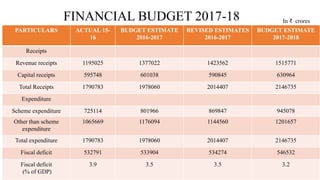

This document provides an overview of the Indian budget for 2017-2018. It includes details of revenue and expenditure estimates for 2015-2016, 2016-2017, and projections for 2017-2018. Revenue estimates are projected to increase to Rs. 1515771 crores in 2017-2018. Expenditure on schemes is projected to increase to Rs. 945078 crores in 2017-2018. The fiscal deficit is projected to decrease to 3.2% of GDP for 2017-2018. The budget aims to boost the rural economy, digital economy, and FMCG sector through increased capital expenditures and tax reductions for small companies. However, it is criticized for a lack of support for manufacturing and scientific research.