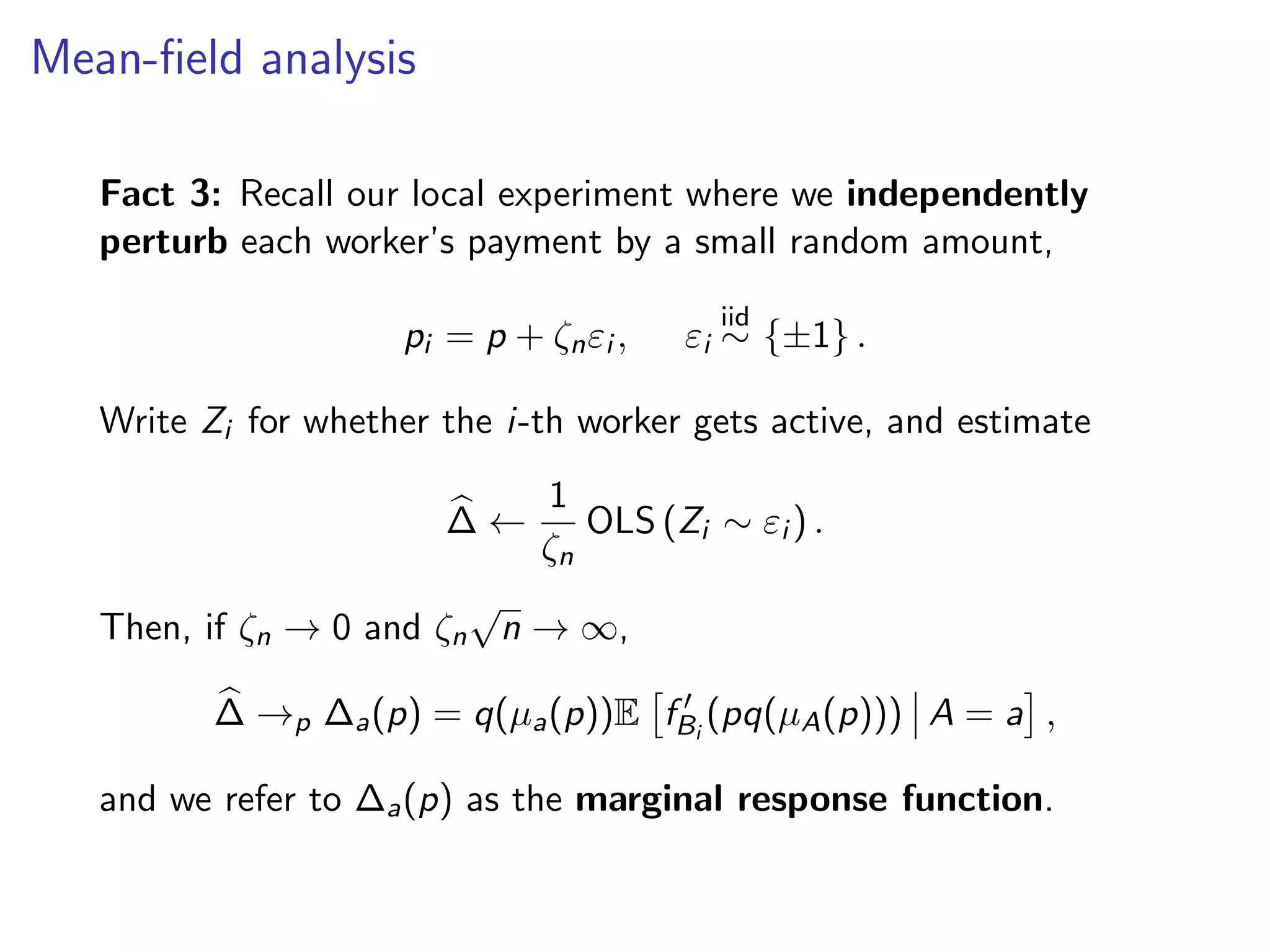

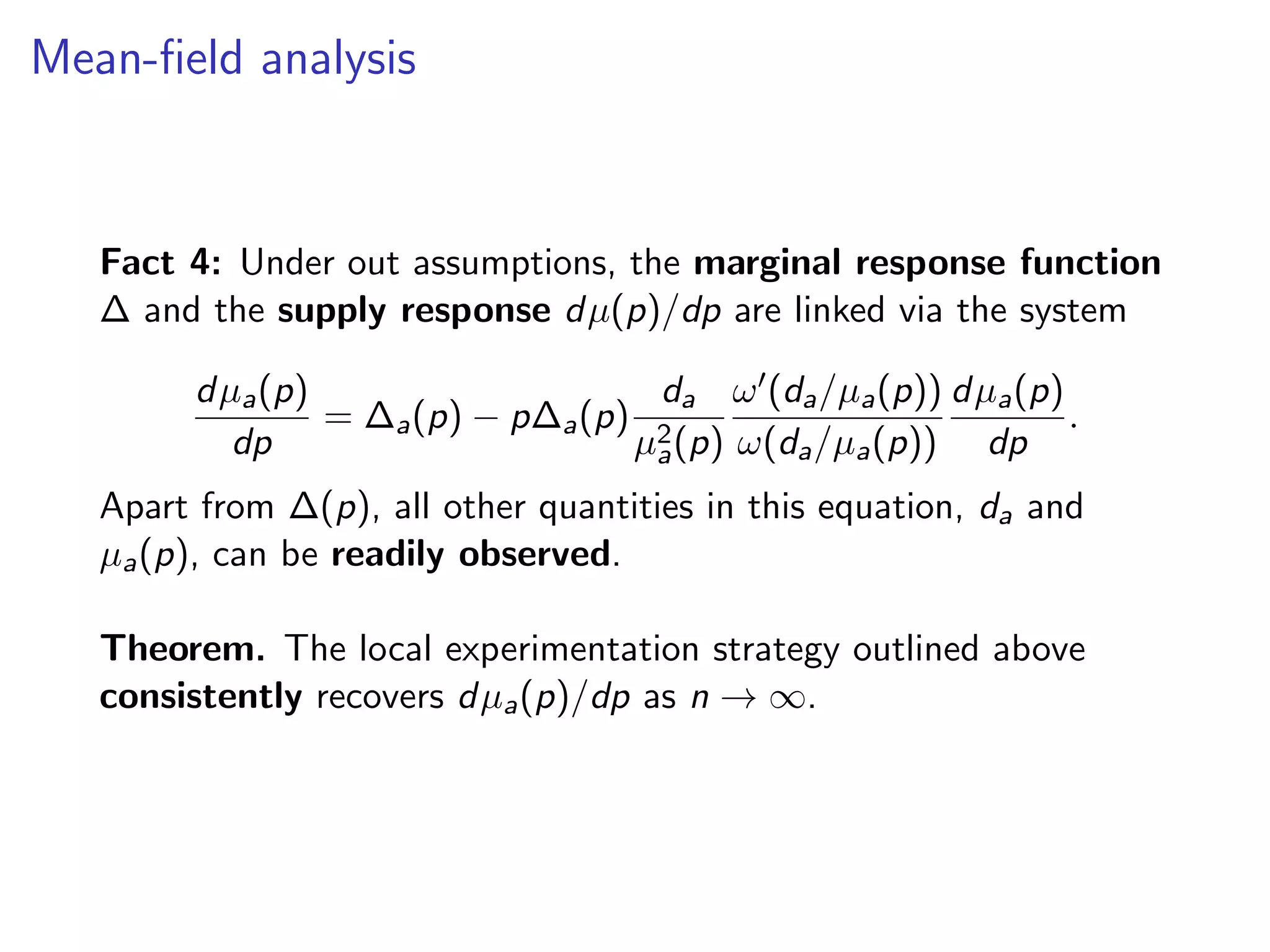

This document discusses challenges and strategies in optimizing payment structures for workers in sharing economy platforms through experimentation. It explores interference effects and proposes a local experimentation approach to efficiently estimate the marginal response of workers to payment changes while correcting for demand cannibalization. Simulation studies highlight the effectiveness of this method compared to traditional global experimentation in improving utility over time.

