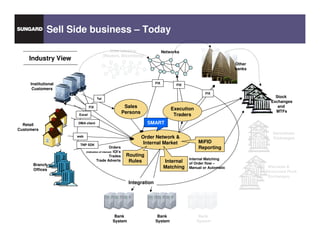

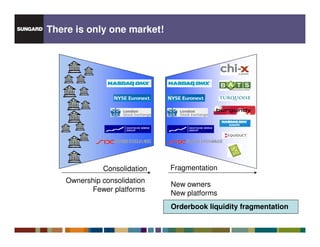

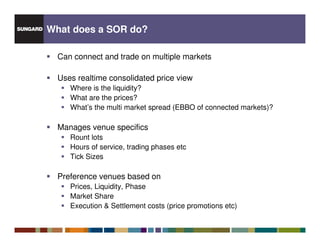

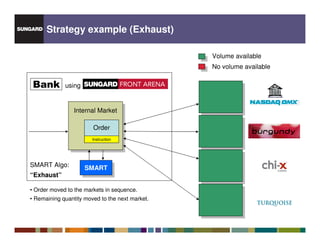

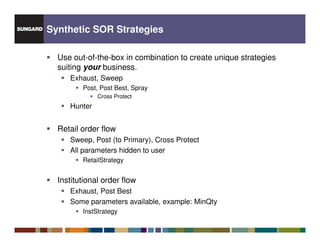

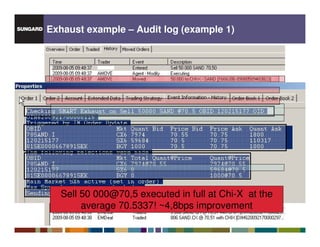

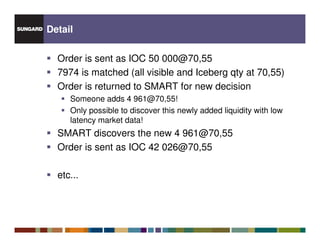

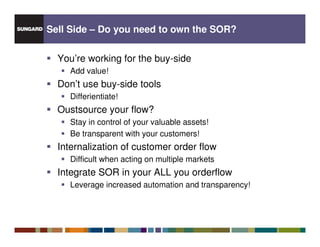

The seminar discusses the importance of smart order routing (SOR) in navigating a fragmented market, highlighting how SOR can consolidate real-time price data and manage liquidity across various trading venues. It emphasizes strategies like exhaust and synthetic SORs to optimize trading processes and improve execution costs. Additionally, it points out the shift towards internalization of customer orders, which has become necessary due to increased market fragmentation.