This document provides information for potential home buyers on various topics related to the home buying process. It discusses 4 reasons to buy a home in the spring, including that home prices and mortgage interest rates are projected to rise. It emphasizes the importance of using a real estate professional when buying a home. Additional sections cover trends in home prices over the last year, comparing the cost of buying versus renting, and the financial benefits of homeownership according to Harvard research. The document also addresses common misconceptions around home mortgage qualification criteria.

![TABLE OF CONTENTS

4 REASONS TO BUY A HOME THIS SPRING!1

YOU NEED A PROFESSIONAL WHEN BUYING A HOME3

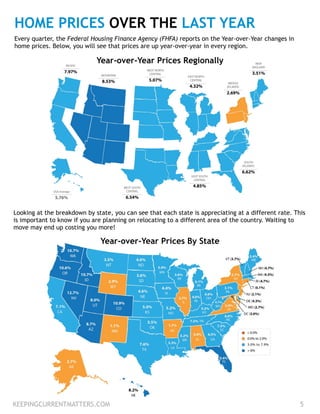

HOME PRICES OVER THE LAST YEAR5

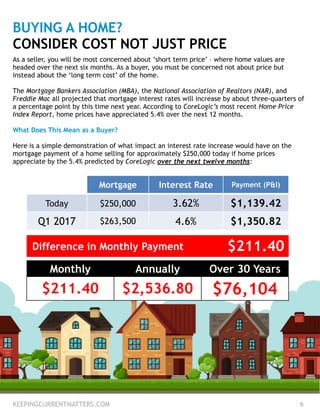

BUYING A HOME? CONSIDER COST NOT JUST PRICE6

THE COST OF RENTING VS. BUYING [INFOGRAPHIC]16

HOMEOWNERSHIP REMAINS AMERICAN DREAM4

WHAT YOU NEED TO KNOW ABOUT THE MORTGAGE PROCESS12

13 WHAT DO YOU ACTUALLY NEED TO QUALIFY FOR A MORTGAGE?

BUILDING FAMILY WEALTH OVER THE NEXT 5 YEARS9

HARVARD: 5 FINANCIAL REASONS TO BUY A HOME10

THE REAL REASONS AMERICANS BUY A HOME20

7 DON’T LET RISING RENTS TRAP YOU

15 GETTING A MORTGAGE: WHY SO MUCH

PAPERWORK?

18 4 DEMANDS TO MAKE ON YOUR REAL ESTATE AGENT

217,726 REASONS TO BUY A HOME NOW17](https://image.slidesharecdn.com/buyingahomespring2016-160330012854/85/Buying-a-Home-Spring-2016-2-320.jpg)