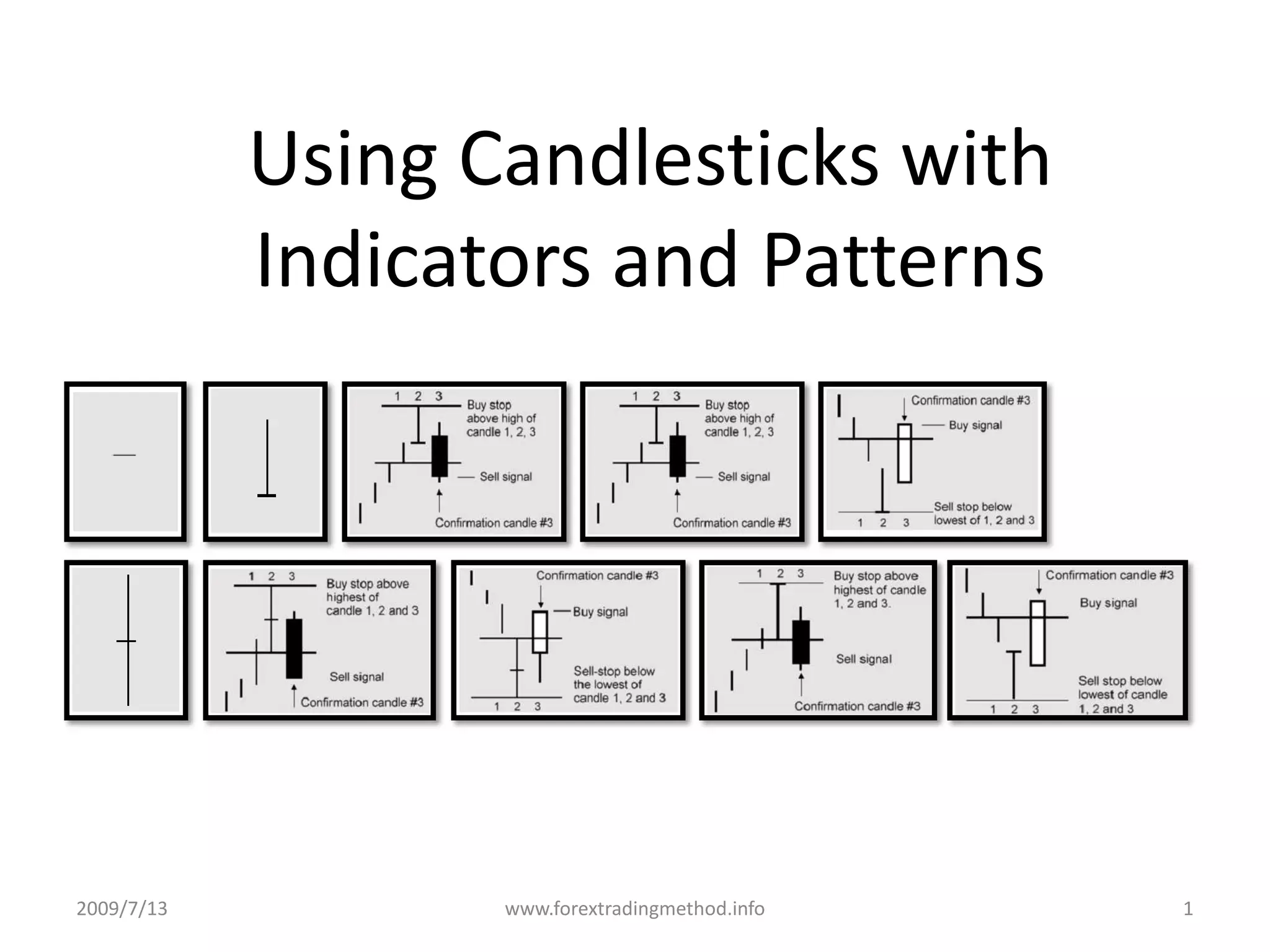

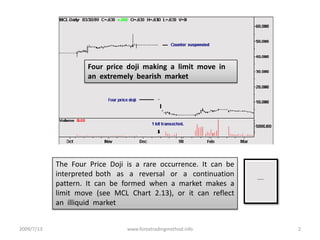

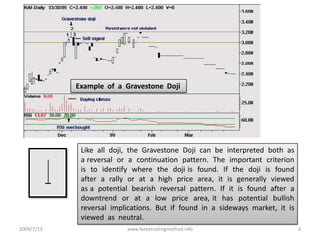

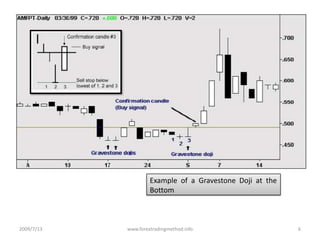

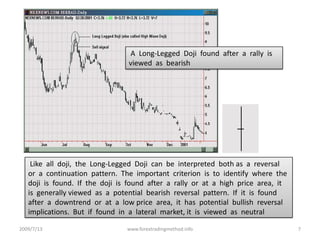

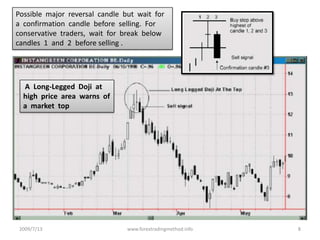

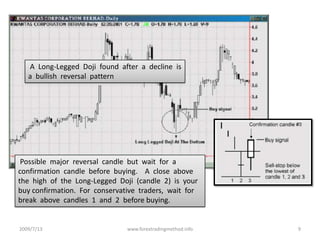

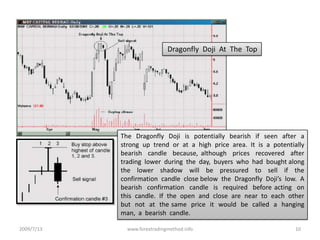

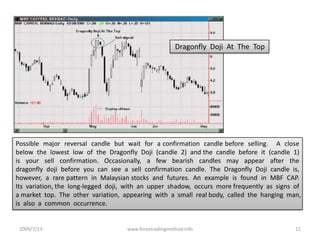

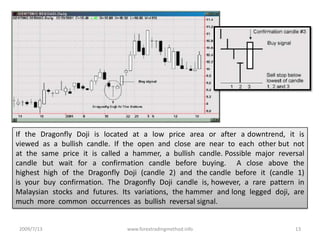

This document discusses candlestick patterns and their use in technical analysis. It describes several doji candlestick patterns including the four price doji, gravestone doji, shooting star, long-legged doji, and dragonfly doji. For each pattern, it explains how they can indicate reversals or continuations depending on where they occur, such as after a rally or downtrend. It also notes that confirmation from subsequent candles is needed before entering positions based on these patterns alone. Examples of each pattern are shown along with guidance on interpretation and trading implications.