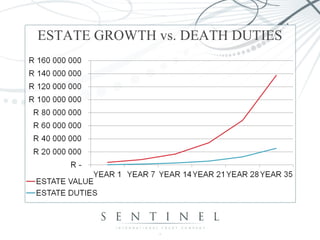

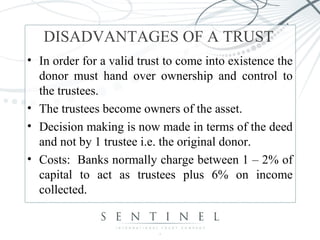

The document discusses the benefits and drawbacks of trusts, highlighting their role in asset management, tax reductions, and estate planning, while also addressing common misconceptions and management issues related to trusts. It emphasizes the importance of having a compliant trust deed and an independent trustee to ensure proper administration and oversight. The document concludes by advising the need for regular reviews of both trust deeds and wills to maintain compliance with evolving legislation.