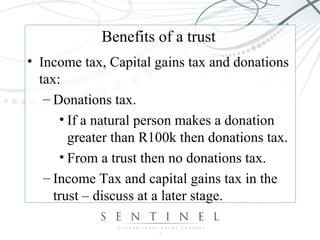

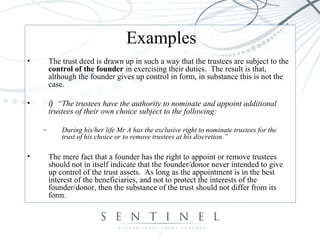

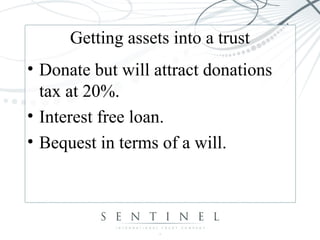

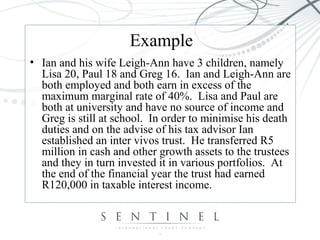

The document discusses the legal nature and benefits of trusts. It states that a trust is not a legal entity but that trustees are considered separate legal entities. It lists benefits of trusts such as reducing estate duties and protecting assets from creditors. It also discusses disadvantages like loss of control over assets. The document then covers topics like the differences between inter vivos and testamentary trusts, the role of independent trustees, trustees' duties, and common problematic clauses in trust deeds. It provides tax implications of trusts and strategies for transferring assets to trusts.