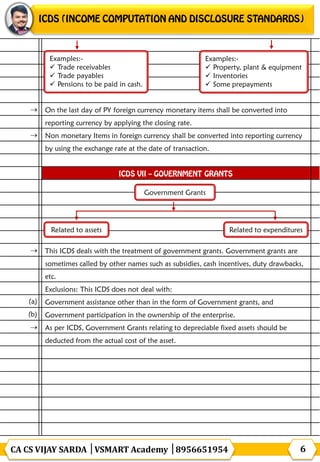

The document discusses the Income Computation and Disclosure Standards (ICDS) applicable to various taxpayers, including requirements for accounting policies, revenue recognition, inventory valuation, and treatment of foreign currency transactions. It emphasizes that while ICDS influences income computation, it does not dictate the maintenance of books of accounts and conflicts with existing laws favor the provisions of the Act. The document outlines specific ICDS names and their associated requirements, including disclosures for different categories of assets and liabilities.

![→

→

→

→

→

→

→

→

→

→

→

CA CS VIJAY SARDA │VSMART Academy │8956651954 1

ICDS are applicable to all taxpayers except individual/ HUF who are not liable to

tax audit.

ICDS is applicable only to those assessee who follow Mercantile basis of Accounting.

ICDS are applicable for computation of Income under the head “PGBP” or “IFOS”

& not for maintaining books of Accounts.

Assessees need not maintain Separate Books of accounts for the purpose of ICDS.

In case of Conflict Between Act and ICDS the Provision of Act shall prevail to that

extent.

ICDS is also applicable to Assessee showing Presumptive Income

[Sec.44AD/44AE/44ADA/44B/44BB/44BBA].

ICDS is applicable irrespective of fact that companies follows AS or IND-AS.

ICDS is not applicable for computation of Book Profit for the purpose of MAT u/s

115JB. However AMT is computed on ATI and Hence ICDS is applicable for

computation of AMT.

ICDS is also Applicable for Computation of Income on Gross Basis Eg: Interest/

Royalty Etc.)

If there is a conflict between Income Tax Rules and ICDS provision of Rules shall

prevail over ICDS.

Net effect on the Income due to application of ICDS is to be disclosed in ROI & Tax

Audit Report in form 3CD. However, if a person is not liable for Tax Audit no

separate disclosure is required.

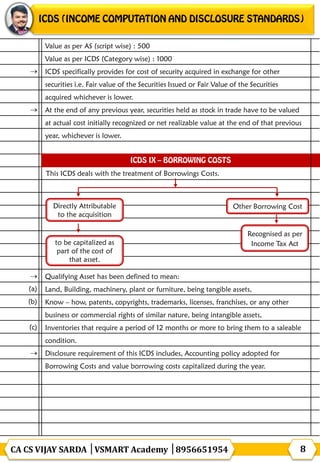

ICDS Name Eq. Name

Accounting Standard

I Accounting Policies 1 Disclosure of accounting

Policy

II Valuation of inventories 2 Valuation of inventories

III Construction Contracts 7 Construction Contracts

IV Revenue Recognition 9 Revenue Recognition](https://image.slidesharecdn.com/canotesonincomecomputationanddisclosurestandards-210510200532/75/CA-NOTES-ON-INCOME-COMPUTATION-AND-DISCLOSURE-STANDARDS-1-2048.jpg)

![→

→

→

→

→

→

(a)

(b)

(c)

→

CA CS VIJAY SARDA │VSMART Academy │8956651954 5

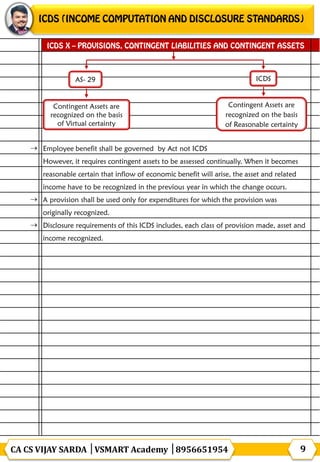

Furniture held with intention of being used for purpose of producing

or providing goods & services and is not held for sale in normal

course of business.

Revaluation of Assets is not permitted as per ICDS.

In case of exchange of assets cost of assets shall be FMV of assets

received in Return.

Income arising from transfer of tangible assets shall be computed as per Income Tax

Act.

The expenditure incurred till the plant begun commercial production, that is,

intended for sale or captive consumption shall be treated as capital expenditure.[for

example exp on trial run, experimental production]

Disclosure requirement of this ICDS includes, the description of Asset or Block of

Assets, Rate of Depreciation, Actual Cost or Written Down Value, etc.

This ICDS deals with:

Treatment of transactions in foreign currencies,

Translating the financial statements of foreign operations,

Treatment of foreign currency transactions in the nature of

Forward Exchange Contracts

Treatment of Exchange – Difference at the Last day of the Previous Year:

For Monetary Items – Recognized as Income or as Expense.

For Non-Monetary items – Not recognized as income or as expenses.

Is there right/obligation to deliver

fixed/determinable amount of currency units

Yes No

Monetary Item Non-monetary Item](https://image.slidesharecdn.com/canotesonincomecomputationanddisclosurestandards-210510200532/85/CA-NOTES-ON-INCOME-COMPUTATION-AND-DISCLOSURE-STANDARDS-5-320.jpg)

![→

→

→

→

→

CA CS VIJAY SARDA │VSMART Academy │8956651954 7

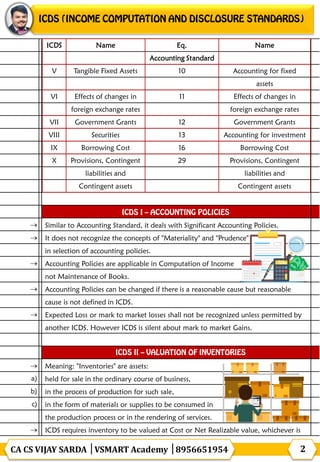

Disclosure requirement of this ICDS includes, nature and extent of Government

Grants recognized during the previous year as income, nature and extent of

Government Grants not recognized.

This ICDS deals with securities held as stock in trade. ICDS

excludes Derivatives from the definition of Securities. For

computation of PGBP and IFOS not CG

Meaning of Fair Value: “Fair value” is the amount for which an

asset could be exchanged between knowledgeable, willing buyer and a

knowledgeable, willing seller in an arm’s length transaction.

Securities are to be recognized at actual cost on acquisition, which shall comprise of

its purchase price & include acquisition charges like brokerage, fees, tax duty or cess.

ICDS Prescribe valuation category wise and not security wise as required by AS

[category means equity and Preference]

Government Grants

Against

Depreciable Assets

Against Non

Depreciable Assets

Reduce from cost

of Assets

Not related

to assets

Pro rata reduction should be

made in the same proportion

as such assets bears to all assets

with reference to which govt

grants is so received

To be recognized as

Income over the

same period which

the cost of meeting

such obligation is

charged to Income

Shares Cost NRV AS-13 ICDS

Vishal LTD 520 150 50

Darshan Ispath Ltd 400 200 200

Rohan Ltd 150 350 150

Prakash Ltd 100 300 100

Total 1200 1000 500 1000](https://image.slidesharecdn.com/canotesonincomecomputationanddisclosurestandards-210510200532/85/CA-NOTES-ON-INCOME-COMPUTATION-AND-DISCLOSURE-STANDARDS-7-320.jpg)