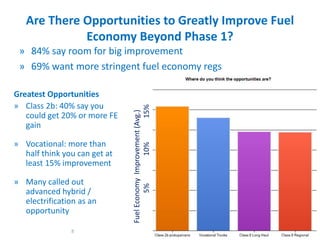

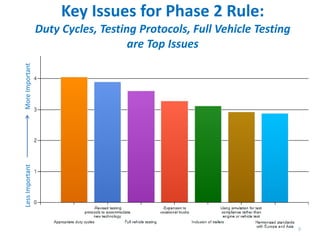

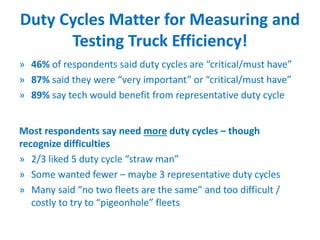

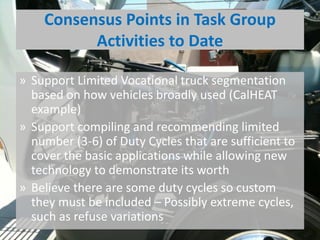

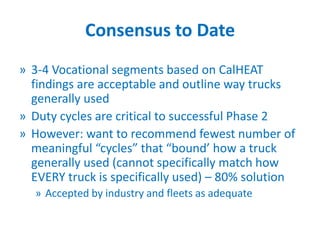

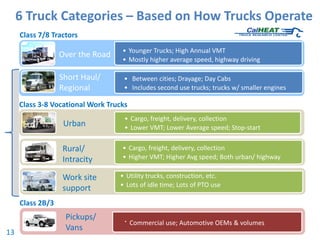

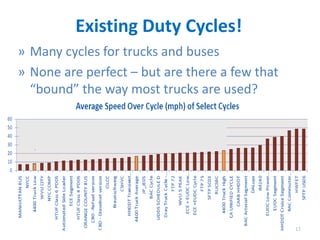

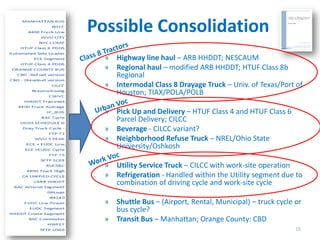

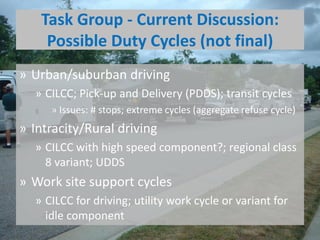

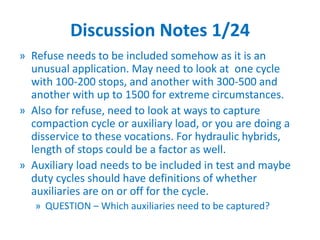

This document discusses key issues for the second phase of the EPA/NHTSA rule on heavy-duty truck fuel economy. It summarizes discussions from the HD Truck Fuel Economy Task Group on developing recommendations for regulators. Some of the main topics discussed include focusing the phase 2 rule more on vocational trucks, identifying advanced technologies that could be required like hybrids and electric vehicles, refining test procedures and duty cycles to better recognize new technologies, and balancing stringency and flexibility in setting new standards. The task group reached consensus that a limited set of representative duty cycles are needed for testing while still allowing new technologies to demonstrate benefits across different applications.