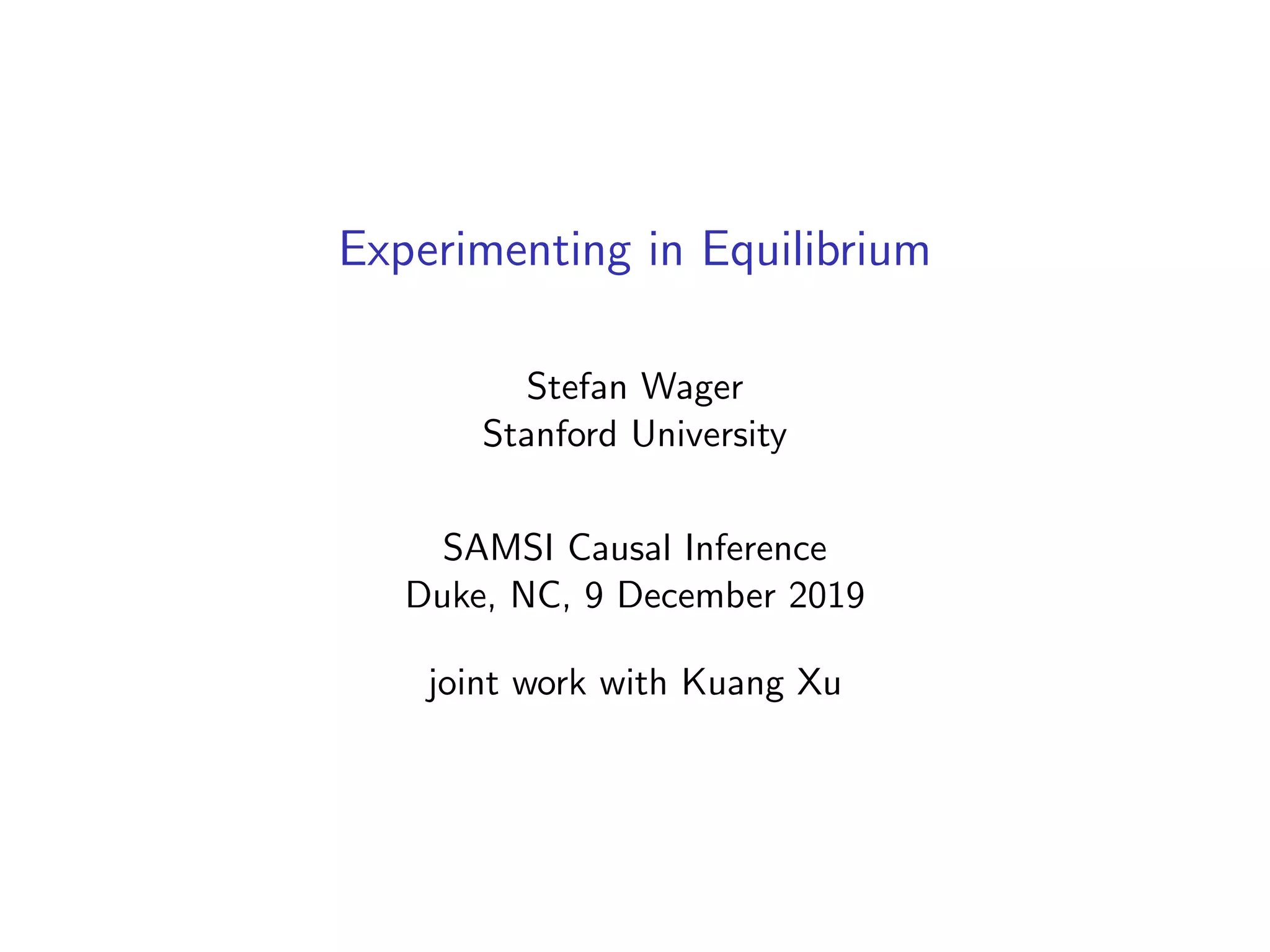

![A simple model

In order to correct for interference, we assume the following model:

The platform chooses a distribution π, and promises a

payment Pi

iid

∼ π to each worker.

