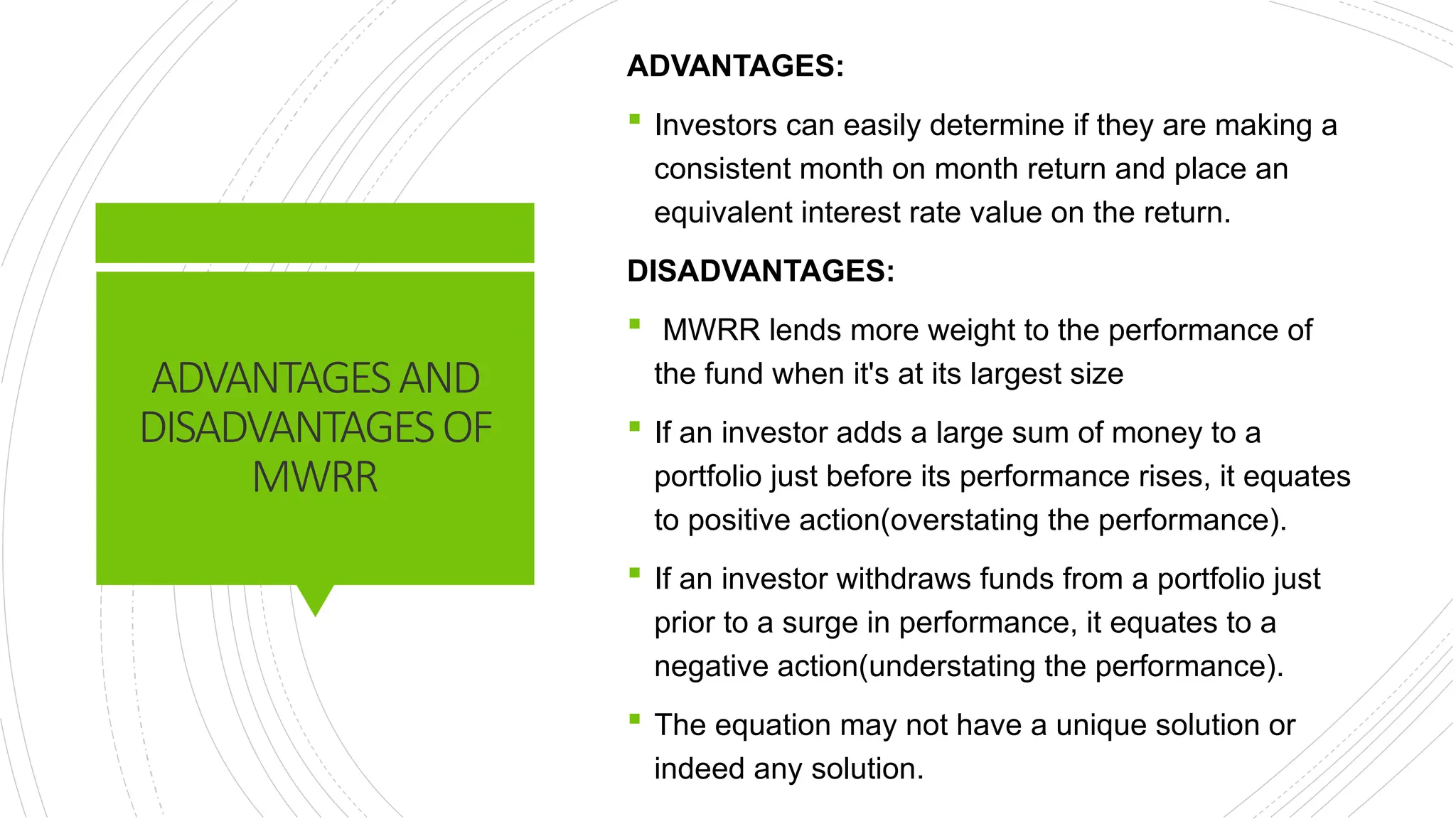

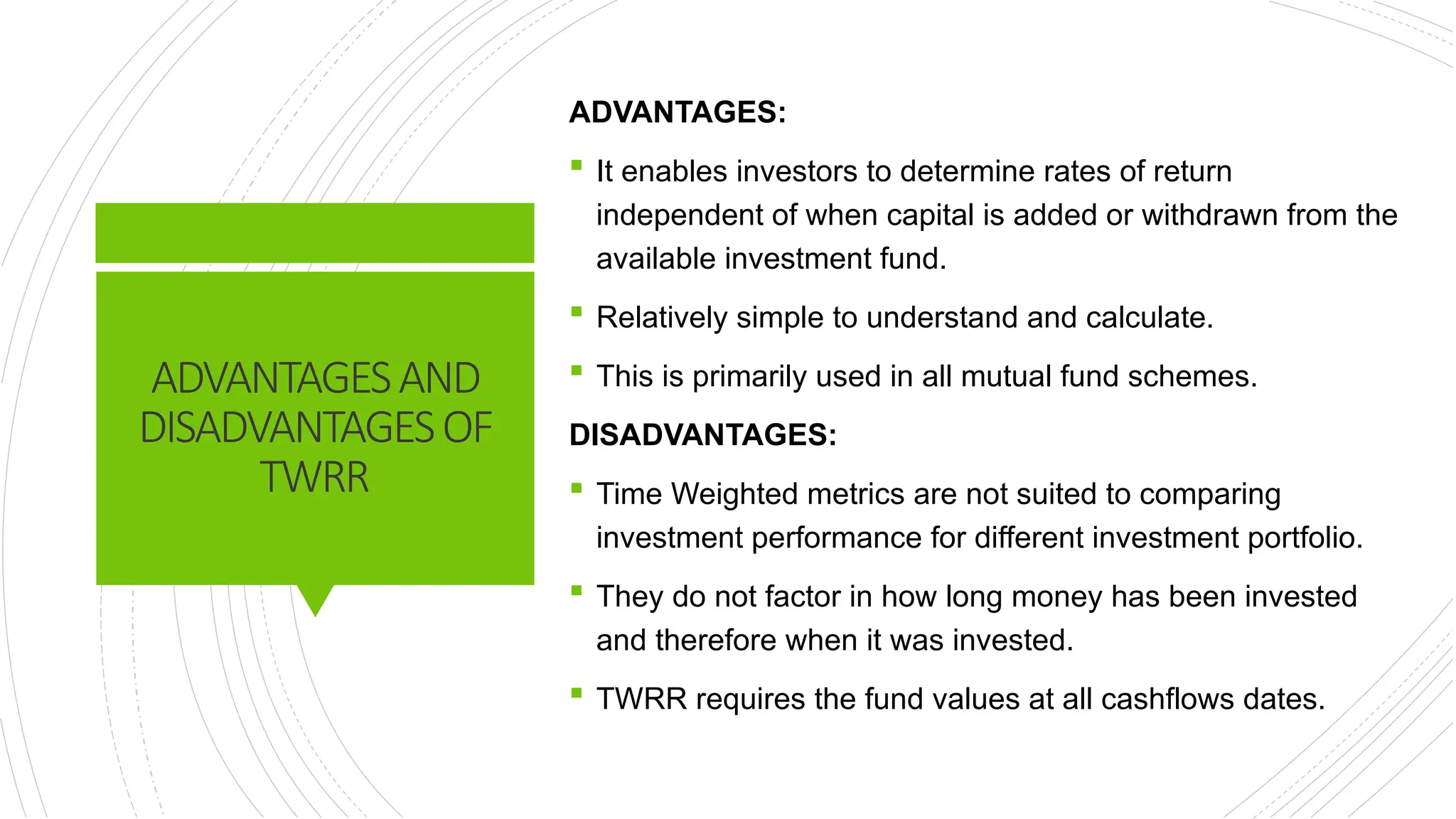

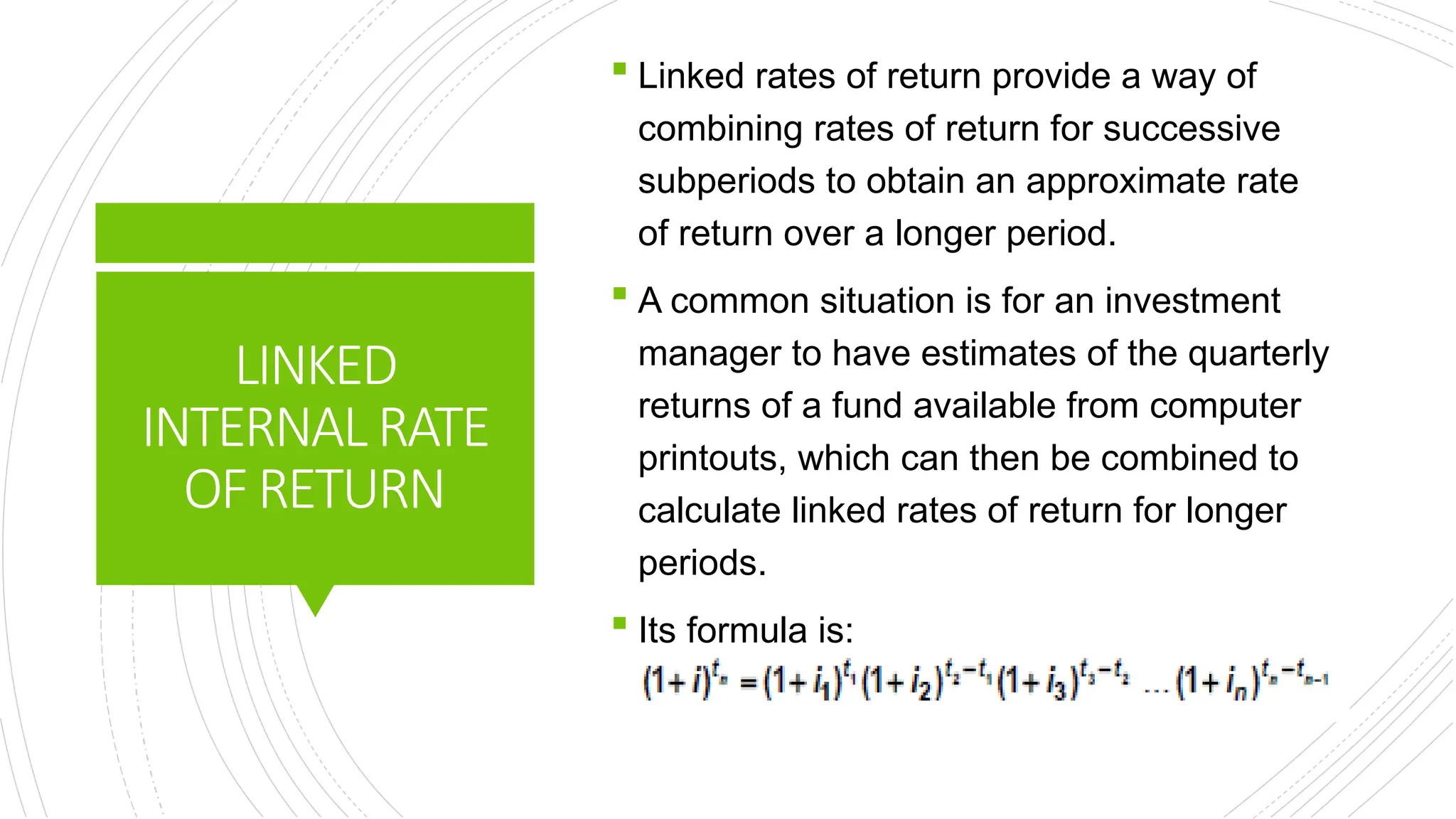

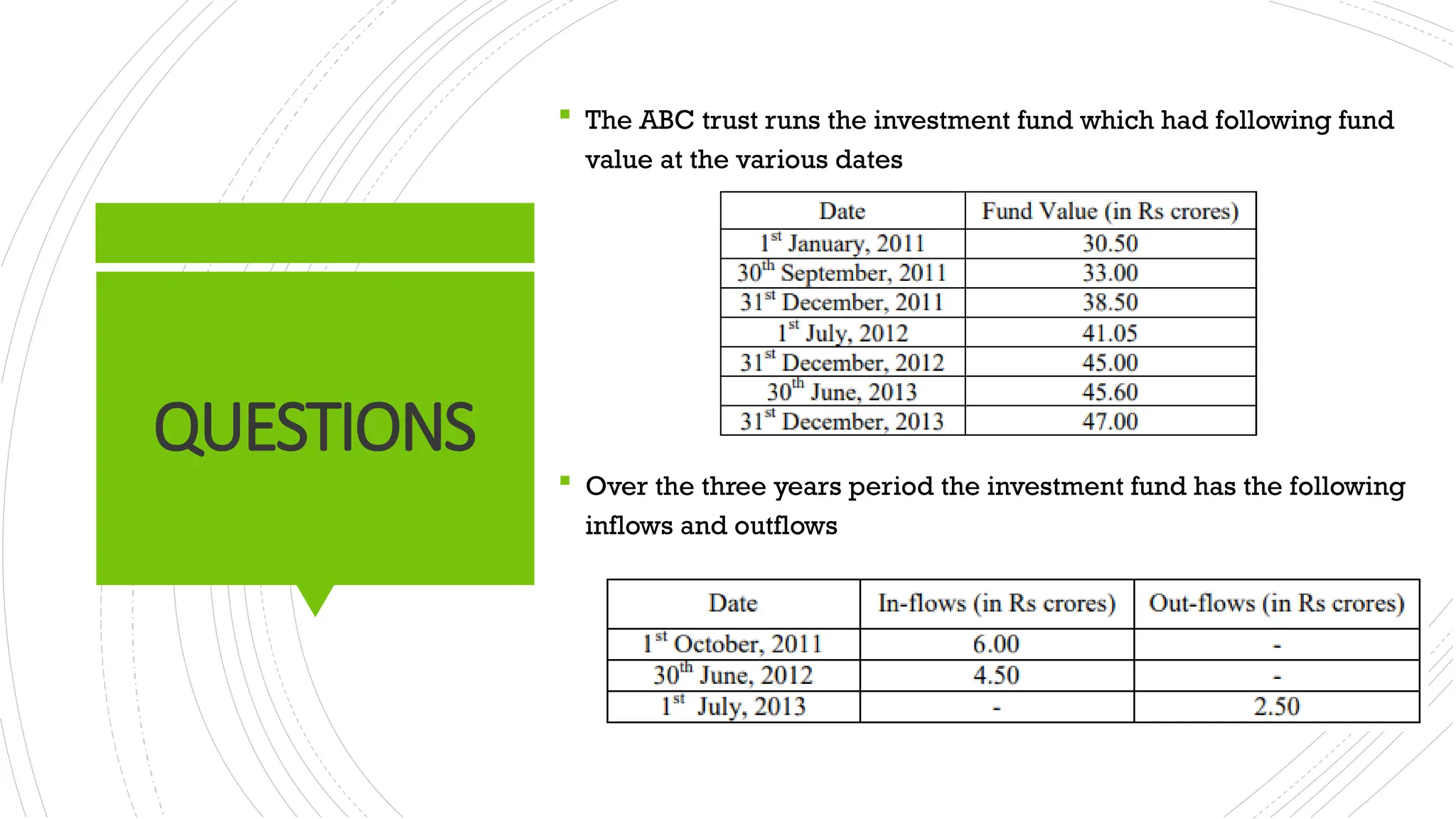

The document discusses different methods for calculating investment returns, focusing on the money-weighted rate of return (MWRR), time-weighted rate of return (TWRR), and linked internal rate of return. MWRR considers the timing and size of cash flows but may misrepresent performance due to large contributions or withdrawals, while TWRR calculates returns without the influence of cash flows, offering a clearer understanding of portfolio growth. Examples are provided to illustrate the effective calculations for both MWRR and TWRR over specified periods.