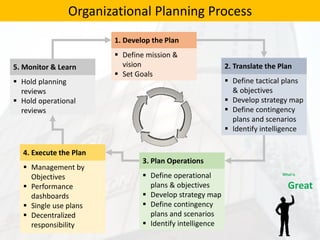

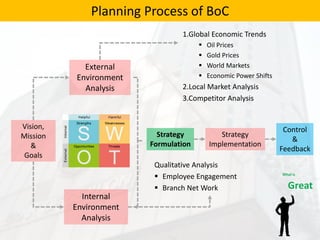

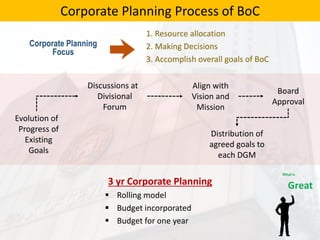

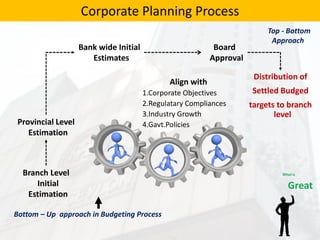

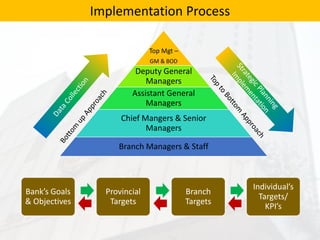

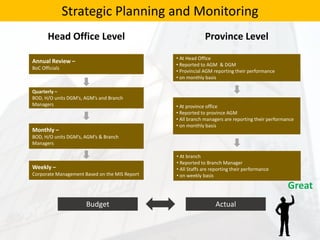

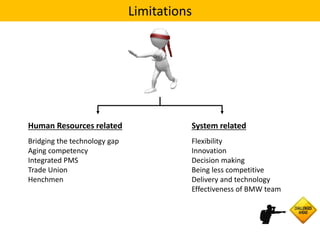

The document discusses the strategic planning process of Bank of Ceylon (BoC), the largest bank in Sri Lanka. It provides an overview of BoC's current operations and performance. It then outlines BoC's planning process, which involves analyzing the internal and external environment, setting goals and objectives at different levels from corporate down to individual branches, implementing plans, and monitoring performance. The planning process uses both a top-down and bottom-up approach. Challenges in the process include the global economic context, technology changes, aging workforce issues, and competition. Recommendations are made to address politics, introduce advanced planning tools, and use business intelligence systems.