If a fraction µ of workers are active, the expected amount of

demand served by any worker if they become active is q(µ).

Workers have random outside options Bi such that, given

the distribution π, the i-th worker is active with probability

fBi

(pi q(µ(π))) = 1/ (1 + exp [−β (pi q(µ(π)) − Bi )]) .

Note: the expected revenue of the i-th worker is pi q(µ(π)).

The system is in equilibrium, i.e., the fraction of active

workers is µ(π) = E [fBi

(pi q(µ(π)))].](https://image.slidesharecdn.com/wagner-expinequilibrium-191219170411/75/Causal-Inference-Opening-Workshop-Experimenting-in-Equilibrium-Stefan-Wager-December-9-2019-10-2048.jpg)

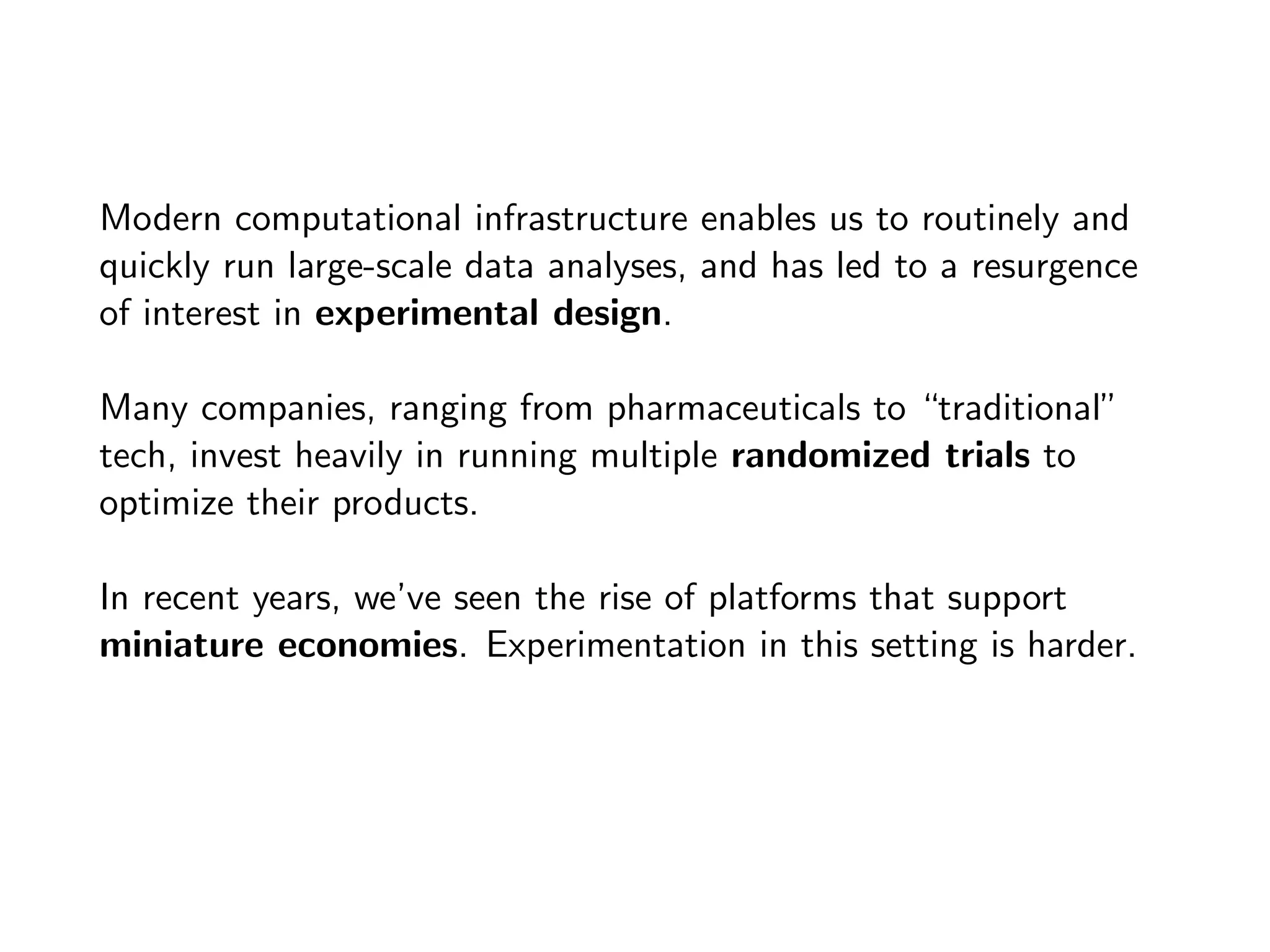

![A simple model

In order to correct for interference, we assume the following model:

The platform chooses a distribution π, and promises a

payment Pi

iid

∼ π to each worker.

If a fraction µ of workers are active and conditionally on daily

state A = a, the expected amount of demand served by

any worker if they become active is qa(µ).

Workers have random outside options Bi such that, given

the distribution π, the i-th worker is active with probability

fBi

(pi q(µ(π))) = 1/ (1 + exp [−β (pi q(µ(π)) − Bi )]) .

Note: the expected revenue of the i-th worker is pi q(µ(π)).

The system is in equilibrium, i.e., the fraction of active

workers is µa(π) = E fBi

(pi qA(µ(π))) A = a .

NB: The distribution of outside options Bi may depend on state A.](https://image.slidesharecdn.com/wagner-expinequilibrium-191219170411/75/Causal-Inference-Opening-Workshop-Experimenting-in-Equilibrium-Stefan-Wager-December-9-2019-17-2048.jpg)

