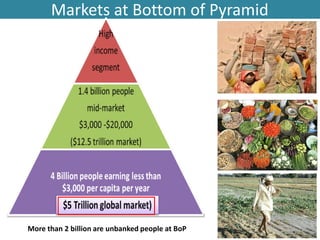

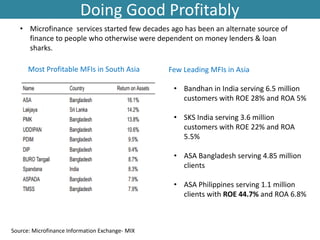

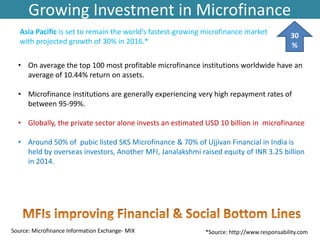

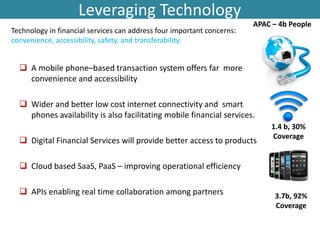

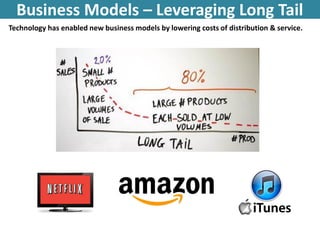

The document highlights the importance of financial inclusion as a means to alleviate poverty, noting the World Bank's goal of providing access to financial services for 1 billion people by 2020. It emphasizes the growth of microfinance institutions, particularly in Asia, showcasing their profitability and high repayment rates, and discusses the role of technology in enhancing financial service accessibility for the unbanked population. The author, Jaiveer Singh, advocates for innovative solutions in financial inclusion and offers mentorship to startups in the fintech space.