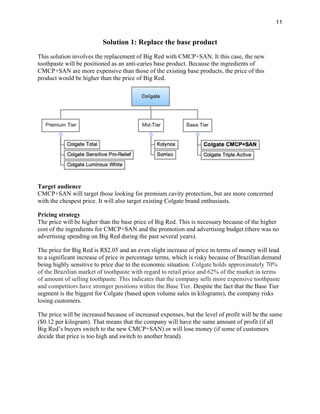

Colgate is launching a new toothpaste, CMCP+SAN, in Brazil to address ongoing dental caries issues. CMCP+SAN contains arginine and calcium compounds that are clinically proven to prevent 20% more cavities than fluoride alone. Brazil represents an opportunity as the world's third largest oral care market with high caries rates and poverty levels reducing access to dental care. However, Colgate must consider pricing strategies and potential cannibalization of existing products to maximize the launch of CMCP+SAN in Brazil.