Capital and revenue concept

•Download as DOCX, PDF•

0 likes•216 views

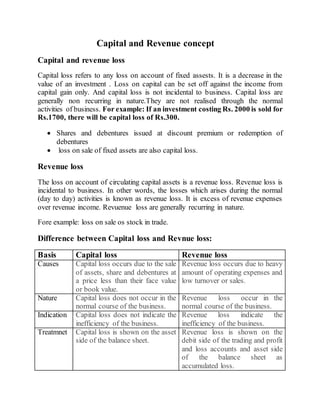

Capital losses refer to losses from the sale of fixed assets and are generally non-recurring. They do not arise from normal business activities and can only be set off against capital gains. Revenue losses arise from normal business operations and recurring expenses exceeding income. Revenue losses indicate business inefficiency while capital losses do not. Capital expenditures provide benefits over many years while revenue expenditures only provide short-term benefits within a year. Capital receipts are non-recurring from sources like owner's capital or asset sales, while revenue receipts are recurring from regular business operations.

Report

Share

Report

Share

Recommended

Classification of accounts || personal account || real account || nominal acc...

This document discusses the different types of accounts in accounting - personal, real, and nominal accounts. Personal accounts can be natural, artificial, or representative and are related to individuals or organizations. The golden rule for personal accounts is to debit the receiver and credit the giver. Real accounts represent tangible and intangible assets, and their golden rule is to debit what comes in and credit what goes out. Nominal accounts relate to income, gains, losses, and expenses, and their golden rule is to debit expenses and losses and credit incomes and gains.

Profit & Gains from Business or Profession.

This document provides an overview of income from business and profession under the Indian Income Tax Act. It defines business and profession, outlines the key points and basis of charge for income from business/profession. It also discusses the computation of income, specific deductions allowed, depreciation rules and amounts that are not deductible. The key information includes definitions of business and profession, income includes profits and losses, relevance of accounting method, and that income from illegal businesses is taxable.

Incomes exempt from tax under section 10

Useful for undergraduate students of taxation, covers selected items exempt from tax under section 10 of Income Tax Act 1961

Exempted income under income tax act

The document discusses various types of income that are exempt from income tax under the Income Tax Act in India. It provides details on exemptions for agricultural income, HUF income, partner's share of profit, leave travel concession, pension, leave salary, voluntary retirement compensation, house rent allowance, special allowances like transport allowance, interest income from certain securities, income of employee welfare funds, income of the Employee State Insurance Fund, and a minor child's income. It also discusses tax exemptions that apply specifically for salaried employees, such as exemptions on pension income, leave encashment, gratuity payments, and certain allowances.

Bill of exchange

The document discusses bills of exchange and promissory notes under Indian law. It defines bills of exchange and promissory notes, lists their key features and parties involved. A bill of exchange contains an unconditional order to pay, while a promissory note contains an unconditional promise to pay. The document also provides sample formats and distinguishes between bills of exchange and promissory notes. It outlines the advantages of bills of exchange as a means for facilitating credit transactions.

Presentation on-Income Tax Return Filing.

1. According to Section 139(1) of the Income Tax Act, every person whose total income exceeds the maximum amount not chargeable to tax or those specified such as companies must file a return of income by the due date in the prescribed form.

2. The due date for filing return of income electronically depends on the type of assessee - it is 30th September for companies and those required to get accounts audited, 30th November for those filing transfer pricing reports, and 31st July for other assessees.

3. It is now mandatory for companies, firms, and individuals subject to tax audit to file returns electronically, while individuals with over 5 lakhs income can

Deductions from gross total income

This document provides an overview of various deductions that can be claimed under sections 80C to 80U of the Indian Income Tax Act of 1961. It explains key deductions such as those for approved savings and investments of up to Rs. 1.5 lakhs under section 80C, contributions to pension schemes under 80CCD, medical and education expenses under 80D, 80DD, 80E, and donations to certain funds under 80G. It also outlines eligibility criteria and limits for claiming these common tax deductions in India.

Profits and Gains of Business or Profession

This document provides information about an income tax course taught by Dr. K. Chellapandian. It includes details about the course code, credit hours, outcomes, units covered, textbooks, and assessment details. The key points are:

- The course is Income Tax Law & Practice - II taught by Dr. K. Chellapandian at Vivekananda College.

- It has 5 units covering topics like computation of profits/capital gains, deductions, assessment of individuals/firms, and tax authorities.

- The course aims to enable students to learn income tax provisions and assessment procedures.

- Assessment includes 40% theory and 60% problems, following amendments up to 6 months

Recommended

Classification of accounts || personal account || real account || nominal acc...

This document discusses the different types of accounts in accounting - personal, real, and nominal accounts. Personal accounts can be natural, artificial, or representative and are related to individuals or organizations. The golden rule for personal accounts is to debit the receiver and credit the giver. Real accounts represent tangible and intangible assets, and their golden rule is to debit what comes in and credit what goes out. Nominal accounts relate to income, gains, losses, and expenses, and their golden rule is to debit expenses and losses and credit incomes and gains.

Profit & Gains from Business or Profession.

