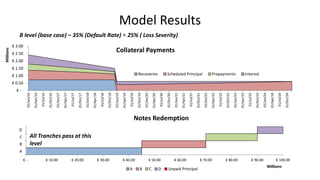

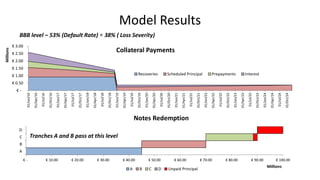

The cash flow model tests the performance of four tranches (A, B, C, D) under different stress scenarios by applying rating-specific default rates, loss severities, and prepayment stresses. The model outputs show that Tranche A achieves an AAA rating, Tranche B achieves an A rating, Tranche C achieves a BB rating, and Tranche D achieves a B rating as they are the highest stress levels where each tranche passes the timely interest and ultimate principal tests.