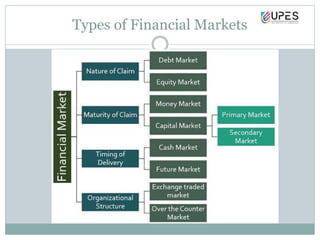

The document discusses money and capital markets. It defines money markets as trading highly liquid short-term products with safety and low returns. Capital markets refer to venues where funds are exchanged between those seeking capital and suppliers of capital like businesses and investors. Capital markets are divided into primary markets where new stocks/bonds are issued, and secondary markets where previously issued securities are traded. The main components of capital markets are the equity market for stocks, debt market for bonds, and derivatives market for financial contracts deriving value from underlying assets. Common capital market instruments include equities like shares, debt securities like bonds and debentures, derivatives like futures and options, and exchange-traded funds.