This document provides an overview of income from business and profession under the Indian Income Tax Act. It defines business and profession, outlines the key points and basis of charge for income from business/profession. It also discusses the computation of income, specific deductions allowed, depreciation rules and amounts that are not deductible. The key information includes definitions of business and profession, income includes profits and losses, relevance of accounting method, and that income from illegal businesses is taxable.

Incomes exempt from tax under section 10

Useful for undergraduate students of taxation, covers selected items exempt from tax under section 10 of Income Tax Act 1961

Exempted income under income tax act

The document discusses various types of income that are exempt from income tax under the Income Tax Act in India. It provides details on exemptions for agricultural income, HUF income, partner's share of profit, leave travel concession, pension, leave salary, voluntary retirement compensation, house rent allowance, special allowances like transport allowance, interest income from certain securities, income of employee welfare funds, income of the Employee State Insurance Fund, and a minor child's income. It also discusses tax exemptions that apply specifically for salaried employees, such as exemptions on pension income, leave encashment, gratuity payments, and certain allowances.

Bill of exchange

The document discusses bills of exchange and promissory notes under Indian law. It defines bills of exchange and promissory notes, lists their key features and parties involved. A bill of exchange contains an unconditional order to pay, while a promissory note contains an unconditional promise to pay. The document also provides sample formats and distinguishes between bills of exchange and promissory notes. It outlines the advantages of bills of exchange as a means for facilitating credit transactions.

Presentation on-Income Tax Return Filing.

1. According to Section 139(1) of the Income Tax Act, every person whose total income exceeds the maximum amount not chargeable to tax or those specified such as companies must file a return of income by the due date in the prescribed form.

2. The due date for filing return of income electronically depends on the type of assessee - it is 30th September for companies and those required to get accounts audited, 30th November for those filing transfer pricing reports, and 31st July for other assessees.

3. It is now mandatory for companies, firms, and individuals subject to tax audit to file returns electronically, while individuals with over 5 lakhs income can

Deductions from gross total income

This document provides an overview of various deductions that can be claimed under sections 80C to 80U of the Indian Income Tax Act of 1961. It explains key deductions such as those for approved savings and investments of up to Rs. 1.5 lakhs under section 80C, contributions to pension schemes under 80CCD, medical and education expenses under 80D, 80DD, 80E, and donations to certain funds under 80G. It also outlines eligibility criteria and limits for claiming these common tax deductions in India.

Profits and Gains of Business or Profession

This document provides information about an income tax course taught by Dr. K. Chellapandian. It includes details about the course code, credit hours, outcomes, units covered, textbooks, and assessment details. The key points are:

- The course is Income Tax Law & Practice - II taught by Dr. K. Chellapandian at Vivekananda College.

- It has 5 units covering topics like computation of profits/capital gains, deductions, assessment of individuals/firms, and tax authorities.

- The course aims to enable students to learn income tax provisions and assessment procedures.

- Assessment includes 40% theory and 60% problems, following amendments up to 6 months

Income from salary

Dr. P. Ravichandran has listed his academic and professional qualifications. He provides information on the different heads of income under the Income Tax Act, including salary, house property, business/profession, capital gains, and other sources. He notes that income is first computed under these heads and then adjustments are made for set-off losses before determining total income. The document then focuses on income from salary, providing details on what constitutes salary and allowable deductions. It discusses various forms of retirement benefits like leave encashment, gratuity, pension, and their tax treatment.

Deemed Income under Income Tax Act

Deemed income refers to amounts that are treated as taxable income even though they may not meet the normal definition of income. The Income Tax Act extends the definition of income to include various receipts such as capital gains, voluntary contributions, compensation received, insurance surplus, and windfall gains.

Some key types of deemed income discussed in the document include deemed dividends from closely-held companies, income from transferred assets that is clubbed with the transferor's income, gifts exceeding certain thresholds, consideration received for shares issued by closely-held companies above fair market value, unexplained cash credits, unexplained investments/expenditures/money, and certain provident fund contributions and payments.

Types of Assessees and Residential Status

This document summarizes key concepts related to assessees and residential status under Indian income tax law. It defines an assessee as the person who pays tax to the government and describes the different types of assessees, including ordinary, representative/deemed, and assessee in default. It also outlines the criteria for determining residential status, such as an individual being considered a resident if they are in India for at least 182 days or at least 60 days plus 365 days in the last 4 years. Finally, it provides an example problem of determining residential status for an individual who left India on October 1st and returned on March 10th of the following year.

Issue of debentures by N. Bala Murali Krishna

The document discusses debentures, which are instruments issued by a company to raise funds through loans. It defines debentures and explains why companies issue them instead of shares. It then describes the different types of debentures based on security, redemption, negotiability, convertibility, priority, and coupon/interest rate. The document also covers the accounting treatment for issuing debentures for cash, premium, discount, as collateral, or for consideration other than cash. It discusses oversubscription of debentures and conditions for redemption. Finally, it provides journal entries for recording interest payment on debentures.

Accounting for issue of debentures

The document discusses accounting treatments for various aspects of issuing and accounting for debentures by a company. It defines debentures and outlines their key features. It also describes different types of debentures based on security, redemption, records, convertibility, priority, and coupon rate. The document then explains accounting entries for issuing debentures for cash at par, premium, and discount. It also covers entries for interest on debentures, writing off discounts, and accrued interest.

