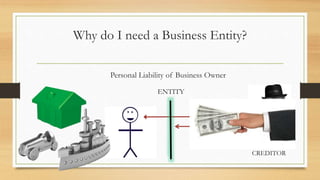

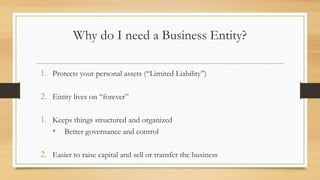

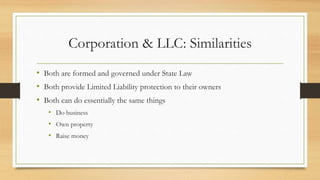

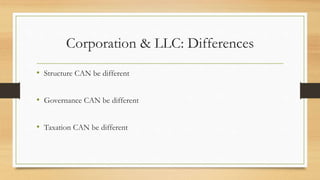

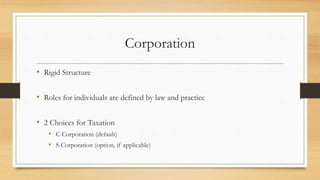

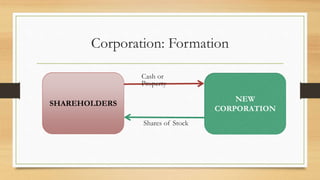

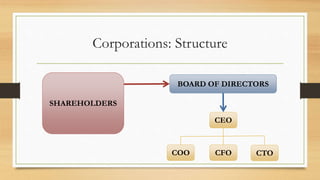

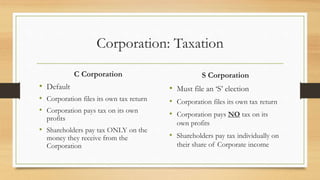

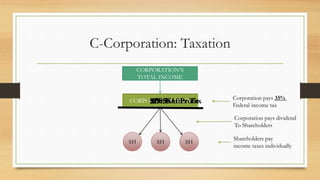

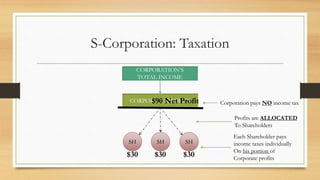

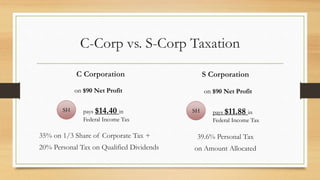

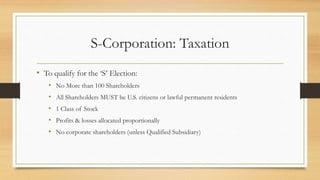

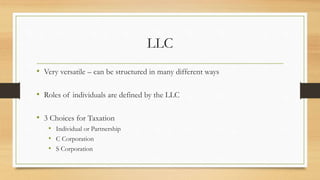

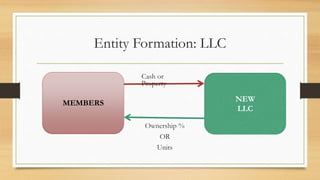

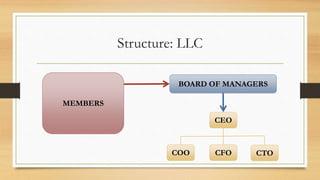

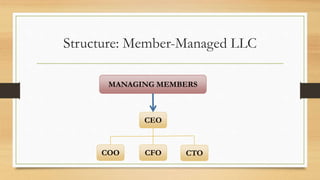

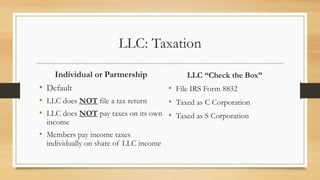

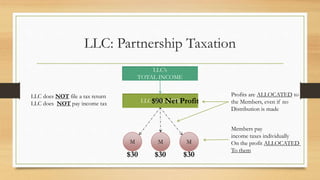

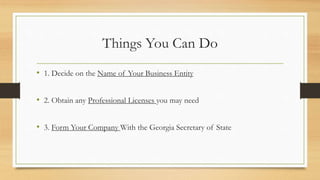

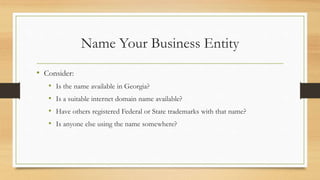

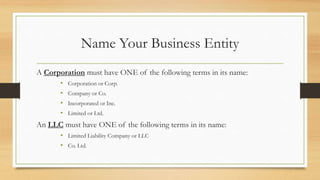

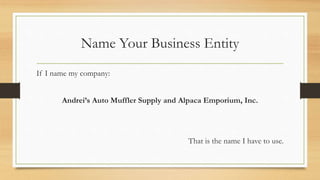

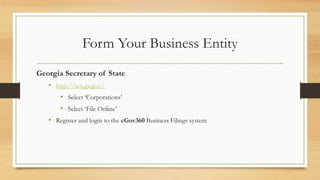

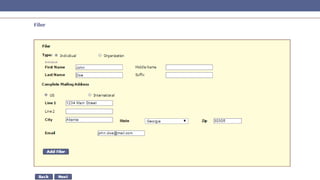

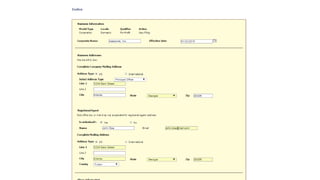

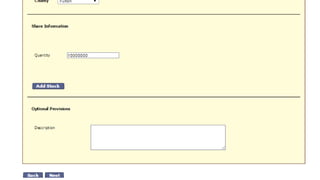

