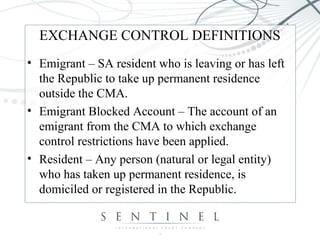

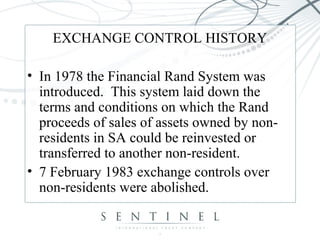

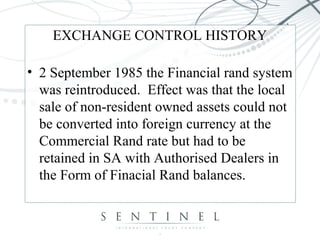

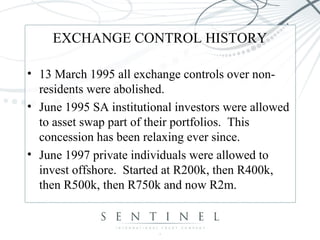

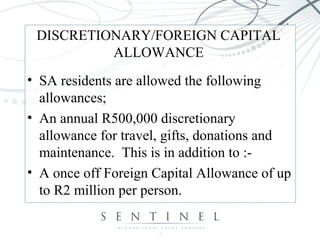

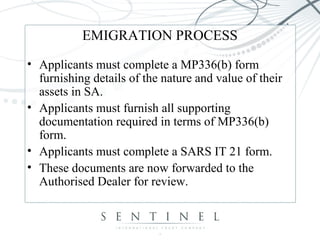

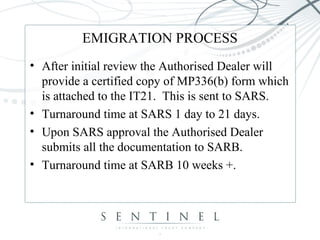

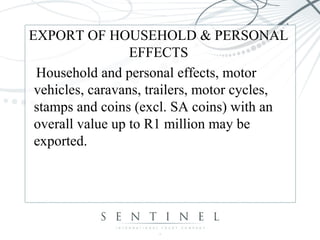

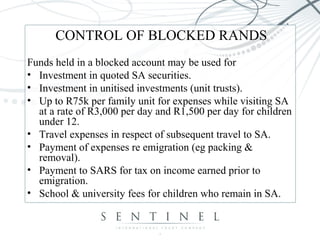

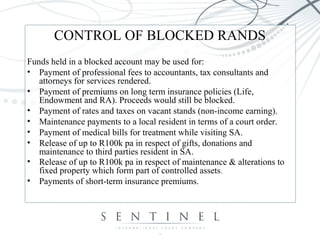

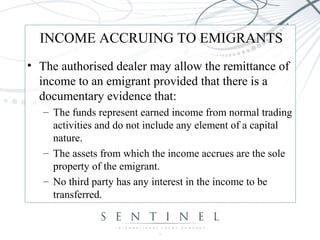

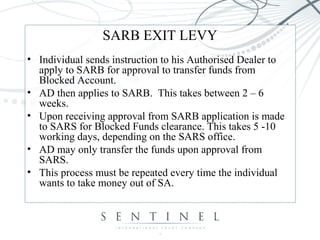

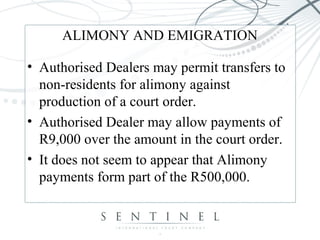

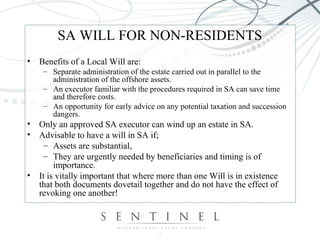

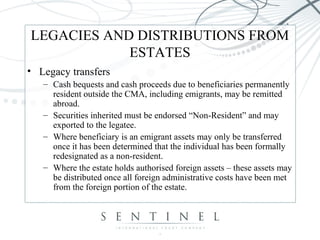

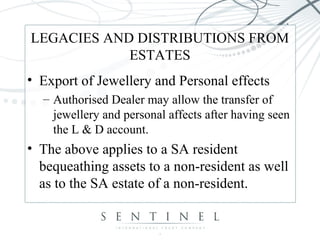

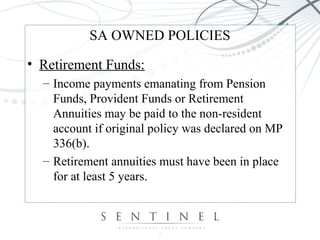

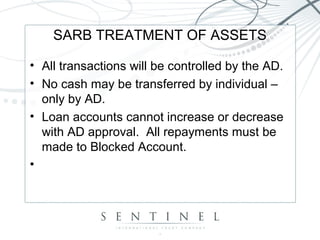

The document provides information about South African exchange controls, including definitions of key terms, the history and purpose of exchange controls, and rules regarding emigration from South Africa. It summarizes the emigration process, which involves completing forms, providing supporting documents, and obtaining approval from the South African Revenue Service and South African Reserve Bank. It also outlines restrictions on funds held in blocked accounts and rules regarding trusts, estates, policies and assets after emigrating from South Africa.