Company Final accounts

This document provides an overview of financial statements that companies are required to prepare under the Companies Act. It discusses the key components of the income statement and balance sheet, including revenues, expenses, assets, liabilities, and equity. Sample income statements and balance sheets are presented with explanatory notes. Key terms related to revenues, expenses, assets, liabilities, equity, and other items are also defined.

Income from other sources

computation of income from other sources for the benefit of taxation students, based on provisions of Income tax Act 1961

Factors affecting working capital

Factors Affecting Working Capital

Working capital consists of current assets like receivables, inventories, and cash. Several factors affect the required level of working capital including: 1) the nature of the industry, with larger industries requiring more working capital; 2) creditors' demands for adequate asset coverage of liabilities; and 3) the general nature of the business, with manufacturing requiring more working capital due to slower inventory and receivable turnover than services. Other key factors are inventory and receivable turnover, sales volume, production cycle length, and price level changes. Proper management of these factors can optimize the balance between liquidity and profitability of a firm's working capital.

Auditing and assurance standards

1. The document discusses auditing and assurance standards, including the roles of the International Auditing and Assurance Standards Board (IAASB) and the Auditing and Assurance Standards Board (AASB) in India in setting standards.

2. It describes the standard-setting process undertaken by the AASB, including determining priority areas, forming study groups, exposure drafts, final drafts, and issue of standards.

3. Key aspects of audit work covered include audit planning, evidence, quality control, working papers, and files. Factors affecting planning and benefits of planning are highlighted. Characteristics of objective evidence are also noted.

Income from house property

The document discusses income from house property under the Indian Income Tax Act. It defines income from house property as the annual value of any buildings or lands owned by an assessee. It provides details on computation of gross annual value, deductions allowed, treatment of self-occupied properties, and exempted incomes from house property. The key steps involved in computing income from house property are determining the annual value, calculating the net annual value, and claiming allowed deductions.

Accounting for non profit organization

NPO Accounting is very important topic for all Accounting and Finance students to learn and have knowledge of its basics theory and accounting.

customs duty 1966

The document discusses India's customs laws and procedures. It notes that customs duties were established in 1786 with the creation of a board of revenue in Calcutta. Over time, various acts standardized customs duties and procedures, including the Customs Act of 1962 and Customs Tariff Act of 1975. Customs aims to generate government revenue, protect domestic industries, and prevent smuggling. Goods are subject to customs checks and duty assessments when imported or exported. Drawback allows refunds or rebates of customs duties paid on goods that are later exported.

Accounts & Records in GST

1) The document discusses the key requirements for maintaining accounts and records under the GST law in India, including the purpose of maintaining books of accounts, relevant provisions under the GST Act, and types of audits.

2) It explains that under GST, registered persons must maintain accounts and supporting documents for 6 years and in certain cases where tax proceedings are ongoing, for 1 year after their completion. They must record production, purchases, sales, input tax credit, and output tax regularly.

3) The document outlines the processes for tax authority audits as well as special audits that can be ordered, and the powers of inspection, search, seizure and arrest granted to officers in case of suspected tax

Collecting banker

Collecting Banker: Duties, Statutory Protection and Concept of Negligence, Position of a Collecting Banker, Duties and Responsibilities of Collecting Banker,Statutory Protection to Collecting Banker, Holder

and

Holder in Due Course

Tax deductions u/s 80c to 80u

This document provides an overview of tax deductions available under Sections 80C to 80U of the Indian Income Tax Act. It explains that these deductions are intended to incentivize taxpayers to engage in socially desirable activities and investments. The key deductions covered include those for life insurance premiums (Section 80C), pension contributions (Section 80CCC), medical insurance (Section 80D), treatment of disabled dependents (Section 80DD), tuition fees (Section 80E), interest on education loans (Section 80E), rent payments (Section 80GG), among others. Eligibility conditions and calculation of allowable deductions for each section are described.

Aggregation of income, set off and carry forward

This presentation intents to explain the concepts of Set off and Carry Forward of losses under income tax law to students. For detail understanding of the concept viewers are invited to our YouTube Channel.

Income from business or profession

The document discusses key aspects of income from business and profession under the Income Tax Act of 1961 in India. It defines business and profession, outlines the basis of charge for income from business/profession, and describes various deductions that are allowed under sections 30-37 of the Act such as rent, repairs, insurance, depreciation, bad debts, and more. It provides explanations and conditions for claiming many of these deductions.

Issue of Shares

The document discusses key differences between private and public companies. It states that private companies have restrictions on the number of members and cannot invite the public to subscribe to its shares, while public companies can have an unlimited number of members and can invite public subscription. Additionally, private companies have restrictions on the transfer of shares while public companies do not.

Consignment and joint venture – accounting aspects

The document discusses accounting aspects of consignment and joint ventures. It defines consignment as goods sent by one party to another to sell on their behalf, with the owner retaining ownership. It covers key accounts like consignment account, consignee account, and entries for expenses, sales, and closing stock. Joint ventures are temporary associations of two firms to work on a project, differing from partnerships. Accounting can involve separate joint venture books or memorandum accounts in each party's books.

Computation of total income & tax liability individual, Partnership Firm,...

