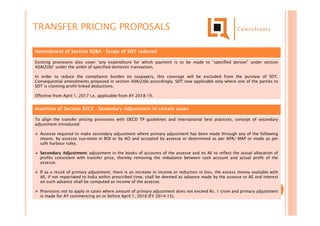

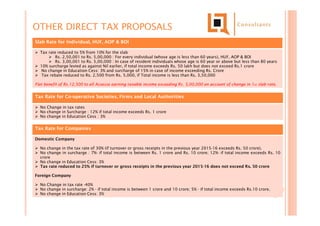

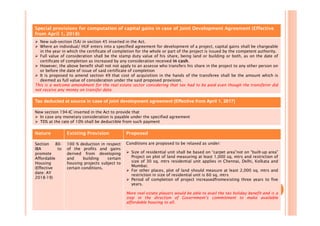

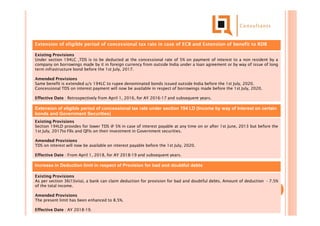

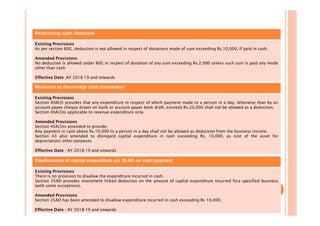

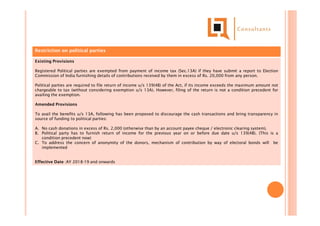

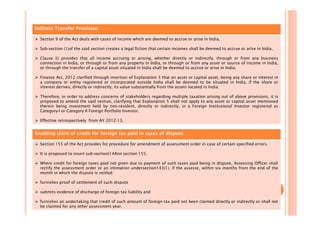

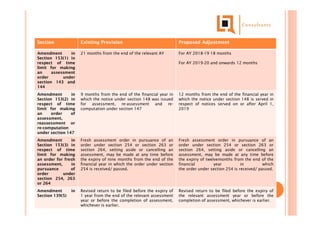

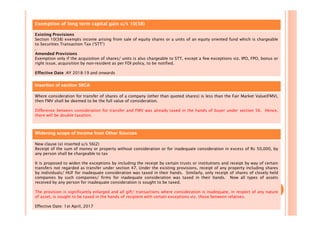

The document provides an analysis of key direct tax proposals in the Union Budget 2017 relating to transfer pricing, thin capitalization rules, taxation of individuals and companies, capital gains, real estate transactions, startups, and measures to promote digital payments and discourage cash transactions. Some key changes include reduced tax rates for individuals, introduction of secondary adjustment and thin capitalization rules for transfer pricing, relaxation of conditions for affordable housing tax exemption, and restrictions on cash donations and transactions above certain thresholds.