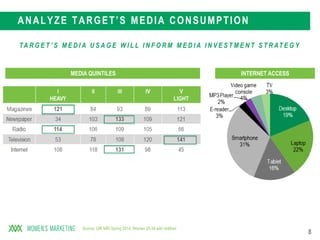

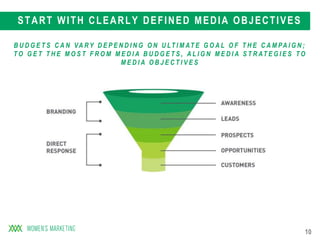

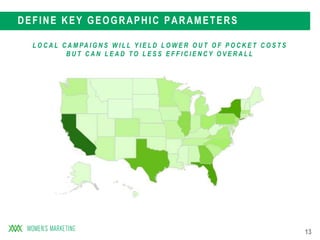

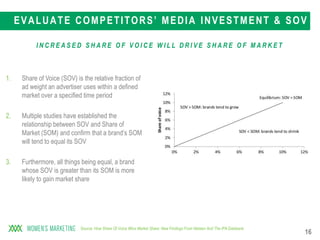

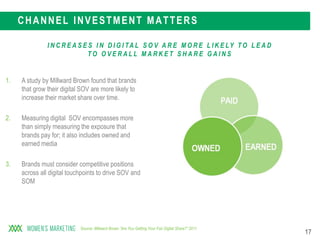

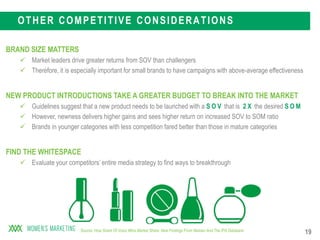

This document provides guidance on developing media budgets by analyzing three key areas: the consumer, business objectives, and the competitive marketplace. It recommends identifying the core target consumer and their media consumption habits to focus budgets. Objectives, timing, geography, and retailers' needs should also influence budget allocation. Analyzing competitors' spending, digital strategy, and campaign quality can provide benchmarks for budget setting, as increased share of voice is linked to gaining market share. Both traditional and digital campaigns require quality messaging to drive engagement.