Computation of total income & tax liability individual. Rebate U/s 87A, Surcharge, Tax On Partnership Firm, Individual, Companies, Society & Trust, Health & Education Cess, Foreign Company

Accounting chapter-4

This powerpoint presentation is created by Gyanbikash.com for the students of class nine to ten from their accounting NCTB textbook for multimedia class.

Xi acc.financial stts.

This document defines key stakeholders as any person associated with a business, whether internally or externally, and with monetary or non-monetary interests. It identifies common stakeholder groups like owners, managers, government, and potential owners. It also distinguishes between capital and revenue items that affect financial statements, and defines capital, deferred revenue, and ordinary revenue expenditures. Capital receipts incur an obligation to return money while revenue receipts do not. Financial statements aim to present an accurate view of financial performance and position by properly reporting items as either capital or revenue.

More Related Content

What's hot

Income from salary

Dr. P. Ravichandran has listed his academic and professional qualifications. He provides information on the different heads of income under the Income Tax Act, including salary, house property, business/profession, capital gains, and other sources. He notes that income is first computed under these heads and then adjustments are made for set-off losses before determining total income. The document then focuses on income from salary, providing details on what constitutes salary and allowable deductions. It discusses various forms of retirement benefits like leave encashment, gratuity, pension, and their tax treatment.

Deemed Income under Income Tax Act

Deemed income refers to amounts that are treated as taxable income even though they may not meet the normal definition of income. The Income Tax Act extends the definition of income to include various receipts such as capital gains, voluntary contributions, compensation received, insurance surplus, and windfall gains.

Some key types of deemed income discussed in the document include deemed dividends from closely-held companies, income from transferred assets that is clubbed with the transferor's income, gifts exceeding certain thresholds, consideration received for shares issued by closely-held companies above fair market value, unexplained cash credits, unexplained investments/expenditures/money, and certain provident fund contributions and payments.

Types of Assessees and Residential Status

This document summarizes key concepts related to assessees and residential status under Indian income tax law. It defines an assessee as the person who pays tax to the government and describes the different types of assessees, including ordinary, representative/deemed, and assessee in default. It also outlines the criteria for determining residential status, such as an individual being considered a resident if they are in India for at least 182 days or at least 60 days plus 365 days in the last 4 years. Finally, it provides an example problem of determining residential status for an individual who left India on October 1st and returned on March 10th of the following year.

Issue of debentures by N. Bala Murali Krishna

The document discusses debentures, which are instruments issued by a company to raise funds through loans. It defines debentures and explains why companies issue them instead of shares. It then describes the different types of debentures based on security, redemption, negotiability, convertibility, priority, and coupon/interest rate. The document also covers the accounting treatment for issuing debentures for cash, premium, discount, as collateral, or for consideration other than cash. It discusses oversubscription of debentures and conditions for redemption. Finally, it provides journal entries for recording interest payment on debentures.

Accounting for issue of debentures

The document discusses accounting treatments for various aspects of issuing and accounting for debentures by a company. It defines debentures and outlines their key features. It also describes different types of debentures based on security, redemption, records, convertibility, priority, and coupon rate. The document then explains accounting entries for issuing debentures for cash at par, premium, and discount. It also covers entries for interest on debentures, writing off discounts, and accrued interest.

Company Final accounts

This document provides an overview of financial statements that companies are required to prepare under the Companies Act. It discusses the key components of the income statement and balance sheet, including revenues, expenses, assets, liabilities, and equity. Sample income statements and balance sheets are presented with explanatory notes. Key terms related to revenues, expenses, assets, liabilities, equity, and other items are also defined.

Income from other sources

computation of income from other sources for the benefit of taxation students, based on provisions of Income tax Act 1961

Factors affecting working capital

Factors Affecting Working Capital

Working capital consists of current assets like receivables, inventories, and cash. Several factors affect the required level of working capital including: 1) the nature of the industry, with larger industries requiring more working capital; 2) creditors' demands for adequate asset coverage of liabilities; and 3) the general nature of the business, with manufacturing requiring more working capital due to slower inventory and receivable turnover than services. Other key factors are inventory and receivable turnover, sales volume, production cycle length, and price level changes. Proper management of these factors can optimize the balance between liquidity and profitability of a firm's working capital.

Auditing and assurance standards

1. The document discusses auditing and assurance standards, including the roles of the International Auditing and Assurance Standards Board (IAASB) and the Auditing and Assurance Standards Board (AASB) in India in setting standards.

2. It describes the standard-setting process undertaken by the AASB, including determining priority areas, forming study groups, exposure drafts, final drafts, and issue of standards.

3. Key aspects of audit work covered include audit planning, evidence, quality control, working papers, and files. Factors affecting planning and benefits of planning are highlighted. Characteristics of objective evidence are also noted.

Income from house property

The document discusses income from house property under the Indian Income Tax Act. It defines income from house property as the annual value of any buildings or lands owned by an assessee. It provides details on computation of gross annual value, deductions allowed, treatment of self-occupied properties, and exempted incomes from house property. The key steps involved in computing income from house property are determining the annual value, calculating the net annual value, and claiming allowed deductions.