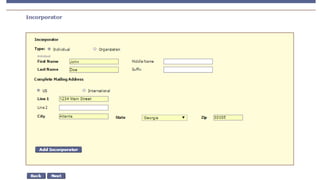

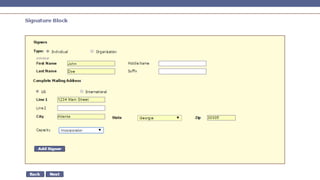

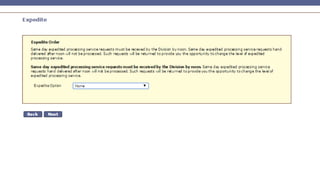

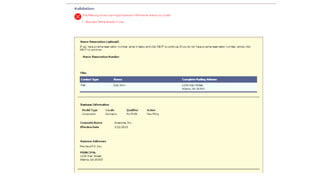

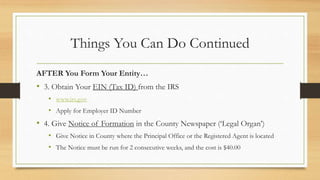

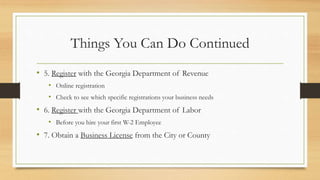

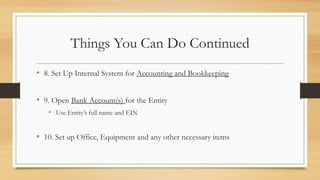

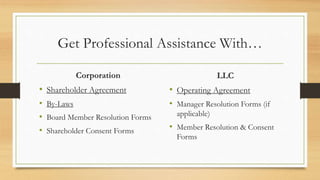

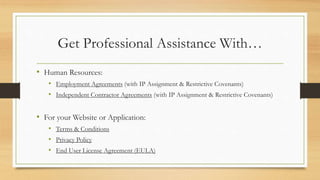

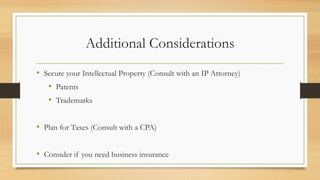

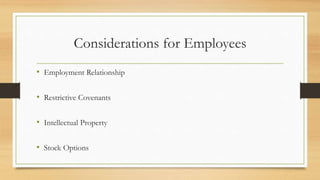

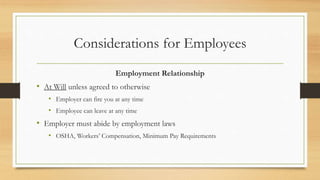

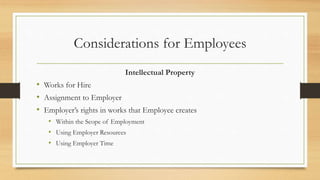

The document presents a comprehensive overview of business formation, focusing on the legal perspectives of establishing a company, including the importance of having a business entity for limited liability and asset protection. It outlines the differences and similarities between corporations and LLCs, their taxation structures, and the necessary steps for forming a business in Georgia. Furthermore, it highlights the significance of obtaining professional assistance for various legal and operational considerations during the setup process.