This document provides information and advice for potential home buyers. It discusses reasons to buy a home now rather than wait, such as projected increases in home prices and mortgage interest rates. It emphasizes the importance of using a real estate professional for their negotiating skills and market expertise. Additional articles discuss saving for a down payment, the costs of renting vs buying, and the financial benefits of homeownership like building equity and tax deductions. The document aims to inform readers of current housing market trends and the process of obtaining a mortgage.

![TABLE OF CONTENTS

4 REASONS TO BUY A HOME THIS SUMMER!1

YOU NEED A PROFESSIONAL WHEN BUYING A HOME3

THE TOP REASONS WHY AMERICANS BUY HOMES6

YOU CAN SAVE FOR A DOWN PAYMENT FASTER THAN YOU

THINK

15

DON’T LET RISING RENTS TRAP YOU4

WHAT YOU NEED TO KNOW ABOUT THE MORTGAGE PROCESS11

GETTING A MORTGAGE: WHY SO MUCH

PAPERWORK?

12

HARVARD: 5 FINANCIAL REASONS TO BUY A HOME9

BUYING A HOME? CONSIDER COST NOT JUST PRICE8

WHAT DO YOU ACTUALLY NEED TO QUALIFY FOR A MORTGAGE?13

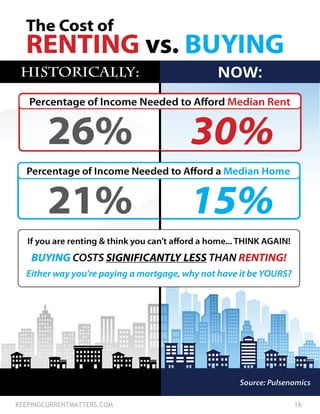

17 4 DEMANDS TO MAKE ON YOUR REAL ESTATE AGENT

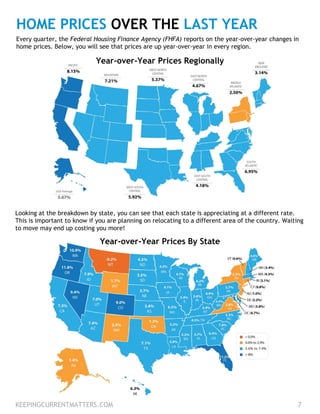

7 HOME PRICES OVER THE LAST YEAR

16 THE COST OF RENTING VS. BUYING [INFOGRAPHIC]

19 REAL ESTATE AGAIN SEEN AS BEST INVESTMENT

10 BUILDING FAMILY WEALTH OVER THE NEXT 5 YEARS](https://image.slidesharecdn.com/1e47ded3-f624-4fd8-9f80-257abc777c28-160603220629/85/BuyingaHomeSummer2016-2-320.jpg)