Accounting for non profit organization

NPO Accounting is very important topic for all Accounting and Finance students to learn and have knowledge of its basics theory and accounting.

customs duty 1966

The document discusses India's customs laws and procedures. It notes that customs duties were established in 1786 with the creation of a board of revenue in Calcutta. Over time, various acts standardized customs duties and procedures, including the Customs Act of 1962 and Customs Tariff Act of 1975. Customs aims to generate government revenue, protect domestic industries, and prevent smuggling. Goods are subject to customs checks and duty assessments when imported or exported. Drawback allows refunds or rebates of customs duties paid on goods that are later exported.

Accounts & Records in GST

1) The document discusses the key requirements for maintaining accounts and records under the GST law in India, including the purpose of maintaining books of accounts, relevant provisions under the GST Act, and types of audits.

2) It explains that under GST, registered persons must maintain accounts and supporting documents for 6 years and in certain cases where tax proceedings are ongoing, for 1 year after their completion. They must record production, purchases, sales, input tax credit, and output tax regularly.

3) The document outlines the processes for tax authority audits as well as special audits that can be ordered, and the powers of inspection, search, seizure and arrest granted to officers in case of suspected tax

Collecting banker

Collecting Banker: Duties, Statutory Protection and Concept of Negligence, Position of a Collecting Banker, Duties and Responsibilities of Collecting Banker,Statutory Protection to Collecting Banker, Holder

and

Holder in Due Course

Tax deductions u/s 80c to 80u

This document provides an overview of tax deductions available under Sections 80C to 80U of the Indian Income Tax Act. It explains that these deductions are intended to incentivize taxpayers to engage in socially desirable activities and investments. The key deductions covered include those for life insurance premiums (Section 80C), pension contributions (Section 80CCC), medical insurance (Section 80D), treatment of disabled dependents (Section 80DD), tuition fees (Section 80E), interest on education loans (Section 80E), rent payments (Section 80GG), among others. Eligibility conditions and calculation of allowable deductions for each section are described.

Aggregation of income, set off and carry forward

This presentation intents to explain the concepts of Set off and Carry Forward of losses under income tax law to students. For detail understanding of the concept viewers are invited to our YouTube Channel.

Income from business or profession

The document discusses key aspects of income from business and profession under the Income Tax Act of 1961 in India. It defines business and profession, outlines the basis of charge for income from business/profession, and describes various deductions that are allowed under sections 30-37 of the Act such as rent, repairs, insurance, depreciation, bad debts, and more. It provides explanations and conditions for claiming many of these deductions.

Issue of Shares

The document discusses key differences between private and public companies. It states that private companies have restrictions on the number of members and cannot invite the public to subscribe to its shares, while public companies can have an unlimited number of members and can invite public subscription. Additionally, private companies have restrictions on the transfer of shares while public companies do not.

Consignment and joint venture – accounting aspects

The document discusses accounting aspects of consignment and joint ventures. It defines consignment as goods sent by one party to another to sell on their behalf, with the owner retaining ownership. It covers key accounts like consignment account, consignee account, and entries for expenses, sales, and closing stock. Joint ventures are temporary associations of two firms to work on a project, differing from partnerships. Accounting can involve separate joint venture books or memorandum accounts in each party's books.

Computation of total income & tax liability individual, Partnership Firm,...

Computation of total income & tax liability individual. Rebate U/s 87A, Surcharge, Tax On Partnership Firm, Individual, Companies, Society & Trust, Health & Education Cess, Foreign Company

What's hot (20)

Consignment and joint venture – accounting aspects

Consignment and joint venture – accounting aspects

Computation of total income & tax liability individual, Partnership Firm,...

Computation of total income & tax liability individual, Partnership Firm,...

Similar to Capital and revenue concept

Accounting chapter-4

This powerpoint presentation is created by Gyanbikash.com for the students of class nine to ten from their accounting NCTB textbook for multimedia class.

Xi acc.financial stts.

This document defines key stakeholders as any person associated with a business, whether internally or externally, and with monetary or non-monetary interests. It identifies common stakeholder groups like owners, managers, government, and potential owners. It also distinguishes between capital and revenue items that affect financial statements, and defines capital, deferred revenue, and ordinary revenue expenditures. Capital receipts incur an obligation to return money while revenue receipts do not. Financial statements aim to present an accurate view of financial performance and position by properly reporting items as either capital or revenue.

The finance perspective dupont

The document provides an overview of key financial concepts including balance sheets, profit and loss statements, working capital, assets, liabilities, ratios, and how various business decisions impact financial statements. It discusses the components of balance sheets and profit/loss statements and how they are used to analyze a company's financial performance and position. It also summarizes various financing options and strategic financial objectives companies may have.

Fsaa

This document discusses capital expenditure versus revenue expenditure and operating versus non-operating items. Capital expenditure includes money spent on long-term assets that provide benefits for over a year. Revenue expenditure includes day-to-day operating costs that provide short-term benefits within a year. Operating items refer to income and expenses from core business operations, while non-operating items are from ancillary activities like investments or financing. Cash flows are also categorized as arising from operating, investing, or financing activities.

Accounts - Costing / Cost accounts

Accounts , Costing , Cost accounts

Capital Revenue , Revenue , Deferred Revenue , Expenditure & Receipts

5.capital and revenue

Capital and revenue expenditures and receipts must be distinguished to determine which items appear in which financial statements. Capital items appear on the balance sheet, while revenue items appear on the profit and loss account. This distinction is also important for determining net profit, which equals revenue receipts minus revenue expenses. Capital receipts include contributions of capital and loans, while revenue receipts are generated from a firm's regular activities like sales. Capital expenditures acquire or improve long-term assets, increasing earning capacity, while revenue expenditures maintain assets and earnings over a single accounting period.