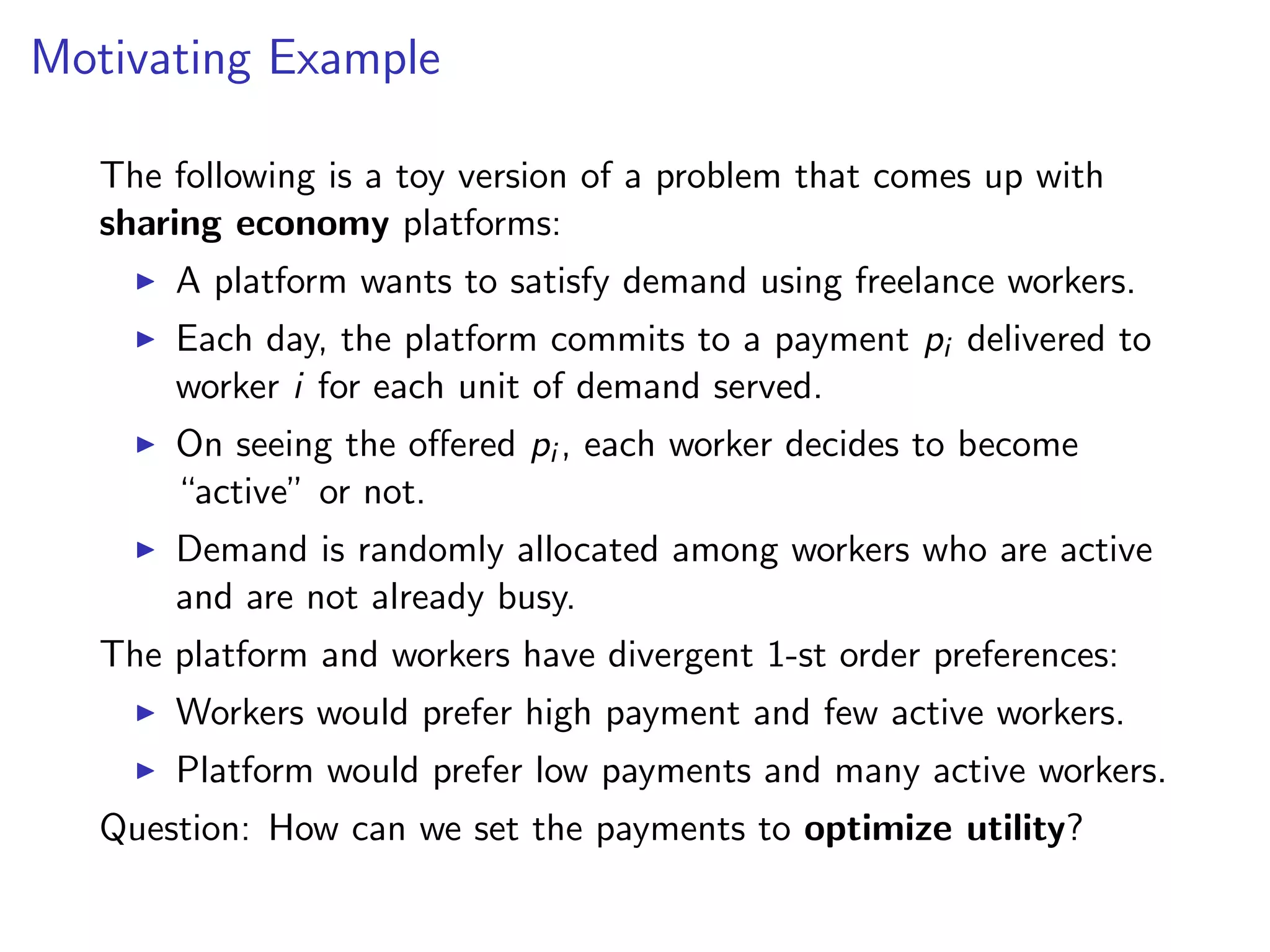

![Learning via Local Experimentation

The ultimate goal of the platform is to maximize its utility U, for

our purposes taken as total cost minus total revenue.

Write γ for the platform’s revenue per unit of demand served. In

the mean-field limit, the utility then converges to

n−1

Ua(p) = (γ − p) ω(da/µa(p)) µa(p), U(p) = E [UA(p)] .

Once we know dµa(p)/dp, working out the utility derivative

dUa(p)/dp amounts to calculus.

We consider a platform that uses these estimates to optimize U(p)

by gradient descent (or rather ascent).](https://image.slidesharecdn.com/wagner-expinequilibrium-191219170411/75/Causal-Inference-Opening-Workshop-Experimenting-in-Equilibrium-Stefan-Wager-December-9-2019-21-2048.jpg)

