The document summarizes key changes to India's income tax rates and policies introduced in the 2017 Union Budget. Some highlights include:

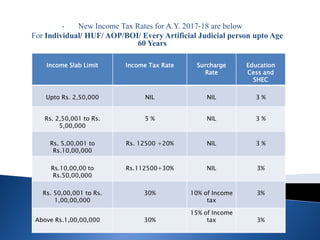

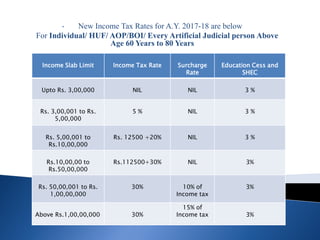

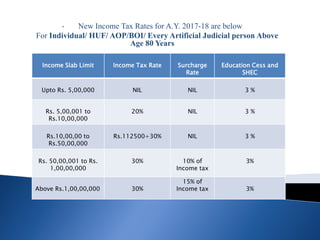

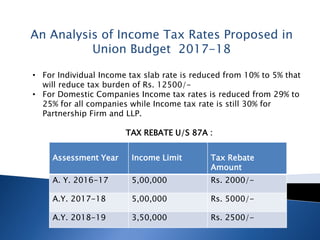

- Income tax slab rates were reduced for individual taxpayers with annual income up to Rs. 250,000 taxed at 5% instead of 10%.

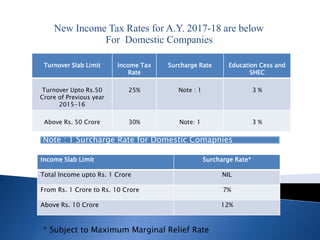

- Corporate tax rates were lowered to 25% for domestic companies from 29% previously.

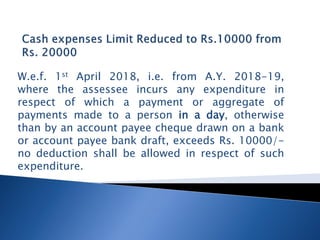

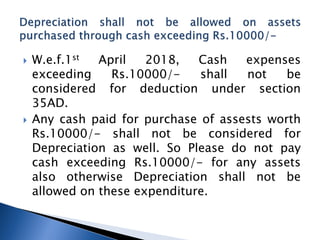

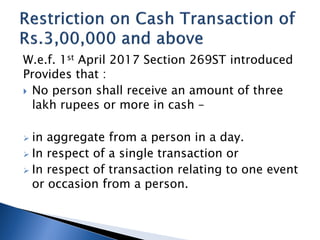

- Cash transaction limits for tax deductibility were set at Rs. 10,000 and tax rebates were increased for individual taxpayers.

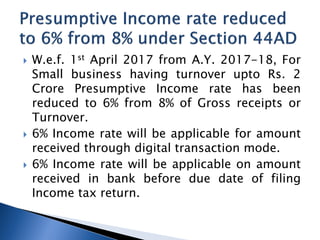

- Presumptive income rates were reduced to 6% for small businesses with annual turnover up to Rs. 2 crore.

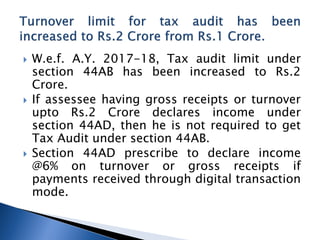

- Tax audit limits were increased to Rs. 2 crore annual turnover.