- A Will should be reviewed every 2 years or when major life events occur like marriage, divorce, birth of children. It ensures assets go to intended beneficiaries and avoids unintended consequences like higher taxes.

- South African law provides broad freedom of testation but children must be maintained and spouses can claim maintenance.

- To be valid, a Will must be signed and dated in front of two witnesses over age 14 who do not benefit from the Will.

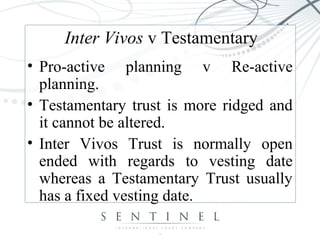

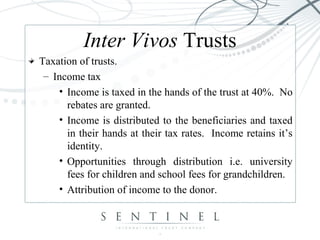

- Trusts are an agreement, not a legal entity, and can help reduce death duties and preserve wealth across generations while protecting assets from creditors. Inter vivos trusts allow more control than testamentary trusts but come with costs and tax implications.