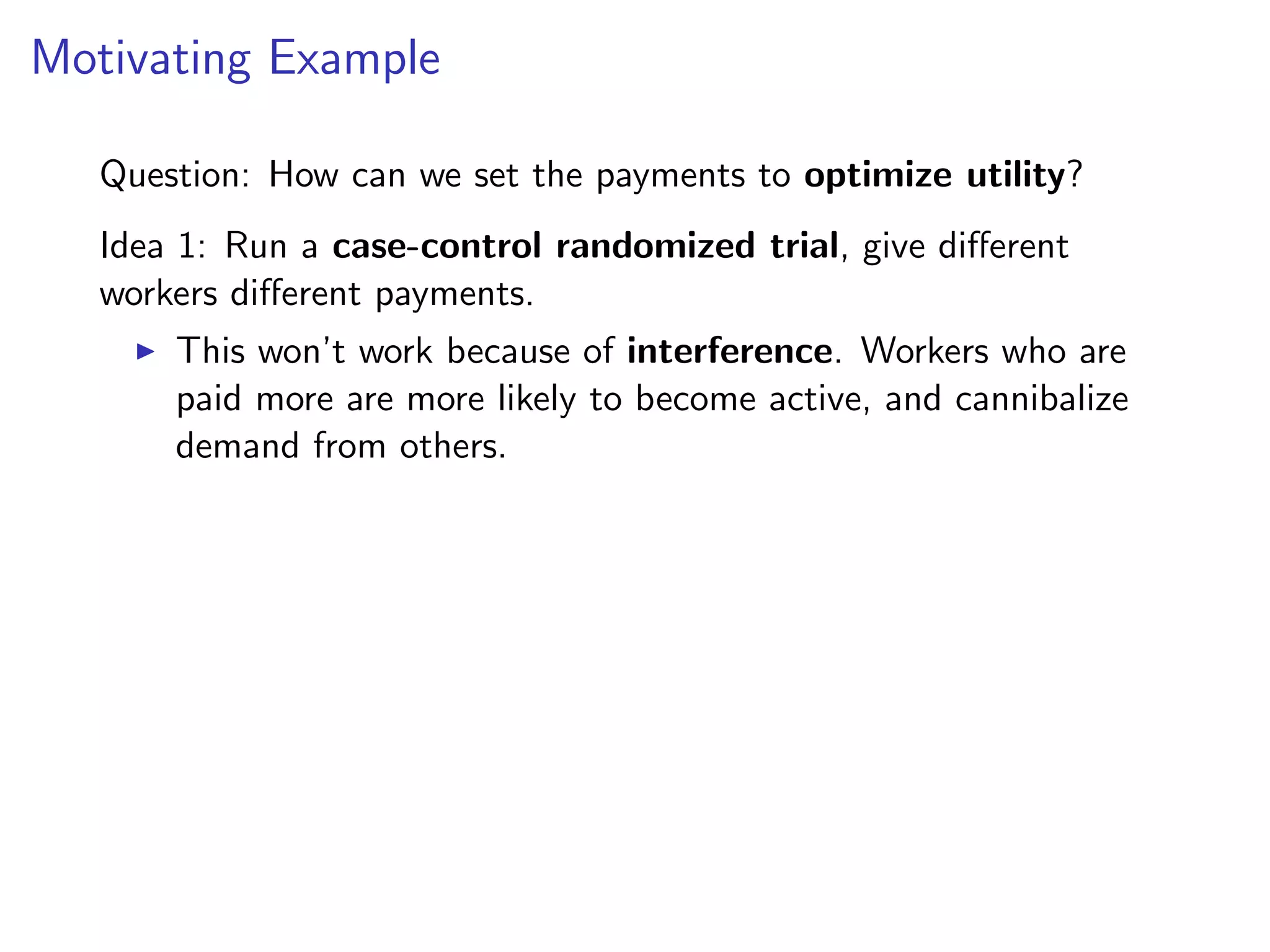

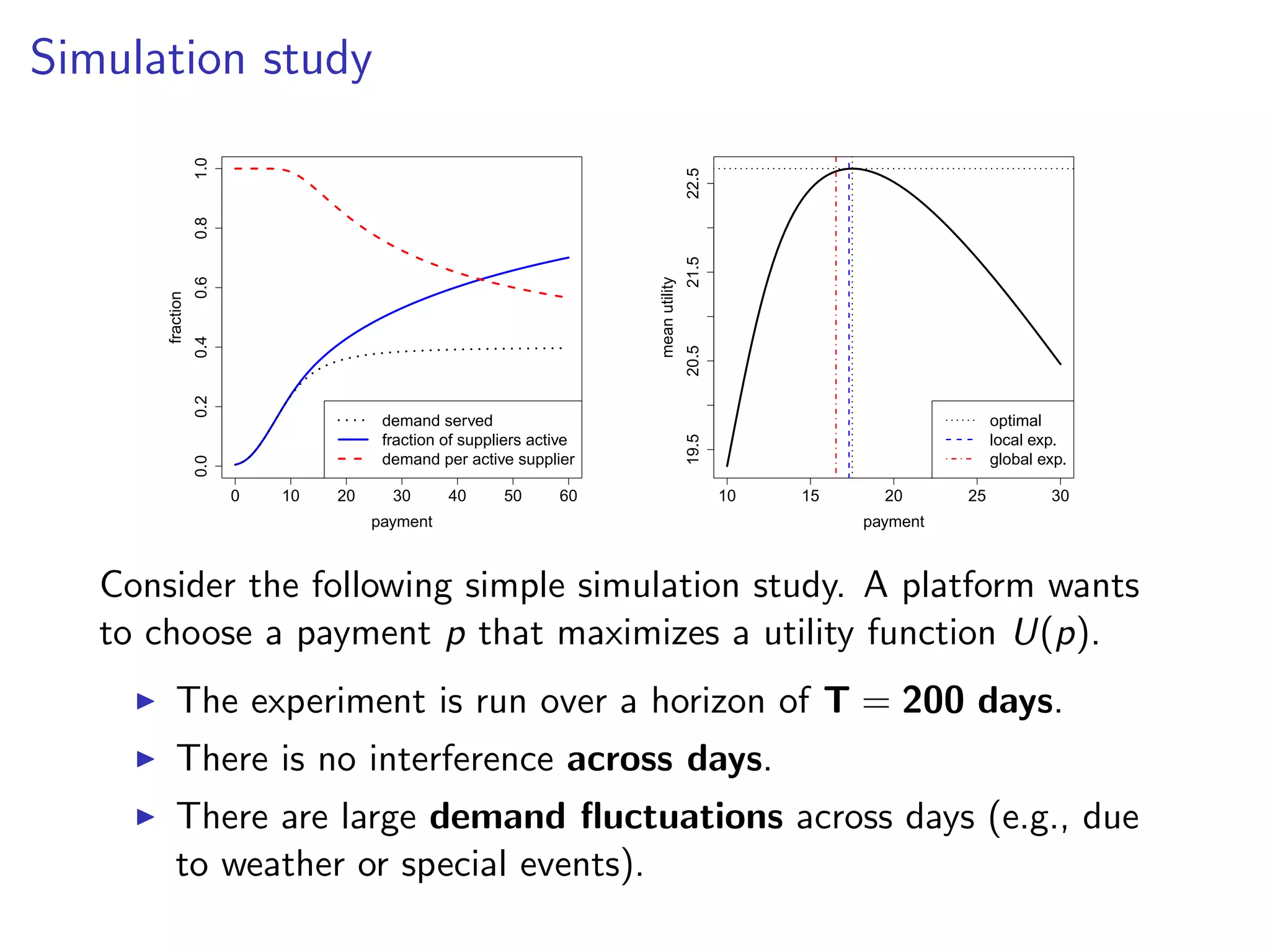

![A First-Order Algorithm

We now proceed to optimize payments via a variant of mirror

descent Specify a step size η, an interval I = [c−, c+], and an

initial payment p1. Then, at time period t = 1, 2, ...:

1. Deploy randomized payment perturbations εit around pt.

2. Estimate ∆ by regressing market participation on εit.

3. Translate this into an estimate Γt of dUAt (p)/dp via the

transformation implied by the mean-field limit.

4. Perform a gradient update, where θt = t

