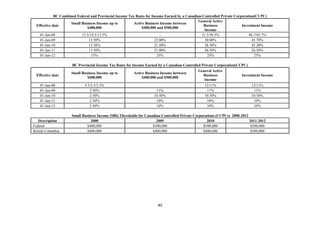

This document provides Canadian federal marginal tax rates from 1998-2012. It shows the tax brackets and tax rates for each year. Taxable income is broken into brackets such as $0-$10,527, $10,527-$42,707, etc. The rates range from 0% to 29% depending on the tax bracket. Certain types of income like gifts, inheritances, and lottery winnings are not taxed in Canada.

![References:

1. BC budget 2012,2011,2010

http://www.bcbudget.gov.bc.ca/2010/highlights/2010_Highlights.pdf

2. BC Budget 2009 http://www.bcbudget.gov.bc.ca/2009/estimates/2009_Estimates.pdf

3. http://www.fin.gov.bc.ca/Fed_Prov_MOU_english_July23.pdf

4. Taxation and Economic Efficiency: Results from a Canadian CGE Model, par

Maximilian Baylor et Louis Beauséjour, Canadian federal Finance Minister 2004

5. Vaughn Palmer Ambitious reforms by Liberal governments to be eclipsed by HST,

Vancouver Sun, July 28th, 2009

6. from [[2][Public account of Canada]], stating at $29.9 billions the 5% GST revenue

for whole Canada for the exercise 2007/2008, and considering the contributively part

of the British Columbia is of 15.4% in 2003 according to

http://www.parl.gc.ca/information/library/PRBpubs/prb0610-e.htm, , 29.9*(15.7%)=

$4.6Billions not including the BC GDP growth

7. http://www2.news.gov.bc.ca/news_releases_2009-2013/2009PREM0017-000141.htm

8. Taxation and Economic Efficiency: Results from a Canadian CGE Model, par

Maximilian Baylor et Louis Beauséjour, Canadian federal Finance Minister 2004

9. http://www.fraserinstitute.org/Commerce.Web/product_files/JulAug06ffTaxCuts.pdf

10. http://www.vancouversun.com/business/good+business+business+should+tell/187258

2/story.html

11. http://www.theprovince.com/news/Revenue+neutral+levy+could+pull+200m/186476

6/story.html

12. http://www.strategicthoughts.com/record2009/HSTbase.html

13. Alberta Budget Eliminates Health-Care Premiums

14. Canada Revenue Agency

15. http://www.vancouver-real-estate-direct.com/HST/index.html)

16. http://vancouver.ca/aboutvan.htm

17. OECD, 2005 data

18. Deloitte country guide Canada tax

19. PMG Canada tax

20. http://www.Taxtips.ca

21. https://hst.blog.gov.bc.ca/wp-content/uploads/2010/05/GST_PST_HST_List_v04.pdf

52](https://image.slidesharecdn.com/canadataxsumury2012-120731035219-phpapp01/85/Canada-tax-sumury-2012-52-320.jpg)