Money and finance management chapter 3

This document outlines the key topics covered in a money and finance management course, including chapters on business accounting. Chapter 3 focuses on accounting and discusses the aim of accounting, which is to report financial information about a business's performance, financial position, and cash flow. It explains that accounting information is compiled into common financial statements like the income statement, balance sheet, statement of cash flows, and statement of retained earnings. The balance sheet section describes how a balance sheet categorizes a company's assets, liabilities, and shareholders' equity, with assets divided into current and fixed assets. It also provides a sample balance sheet formula showing that total assets must equal the sum of total liabilities and shareholders' equity.

Revenue recognition & management revenue vss capital

Revenue Recognition & Management Revenue v/s Capital (Receipts & Expenditure)

Receipts and Expenditures

Everything related to Capital and Revenue Receipts, and Capital and Revenue Expenditure along with their differentiation and examples.

Capitalization (2).pptx

The document discusses capitalization and different types of capitalization situations for companies. It defines capitalization broadly as the total amount invested in a business and more narrowly as determining long-term funding needs. Over-capitalization occurs when a company's capitalization exceeds its average income, preventing a fair return. Under-capitalization is the opposite, with high profits generated from efficient asset use. The document outlines causes, effects, and remedies for over-capitalization and under-capitalization situations.

Basics of accounts1

This document provides an overview of basic accounting concepts including definitions, objectives, processes, principles, and key terms. It defines accounting as recording, classifying, and summarizing financial transactions and events. The main objectives are to keep records, ascertain profits/losses, and facilitate decision making. The accounting process involves identifying transactions, recording them, posting to ledgers, and preparing financial statements. Key principles include concepts like money measurement and conventions like consistency. It also outlines accounts, rules of debit/credit, and final accounts such as trading, profit and loss, and balance sheet.

Ch02..

The document provides an overview of key financial statements including the balance sheet, income statement, and statement of cash flows. It explains the purpose and components of each statement. The balance sheet presents assets, liabilities, and equity of a company at a point in time. It lists current assets like cash, receivables, and inventory as well as long-term assets. Liabilities include current obligations and long-term debt. Equity encompasses share capital and retained earnings. The income statement displays revenues and expenses over a period of time to arrive at net income. It is used to analyze a company's profitability.

Money cycle1

The document discusses key accounting concepts including accrual accounting, capital and revenue income/expenditure, and deferred revenue expenditure. It defines accrual accounting as recognizing income when earned and expenses when incurred, regardless of when cash is received or paid. Capital income arises from asset sales rather than regular business, while revenue income comes from ongoing operations. Capital expenditures provide long-term benefits while revenue expenditures benefit the current period. Deferred revenue expenditures provide benefits over multiple periods.

Cpt accounts - unit6

The document discusses the differences between revenue and capital expenditures and receipts. Revenue expenditures relate to operations or revenue earned in an accounting period, while capital expenditures generate benefits over multiple periods. Revenue expenses are transferred to the profit and loss account in the year spent, while capital expenses are transferred over the years benefited. Determining factors include nature, frequency, purpose, and materiality of the expense. Deferred revenue expenditures provide benefits over multiple periods but cannot be precisely estimated. Revenue receipts come from normal business activities, while capital receipts are non-recurring.

Accounting key terms

The document defines key terms used in finance, including financial statements, balance sheets, assets, liabilities, equity, and profit and loss statements. It explains that financial statements provide information on a firm's financial activities and position, while balance sheets indicate its financial position by listing assets, liabilities, and equity. It also defines current and fixed assets, current and long-term liabilities, equity, capital employed, and key elements of profit and loss statements such as revenue, expenses, depreciation, and different types of profit.

Financial Statements I - Reynolds Week 2011

Jimmy Gentry on 'Financial Statements I" at Reynolds Business Journalism Week, Feb. 4-7, 2011.

Reynolds Center for Business Journalism, BusinessJournalism.org, Arizona State University's Walter Cronkite School of Journalism.

Basics of accounts

The document defines accounting and its objectives, which include keeping systematic records and ascertaining the financial position of a business. It describes the accounting process and key principles. It also defines important accounting terms like assets, liabilities, expenses, capital, and different types of accounts. Finally, it discusses the key final accounts prepared in accounting - the trading account, profit and loss account, and balance sheet.

Financial Statements I by Jimmy Gentry

Jimmy Gentry presents "Financial Statements I" during the annual 2012 Reynolds Business Journalism Seminars, hosted by the Donald W. Reynolds National Center for Business Journalism. For more information about free training for business journalists, please visit businessjournalism.org.

Accounting & finance definations

The document defines key accounting terms like assets, liabilities, equity, accounts receivable, accounts payable, accrued liabilities, and provides explanations of accounting concepts like the accounting equation, accrual basis accounting, and balance sheet. It also summarizes key financial statements including the income statement, cash flow statement, and discusses other accounting topics such as capital expenditures, revenue expenditures, cost of capital, retained earnings, and current assets vs current liabilities.

