This document discusses reasons to consider buying a home. It begins by outlining 4 key reasons: home prices will continue rising in the next year and beyond; mortgage interest rates are projected to increase; both renters and homeowners pay a mortgage, either directly or indirectly; and it may be the right time for readers' lives to move forward with homeownership. It then provides more details on each reason. The document emphasizes doing research and working with professionals when considering a home purchase.

![TABLE OF CONTENTS

9 BUILDING FAMILY WEALTH OVER THE NEXT 5 YEARS

20 THE REAL REASONS AMERICANS BUY A HOME

3 YOU NEED A PROFESSIONAL WHEN BUYING A HOME

17 4 DEMANDS TO MAKE ON YOUR REAL ESTATE AGENT

1 4 REASONS TO BUY A HOME THIS SPRING!

10 HARVARD: 5 FINANCIAL REASONS TO BUY A HOME

15 GETTING A MORTGAGE: WHY SO MUCH PAPERWORK?

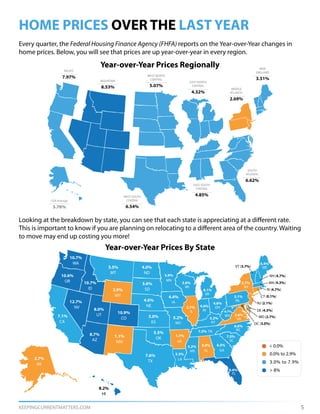

HOME PRICES OVER THE LAST YEAR5

BUYING A HOME? CONSIDER COST NOT JUST PRICE6

HOMEOWNERSHIP REMAINS AMERICAN DREAM4

THE COST OF RENTING VS. BUYING [INFOGRAPHIC]16

217,726 REASONS TO BUY A HOME NOW19

WHAT DO YOU ACTUALLY NEED TO QUALIFY FOR A MORTGAGE?13

12 WHAT YOU NEED TO KNOW ABOUT THE MORTGAGE PROCESS

DON’T LET RISING RENTS TRAP YOU7](https://image.slidesharecdn.com/buyingahomespring2016-160503131654/85/First-Time-Home-Buyers-Guide-2-320.jpg)