The document emphasizes the importance of buying a home now due to projected rising home prices and mortgage interest rates, which could significantly increase housing costs in the future. It outlines key reasons to buy immediately, including the financial advantages of homeownership and the necessity of hiring a real estate professional to navigate the complex market. Additionally, it addresses common misconceptions about mortgage qualifications, stressing that lower down payments and credit scores than expected may be sufficient for potential buyers.

![TABLE OF CONTENTS

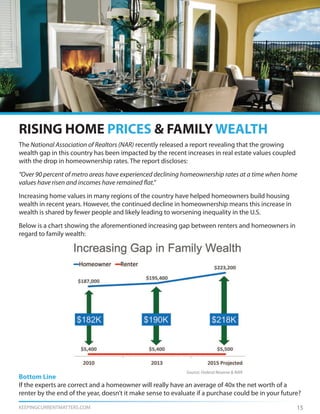

14 RISING HOME PRICES & FAMILY WEALTH

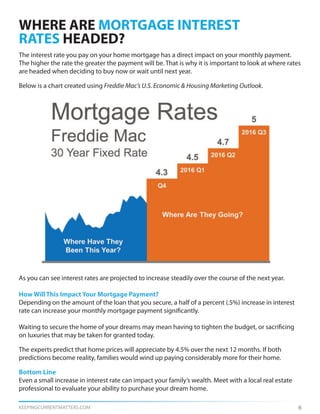

6 WHERE ARE MORTGAGE INTEREST RATES HEADED?

5 WHERE ARE PRICES HEADED OVER THE NEXT 5 YEARS?

3 YOU NEED A PROFESSIONAL WHEN BUYING A HOME

15 4 DEMANDS TO MAKE ON YOUR REAL ESTATE AGENT

1 4 REASONS TO BUY YOUR HOME NOW!

13 HARVARD: 5 FINANCIAL REASONS TO BUY A HOME

9 GETTING A MORTGAGE: WHY SO MUCH PAPERWORK?

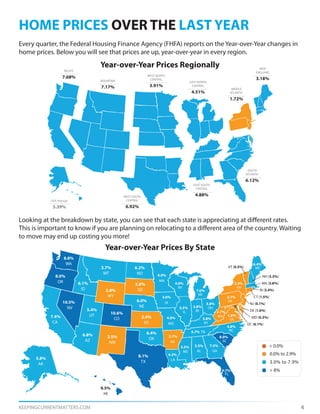

HOME PRICES OVER THE LAST YEAR4

5 REASONS TO HIRE A REAL ESTATE PROFESSIONAL12

BUYING A HOME? CONSIDER COST NOT JUST PRICE7

REAL ESTATE AGAIN SEEN AS BEST INVESTMENT19

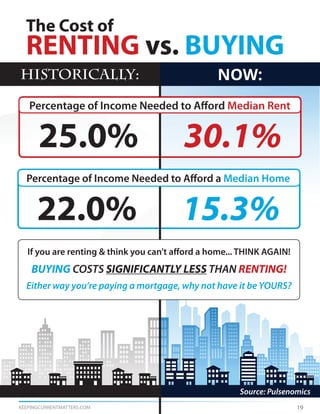

THE COST OF RENTING VS. BUYING [INFOGRAPHIC]18

217,726 REASONS TO BUY A HOME NOW10

WHAT DO YOU REALLY NEED TO QUALIFY FOR A MORTGAGE?11

8 WHAT YOU NEED TO KNOW ABOUT THE MORTGAGE PROCESS

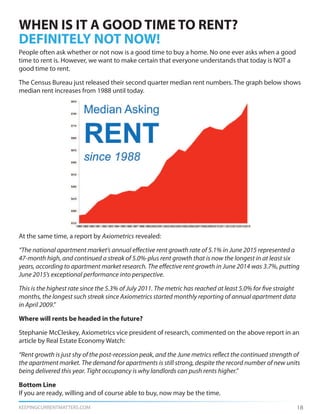

WHEN IS IT A GOOD TIME TO RENT? DEFINITELY NOT NOW!17](https://image.slidesharecdn.com/buyingahomefall2015-151024183848-lva1-app6892/85/Buying-a-Home-Fall-2015-2-320.jpg)