Deferred Revenue expenditure

Deferred Revenue expenditure

Meaning- Sometimes any revenue expenditure is such that its amount is more and its usefulness remains for many years, such expenditure is called ‘deferred revenue expenditure’. Such expenses are not charged to the profit and loss account of the year in which they are incurred, they are charged to the profit and loss account of several years. Example- (i) Preliminary Expenses, (ii) Deduction and commission on issue of shares and debentures, (iii) Huge advertisement expenditure etc., (iv) If there is an extraordinary loss then it is considered as deferred revenue expenditure.

Features — Following are the characteristics of deferred revenue expenditure.1. It is a capital revenue expenditure.

2. Its profits are not used in the year to which they relate.

3. It is a sudden and usually large amount of money.

4. They are not written off from the profit of one year. A part of the expenses is written off in the profit and loss account of the respective year. The remaining part of this expenditure is shown in the balance sheet as miscellaneous expenditure.

Accounting Treatment

(1) Since deferred revenue expenditure yields future benefits also, its entire amount is not charged to the profit and loss account in the current accounting year, but is treated as capital.

(2) It is generally written off in 3 to 5 years.

(3) That part of deferred revenue expenditure which is written off in the accounting year is treated as ‘Expense’ and transferred to Profit & Loss A/c.

(4) That part of deferred revenue expenditure which is not written off at the end of the accounting year (which is to be written off in subsequent years), is shown in the assets part of the balance sheet.

Similar to Capital and revenue concept (20)

Revenue recognition & management revenue vss capital

Revenue recognition & management revenue vss capital

Recently uploaded

Bossa N’ Roll Records by Ismael Vazquez.

Bossa N Roll Records presentation by Izzy Vazquez for Music Retail and Distribution class at Full Sail University

مصحف القراءات العشر أعد أحرف الخلاف سمير بسيوني.pdf

مصحف أحرف الخلاف للقراء العشرةأعد أحرف الخلاف بالتلوين وصلا سمير بسيوني غفر الله له

How Barcodes Can Be Leveraged Within Odoo 17

In this presentation, we will explore how barcodes can be leveraged within Odoo 17 to streamline our manufacturing processes. We will cover the configuration steps, how to utilize barcodes in different manufacturing scenarios, and the overall benefits of implementing this technology.

RHEOLOGY Physical pharmaceutics-II notes for B.pharm 4th sem students

Physical pharmaceutics notes for B.pharm students

CapTechTalks Webinar Slides June 2024 Donovan Wright.pptx

Slides from a Capitol Technology University webinar held June 20, 2024. The webinar featured Dr. Donovan Wright, presenting on the Department of Defense Digital Transformation.

How to Download & Install Module From the Odoo App Store in Odoo 17

Custom modules offer the flexibility to extend Odoo's capabilities, address unique requirements, and optimize workflows to align seamlessly with your organization's processes. By leveraging custom modules, businesses can unlock greater efficiency, productivity, and innovation, empowering them to stay competitive in today's dynamic market landscape. In this tutorial, we'll guide you step by step on how to easily download and install modules from the Odoo App Store.

Elevate Your Nonprofit's Online Presence_ A Guide to Effective SEO Strategies...

Whether you're new to SEO or looking to refine your existing strategies, this webinar will provide you with actionable insights and practical tips to elevate your nonprofit's online presence.

BÀI TẬP BỔ TRỢ TIẾNG ANH LỚP 8 - CẢ NĂM - FRIENDS PLUS - NĂM HỌC 2023-2024 (B...

BÀI TẬP BỔ TRỢ TIẾNG ANH LỚP 8 - CẢ NĂM - FRIENDS PLUS - NĂM HỌC 2023-2024 (B...Nguyen Thanh Tu Collection

https://app.box.com/s/nrwz52lilmrw6m5kqeqn83q6vbdp8yzpLeveraging Generative AI to Drive Nonprofit Innovation

In this webinar, participants learned how to utilize Generative AI to streamline operations and elevate member engagement. Amazon Web Service experts provided a customer specific use cases and dived into low/no-code tools that are quick and easy to deploy through Amazon Web Service (AWS.)

Educational Technology in the Health Sciences

Plenary presentation at the NTTC Inter-university Workshop, 18 June 2024, Manila Prince Hotel.

Recently uploaded (20)

NEWSPAPERS - QUESTION 1 - REVISION POWERPOINT.pptx

NEWSPAPERS - QUESTION 1 - REVISION POWERPOINT.pptx

مصحف القراءات العشر أعد أحرف الخلاف سمير بسيوني.pdf

مصحف القراءات العشر أعد أحرف الخلاف سمير بسيوني.pdf

Juneteenth Freedom Day 2024 David Douglas School District

Juneteenth Freedom Day 2024 David Douglas School District

SWOT analysis in the project Keeping the Memory @live.pptx

SWOT analysis in the project Keeping the Memory @live.pptx

RHEOLOGY Physical pharmaceutics-II notes for B.pharm 4th sem students

RHEOLOGY Physical pharmaceutics-II notes for B.pharm 4th sem students

CapTechTalks Webinar Slides June 2024 Donovan Wright.pptx

CapTechTalks Webinar Slides June 2024 Donovan Wright.pptx

spot a liar (Haiqa 146).pptx Technical writhing and presentation skills

spot a liar (Haiqa 146).pptx Technical writhing and presentation skills

How to Download & Install Module From the Odoo App Store in Odoo 17

How to Download & Install Module From the Odoo App Store in Odoo 17

Elevate Your Nonprofit's Online Presence_ A Guide to Effective SEO Strategies...