s=1 sΓs:

pt+1 = argminp

1

2η

t

s=1

s(p − ps)2

− θtp : p ∈ I

If the Ua(p) functions are strongly concave, this attains a 1/t rate

of convergence in large markets, both in regret and squared error.](https://image.slidesharecdn.com/wagner-expinequilibrium-191219170411/75/Causal-Inference-Opening-Workshop-Experimenting-in-Equilibrium-Stefan-Wager-December-9-2019-22-2048.jpg)

![A First-Order Algorithm

If the Ua(p) functions are strongly concave, this attains a 1/t rate

of convergence in large markets, both in regret and squared error.

Theorem. If the Ua(p) functions are σ-strongly concave,

|ua(p)| ≤ M, and we use a step size η > σ−1 then

lim

n→∞

P

1

T

T

t=1

t (UAt (p) − UAt (pt)) ≤

ηM2

2

= 1,

for any fixed payment p ∈ [c−, c+].

Corollary. If in addition the day-specific states At are IID, then

lim sup

n→∞

P (p∗

− ¯pT )2

≤

ηM2

σT

16 log δ−1

+ 4 ≥ 1 − δ,

p∗ = argmax {E [UA(p)] : p ∈ I} and ¯pT = 2

T(T+1)

T

t=1 t pt.](https://image.slidesharecdn.com/wagner-expinequilibrium-191219170411/75/Causal-Inference-Opening-Workshop-Experimenting-in-Equilibrium-Stefan-Wager-December-9-2019-23-2048.jpg)