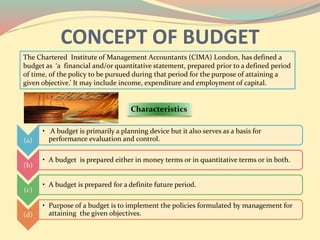

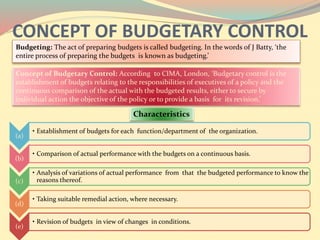

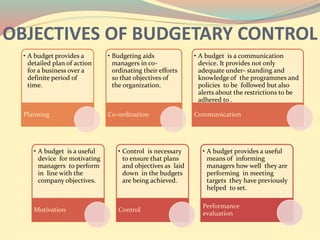

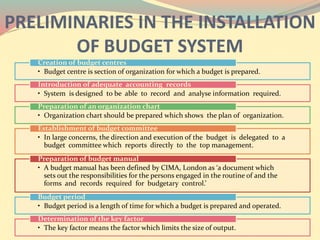

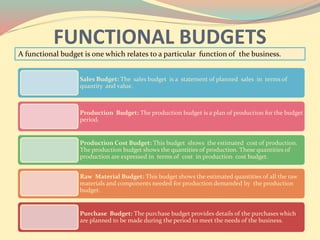

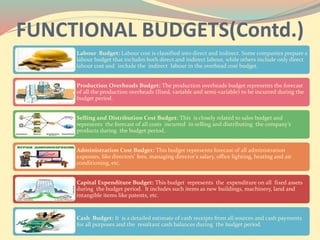

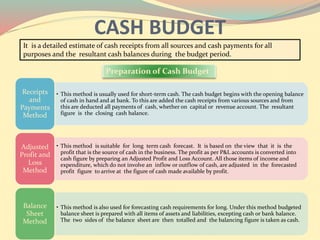

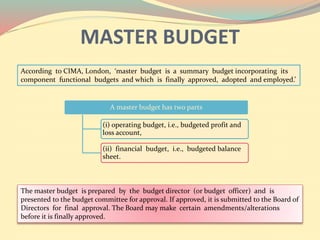

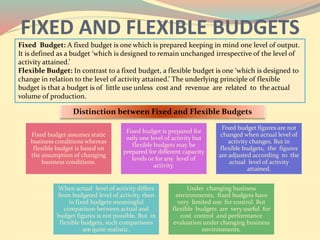

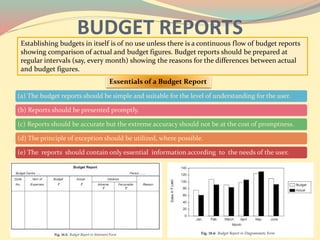

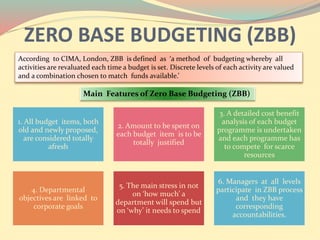

The document defines budgets and budgetary control. It states that a budget is a financial plan for a defined future period that is used for planning, performance evaluation, and control. Budgetary control involves establishing budgets for departments, continuously comparing actual performance to budgets, analyzing variations, and taking corrective actions. The document also discusses the objectives, essentials, and preliminary steps in installing an effective budgeting system, including creating budget centers and a budget committee. It describes different types of functional and master budgets.