Elevate Your Nonprofit's Online Presence_ A Guide to Effective SEO Strategies...

BÀI TẬP BỔ TRỢ TIẾNG ANH LỚP 8 - CẢ NĂM - FRIENDS PLUS - NĂM HỌC 2023-2024 (B...

BÀI TẬP BỔ TRỢ TIẾNG ANH LỚP 8 - CẢ NĂM - FRIENDS PLUS - NĂM HỌC 2023-2024 (B...

Leveraging Generative AI to Drive Nonprofit Innovation

Leveraging Generative AI to Drive Nonprofit Innovation

Capital and revenue concept

- 1. Capital and Revenue concept Capital and revenue loss Capital loss refers to any loss on account of fixed assests. It is a decrease in the value of an investment . Loss on capital can be set off against the income from capital gain only. And capital loss is not incidental to business. Capital loss are generally non recurring in nature.They are not realised through the normal activities of business. For example: If an investment costing Rs. 2000 is sold for Rs.1700, there will be capital loss of Rs.300. Shares and debentures issued at discount premium or redemption of debentures loss on sale of fixed assets are also capital loss. Revenue loss The loss on account of circulating capital assets is a revenue loss. Revenue loss is incidental to business. In other words, the losses which arises during the normal (day to day) activities is known as revenue loss. It is excess of revenue expenses over revenue income. Revuenue loss are generally recurring in nature. Fore example: loss on sale os stock in trade. Difference between Capital loss and Revnue loss: Basis Capital loss Revenue loss Causes Capital loss occurs due to the sale of assets, share and debentures at a price less than their face value or book value. Revenue loss occurs due to heavy amount of operating expenses and low turnover or sales. Nature Capital loss does not occur in the normal course of the business. Revenue loss occur in the normal course of the business. Indication Capital loss does not indicate the inefficiency of the business. Revenue loss indicate the inefficiency of the business. Treatmnet Capital loss is shown on the asset side of the balance sheet. Revenue loss is shown on the debit side of the trading and profit and loss accounts and asset side of the balance sheet as accumulated loss.

- 2. Capital and Revenue expenditure When the benefit of expenditure is available over a number of years , it is a capital expenditure. Capital expenditure has physical existence except intangible assets. Expenditure in the acquisition of fixed assets Other expenses inccured in connection with their acquisition Any expenses which results as expansion and increase in life substantially of fixed asset Expenses on development of mine and land plantation till they become operation Cost of experiment which ultimately result in acquisition of a patent Legal charges incurred in connection with acquiring or defending suits for protecting fixed assets , rights , etc Revuenue expemditure When the benefit of expenditure is likely to affect for less than a period of one year, it is considered as revenue expenditure. So all expenses incurred during the regular course of business are treated revenue expenditure. Depreciation on fixed assets Expenses incured in the day to day conduct of business Expenses incured im buying goods for resale on raw materials for manufacturing Interest on loans borrowed for running the business Deferred revenue expenditure The benefits of certain expenditure are available for more than a year. It should be spread over number of accounting years, Expenses incurred on adverstising campaigns to introduce new product in the market Expenses incurred in the fornation of a new company Brokerage charge, underwriting comission and other expenses incurred in connection with the issue of shares and debentures.

- 3. Difference between Capital expenditure and Revenue expenditure Basis Capital expenditure Revenue expenditure Meaning Expenses incurred in acquiring of a capital asset or improving the capacity of an existence one. Expenses incurred in regulating th day to day activities of bueinss Term It has long term effect It has short term effect Captalisation Yes No Show in It is shown in the income statement and balance sheet It is shown in income statement Outlay It is non recurring in nature It is recurring in nature Benefit Benefit more than a year Only in the current accounting year Earning capacity It seeks to improve earning capacity It maintains earning capacity Matching concept It is not matched with capital receipts It is matched with revenue receipts Capital and Revenue receipts Capital receipts Capital receipts are the amounts receibed from the owner as capital, loan from outsiders and proceeds from the sale of fixed assets, they are non recurring in nature. In other words, capital receipts are the receipts which do not results from the regular course of business. Capital reecived from owner Loan from outsiders Sale of fixed assets Revenue receipts Revenue receipts are the receipts which results from the regular course of business activities. The revenue receivd from the sale of product and services are revenue receipts. Revenue receipts are shown in income statemnt as income.

- 4. Difference between Capital receipts and Revenue receipts Basis Capital receipts Revenue receipts Meaning Capital receipts are the income generated from the incvesting or financing activities of a firm Revenue receipts are the income generated from the operating activites of a business firm Nature It is non recurring in nature It is recurring in nature Term It has long term effect It has short term effect Show in It is shown in Balance sheet It is shown in Income ststement Received in exchange of Source of income Income Value of asses or liability It either decrases the value of assets or increases the vlue of liability It increase or decrease the value of assets or liability